Open Access

Open Access

REVIEW

Energy Storage Operation Modes in Typical Electricity Market and Their Implications for China

1 State Grid Henan Economic Research Institute, Zhengzhou, 450052, China

2 School of Electrical and Electronic Engineering, North China Electric Power University, Beijing, 102206, China

* Corresponding Author: Zhaoyuan Wu. Email:

Energy Engineering 2024, 121(9), 2409-2434. https://doi.org/10.32604/ee.2024.051554

Received 08 March 2024; Accepted 19 April 2024; Issue published 19 August 2024

Abstract

As the Chinese government proposes ambitious plans to promote low-carbon transition, energy storage will play a pivotal role in China’s future power system. However, due to the lack of a mature electricity market environment and corresponding mechanisms, current energy storage in China faces problems such as unclear operational models, insufficient cost recovery mechanisms, and a single investment entity, making it difficult to support the rapid development of the energy storage industry. In contrast, European and American countries have already embarked on certain practices in energy storage operation models. Through exploration of key issues such as investment entities, market participation forms, and cost recovery channels in both front and back markets, a wealth of mature experiences has been accumulated. Therefore, this paper first summarizes the existing practices of energy storage operation models in North America, Europe, and Australia’s electricity markets separately from front and back markets, finding that perfect market mechanisms and reasonable subsidy policies are among the main drivers for promoting the rapid development of energy storage markets. Subsequently, combined with the actual development of China’s electricity market, it explores three key issues affecting the construction of cost-sharing mechanisms for energy storage under market conditions: Market participation forms, investment and operation modes, and cost recovery mechanisms. Finally, in line with the development expectations of China’s future electricity market, suggestions are proposed from four aspects: Market environment construction, electricity price formation mechanism, cost sharing path, and policy subsidy mechanism, to promote the healthy and rapid development of China’s energy storage industry.Keywords

Under the “Dual Carbon” target, the high proportion of variable energy has become the inevitable trend of power system, which puts higher requirements on system flexibility [1]. Energy storage (ES) resources can improve the system’s power balance ability, transform the original point balance into surface balance, and have important significance for ensuring the low-carbon safe operation of new power systems. In this context, various forms of new energy storage, such as centralized and distributed, are gradually permeating through various links of the power system [2]. Diversified energy storage, through charging during low-load periods and discharging during high-load periods, can address the issue of temporal and spatial mismatches in electricity supply and demand, thereby optimizing flexibility resource allocation, improving system operational efficiency, and demonstrating greater potential in providing rapid frequency response, flexible regulation, and virtual inertia support for auxiliary services [3]. However, with the rapid growth of new energy storage, existing projects have gradually exposed weaknesses such as single operational models, disconnected market mechanisms, and lack of economic viability, which are not conducive to the further development of the energy storage market. As China accelerates the construction of its electricity market, changes are expected in investment entities, market access mechanisms, cost recovery channels, and other aspects compared to existing mechanisms. Therefore, it is necessary to explore energy storage operation models that are adapted to China’s national conditions in anticipation of the future development of China’s electricity market.

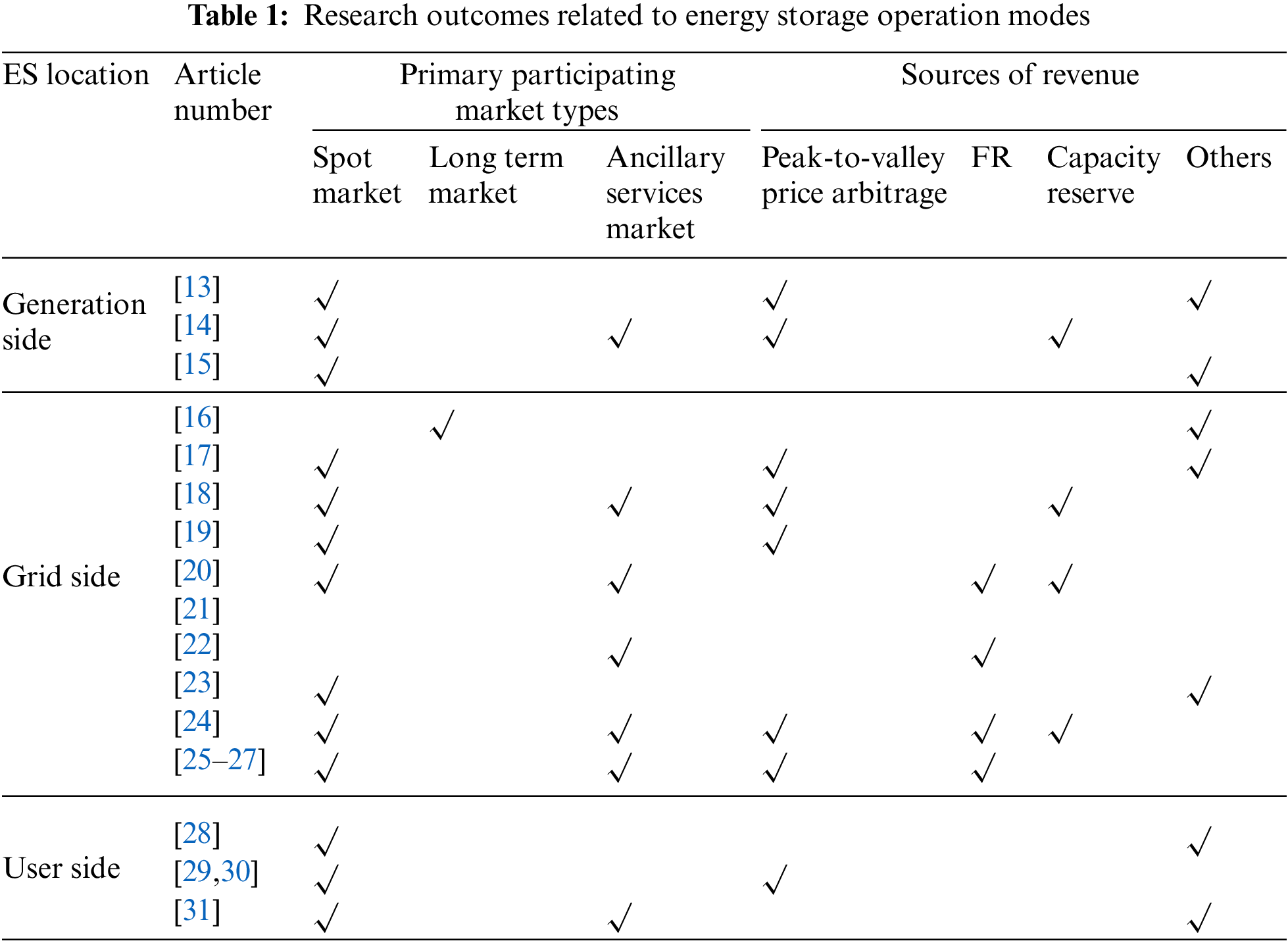

In the academic realm, scholars from various countries have conducted extensive research on different operational strategies [4,5], revenue sources [6,7], value allocation [8,9], and economic evaluations [10,11] of energy storage under different operation modes. Reference [4] establishes a performance evaluation index system for peer-to-peer energy sharing mechanisms and analyzes three common modes: supply-demand ratio (SDR), middle-market rate (MMR), and bill sharing (BS), indicating that the MMR mechanism performs well under moderate PV penetration levels. Reference [5] investigates the equilibrium state of supply-demand flow in a peer-to-peer market model for residential shared energy storage units and proposes a method for service pricing and load dispatching. Through case simulations, it is demonstrated that the point-to-point commercial model is beneficial for both shared energy storage and users. Reference [12] presents a tri-layer model for managing a competitive electricity market in the presence of microgrids and demand response (DR) aggregators, effectively increasing user comfort and reducing total operating costs by simultaneously considering system stability and the users’ comfort index (CI). Other scholars have also conducted research on energy storage operating modes at different grid connection points, as shown in Table 1.

Although existing theoretical research has explored the possibilities of diversified operation modes for energy storage, there are still some shortcomings in guiding energy storage participation in the Chinese electricity market. Therefore, academic research may not fully align with the future development of energy storage markets in various countries. Consequently, the existing practices in other countries hold greater reference value. In regions like the United States, Europe, and Australia, operators have gradually explored and established relevant energy storage operation mechanisms through incremental market practices. They have ensured the economic viability of energy storage projects by combining improved market mechanisms with subsidy policies. This provides valuable experience for the development of the Chinese energy storage market. However, China is currently in a transitional period for spot markets, lacking a well-established investment mechanism for energy storage and diverse revenue streams. It is essential to integrate the experiences of other countries with the practical development of the Chinese electricity market. Therefore, analyzing energy storage operation modes in other countries, drawing on their excellent practices, and combining them with the actual exploration of China’s energy storage market development are necessary steps to formulate a reasonable energy storage operation model. This will facilitate better promotion of energy transformation and the healthy development of the power system.

The main innovations of this paper are as follows:

1) This paper provides an overview of the policy orientation and operational models of energy storage in three typical foreign electricity markets: the United States, Europe, and Australia. It compares the characteristics of energy storage operation policies in regional electricity markets and their synergies with marketization. By comparing the market access mechanisms, cost recovery channels, policy subsidies, and economic viability of energy storage projects in the front and back markets of each country, it summarizes the advanced experiences of other countries in energy storage operation models. The analysis points out that the improvement of electricity market mechanisms and rational subsidy policies are crucial for the economic viability of energy storage projects and are also key issues to focus on in the future development of energy storage operation models in China.

2) Based on summarizing the historical development and current situation of China’s electricity marketization and analyzing the existing practical experience in typical power systems, this paper identifies the key issues of the cost guidance mechanism for energy storage under market conditions: forms of energy storage participation in the market, energy storage operation and investment modes, and energy storage profit models. On this basis, it further points out the existing problems in the current development of China’s energy storage market.

3) Addressing the design issues of cost sharing mechanisms for adapting to China’s market-oriented development of energy storage, this paper proposes policy suggestions to promote the development of the energy storage industry from aspects such as electricity price formation mechanisms, cost sharing targets, and compensation mechanisms. It particularly emphasizes the need to formulate adaptive cost sharing mechanisms for different stages of market-oriented development.

Hopefully, the research aims to summarize valuable experiences from energy storage practices in various countries, identify key factors needed to adapt to China’s electricity marketization. Additionally, it provides valuable references for the comprehensive development of the new energy storage industry under the background of market-oriented reforms.

2 Operation Modes of ES in Typical Electricity Markets

In recent years, with changes in the international situation and grid demand, energy security independence has become a universal consensus globally. In order to promote energy transition and accelerate the construction of an energy security system, the United States [32–35], the United Kingdom [36–39], Germany [40–43] and China [44,45] have successively proposed a series of policy bills to promote the development of the energy storage industry, vigorously supporting the development of various types of energy storage industries. As of the end of 2022, the cumulative global energy storage installed capacity reached 237.2 GW, with an average annual growth rate of 15% [46]. Considering the urgent need for global energy development transformation due to climate change and regional conflicts, it is expected that the global energy storage industry will continue to flourish within a certain range.

