Open Access

Open Access

ARTICLE

Blockchain-Based Power Transaction Method for Active Distribution Network

1 College of Energy and Electrical Engineering, Hohai University, Nanjing, 211100, China

2 School of Microelectronics and Control Engineering, Changzhou University, Changzhou, 213164, China

* Corresponding Author: Haiteng Han. Email:

Energy Engineering 2023, 120(5), 1067-1080. https://doi.org/10.32604/ee.2023.022479

Received 12 March 2022; Accepted 29 July 2022; Issue published 20 February 2023

Abstract

A blockchain-based power transaction method is proposed for Active Distribution Network (ADN), considering the poor security and high cost of a centralized power trading system. Firstly, the decentralized blockchain structure of the ADN power transaction is built and the transaction information is kept in blocks. Secondly, considering the transaction needs between users and power suppliers in ADN, an energy request mechanism is proposed, and the optimization objective function is designed by integrating cost aware requests and storage aware requests. Finally, the particle swarm optimization algorithm is used for multi-objective optimal search to find the power trading scheme with the minimum power purchase cost of users and the maximum power sold by power suppliers. The experimental demonstration of the proposed method based on the experimental platform shows that when the number of participants is no more than 10, the transaction delay time is 0.2 s, and the transaction cost fluctuates at 200,000 yuan, which is better than other comparison methods.Keywords

With the wide promotion and application of new energy sources such as photovoltaics, wind power, and biomass energy, renewable energy is now being connected to the distribution network through microgrids with great penetration [1] and thus form an active distribution network (ADN) [2], which calls for an efficient and reliable energy trading and control mechanism to increase the energy utilization [3]. Most of the electricity transactions are affected in centralized trading centers and dominated by qualified organizations, which to some extent ensures that the power transactions are safe and reliable. However, congestion problems still exist, which calls for further optimization [4].

In recent years, extensive research has been conducted to address the energy transaction issues in AND [5,6]. Rui et al. [6] proposed a Nash bargaining method for multi-microgrid energy trading to minimize the operation costs and designed the cooperative game model for MMG bargaining, reducing the MMG operation cost. However, the transaction efficiency of ADN needs to be improved. Hayes et al. [7] designed a method for joint simulation of distribution network and local energy trading platform. The interface between the distribution system simulator and energy trading platform uses a distributed double auction transaction mechanism based on blockchain. Complicated transactions require greater computational costs and put greater pressure on the trading platform. Luo et al. [8] proposed a two-layer distributed electricity trading system based on electricity sharing among prosumers. The bottom layer was a multi-agent system to support the transaction progress while the top layer was a blockchain-based transaction settlement mechanism, which made sure that the settlement was safe and reliable. However, the proposed system failed to consider the randomness of new energy output.

Blockchain is a newly emerging transaction method in recent years. During the transaction, all data is encrypted using a modern cryptographic algorithm to make that the data is complete and tamper-proof and this is how block provided a solution to the problems of the many transaction entities and low security in ADN. Besides, blockchain enables the energy trading between the ADN user and power supplier, which ensures the balance of production and consumption of renewable energy [9]. Che et al. [10] proposed a blockchain-based distributed renewable energy trading authentication mechanism in which the transaction nodes had to go through the ID authentication process. The system provided nodes with access by controlling the public keys and private keys of trading participants for identity authentication. However, for complex heterogeneous systems containing various types of new energy and energy storage, their security performance needs to be verified. He et al. [11] combined cross-chain trading and blockchain technology and proposed a joint operation mechanism for the energy market, which ensures that the mainchain and sidechain can share data and circulate value. However, the method proposed is too complicated for efficient electricity trading. In Chaudhary et al. [12], a blockchain-based secure energy trading scheme for electric vehicles was suggested to verify the charging requests of electric vehicles. However, the evaluation of the communication and transaction costs needs to be improved. Li et al. [13] designed a transaction system of a multi-energy system based on heterogeneous blockchain technology to enhance information security in coalition transactions. However, this work did not delve into the economy and applicability of the electricity trading process.

In this study, we propose a blockchain-based power transaction method for ADN considering the security and economy of the transactions. The novelty of the method lies with the following aspects:

1) In view of the shortcomings of centralized trading mode, such as low efficiency and high energy consumption, blockchain technology [14] is introduced to conduct power trading to ensure the security of trading information.

2) In order to improve the economy of power trading, particle swarm optimization [15] is introduced to carry out multi-objective search optimization and find the optimal scheme.

Firstly, the blockchain structure of ADN power trading is designed by using the decentralized characteristics of blockchain; Then, the energy request mechanism is proposed to meet the transaction needs, and the cost aware and storage aware requests are integrated to design the optimization objective function; Finally, particle swarm optimization algorithm is used for multi-objective optimal search to obtain the optimal power trading scheme. The experimental results of the simulation platform show that the proposed method can increase the sales of new energy and reduce the amount of wind and light abandonment while ensuring the minimum cost of power purchase.