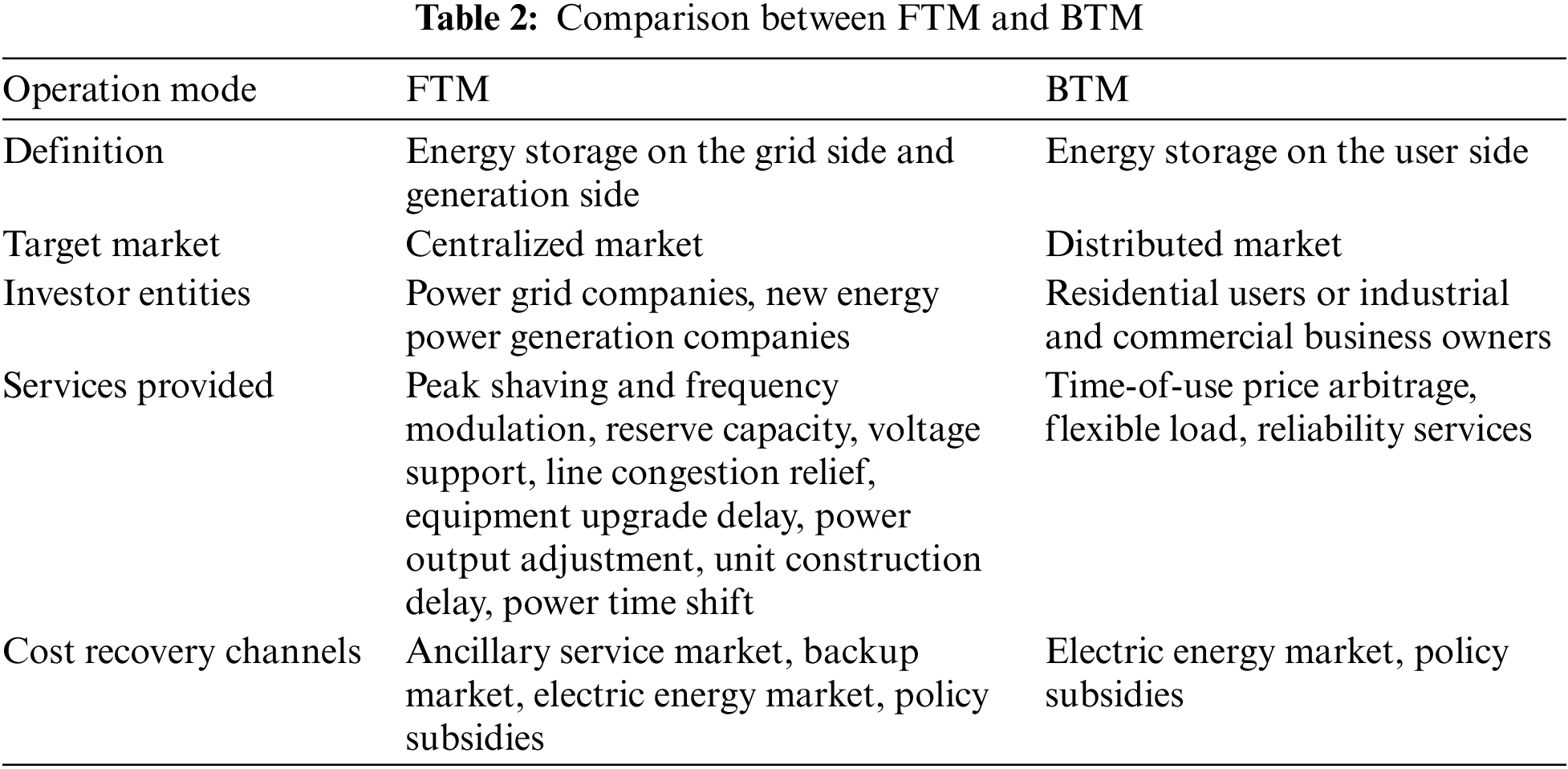

With the expansion of the energy storage market and the evolution of application scenarios, energy storage is no longer limited to a single operating mode. Depending on the location of integration, many countries have gradually developed two main market operating models for energy storage: front-of-the-meter (FTM) and behind-the-meter (BTM). The operation mode of energy storage in the pre-market is highly related to different dispatch plans and is aimed at centralized markets, usually corresponding to grid-side energy storage and generation-side energy storage in China. The post-market energy storage mainly refers to batteries owned by residential users or businesses, and is mainly aimed at distributed markets, similar to user-side energy storage in China. The definitions and differences of different energy storage markets are shown in Table 2.

Globally, the markets where energy storage development is particularly rapid are the United States, Europe, and Australia. The United States predominantly focuses on centralized storage, while the latter two emphasize distributed energy storage. Various countries have explored a great deal in areas such as investment entities for energy storage, cost recovery, and subsidy policies. In contrast, China does not yet have a mature energy storage operating mechanism, and both centralized and distributed energy storage are still in the early stages of development. Therefore, it is necessary to refer to the development paths and policy guidance methods of energy storage markets in typical electricity markets, and explore a future energy storage development model that is suitable for China’s national conditions. This section will explore the differences and similarities in different market transaction mechanisms, investment entities, and cost recovery aspects in the FTM and BTM markets, taking the United States, Europe, and Australia as examples.

2.1 Operation Modes in United States

Constrained by the high costs of energy storage technology and the corresponding inadequate supportive policies, the widespread application and promotion of large-scale energy storage before 2016 remained extremely challenging in the United States [47]. However, with the gradual improvement of relevant policies, the United States has gradually formed two energy storage markets depending on different application scenarios. The application scenarios of energy storage in the United States are also discussed in terms of front-of-the-meter and behind-the-meter. The operating scope of front-of-the-meter energy storage market mainly includes peak shaving, frequency regulation, and ancillary services markets, spot energy market, and renewable energy generation side energy time shifting and friendly access; while the operating scope of behind-the-meter energy storage market mainly includes household energy storage and commercial and industrial user energy storage.

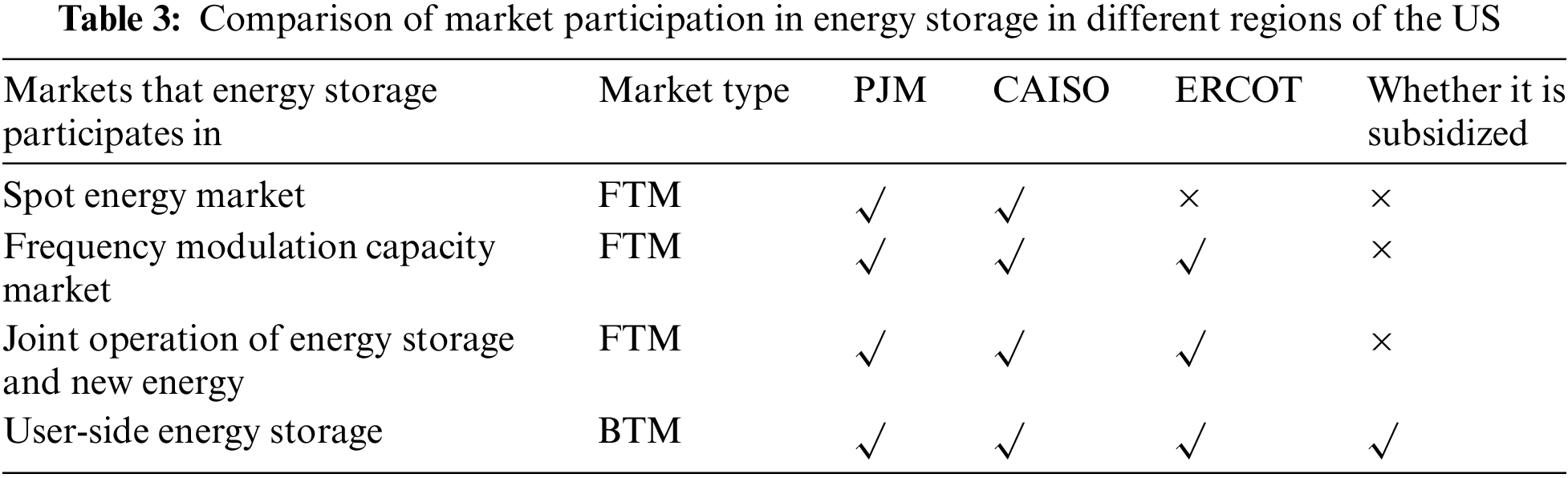

Due to the United States being divided into multiple electricity markets based on regional operators, the participation mechanisms and subsidy policies for energy storage also vary. Representative examples include the PJM market, CAISO market, and ERCOT market. Specifically, the PJM market is in Pennsylvania-New Jersey-Maryland, the CAISO market is in California, and the ERCOT market is in Texas. The market participation of energy storage in different regions is shown in Table 3.

As shown in Table 3, the revenue of front-of-the-meter energy storage in the United States is mainly driven by market competition under a market-based mechanism, with large-scale energy storage actively participating in the market for rapid frequency regulation. Policy subsidies are not yet prominent, mainly because CAISO, PJM, and ERCOT are all deregulated electricity markets under the jurisdiction of Independent System Operators (ISOs). However, the growth of behind-the-meter energy storage in the United States relies to a large extent on government subsidies, with each state having relevant policies for tax deductions or subsidies for demand-side energy storage investment projects.

2.1.1 FTM Market in United States

The revenue growth of the front-of-the-meter energy storage market in the United States mainly comes from two sources: participation in frequency regulation and other ancillary service markets and the spot energy market, and joint operation with renewable energy generators.

At present, the most common application of front-of-the-meter energy storage in the United States is in frequency regulation ancillary service markets, which are the most significant capacity markets, and the economic viability of energy storage in frequency regulation ancillary service markets has been fully validated. Among them, the PJM market mainly focuses on electricity markets (capacity markets); the CAISO market mainly focuses on energy markets; and the ERCOT market’s market design only pays for energy, not capacity fees. Unlike the CAISO and PJM markets, the ERCOT market in Texas is not designed for real-time spot markets, only planning for the next day’s electricity usage. In addition, energy storage in the ERCOT market mainly relies on ancillary service markets to solve the problem of electricity market energy imbalances and frequency fluctuations and generate revenue.

Although the theoretical application range of energy storage is very broad, and Order 841 fully supports energy storage to participate in various markets [34], energy storage has not been widely operated in the US energy and capacity markets. This is because the cost of energy storage in the wholesale energy market and capacity market is difficult to determine, and there are contradictions between income and expenditure; energy storage investors consider the market economics and policy subsidy levels related to the operation of energy storage, and are currently in a wait-and-see mode.

2.1.2 BTM Market in United States

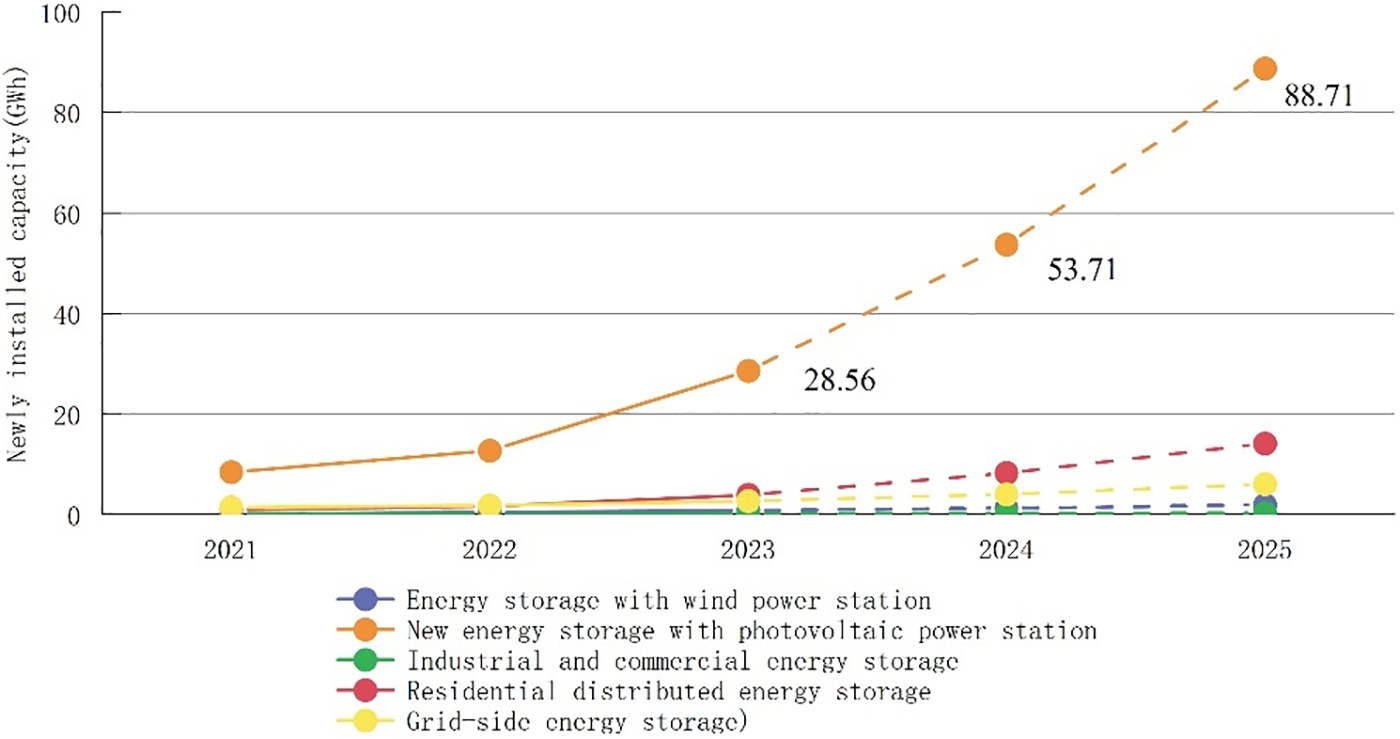

The operation modes of behind-the-meter energy storage markets include residential energy storage users and commercial and industrial energy storage users. According to statistics, in 2020, household energy storage installations increased by 154 MW, a year-on-year increase of 63%, accounting for 15% of the total new installations that year; commercial and industrial energy storage installations increased by 55 MW, a year-on-year decrease of 24%, accounting for 5% of the total new installations that year [48]. The growth trends and future forecasts of various types of energy storage in the United States from 2021 to 2023 are shown in Fig. 1. Observation in the figure shows that the growth of household user-side energy storage is second only to energy storage participation in ancillary services markets and has become the second-largest energy storage market in the United States; in contrast, the demand for industrial energy storage is gradually decreasing.