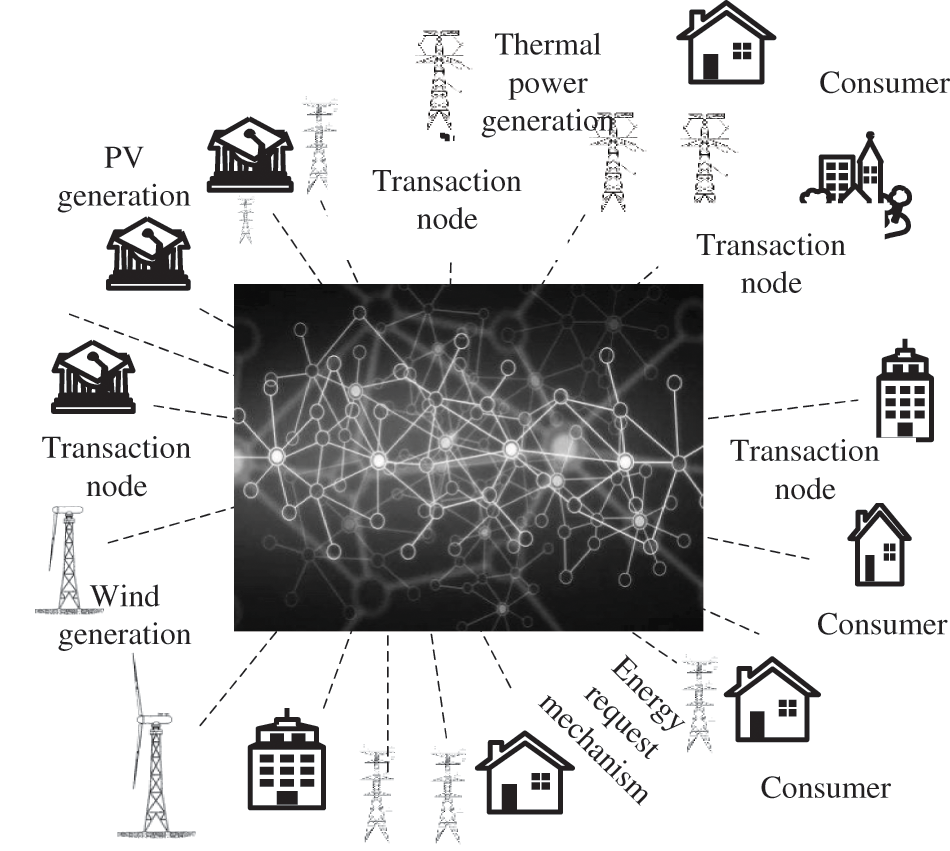

In the proposed ADNs, the energy trading between the power supplier and the user provides sufficient energy at a low rate without dependence on other power suppliers [16]. Therefore, the extra energy provided by the transaction nodes could be used for reliable power transactions via blockchain, which meets the economic demand of the power grid. Assuming that each group of transaction nodes could store the dispensable extra energy and have its energy storage capacity with the limitations set, and the transaction nodes could have different energy requests over a period of time, the ADN system architecture can be shown as Fig. 1.

Figure 1: Architecture of the system

In which the decentralized blockchain architecture of ADN power transactions is designed. The transaction information is stored in blocks and each node is related to renewable energy sources like solar energy, hydropower, and wind power to meet the energy demand of corresponding areas [14]. The storage perception and storage perception processing requests are proposed to handle the energy requests of the nodes. Meanwhile, considering the costs and storage capacity, the multi-objective particle swarm algorithm is used to search for an economic and safe power transaction plan, which minimizes the purchase cost of the user and maximizes the sales of the power supplier.

The processing of the trading requests submitted by the users in the centralized trading system will bring up the heavy cost of data processing and computation [17]. Therefore, a decision variable

Whereas the variation of the dispensable energy storage in a generation cycle is:

In the equations,

If the internal storage unit

The distance matrix

where

3 Blockchain-Based Power Trading Method

All power suppliers and users form the power transaction nodes in ADN. Newly added nodes to the network need to prepare their identity information, public key, and private key, etc. Authentication of identity information can be performed by a qualified third party. At the same time, the review and earnest money deposit will guarantee the authenticity of the identity information of the new nodes [20]. The public key and identity information of the new node will be sent to other transaction nodes, so the authenticity of the information can be verified by the public key. The private key will only be kept secret by its owner, which can testify to the authenticity of the power transaction blockchain. As other nodes cannot decrypt the private key, they cannot provide fake transactions.

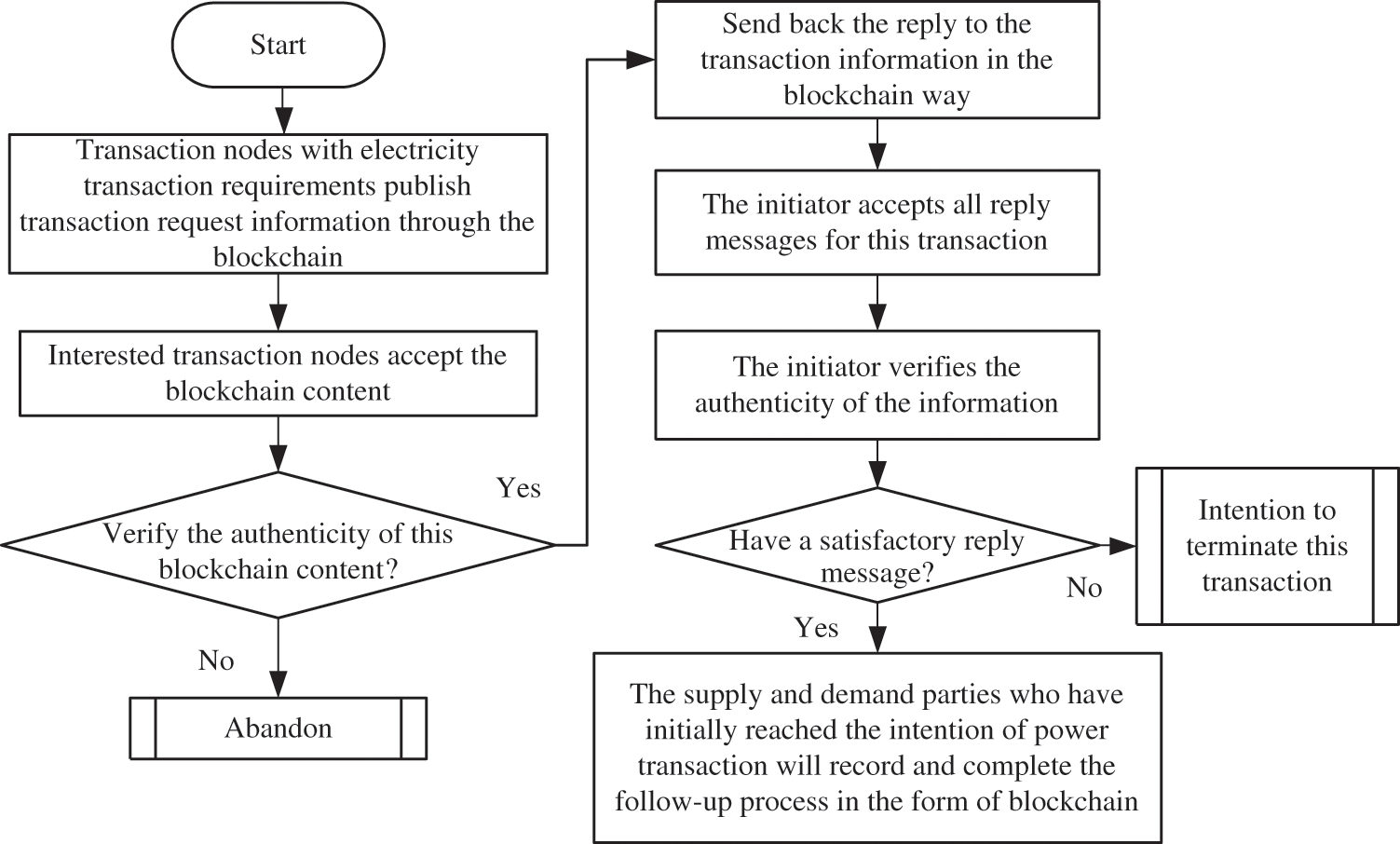

When a transaction node joins an ADN power transaction, its identity information and public key will form the initial state of the blockchain for power transactions. The identity information and public key will be sent to other transaction nodes in the ADN for use. As the information recorded by the blockchain is immutable, it will be a security guarantee for the power transactions that follows. The electricity transaction flow based on blockchain is shown in Fig. 2.

Figure 2: Blockchain-based power transaction flow

The key steps of power trading are as follows:

1) All ADN power transaction nodes monitor the blockchain data in the ADN communication network uninterruptedly. In case the power transaction request is put forward by a node, its transaction volume will be calculated via Hash algorithm and be encrypted by its private key, then it will be sent to the blockchain. The blockchain information of the transaction request will be broadcast across the ADN network to all transaction nodes.

2) Any transaction node receiving the blockchain data with the latest transaction request can then decrypt the Hash data using the public key and compare it with the received transaction demand hash. If the information matches, we could conclude that the blockchain information is real, and to same as the power transaction demand of the transaction node.

3) Following the energy request mechanism, the node will then search for an optimal power transaction plan using the particle swarm algorithm based on its power generation or power consumption. It will take this power trading request if all conditions are met. If not, it will ignore the information. Under the condition that the request is taken or the need to negotiate the price and volume arises, the transaction node will propose a new transaction plan, encrypt the blockchain data with the plan with its private key and broadcast it across the network.

4) The supply and demand parties who have reached the consensus on the power transaction will record the whole process in blockchain [21].