Figure 1: Growth trends and future forecasts of various types of energy storage in the United States from 2021 to 2024 [49]

The growth of behind-the-meter energy storage is driven by the need for power reliability and related incentive policies. The development of the US behind-the-meter market is mainly due to two reasons: one is the growth of demand-side energy storage due to the instability of the US power grid. The strong independence of the US power grid in different regions makes cross-regional scheduling difficult, and high electricity consumption peaks can easily cause local grid frequency fluctuations and transmission blockages, especially in 2021, due to the pandemic and extreme weather, which further affected the power reliability of end-users, and the demand for end-user emergency energy storage gradually increased. Second, the United States has adopted certain welfare policies for installing energy storage. Users who install energy storage can be exempted from some taxes, which is equivalent to reducing the investment cost of energy storage. For example, the Self-Generation Incentive Program (SGIP) initiated by the United States in 2001 has been continuously revised over the years and has increased its budget for energy storage. In August 2018, the California State Assembly passed the SB700 bill, extending the SGIP program to 2026, to continue to incentivize the construction of more distributed residential energy storage projects [50].

The economic viability of household energy storage has promoted the rapid development of residential photovoltaic (PV) systems with energy storage. According to statistics from the Berkeley Lab, as of 2020, the installed capacity of behind-the-meter energy storage is approximately 1000 MW, of which 550 MW is paired with solar PV, and currently 80% of household energy storage is installed bundled with solar PV. In terms of policy, the federal and state governments provide different levels of tax offsets and rebates for installing solar PV systems, reducing the construction costs of residential energy storage for self-use. Economically, residents can store electricity during good sunlight and low electricity prices, reduce the amount of electricity purchased at high prices at night, greatly save their own electricity costs, and also provide benefits to the entire power system.

Overall, the overall growth demand for commercial and industrial energy storage in the United States is slightly lower than that of household energy storage. Contrary to the domestic electricity price mechanism, the industrial and commercial electricity prices in the United States are lower than the residential electricity prices, so residential users have a stronger inclination to install energy storage. Except for the CAISO market in California, the installation of energy storage in most other electricity markets is greater in residential areas than in commercial and industrial areas.

2.2 Operation Modes in European

The European electricity market has been an early mover in the development of renewable energy and energy storage. However, the fundamental national conditions and policies of the United Kingdom and Germany have led to markedly different focuses in the development of energy storage markets. For example, in the United Kingdom, energy storage is mainly distributed in front-of-the-meter markets and focuses on the construction of markets where energy storage provides ancillary services. In Germany, energy storage is mainly involved in behind-the-meter markets, with user-side distributed energy storage leading the world. At the same time, Australia has experienced rapid growth in solar photovoltaic development, leading to a significant increase in the scale of customer-side energy storage, and it has also initiated certain practices in the behind-the-meter market. Therefore, this section examines the energy storage operation models in the European electricity markets, focusing on the representative cases of the United Kingdom and Germany, while also considering Australia’s behind-the-meter market. Therefore, this section analyzes and studies the energy storage operation modes in European electricity markets with the United Kingdom and Germany as representatives.

The United Kingdom is the largest front-of-the-meter energy storage market in Europe, with large-capacity installations mainly participating in ancillary services markets. The main functions of energy storage in front-of-the-meter markets include peak shaving, frequency regulation, acting as a backup power source, renewable energy integration, and flexible loads.

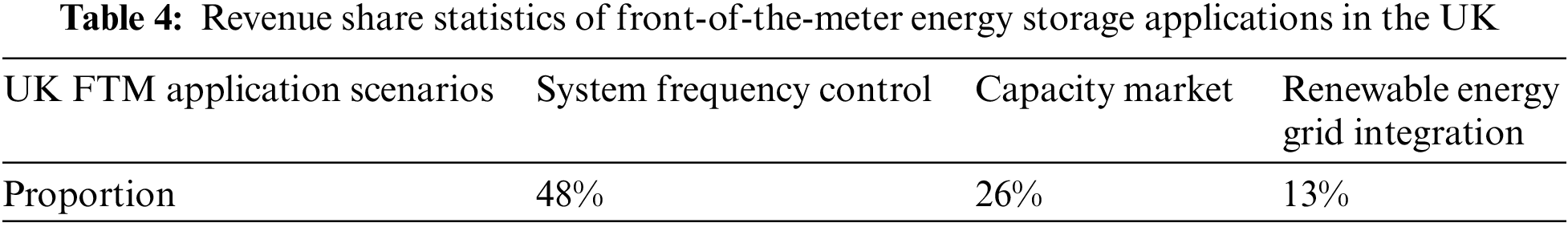

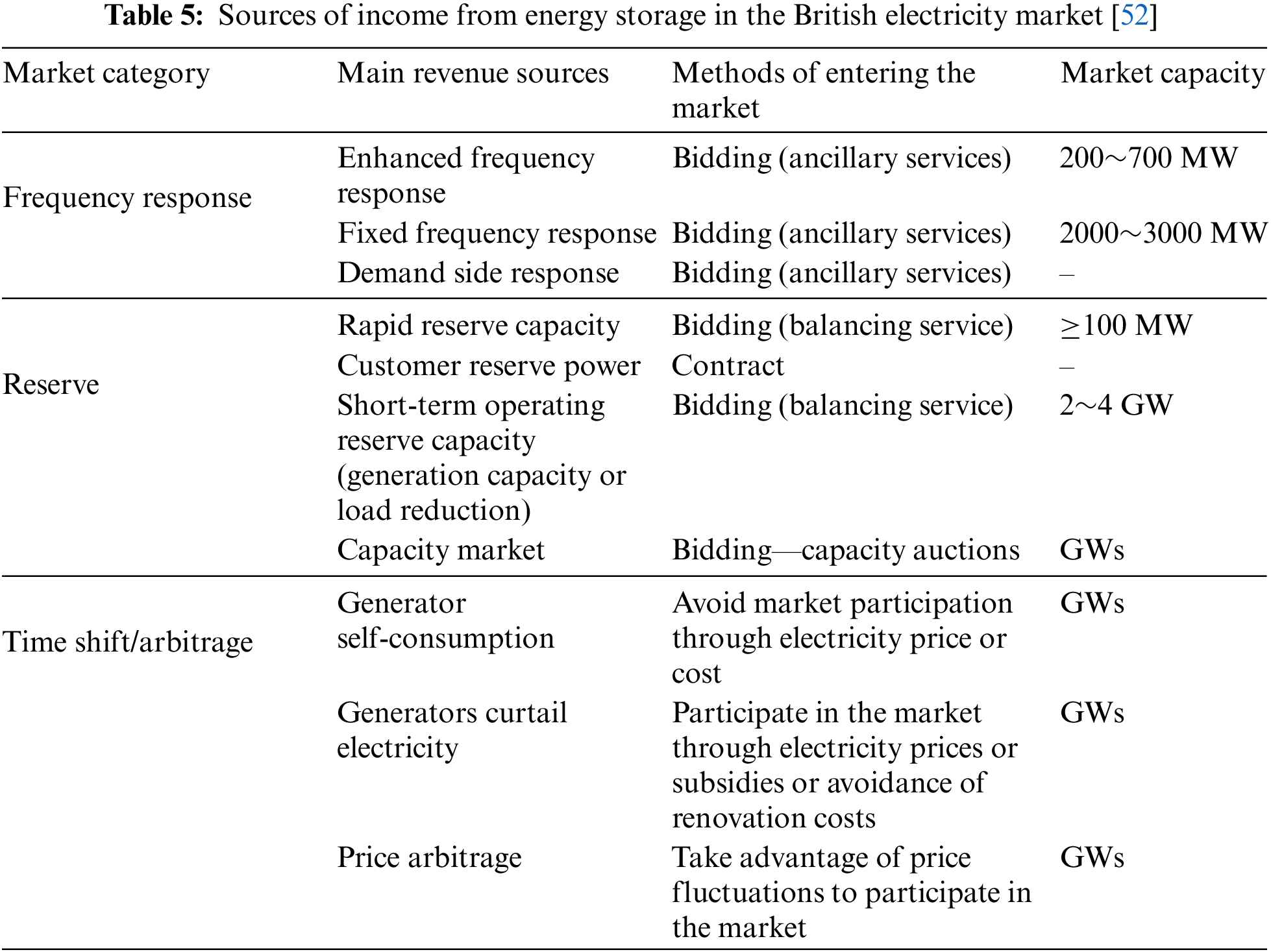

In the United Kingdom’s energy storage market, the main source of income for new energy storage systems on the generation side is providing frequency control reserves (FCR) services. Participation in the energy market to obtain clearance revenue is not the main source of income for energy storage in the United Kingdom. Energy storage mainly obtains revenue by providing ancillary services to the grid or helping renewable energy generators to integrate into the grid. As shown in Table 4, approximately 48% of the United Kingdom’s large-scale front-of-the-meter energy storage systems are used for frequency control, followed by 26% in capacity markets, and 13% in the renewable energy grid integration field [51].

The marketization process of the UK’s power sector started early, and the operation modes and revenue of energy storage in front-of-the-meter markets are diverse. Table 5 shows the main sources of revenue from energy storage in the British electricity market. Currently, the most mature development in the UK is energy storage’s participation in frequency regulation and reserve markets, where energy storage provides frequency control reserves (FCR) with high and stable value. Although the revenue from frequency regulation services is high, the demand for it is limited, and the market capacity is usually only a few hundred or a few thousand megawatts. Compared with the demand for energy storage for short-term operational reserves (generation capacity or load reduction) or energy arbitrage, which is tens to hundreds of times lower.

The value of energy storage obtaining clearance revenue in the UK energy market or through energy price arbitrage is not stable, and the participation of energy storage in the energy market system has not been fully established. This is different from the United States, where front-of-the-meter energy storage markets tend to develop both day-ahead energy markets in trading centers and ISO-scheduled ancillary service markets. However, it is worth noting that the UK is promoting the establishment of a spot market system that can reflect the scarcity of flexibility across time periods. When the price difference increases, the arbitrage value of energy storage participating in the day-ahead energy market is expected to be more fully demonstrated.

2.2.2 BTM Market in European and Australia

1) Germany

In contrast to the United Kingdom, Germany is leading the way in the development of new energy storage in behind-the-meter markets, with the growth of energy storage in the behind-the-meter market far exceeding that in the front-of-the-meter market. Germany is the country with the widest range of user-side energy storage operation modes in Europe and even globally.

New energy storage has the highest growth rate in Germany’s behind-the-meter market, with household PV storage being the main operating mode of energy storage behind-the-meter. The development of user-side photovoltaics and high retail electricity prices provide space for the behind-the-meter market. In 2020, 92% of the newly installed capacity in Germany came from behind-the-meter energy storage. Taking Germany as an example, the average cost of electricity purchases for households in 2020 was 0.314 $/kWh, and it is trending upward. At the same time, the levelized cost of electricity (LCOE) for household PV storage systems continues to decrease [53]. Currently, Germany is promoting policies to subsidize household PV storage equipment, aiming to increase the utilization rate of household PV storage, promote the self-use behind-the-meter energy storage operating model, and offset the high electricity costs.

In summary, household PV storage is the main operating mode of behind-the-meter energy storage in Germany, and it has certain economic viability in increasing self-consumption rates.