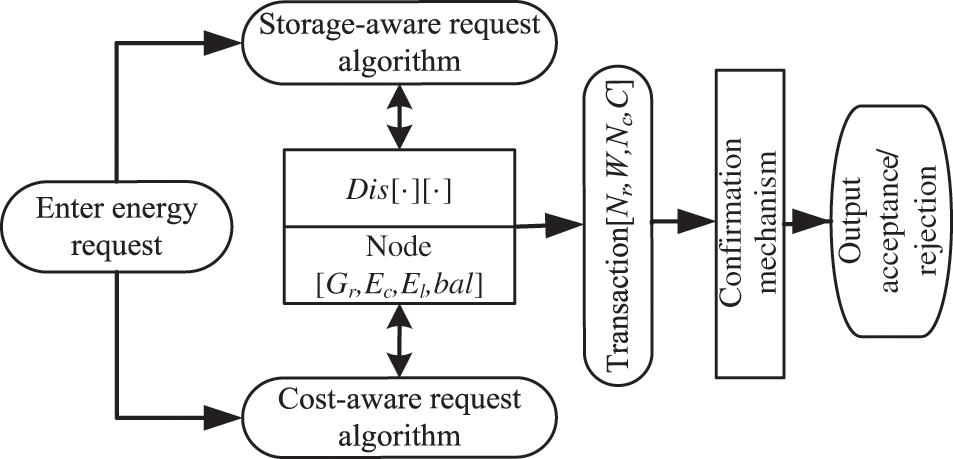

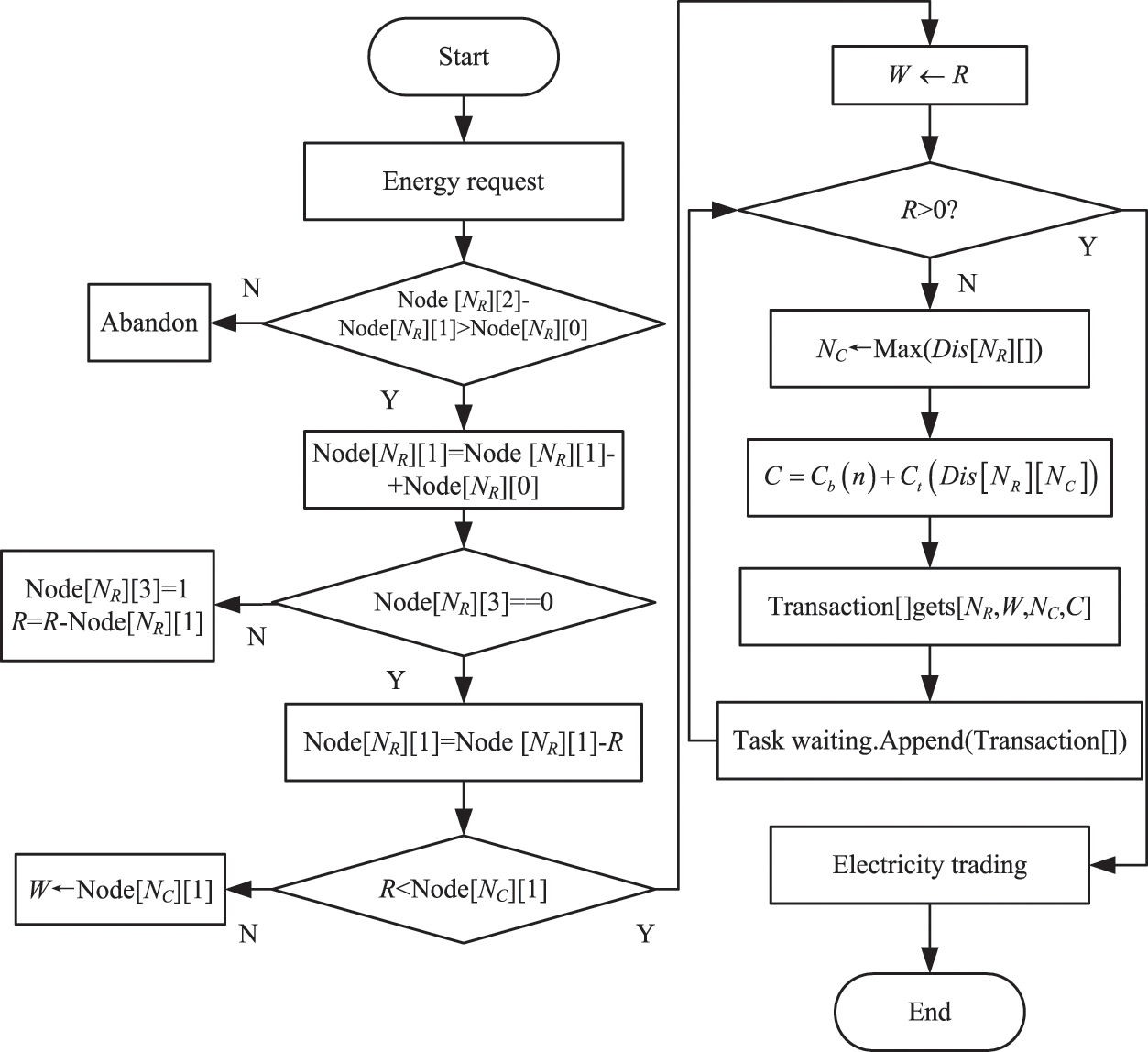

In the transaction process, the energy request is randomly made by the transaction node. If the transaction node can meet its requirements, it can be regarded as self-sufficient [22]. If the current energy of the node cannot meet the demand, the transaction node will request additional energy from the ADN. The energy request mechanism includes cost perception request and storage perception request, the flow of which is shown in Fig. 3.