2) Australia

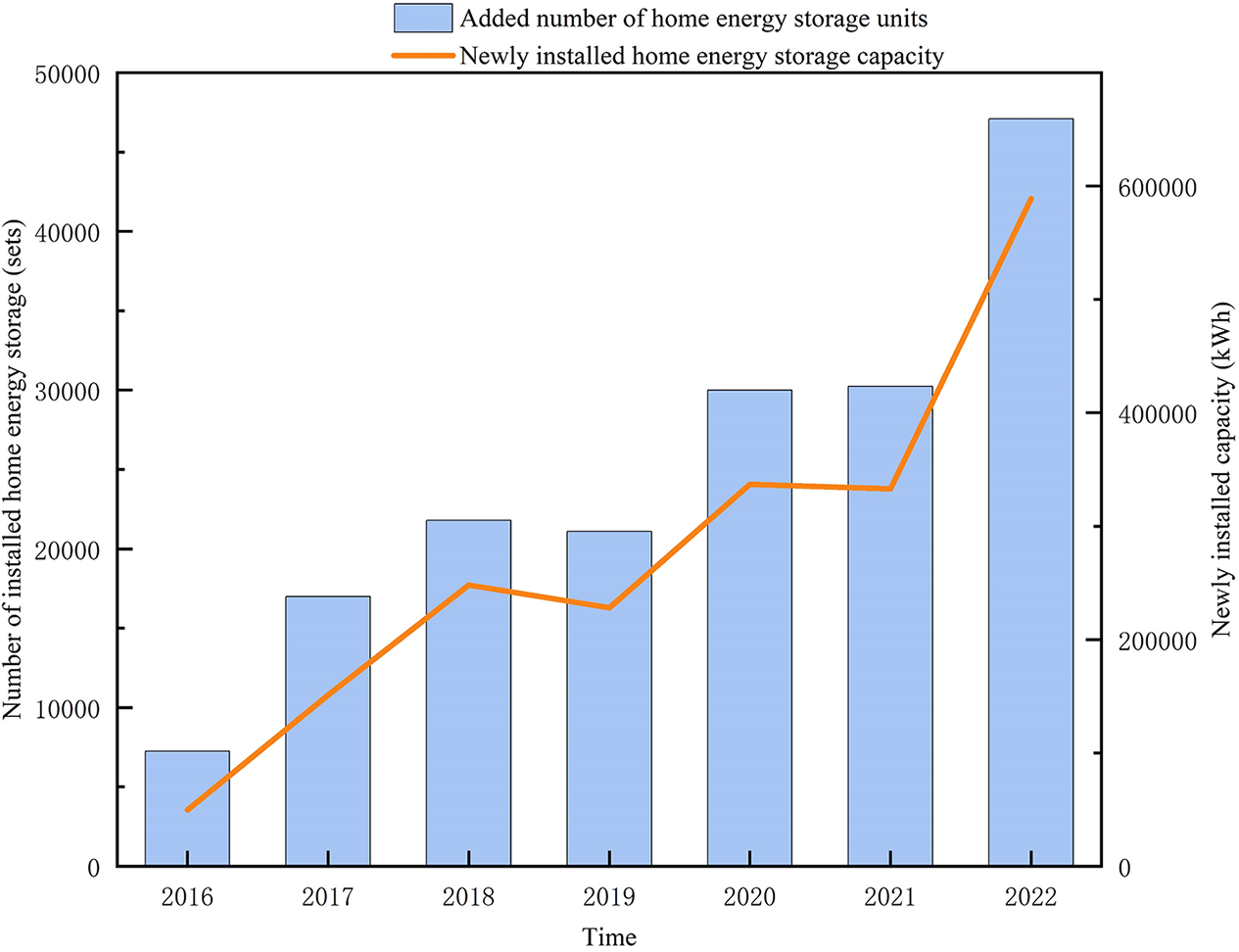

Australia is the world’s second-largest behind-the-meter PV storage market after Germany. Due to Australia’s abundant natural light resources and high electricity prices, the development of PV power generation, microgrid energy storage, and user-side PV storage combined projects has developed rapidly, with a large number of users installing PV systems [54]. In the future, the Australian government will continue to provide subsidies and low-interest loans for users who install PV storage systems to reduce the installation and investment costs of energy storage. The installed capacity of behind-the-meter energy storage in Australia is expected to continue growing, as shown in Fig. 2.

Figure 2: The number of new residential energy storage installations and installed capacity in Australia from 2016 to 2022

The value and income of household PV storage in Australia come mainly from two aspects. One is the income from self-use of electricity stored by household PV storage equipment, saving electricity costs by storing energy during the day and releasing it during peak hours when electricity prices are high at night. The other is the battery subsidy (South Australia government) and tax refund (Victorian government) policies, which to a certain extent ensure the cost recovery of energy storage equipment within a limited number of years.

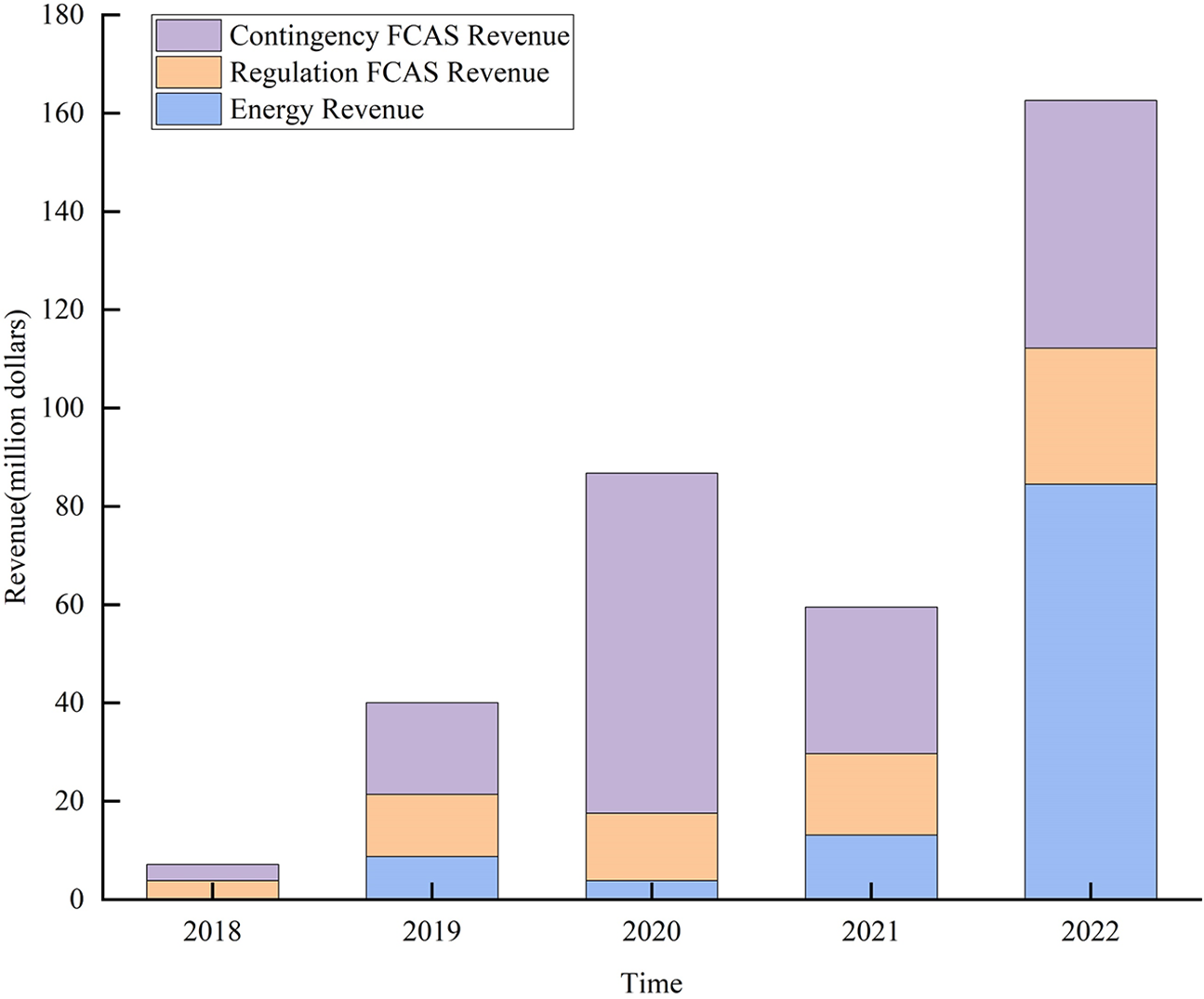

In addition, to promote the diversified development of energy storage projects, energy storage transactions in Australia’s National Electricity Market (NEM) have also begun to grow rapidly, with the main value coming from emergency frequency regulation in the Frequency Control Ancillary Service (FCAS) market [55]. The revenue of energy storage in the ancillary services market has experienced a significant increase, as shown in Fig. 3. It can be seen that the revenue of energy storage in the energy market, although accounting for a small percentage, has also increased. This is because as large-scale renewable energy is introduced into the electricity market, the price fluctuations in different time periods in the energy market are gradually increasing, providing more opportunities for energy storage to arbitrage in the energy market.

Figure 3: The revenue of energy storage in the Australian electricity market [56–58]

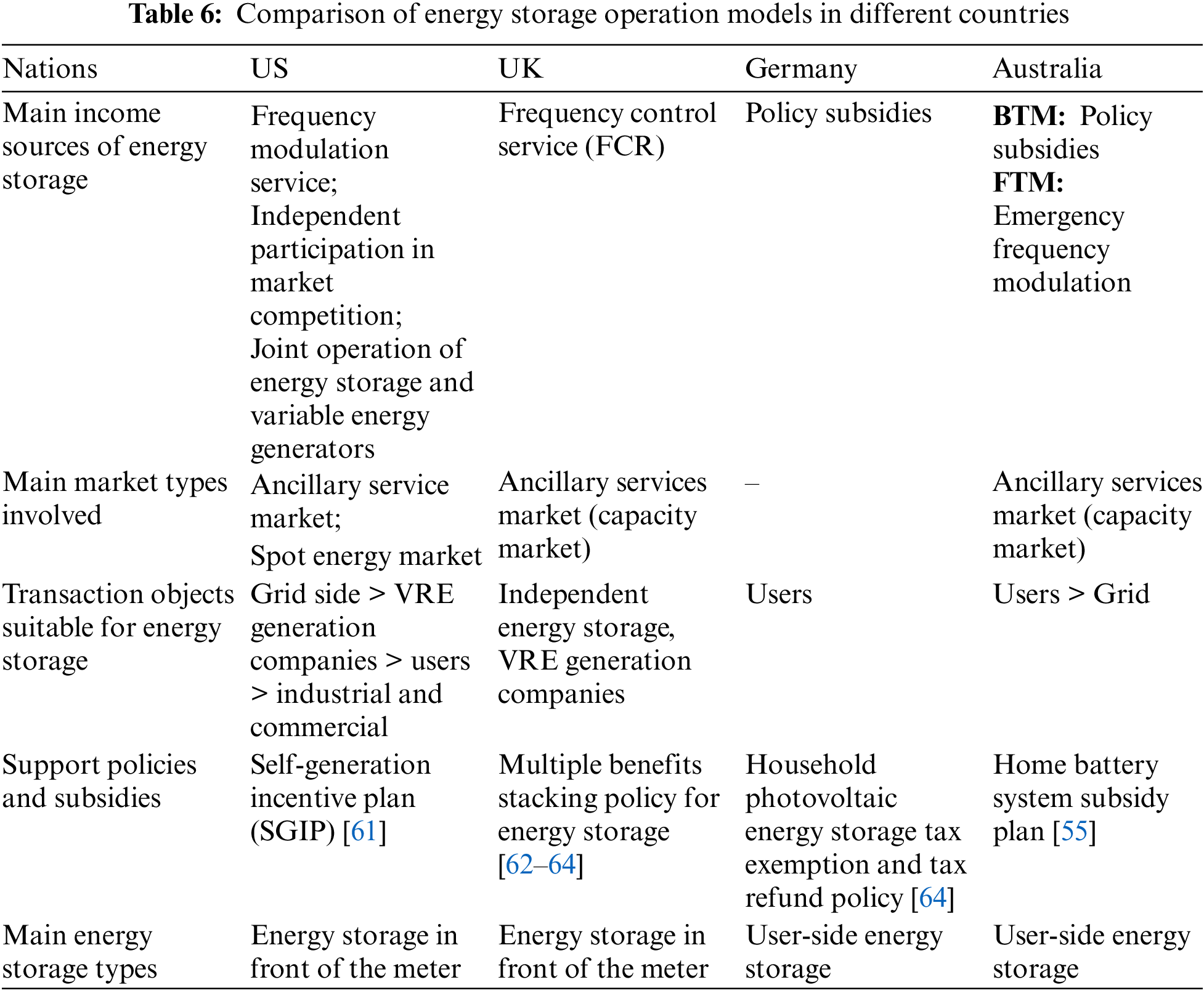

2.3 Comparison of Operation Modes in Different Countries

Based on the different national conditions, the types of energy storage development markets, sources of income, trading objects, and policy subsidy focuses represented by the United States, the United Kingdom, Germany, and Australia are not entirely consistent, as shown in Table 6.

The cost of energy storage in the US front-of-the-meter market is primarily recovered from transactions in the auxiliary service market and the spot energy market. The existing mechanism allows energy storage to declare charging and discharging quantities and selling prices in the market, and the market can spontaneously guide energy storage to realize its own frequency regulation value. The United States has more laws aimed at promoting market mechanism improvement and reform, rather than simple policy incentives [34,59,60], and the centralized large-scale energy storage in the United States has already had good returns under a mature market mechanism. In recent years, some energy storage incentive policies have mainly targeted user-side distributed energy storage.

The revenue of energy storage in the UK front-of-the-meter market mainly comes from independent energy storage or energy storage jointly participating in the capacity market to obtain frequency regulation benefits, and the contribution of the energy market to energy storage cost alleviation is relatively small. The UK market generally does not recognize direct investment and utilization of energy storage by the system operator, often requiring energy storage to act as a market subject to play a frequency regulation role in the system.

The economic viability of energy storage in the German behind-the-meter market is obviously insufficient, and the methods of earning income through peak-valley arbitrage in the electricity market or participating in frequency regulation auxiliary markets are not mature. The leading energy storage project in Germany is household photovoltaic storage, relying on policies such as time-of-use electricity prices, government tax exemptions, and tax exemptions. Users can fully recover the cost in about 5 years by increasing the rate of self-use. It already has certain economic viability.

The development of household energy storage in Australia has been going on for a long time, and its value mainly comes from two aspects: self-use and policy subsidies. It can guarantee that the household self-use energy storage system can recover the cost in a few years with a relatively short period. In addition, as large-scale renewable energy is integrated into the Australian electricity market, fluctuations in electricity prices in the energy market are gradually increasing, and the energy transaction and frequency capacity trading of energy storage participating in the electricity market are also rapidly increasing. The economic viability of energy storage in the market remains to be further observed. By comparison, pioneering countries in energy storage development such as the United States have mainly supported energy storage development through policies such as setting energy storage planning goals, fostering local industry chain technological innovation, providing financial and tax incentives, offering funding support, and developing electricity market transaction varieties adapted to energy storage [47]. By improving market mechanisms to form price signals, it effectively promotes the diversified roles of energy storage and ensures partial revenue. Meanwhile, diversified subsidy policies guarantee the recovery of fixed costs for energy storage, thereby effectively improving the economic viability of energy storage projects. In contrast, China’s development in new energy storage started relatively late, and currently, the economic viability and utilization rate of most energy storage projects are not ideal.

Drawing on the analysis of typical power systems’ existing experiences, this paper tentatively proposes several aspects for future energy storage construction in China. Firstly, it should explore the rational positioning of energy storage roles and the status of market entities to clarify the direction of future energy storage development. Secondly, it should appropriately relax investment and operational restrictions on energy storage and continuously explore and improve market rules in areas such as capacity markets to provide a foundation for future energy storage operation models. Thirdly, it should, at this stage, learn from subsidy models in countries like the United Kingdom and consider expanding energy storage benefits through combined policies to ensure the reasonable recovery of energy storage investments.

However, it should be noted that due to differences in national conditions, the operational experience of typical electricity markets must be adjusted to adapt to the future development of China’s electricity market. It is necessary to conduct adaptive analysis on market participation forms, investment models, and revenue models in the Chinese market environment to develop energy storage operation models adapted to China’s power system’s low-carbon transformation.

3 Key Issues of Cost Sharing Mechanism for Energy Storage under Marketization Context

With the continuous integration of new energy sources such as wind and solar power, energy storage will undertake diverse functions in future power systems. These include smoothing power output and peak shaving on the supply side, alleviating congestion and deferring capacity expansion on the grid side, and peak shaving, valley filling, capacity management, and enhancing reliability on the user side. The vigorous development of new energy storage characterized by “short, flat, and fast” traits will provide a powerful complement to China’s grid operation, improving power supply levels, facilitating the integration of new energy sources, and enhancing system peak-shifting capabilities [47]. In this context, the design of a rational energy storage market mechanism is of paramount importance for promoting the orderly transformation of the power system and ensuring its safe and stable operation.

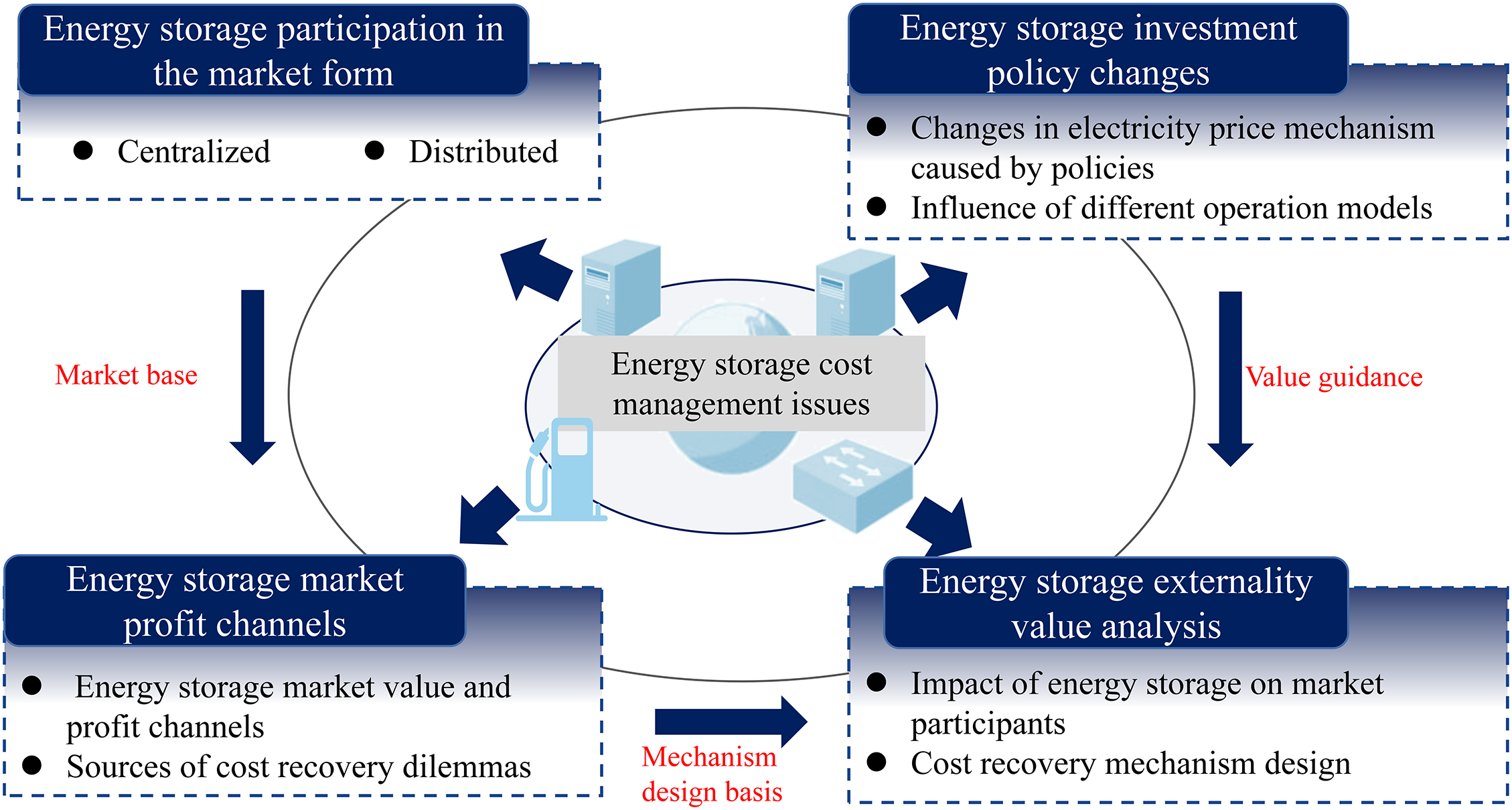

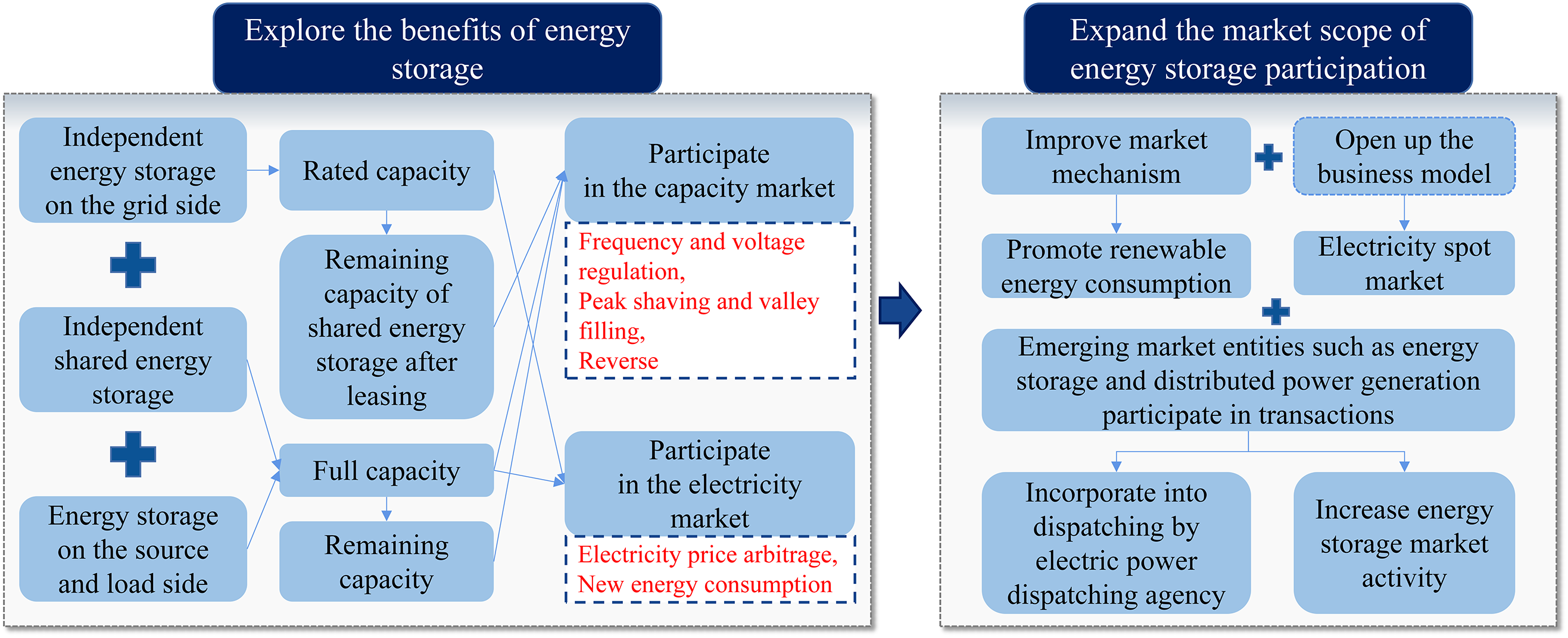

In the process of designing electricity market mechanisms, the cost-sharing mechanism for energy storage stands out as one of the key issues. Under the market environment, the key issue of energy storage cost guidance is a crucial problem in the design of the electricity market mechanism. In the process of continuously promoting the construction of a new type of electricity market and the reform of the electricity market mechanism in China, it is urgent to explore market mechanisms applicable to energy storage participating in market operations. Combined with the current situation of domestic and foreign markets and existing research, this section summarizes the four key elements that need to be considered in the design of energy storage cost sharing mechanisms, as shown in Fig. 4.

Figure 4: Energy storage cost channeling mechanism design framework

3.1 Forms of Market Participation

In the process of energy storage investment and construction, the form of market participation is one of the important factors affecting its functional positioning and cost recovery capability. For large-scale energy storage facilities represented by pumped-storage power stations, due to their high investment costs and the ability to exert a large-scale regulation effect, they are mostly invested and operated independently by grid operators, participating in market transactions in a centralized manner. With the rise of distributed energy storage, on the one hand, a large number of small-scale energy storage systems are connected to the grid; on the other hand, distributed energy storage involves complex investment and operation relationships, and profits are obtained through market competition among different entities rather than centralized dispatch. Therefore, in the future marketization process, it is necessary to determine a reasonable cost-sharing mechanism based on two different market participation forms: centralized and distributed.

Currently, in China, the participation of energy storage systems in the market has mainly been dominated by independent investment and centralized dispatch by the grid. The advantage is that it can unify planning and manage the supply and demand of system electricity, and the scenarios of use are richer and the number of uses is more frequent, and the utilization rate of energy storage equipment is higher; the disadvantage is that the funding pressure and capital recovery pressure of the power grid company as the sole investment subject are greater, and no effective way other than the determination of transmission and distribution electricity prices has been found to recover the investment cost of energy storage, which cannot support the long-term construction of energy storage, and its income does not fully reflect the multiple values that the power station actually plays in the system.

With the increase of the number of energy storage entities and the installed capacity, the trend of independent energy storage as the market main body participating in market competition is inevitable. On 1 June 2022, China’s National Development and Reform Commission and other nine departments jointly issued a notice on the issuance of the “14th Five-Year Plan” for renewable energy development. The “Plan” pointed out: It should promote the scale application of other types of new energy storage outside of grid-side centralized energy storage. Define the independent market position of new energy storage, design appropriate market electricity pricing, declaration, and transaction mechanisms for energy storage participation. Maximize energy storage value in peak shaving, valley filling, peak regulation, frequency regulation, promoting renewable energy consumption, backup support, and encourage multi-scenario applications across supply, grid, and user sides. In other countries, the British electricity market requires energy storage to participate as the market main body and generally does not accept direct investment and dispatch of energy storage resources by system operators [65].

Furthermore, the scenarios where distributed energy storage appears as a market participant are becoming increasingly diverse. Due to objective constraints, the development progress of distributed energy storage as the main participant in the market is significantly higher in other countries than in China. In the 2018 Federal Energy Regulatory Commission (FERC) 841 Act [34], the capacity access threshold for the market main body status of energy storage was reduced to 100 kW; in recent years, the UK has also gradually lowered the threshold for the participation of energy storage to 1 MW [66]. The lower access threshold for foreign electricity markets has greatly increased the number of distributed energy storage operators participating in the entire market, giving small-capacity distributed energy storage and other members equal market status, helping various types of energy storage operations reasonably allocate energy storage resources in a competitive manner, but at the same time, higher requirements are also placed on market mechanism design, so that distributed energy storage can effectively recover on the generation side, the demand side, and the grid side, respectively.