Figure 3: The execution flow of the energy request mechanism

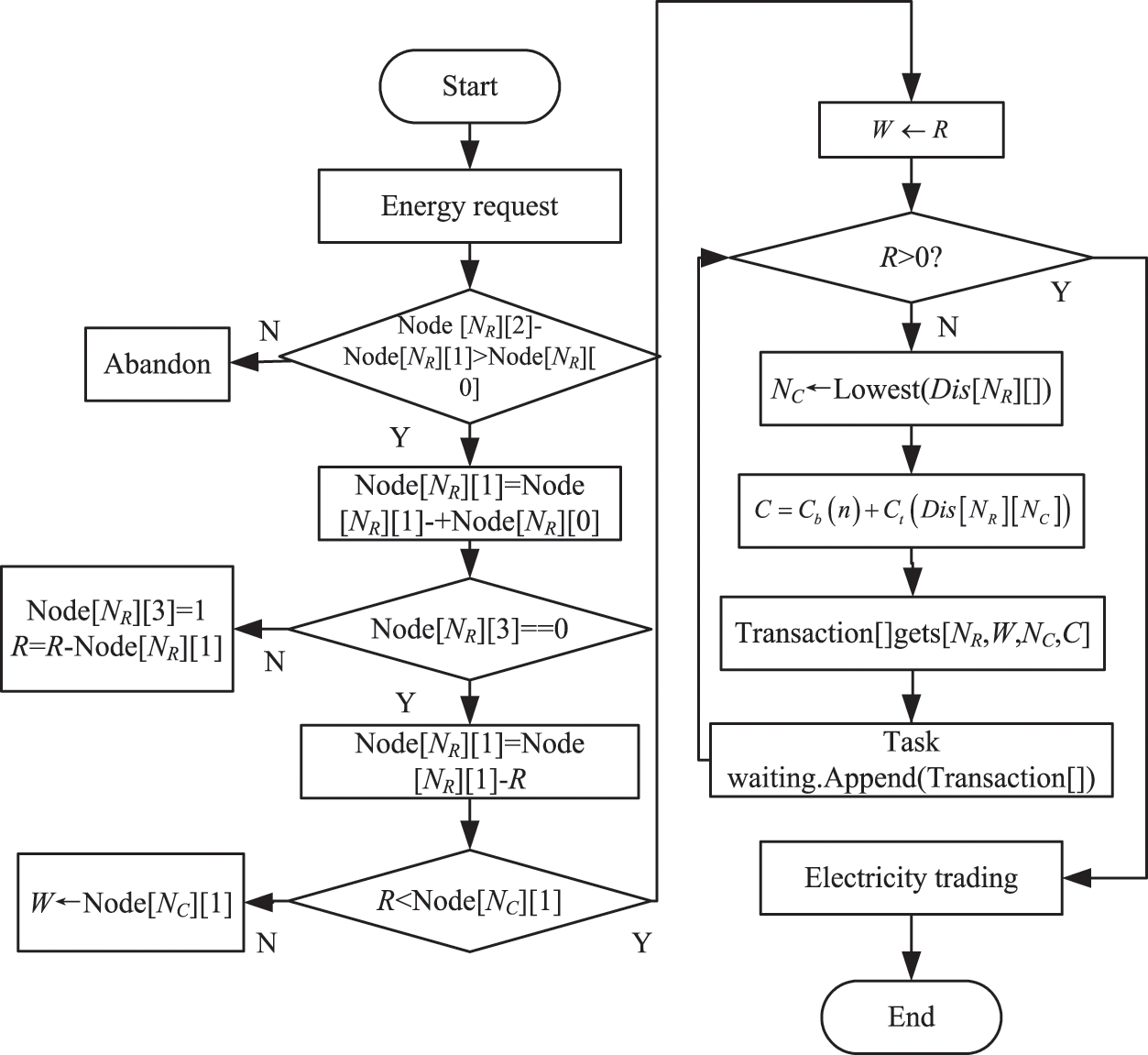

In the cost perception request plan, the transaction node is allowed to request energy supply from the nearest available transaction node in the network. It will attempt to increase the energy generated by its storage unit and use its internal storage to respond to the energy request (

Figure 4: Flow of cost perception request

The cost perception algorithm will go through the nearest transaction nodes in the ADN to provide energy to the requester. And detailed information of the transaction node provided with energy storage

3.1.2 Storage Perception Request

Similar to the case

Figure 5: Flow of the storage perception request algorithm

3.2 Power Transaction Scheme Optimization Based on Particle Swarm Algorithm

The blockchain technology solves the security problem of power transactions, shortens the time of authentication of the original trading platform, and improves the transaction efficiency [24]. Based on the blockchain technology, the power trading scheme uses the particle swarm algorithm for multi-objective optimization to optimize the power transaction, and introduces the power price formulation mode and power purchase strategy to the intelligent contract [25].