3.2 Operation and Investment Modes under the Influence of Electricity Price Mechanisms

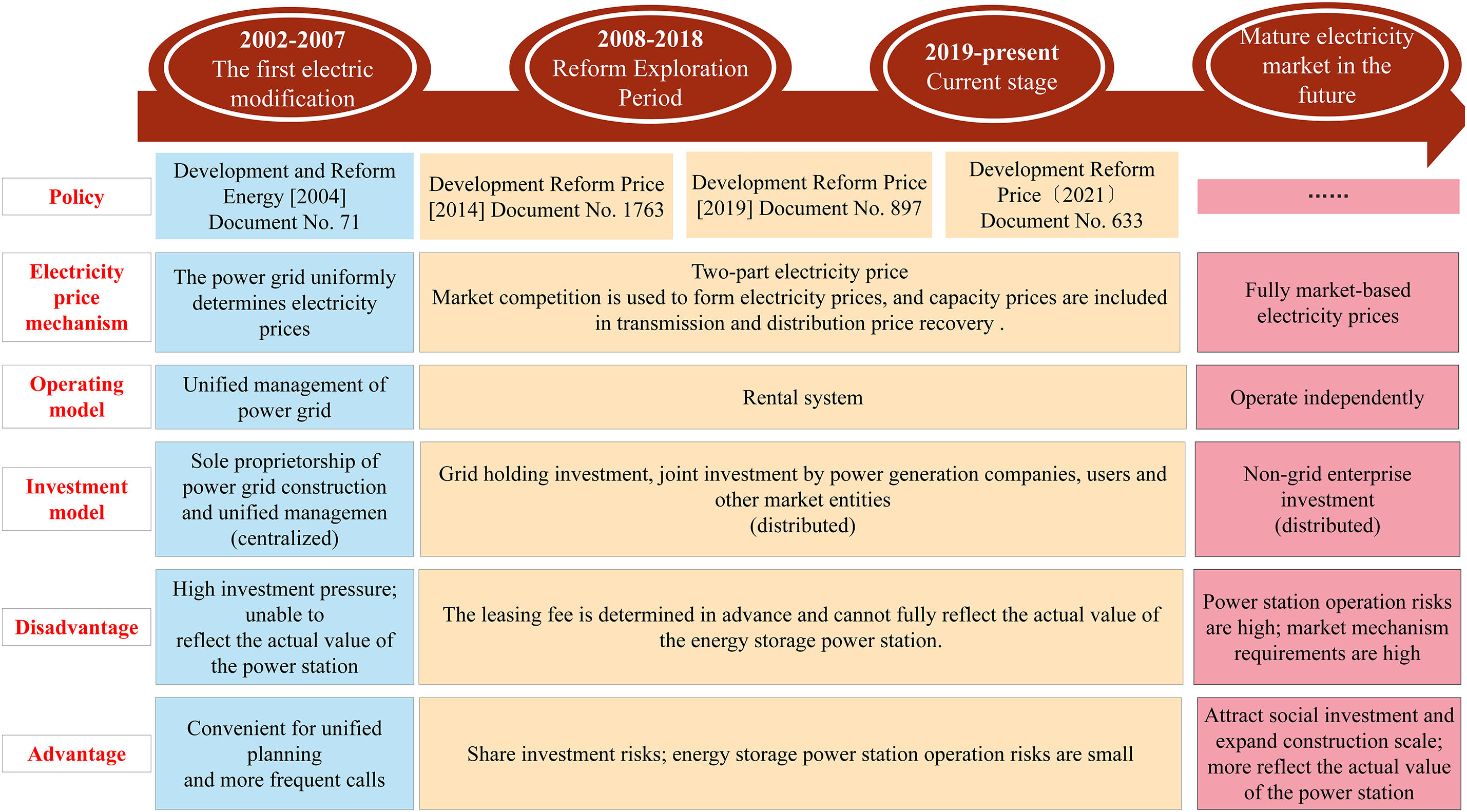

In the process of electricity market development, changes in electricity price mechanisms reflect the evolution of market competition and related mechanisms, directly impacting the operation and investment models of energy storage. Typically, based on differences in regulatory policies and electricity price mechanisms at different times, the operation models of energy storage stations can be categorized into three types: grid integration, leasing, and independent operation.

From the development history of electricity prices abroad, there are different electricity price formation mechanisms in different stages of the electricity market. The early, middle, and mature stages of the electricity market respectively adopt two-tier electricity prices, the price formation mechanism of “fixed income + variable bidding”, and the completely marketized electricity price formation mechanism.

China’s electricity market is still in the initial stage, mainly based on grid-determined electricity prices and two-tier electricity prices, and has not yet formed a completely marketized electricity price. Since China first proposed the reform of the power system in 2002, after 20 years of exploration, market-oriented electricity prices have become an important lever to guide market participants to invest and operate. China has tried some electricity price reforms, such as the implementation of time-of-use electricity prices and stepped electricity prices, but China’s electricity prices have not yet completed market-oriented transformations. Therefore, it is of great significance to formulate appropriate electricity price formation mechanisms for energy storage to obtain benefits in the electric energy market and guide energy storage investment [67,68]. Fig. 5 shows the relevant policies and changes in the electricity price mechanism in China.

Figure 5: Changes in policies and electricity price mechanisms related to Chinese energy storage market

Energy storage power stations are capital-intensive systems, with high construction costs and long payback periods. Large-scale, long-term energy storage projects are not attractive to most social enterprises and investors. Initially, most domestic energy storage projects were funded and constructed by grid companies, with costs recovered through transmission and distribution pricing. However, the fairness and rationality of this approach were questioned and it was revised and improved twice. China’s policy reforms in 2011 and 2019 clearly stipulated that grid investment in energy storage should not drive-up social electricity prices and should not affect the cost of transmission and distribution electricity pricing.

Before 2021, most energy storage projects relied mainly on single-capacity pricing for investment recovery, with little use of two-part tariffs. As of now, China has not yet developed a mature electricity market mechanism, and the operating and pricing mechanisms of new types of energy storage can refer to pumped storage plants, with two-part tariffs being the main mode of operation. Under this model, energy prices are determined through market competition and market clearing, while capacity prices are collected through transmission and distribution pricing. At the same time, it is necessary to promote the development of underlying electricity markets and to promote the good connection between energy storage and the market.

As demand for energy storage from the power system and the market continues to grow, it is imperative to attract more social capital outside of grid companies to invest and to drive the commercial development of energy storage. Therefore, considering the operating mode and profit channels of energy storage, designing a reasonable pricing mechanism and implementing it is crucial. Allowing energy storage to participate in market competition as an independent entity, to develop its own capacity allocation plan for energy and frequency support services, and to maximize its own economic profits, are essential for cost recovery and attracting external investment.

3.3 Income Sources and Existing Problems

Energy storage in China currently falls into two main categories: grid-side storage, directly invested and operated by grid companies, and source-load-side storage, invested by third parties for profit. Under the current dual-pricing system, energy storage profits mainly include capacity income, electricity income, and ancillary services income, achieved through reducing the demand for thermal power capacity, peak-valley price arbitrage, and providing ancillary services. From the perspective of market participants, when energy storage plays a role in ensuring the safe and stable operation of the power system, promoting the absorption of clean energy generation, and reducing the cost of power generation, transmission, and distribution for the system, it will radiate differentiated value to different subjects, including power sources, power grids, and users, and these beneficiaries have the responsibility to work together with energy storage to achieve cost recovery.

However, under the current market mechanism, the profitability of China’s energy storage projects is still relatively low. In terms of grid-side energy storage, the current investment entities and cost recovery methods for energy storage are relatively single. Although the investment cost of energy storage is generally considered in the formulation of market transmission and distribution electricity prices, under the constraints of national policies, the formulation of electricity prices needs to consider benefiting the people, which is not conducive to the profitability of energy storage itself, and grid companies face great investment pressure. In terms of source-load-side energy storage, its income mainly comes from the electricity market and ancillary services market. At the level of the electricity market, the current market mechanism in China has a small difference in time-of-use electricity prices, so the arbitrage value of energy storage charging and discharging is small, which is not compatible with the balancing value of electricity brought to the market. At the level of the ancillary services market, there is greater uncertainty in the volume and price of energy storage participating in peak load and frequency regulation, which depends on policy subsidies, and the scale of energy storage participating in the ancillary services market is limited, which is not compatible with the actual adjustment value it plays in the ancillary services market. Generally speaking, the current cost recovery of energy storage projects is highly dependent on policy subsidies, and the specific ancillary service income depends on the compensation for energy storage frequency regulation miles, capacity compensation, and compensation for improving user power quality formulated by relevant standards.

Facing the profitability dilemma of energy storage, some scholars have proposed to explore the profitability of energy storage through the business model of shared energy storage. “Shared energy storage” is a large independent energy storage aggregation merchant invested, constructed, and operated by a third party or a specific manufacturer, and is rented to demand-side entities such as new energy power stations and users to obtain revenue through capacity leasing. It is more flexible to meet the demand for power storage of different distributed market members. However, the fundamental profit dilemma of energy storage lies in the mismatch between its high cost and the market electricity price mechanism. The rent of shared energy storage to tenants cannot be higher than the benefits of energy storage to tenants. Without a substantial technological breakthrough to significantly reduce energy storage costs or the implementation of new supportive policies, achieving a closed-loop business model remains challenging.

In order to solve the current profitability problem of energy storage in China, it is necessary to refer to the practical experience of various countries to formulate a reasonable cost-guiding mechanism. From the perspective of different market types, in relatively mature electricity markets abroad, power source investment including the cost recovery of pumped storage is generally composed of electricity market, ancillary services market, and capacity market [69]. Considering the connection with the electricity market, the latest “Opinions on Further Improving the Pricing Mechanism of Pumped Storage” points out that energy storage power stations represented by pumped storage can obtain income through three main channels of electricity price, ancillary services market, and capacity fee, which are included in the transmission and distribution electricity price.

For China’s most widely used dual-pricing system, the external value of energy storage in the market can be regarded as reflecting and radiating value through the electricity market and capacity market, where the capacity market includes some functions of the ancillary services market. The cost-guiding path of energy storage power stations under the dual-pricing system is shown in Fig. 6.

Figure 6: Cost relief path for energy storage power stations under the two-part electricity price system

Currently, some companies in the United States and Germany use the “lease-to-own” model to serve users, promoting the interaction between distributed flexible energy storage resources and the entire power system operation [70]. The main benefits of distributed energy storage in China come from four parts: time-of-use electricity fee management, capacity fee management, improved power supply reliability, and improved power quality. As the installed capacity of commercial and industrial photovoltaics exceeds household photovoltaics, the benefits of energy storage have been greatly improved, occupying the dominant position of revenue flow. Commercial and industrial users can also obtain certain benefits through peak-valley price difference arbitrage, demand management, backup power supply, electricity spot trading, and electricity auxiliary services, further reducing enterprise electricity costs. However, the main problem with distributed energy storage remains the lack of a clear business model, a lack of effective time-of-use electricity price mechanism, insufficient user investment willingness, and difficult to support the vigorous development of distributed energy storage.

Currently, the Chinese electricity market is still in its early stages, primarily transferring some of the costs of energy storage to users through the formulation of transmission and distribution tariffs by grid companies. However, a cost recovery method guided by price signals and unified market mechanisms has not yet been established. Therefore, when designing relevant mechanisms for energy storage participation in the Chinese electricity market, foreign models should not be directly applied. Instead, cost sharing methods should be designed according to the price mechanisms of different stages of development in the Chinese electricity market, following the market evolution path.

4.1 Cost Sharing Path of ES in Different Stages of Marketization

Although the Chinese electricity market has not yet reached a mature stage, this section divides the marketization process into three different stages based on the development status and trends of foreign electricity markets. In different stages of marketization, there are similarities and differences in the mechanisms for electricity price formation, market participation forms, and profit channels, leading to gradual changes in the cost-sharing mechanisms for energy storage.

In the initial stage of electricity market construction, energy storage occupies a small market share, and power stations use a two-part tariff. The cost sharing path of energy storage is transmitted to the user side through the transmission and distribution price determined by the government. Users pay electricity fees to the power grid company according to the electricity price. This part of the electricity sales price includes two parts: electricity price and capacity price; the power grid company recovers the investment cost of the energy storage power station through the electricity fee and capacity fee paid by the user. In this stage, network-side energy storage can achieve a certain diversion of costs according to the transmission and distribution price, while the profitability of third-party investment source-load energy storage is limited by the difficulty of obtaining direct benefits from the electricity price mechanism, and the cost diversion is difficult.

In the middle stage of the development of the electricity market, the construction of the ancillary services market is still not perfect, and the energy storage power station can adopt the price formation mechanism of “fixed income + variable bidding”. This mechanism can guarantee the income of the energy storage power station to a certain extent and introduce the market mechanism to reflect the objective value of the energy storage power station. The fixed income part includes compensation for ancillary services and compensation for peak filling and valley power generation, which is shared by power generation enterprises, power grids, and users; the transmission and distribution prices of users and the transaction prices of power generation enterprises are determined by the government annually and are uniformly paid to the power grid company, which is then paid annually to the energy storage power station by the power grid company. The variable bidding part is determined by market competition, and the remaining capacity participates in the bidding of electric energy market and ancillary services market. This part of the additional income is directly transferred to the energy storage power station by users and power generation enterprises in a certain proportion. At this time, the cost of both network-side and source-load energy storage can be well diverted to various stakeholders, but it is still subject to certain constraints of relevant policies and systems.

In the mature stage of the electricity market development, the energy storage power station adopts a completely marketized price formation mechanism in the complete market system, and the government does not participate in the determination of any stage of electricity price. The energy storage system obtains many profit opportunities in the auxiliary services market and electric energy market at different time dimensions such as day-ahead, real-time, etc., and obtains reasonable returns. Through market competition, all participants in the market should provide a certain amount of funds to the energy storage system according to market rules, including contract electricity price in the medium and long-term market, electricity fees in the electric energy market, and ancillary service fees in the backup and ancillary service market. All participants in the electricity market participate in cost diversion, including users, various power generation enterprises, power grid companies, and electricity sales companies. At this time, both network-side energy storage invested by power grid companies and third-party source-load energy storage invested by third parties can recover costs through multiple markets and use reasonable and effective market mechanisms to divert energy storage investment and construction costs to beneficiaries.

4.2 Policy Suggestions for ES Cost Sharing Mechanism in China

1) Gradually improve the domestic spot market mechanism, form electricity market clearing prices and auxiliary service prices through market-oriented means. Enhancing market mechanisms helps to establish reasonable price signals, incentivizing energy storage to profit from the market through various services. It is recommended to reference the spot market mechanisms of typical electricity systems in North America, Europe, and other regions to design electricity energy markets and ancillary service markets suitable for China’s conditions, gradually, through market competition, achieve the rational allocation of various generation resources and form electricity clearing prices and ancillary service prices through market-oriented means. At present, we strive to use the time-of-use electricity price mechanism to form peak-valley price difference income to fill capacity costs, increase the income of energy storage itself; under the policy of two-part electricity price, ensure that new energy storage participates in various markets, provides multiple services, and realizes the superposition of multiple market income; in the long run, aim to compete in large-scale energy storage in the whole electric energy market, use its market influence to form a larger electricity price difference to facilitate obtaining income while peak shaving, no longer give capacity compensation to energy storage power stations, and fully recover costs and obtain income through the market.

2) Formulate reasonable time-of-use electricity price mechanism to guide the orderly investment of distributed energy storage. The distributed energy storage system has flexible access locations. Referring to the development path of energy storage markets in countries such as Germany and Australia, the proportion of household energy storage projects and light storage joint construction projects will continue to increase in the future, and the potential market of distributed energy storage is huge. The time-of-use electricity price in the domestic market is often determined by the power grid, and the price difference between peak and valley hours is not large. Energy storage cannot fully recover its own value by arbitrage income in the electric energy market. Therefore, it is recommended to draw from the existing experience of electricity price mechanisms in typical power systems and formulate more reasonable time-of-use electricity price mechanisms. This would help increase societal capital’s willingness to invest in energy storage.

3) Strengthen the cost sharing path of energy storage by both supply and demand sides of the power system. In the stage with low degree of marketization, energy storage cannot divert costs to all market participants through the form of the market, and a relatively crude secondary allocation form can be adopted to recover a part of the energy storage costs in advance: firstly, calculate the external value of energy storage to power generation side and demand side, and actively include the three aspects of user side, power grid side, and power source side into the market mechanism; secondly, within the power generation side and demand side, each unit or user shall bear a part of the construction cost of the energy storage power station according to the degree of demand or benefit from the energy storage, and the cost borne by the unit or user shall not exceed 85% of the additional value.

4) Adaptation of the capacity compensation mechanism for energy storage. In the initial stages of establishing a capacity market, it is recommended to consider compensation mechanisms from regions such as North America and the United Kingdom. Governments and authoritative institutions can provide differentiated capacity compensation based on the available capacity of energy storage stations and related cost estimates. This will help energy storage stations expand their profit channels and recover fixed costs as much as possible in the early stages. As the capacity market mechanism matures, it is advisable to gradually promote the marketization of energy storage transactions. Through market competition, capacity compensation prices can be formed, and ultimately, these costs can be distributed among all users through transmission and distribution tariffs.

As the scale of new energy storage continues to expand and its diverse applications emerge, it has become an inevitable trend to establish reasonable market mechanisms to meet investment and construction needs. However, the current market mechanisms are not conducive to the proper cost-sharing of energy storage and are difficult to support the large-scale investment and operation of future new energy storage projects in China. Therefore, this paper first compares and analyzes the energy storage operation mechanisms in three typical markets: the United States, Europe, and Australia. It analyzes and explores feasible market operation experiences of these countries from the perspectives of pre-market and post-market participation, operating modes, profit channels, and other factors. Based on this analysis, it focuses on the development history of China’s energy storage market participation forms, investment models, and profit channels, and summarizes the key issues of cost-sharing mechanisms for energy storage under market conditions. Finally, it looks forward to the cost-sharing paths under different stages of marketization and proposes policy recommendations for cost-sharing mechanisms adapted to China’s electricity market development. The aim is to clarify the diverse revenue channels of energy storage and the existing contradictions, and to address the key issues of energy storage cost sharing under China’s current dual-pricing system.

The main conclusions of this study are as follows:

1) Analysis of typical foreign power systems shows that improved market mechanisms and reasonable policy subsidies are essential for the economic viability of energy storage projects. The pre-market relies more on a well-established market access mechanism and electricity pricing mechanism, while the development of energy storage in the post-market is mainly driven by relevant subsidy policies. With the acceleration of energy transition, it is necessary to promote the development of energy storage in both pre-market and post-market simultaneously, by continuously improving market mechanisms and exploring reasonable subsidy policies to ensure the economic viability of energy storage projects.

2) The current cost guidance mechanism for energy storage in China faces a series of issues in terms of market participation forms, operation and investment modes, and profit channels. There is a need for further exploration of market participation approaches for centralized and distributed energy storage, improvement of electricity pricing mechanisms, and expansion of profit channels for energy storage to better adapt to the future marketization of China’s power sector.

3) Considering the different stages of power marketization in China, it is necessary to adopt different market access mechanisms and energy storage subsidy policies according to the cost guidance paths. This involves gradually improving market mechanisms, formulating reasonable electricity pricing mechanisms, facilitating cost guidance paths on both supply and demand sides, and implementing comprehensive compensation policies. These measures will better ensure the economic viability of energy storage projects and guide the role of energy storage in the future marketization of China’s power sector.

Acknowledgement: The authors would like to thank M. Zhou for the valuable suggestions on the paper.

Funding Statement: This work is supported financially by State Grid Henan Electric Power Company Technology Project “Research on System Cost Impact Assessment and Sharing Mechanism under the Rapid Development of Distributed Photovoltaics” (Grant Number: 5217L0220021).

Author Contributions: The authors confirm contribution to the paper as follows: study conception and design: Junhui Liu, Zijian Meng, Zhaoyuan Wu; data collection: Yihan Zhang, Zijian Meng; analysis and interpretation of results: Junhui Liu, Yihan Zhang, Zijian Meng; draft manuscript preparation: Meng Yang, Yao Lu, Zhe Chai. All authors reviewed the results and approved the final version of the manuscript.

Availability of Data and Materials: The data that support the findings of this study are openly available in U.S. Energy Information Administration at https://www.eia.gov/ (accessed on 1 April 2024) and Australian Energy Market Operator at https://www.aemo.com.au/ (accessed on 1 April 2024).

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

References

1. Z. Wu, M. Zhou, J. Wang, W. Tang, B. Yuan and G. Li, “Review on market mechanism to enhance the flexibility of power system under the dual-carbon target,” (in ChineseProc. CSEE, vol. 42, no. 21, pp. 7746–7764, Nov. 2022. doi: 10.13334/j.0258-8013.pcsee.212117. [Google Scholar] [CrossRef]

2. B. Tarekegne, R. O’Neil, and J. Twitchell, “Energy storage as an equity asset,” Curr. Sustain Renew. Energy Rep., vol. 8, no. 3, pp. 149–155, Sep. 2021. doi: 10.1007/s40518-021-00184-6. [Google Scholar] [CrossRef]

3. T. Levin et al., “Energy storage solutions to decarbonize electricity through enhanced capacity expansion modelling,” Nat. Energy, vol. 8, no. 11, pp. 1199–1208, Nov. 2023. doi: 10.1038/s41560-023-01340-6. [Google Scholar] [CrossRef]

4. Y. Zhou, J. Wu, and C. Long, “Evaluation of peer-to-peer energy sharing mechanisms based on a multiagent simulation framework,” Appl. Energy, vol. 222, pp. 993–1022, Jul. 2018. doi: 10.1016/j.apenergy.2018.02.089. [Google Scholar] [CrossRef]

5. W. Y. Zhang, B. Zheng, W. Wei, L. Chen, and S. Mei, “Peer-to-peer transactive mechanism for residential shared energy storage,” Energy, vol. 246, pp. 123204, May 2022. doi: 10.1016/j.energy.2022.123204. [Google Scholar] [CrossRef]

6. L. Chen, N. Liu, and J. Wang, “Peer-to-peer energy sharing in distribution networks with multiple sharing regions,” IEEE Trans. Ind. Inform., vol. 16, no. 11, pp. 6760–6771, Nov. 2020. doi: 10.1109/TII.2020.2974023. [Google Scholar] [CrossRef]

7. N. Liu, X. Yu, C. Wang, and J. Wang, “Energy sharing management for microgrids with PV prosumers: A stackelberg game approach,” IEEE Trans. Ind. Inform., vol. 13, no. 3, pp. 1088–1098, Jun. 2017. doi: 10.1109/TII.2017.2654302. [Google Scholar] [CrossRef]

8. A. Paudel, K. Chaudhari, C. Long, and H. B. Gooi, “Peer-to-peer energy trading in a prosumer-based community microgrid: A game-theoretic model,” IEEE Trans. Ind. Electron, vol. 66, no. 8, pp. 6087–6097, Aug. 2019. doi: 10.1109/TIE.2018.2874578. [Google Scholar] [CrossRef]

9. P. Chakraborty, E. Baeyens, K. Poolla, P. P. Khargonekar, and P. Varaiya, “Sharing storage in a smart grid: A coalitional game approach,” IEEE Trans. Smart Grid, vol. 10, no. 4, pp. 4379–4390, Jul. 2019. doi: 10.1109/TSG.2018.2858206. [Google Scholar] [CrossRef]

10. J. Liu, N. Zhang, C. Kang, D. S. Kirschen, and Q. Xia, “Decision-making models for the participants in cloud energy storage,” IEEE Trans. Smart Grid, vol. 9, no. 6, pp. 5512–5521, Nov. 2018. doi: 10.1109/TSG.2017.2689239. [Google Scholar] [CrossRef]

11. C. S. Lai and G. Locatelli, “Economic and financial appraisal of novel large-scale energy storage technologies,” Energy, vol. 214, pp. 118954, Jan. 2021. doi: 10.1016/j.energy.2020.118954. [Google Scholar] [CrossRef]

12. S. A. Mansouri, S. Maroufi, and A. Ahmarinejad, “A tri-layer stochastic framework to manage electricity market within a smart community in the presence of energy storage systems,” J. Energy Storage, vol. 71, pp. 108130, Nov. 2023. doi: 10.1016/j.est.2023.108130. [Google Scholar] [CrossRef]

13. I. Duggal and B. Venkatesh, “Short-term scheduling of thermal generators and battery storage with depth of discharge-based cost model,” IEEE Trans. Power Syst., vol. 30, no. 4, pp. 2110–2118, Jul. 2015. doi: 10.1109/TPWRS.2014.2352333. [Google Scholar] [CrossRef]

14. D. Pozo, J. Contreras, and E. E. Sauma, “Unit commitment with ideal and generic energy storage units,” IEEE Tran. Power Syst., vol. 29, no. 6, pp. 2974–2984, Nov. 2014. doi: 10.1109/TPWRS.2014.2313513. [Google Scholar] [CrossRef]

15. Z. Zhang, Y. Zhang, Q. Huang, and W. J. Lee, “Market-oriented optimal dispatching strategy for a wind farm with a multiple stage hybrid energy storage system,” CSEE J. Power Energy Syst., vol. 4, no. 4, pp. 417–424, Dec. 2018. doi: 10.17775/CSEEJPES.2018.00130. [Google Scholar] [CrossRef]

16. H. Oh, “Optimal planning to include storage devices in power systems,” IEEE Trans. Power Syst., vol. 26, no. 3, pp. 1118–1128, Aug. 2011. doi: 10.1109/TPWRS.2010.2091515. [Google Scholar] [CrossRef]

17. H. Akhavan-Hejazi and H. Mohsenian-Rad, “Optimal operation of independent storage systems in energy and reserve markets with high wind penetration,” IEEE Trans. Smart Grid, vol. 5, no. 2, pp. 1088–1097, Mar. 2014. doi: 10.1109/TSG.2013.2273800. [Google Scholar] [CrossRef]