For the power supplier in the trading chain, under the constraints of price and transaction priority, multiple options for selling electricity in intelligent contracts are used to achieve the best benefit, and guarantee the transaction security at the same time. Because the spot trading is still in its infancy, big users’ direct power purchase is the main concern. The power supply focuses on making attractive power sales schemes to increase the power purchase of big users, thus improve the market competitiveness [26].

Specific to the two energy request mechanisms of cost-perception request and storage perception request, particle swarm optimization algorithm is selected for the optimal power transaction scheme search [15]. By using particle swarm optimization mathematical modeling, process optimization, and generation of particle non-inferior solution set, it is applied to the power trading market, and generates the optimal real-time power trading scheme under the constraints of all parties to meet the minimum cost. Particle swarm optimization is the whole step of generating a non-inferior solution, which includes the initial screening of the non-inferior solution and updating of the non-inferior solution set. When the particle swarm is not updated, a random particle from the non-inferior solution set is selected as the optimal solution of the swarm. The particle update process is shown as:

In the equation,

Through the particle swarm multi-objective search algorithm, the power transaction scheme is optimized in the real-time power price transaction process of the power transaction node. Five types of power suppliers (thermal, photovoltaic, hydropower, wind, nuclear) are assumed to participate in transaction competition for the user power purchase, and their power transaction volume, on-grid price, and transmission costs are different. We use particle swarm optimization to model this transaction process and carry out the multi-objective search. Among them, the on-grid price of the power stations is

In the equation,

The associated constraint is:

In the inequality,

To simulate the randomness of the power trading market to the greatest extent, the particle swarm algorithm is modified. Specifically, the lowest cost is not to select the scheme with the lowest power for each purchaser, but to select the optimal power volume and power price combination scheme based on the overall transaction, so as to increase the power utilization rate of renewable energy source power plants and reduce the reliability of fossil fuel power plants. In the market constraint, the optimized particle swarm optimization algorithm is integrated into the intelligent contract and operated by the criteria of user purchase demand and low power price, so as to ensure the openness, transparency, and intelligence of the optimal power transaction scheme.

4 Experimental Results and Analysis

In the experiment, an ADN power transaction platform based on block-chain is built, which includes six suppliers and five users. The suppliers include the large power grid, two photovoltaic power plants, and three wind power plants. Considering the actual power supply state of the existing ADN, the large power grid is the dominating power supply, and the photovoltaic and wind power these distributed power supplies are auxiliary. Because of the volatility and randomness of distributed power, ADN power transactions should be short-term, which can promote distributed energy to be integrated into the ADN in real-time and increase its utilization rate.

All transaction participants are connected to an Ethernet communication bus to exchange power transaction information based on block-chain. Each node has the same transaction opportunities and does not need to rely on third parties to carry out power transactions. Users with intelligent meters and the corresponding power control system, can control their power demand in real-time. Photovoltaic and wind these distributed power sources are equipped with a corresponding number of power storage devices and power control systems, so they have a certain power generation prediction ability.