18. B. Xu et al., “Scalable planning for energy storage in energy and reserve markets,” IEEE Trans. Power Syst., vol. 32, no. 6, pp. 4515–4527, Nov. 2017. doi: 10.1109/TPWRS.2017.2682790. [Google Scholar] [CrossRef]

19. A. S. A. Awad, J. D. Fuller, T. H. M. E. Fouly, and M. M. A. Salama, “Impact of energy storage systems on electricity market equilibrium,” IEEE Trans. Sustain Energy, vol. 5, no. 3, pp. 875–885, Jul. 2014. doi: 10.1109/TSTE.2014.2309661. [Google Scholar] [CrossRef]

20. P. Zou, Q. Chen, Q. Xia, G. He, and C. Kang, “Evaluating the contribution of energy storages to support large-scale renewable generation in joint energy and ancillary service markets,” IEEE Trans. Sustain Energy, vol. 7, no. 2, pp. 808–818, Apr. 2016. doi: 10.1109/TSTE.2015.2497283. [Google Scholar] [CrossRef]

21. D. Krishnamurthy, C. Uckun, Z. Zhou, P. R. Thimmapuram, and A. Botterud, “Energy storage arbitrage under day-ahead and real-time price uncertainty,” IEEE Trans. Power Syst., vol. 33, no. 1, pp. 84–93, Jan. 2018. doi: 10.1109/TPWRS.2017.2685347. [Google Scholar] [CrossRef]

22. Y. Chen, M. Keyser, M. H. Tackett, and X. Ma, “Incorporating short-term stored energy resource into midwest ISO energy and ancillary service market,” IEEE Trans. Power Syst., vol. 26, no. 2, pp. 829–838, May 2011. doi: 10.1109/TPWRS.2010.2061875. [Google Scholar] [CrossRef]

23. J. A. Taylor, “Financial storage rights,” IEEE Trans. Power Syst., vol. 30, no. 2, pp. 997–1005, Mar. 2015. doi: 10.1109/TPWRS.2014.2339016. [Google Scholar] [CrossRef]

24. M. Kazemi, H. Zareipour, N. Amjady, W. D. Rosehart, and M. Ehsan, “Operation scheduling of battery storage systems in joint energy and ancillary services markets,” IEEE Trans. Sustain Energy, vol. 8, no. 4, pp. 1726–1735, Oct. 2017. doi: 10.1109/TSTE.2017.2706563. [Google Scholar] [CrossRef]

25. X. Wu, J. Zhao, and A. J. Conejo, “Optimal battery sizing for frequency regulation and energy arbitrage,” IEEE Trans. Power Deliv., vol. 37, no. 3, pp. 2016–2023, Jun. 2022. doi: 10.1109/TPWRD.2021.3102420. [Google Scholar] [CrossRef]

26. G. He, Q. Chen, C. Kang, P. Pinson, and Q. Xia, “Optimal bidding strategy of battery storage in power markets considering performance-based regulation and battery cycle life,” IEEE Trans. Smart Grid, vol. 7, no. 5, pp. 2359–2367, Sep. 2016. doi: 10.1109/TSG.2015.2424314. [Google Scholar] [CrossRef]

27. G. He, Q. Chen, C. Kang, Q. Xia, and K. Poolla, “Cooperation of wind power and battery storage to provide frequency regulation in power markets,” IEEE Trans. Power Syst., vol. 32, no. 5, pp. 3559–3568, Sep. 2017. doi: 10.1109/TPWRS.2016.2644642. [Google Scholar] [CrossRef]

28. W. Zhong, K. Xie Y. Liu, C. Yang, S. Xie and Y. Zhang, “Online control and near-optimal algorithm for distributed energy storage sharing in smart grid,” IEEE Trans. Smart Grid, vol. 11, no. 3, pp. 2552–2562, May 2020. doi: 10.1109/TSG.2019.2957426. [Google Scholar] [CrossRef]

29. C. Chen et al., “Optimal strategy of distributed energy storage two-layer cooperative game based on improved owen-value method,” (in ChineseProc. CSEE, vol. 42, no. 11, pp. 3924–3936, Jun. 2022. doi: 10.13334/j.0258-8013.pcsee.211275. [Google Scholar] [CrossRef]

30. D. Kalathil, C. Wu, K. Poolla, and P. Varaiya, “The sharing economy for the electricity storage,” IEEE Trans. Smart Grid, vol. 10, no. 1, pp. 556–567, Jan. 2019. doi: 10.1109/TSG.2017.2748519. [Google Scholar] [CrossRef]

31. Y. Li et al., “Multi-energy cloud energy storage for power systems: Basic concepts and research prospects,” (in ChineseProc. CSEE, vol. 43, no. 6, pp. 2179–2190, Mar. 2023. doi: 10.13334/j.0258-8013.pcsee.220244. [Google Scholar] [CrossRef]

32. National Renewable Energy Laboratory, “Federal tax incentives for energy storage systems,” Nov. 2020. Accessed: Apr. 1, 2024. [Online]. Available: https://buildnative.com/wp-content/uploads/2017/12/67558.pdf [Google Scholar]

33. The White House, “The build back better framework,” Oct. 2021. Accessed: Apr. 1, 2024. [Online]. Available: https://www.whitehouse.gov/build-back-better/ [Google Scholar]

34. Federal Energy Regulatory Commission, “Electric storage participation-FERC order 841,” Nov. 2020. Accessed: Apr. 1, 2024. [Online]. Available: https://www.ferc.gov/media/order-no-841 [Google Scholar]

35. Federal Energy Regulatory Commission, “FERC opens wholesale markets to distributed resources: Landmark action breaks down barriers to emerging technologies, boosts competition,” Sep. 2020. Accessed: Apr. 1, 2024. [Online]. Available: https://www.ferc.gov/news-events/news/ferc-opens-wholesale-markets-distributed-resources-landmark-action-breaks-down [Google Scholar]

36. UK Government, “The ten point plan for a green industrial revolution,” Nov. 2020. Accessed: Apr. 1, 2024. [Online]. Available: https://www.gov.uk/government/publications/the-ten-point-plan-for-a-green-industrial-revolution [Google Scholar]

37. UK Government, “Upgrading our energy system: Smart systems and flexibility,” Oct. 2018. Accessed: Apr. 1, 2024. [Online]. Available: https://www.gov.uk/government/publications/upgrading-our-energy-system-smart-systems-and-flexibility-plan [Google Scholar]

38. National Grid, “Enhanced frequency response: Frequently asked questions,” Mar. 2016. Accessed: Apr. 1, 2024. [Online]. Available: https://www.nationalgrid.com/sites/default/files/documents/Enhanced%20Frequency%20Response%20FAQs%20v5.0_.pdf [Google Scholar]

39. National Grid, “Firm frequency response: Frequently asked questions,” Aug. 2017. Accessed: Apr. 1, 2024. [Online]. Available: https://www.nationalgrideso.com/document/95581/download [Google Scholar]

40. K. -P. Kairies, J. Figgener, D. Haberschusz, O. Wessels, B. Tepe and D. U. Sauer, “Market and technology development of PV home storage systems in Germany,” J. Energy Storage, vol. 23, pp. 416–424, Jun. 2019. doi: 10.1016/j.est.2019.02.023. [Google Scholar] [CrossRef]

41. M. Resch, J. Bühler, M. Klausen, and A. Sumper, “Impact of operation strategies of large scale battery systems on distribution grid planning in Germany,” Renew. Sustain Energy Rev., vol. 74, pp. 1042–1063, Jul. 2017. doi: 10.1016/j.rser.2017.02.075. [Google Scholar] [CrossRef]

42. J. Figgener et al., “The development of stationary battery storage systems in Germany—A market review,” J. Energy Storage, vol. 29, pp. 101153, Jun. 2020. doi: 10.1016/j.est.2019.101153. [Google Scholar] [CrossRef]

43. F. Riedel, G. Gorbach, and C. Kost, “Barriers to internal carbon pricing in German companies,” Energy Policy, vol. 159, pp. 112654, Dec. 2021. doi: 10.1016/j.enpol.2021.112654. [Google Scholar] [CrossRef]

44. National Development and Reform Commission and National Energy Administration, “14th Five-Year Plan’ for the construction of a modern energy system,” (in ChineseJan. 2022. Accessed: Apr. 1, 2024. [Online]. Available: http://zfxxgk.nea.gov.cn/2022-01/29/c_1310524241.htm [Google Scholar]

45. National Development and Reform Commission and National Energy Administration, “Guidance on promoting the development of new energy storage,” Jul. 2021. Accessed: Apr. 1, 2024. [Online]. Available: https://www.ndrc.gov.cn/xxgk/zcfb/ghxwj/202107/t20210723_1291321.html [Google Scholar]

46. A. Colthorpe, “World’s energy storage capacity forecast to exceed a terawatt-hour by 2030,” Energy Storage News, Oct. 2023. Accessed: Apr. 1, 2024. [Online]. Available: https://www.energy-storage.news/worlds-energy-storage-capacity-forecast-to-exceed-a-terawatt-hour-by-2030/ [Google Scholar]

47. J. Hu, G. Yang, Z. Song, and C. Kang, “Preliminary discussion on the supporting policies and the china’s development model of the new energy storage,” (in ChinesePower Syst. Technol., vol. 48, no. 2, pp. 469–480, Feb. 2024. doi: 10.13335/j.1000-3673.pst.2023.1577. [Google Scholar] [CrossRef]

48. S. P. Network, “America’s newly installed capacity doubles! Europe becomes the largest market for electrochemical energy storage,” (in ChineseSohu Website, Oct. 2021. Accessed: Apr. 1, 2024. [Online]. Available: https://business.sohu.com/a/497252930_418320 [Google Scholar]

49. U.S. Energy Information Administration, “Electric power annual,” Apr. 2024. Accessed: Apr. 1, 2024. [Online]. Available: https://www.eia.gov/electricity/data.php [Google Scholar]

50. California Solar & Storage Association, “California legislature passes “the million solar roofs of energy storage” bil,” Jul. 2018. Accessed: Apr. 1, 2024. [Online]. Available: https://calssa.org/press-releases/2018/8/30/california-legislature-passes-the-million-solar-roofs-of-energy-storage-bill [Google Scholar]

51. National Energy Information Platform, “Accumulating power: A special analysis report on the European energy storage market,” (in ChineseBaidu Website, Sep. 2021. Accessed: Apr. 1, 2024. [Online]. Available: https://baijiahao.baidu.com/s?id=1712032248958142099&wfr=spider&for=pc [Google Scholar]

52. H. Zhu, J. Xu, G. Liu, F. Yue Z. Yu and X. Zhang, “UK policy mechanisms and business models for energy storage and their applications to China,” (in ChineseEnergy Storage Sci. Technol., vol. 11, no. 1, pp. 370–378, Jan. 2022. doi: 10.19799/j.cnki.2095-4239.2021.0290. [Google Scholar] [CrossRef]

53. A. Skujins, “Solar PV LCOE expected to slide to $0.021/kWh by 2050, DNV says,” PV Magazine International, Oct. 2023. Accessed: Apr. 1, 2024. [Online]. Available: https://www.pv-magazine.com/2023/10/11/solar-pv-lcoe-expected-to-slide-to-0-021-kwh-by-2050-dnv-says/ [Google Scholar]

54. H. Chen, W. Zhang, L. Shi, X. Li, K. Wang and Y. Gong, “Research on the development and application of the photovoltaic and energy storage system in the user-side at home and Abroad,” (in ChinesePower Gener. Technol., vol. 41, no. 2, pp. 110–117, Apr. 2020. doi: 10.12096/j.2096-4528.pgt.19156. [Google Scholar] [CrossRef]

55. G. Liu, B. Li, X. Hu, F. Yue, and J. Xu, “Australia policy mechanisms and business models for energy storage and their applications to China,” (in ChineseEnergy Storage Sci. Technol., vol. 11, no. 7, pp. 2332–2343, Jul. 2022. doi: 10.19799/j.cnki.2095-4239.2021.0605. [Google Scholar] [CrossRef]

56. Australian Energy Market Operator, “Quarterly energy dynamics Q4 2021,” Jan. 2022. Accessed: Apr. 1, 2024. [Online]. Available: https://aemo.com.au/-/media/files/major-publications/qed/2021/q4-report.pdf?la=en [Google Scholar]

57. Australian Energy Market Operator, “Quarterly energy dynamics Q4 2022,” Jan. 2023. Accessed: Apr. 1, 2024. [Online]. Available: https://aemo.com.au/-/media/files/major-publications/qed/2022/qed-q4-2022.pdf?la=en [Google Scholar]

58. Australian Energy Market Operator, “Quarterly energy dynamics Q4 2023,” Jan. 2024. Accessed: Apr. 1, 2024. [Online]. Available: https://aemo.com.au/-/media/files/major-publications/qed/2023/quarterly-energy-dynamics-q4-2023.pdf [Google Scholar]