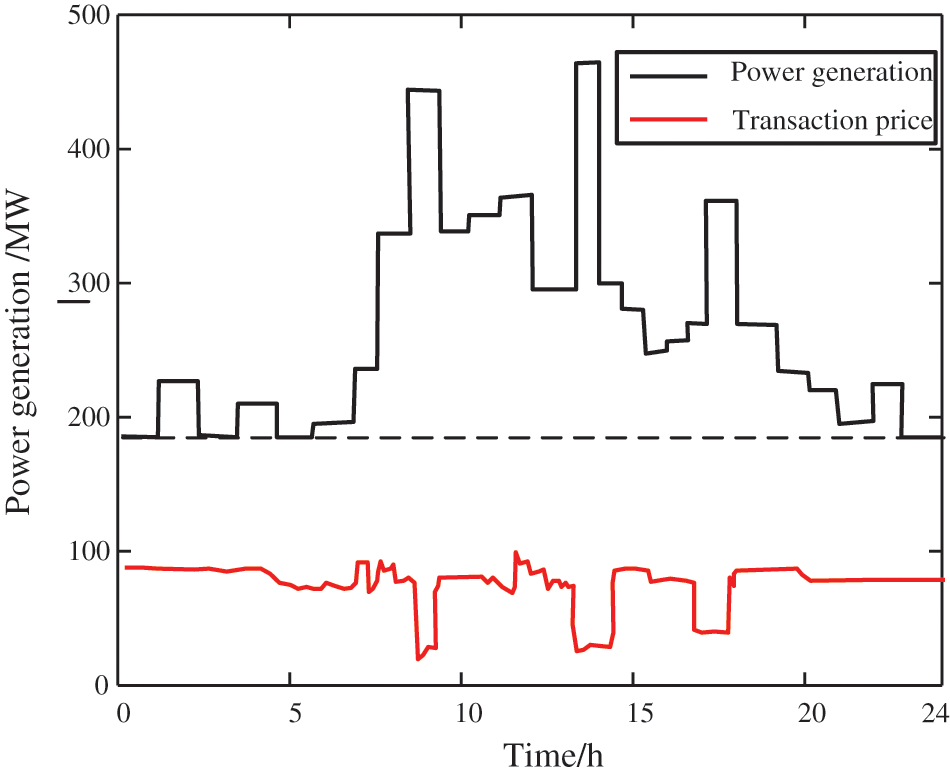

4.1 Power Transaction Analysis

Taking the power supply and demand of ADN within 24 h as an example, this paper analyzes the power transaction status based on block-chain. According to the experimental scenario, the power quantity of the traditional fossil fuel power plant is set to 250 MW. The new energy power plants which have great randomness and volatility due to the influence of the natural environment, are used as a supplement to the power supply. Between 0:00 and 6:00 a.m., photovoltaic and wind power plants are affected by the environment and generate limited electricity. Therefore, there are fewer new energy suppliers involved in the power transaction. After 7:00 a.m., users’ power consumption gradually rises and the demand for power increases, but the increase in new energy generation lags behind the user demand. Therefore, the power transaction market is in the seller’s market, and the power price is high; new energy power providers can sell electricity at a relatively high price through block-chain announcements. The daily changes of power generation and transaction price are shown in Fig. 6.

Figure 6: Power quantity transaction analysis

As can be seen from Fig. 6, the output of the new energy supply is relatively random. About 9:00 a.m., its output is more and the power generation reaches a short-term peak. And the power supply and demand state is constantly displayed in the ADN power transaction based on block-chain. In this way, the new energy supplier can adjust its power sale price in real-time, improve the transaction rate, and reduce the amount of abandoned wind and light. With the normalization of new energy generation, the price of power transactions tends to stabilize. In addition, around 1:00 and 5:00 p.m., the power generated by new energies increases, and through the block-chain transaction process, the new energy power price reduces, resulting in the power transactions. Because the block-chain-based power transactions can be completed in a very short, new energy suppliers and users almost close the deal at the same time.

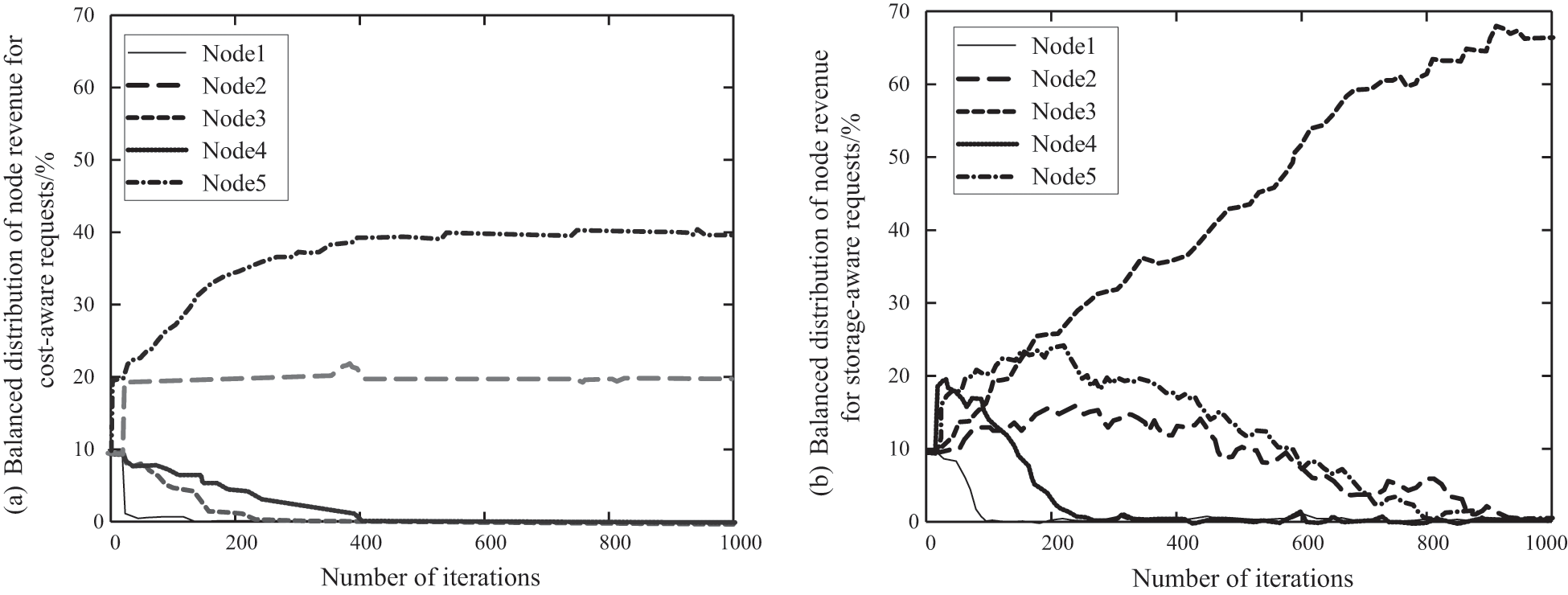

Although the impact of balance constraints on power transactions in ADN is secondary, it is critical from the user’s point of view. Both cost and storage are the key factors should be considered. The purchasing capacity cannot exceed the maximum storage capacity except the real-time supply load. Therefore, cost and storage need to achieve a balanced state to maximize the benefits of users. The energy balance change of transaction nodes in which cost perception and storage perception algorithms participate are shown in Fig. 7.

Figure 7: Income balance change of participating transaction node (a) The node benefit distribution of cost perception request/%; (b) The node benefit distribution of storage perception request/%

As can be seen from Fig. 7a, the available storage and income of transaction nodes in the network do not depend on the initial storage of transaction nodes. In addition, the cost perception algorithm allows the transaction node to buy electricity fairly for the user. Therefore, during any exchange period, transaction nodes will not incur high costs due to transmission. As can be seen in Fig. 7b, significant equilibrium differences can be observed for transaction node 3. Because node 3 has a certain amount of energy storage, it has advantages in network transactions, which leads to differences in the distribution of income among transaction nodes.

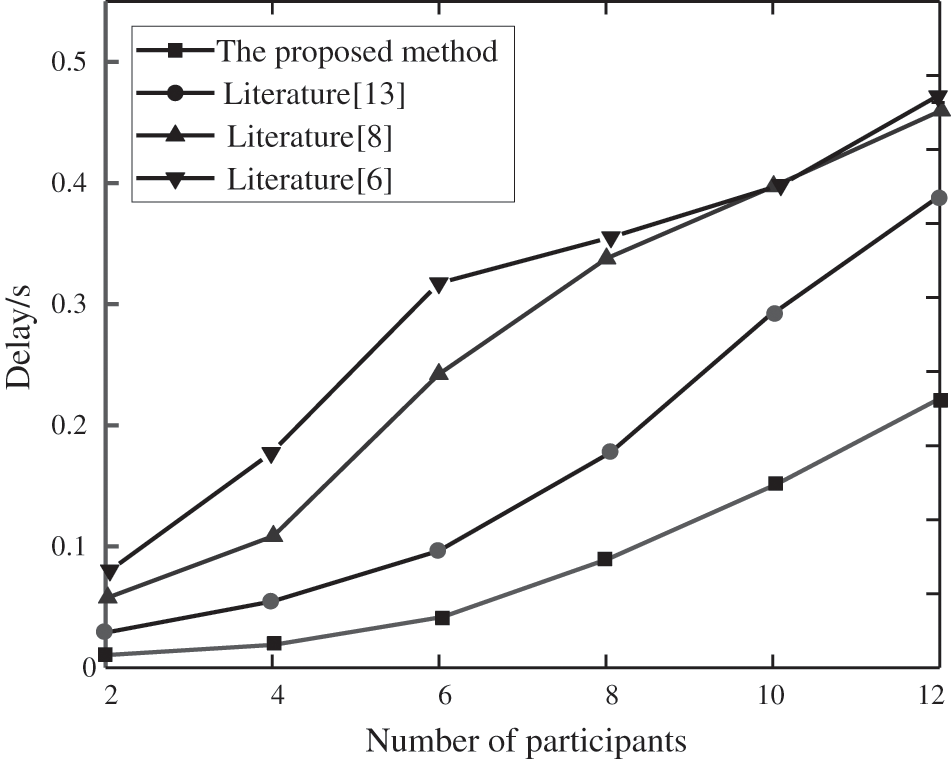

4.3.1 Transaction Delay Analysis

To demonstrate the advantages of the proposed method in terms of transaction delay, a comparative analysis of methods in literature Rui et al. [6], Luo et al. [8], and Li et al. [13] is conducted, and the results are shown in Fig. 8. Among them, Rui et al. [6], Luo et al. [8] and Li et al. [13] respectively adopt Nash equilibrium algorithm, double-layer blockchain technology and heterogeneous blockchain technology to realize reliable transactions, and the transaction time includes the final transaction contract reached by the transaction node in the system and the average calculation time to complete task negotiation.

Figure 8: Comparison of average delay of transactions

As can be seen from Fig. 7, with the increase of power transaction participants, the delay time is also increasing. Because the participant increase produces more power transaction tasks, more power transaction contracts will be reached accordingly, and the average delay will also increase accordingly. However, compared with other methods, the average transaction delay time of the proposed method is the shortest. Rui et al. [6] proposed a Nash bargaining method of multi-micron power transaction, taking the minimum transaction operating cost as the optimization goal, and designs the cooperative game model of multi-micron bargaining. Because the calculation process of the Nash equilibrium algorithm is complicated, it takes a long time. Luo et al. [8] proposed a double-layer distributed power transaction system with power-sharing and combines the block-chain to realize the transaction settlement. However, the double-layer trading mode increases the communication complexity of the system, so the data has a certain communication delay. As the amount of data increases, transaction delays grow faster. Li et al. [13] designed a multi-energy systems transaction system based on heterogeneous block-chain technology to solve the data security problem in joint transactions. This method takes into account the problems of various participants. However, the heterogeneous block-chain technology is complicated, and computational delay is large. Thus, the overall transaction delay is not ideal. The proposed method uses the block-chain technology to shorten the delay time of centralized transaction mode and the particle swarm algorithm for quick optimization. Therefore, the transaction delay is short; when the number of participants is not more than 10, the transaction delay time is about 0.2 s.

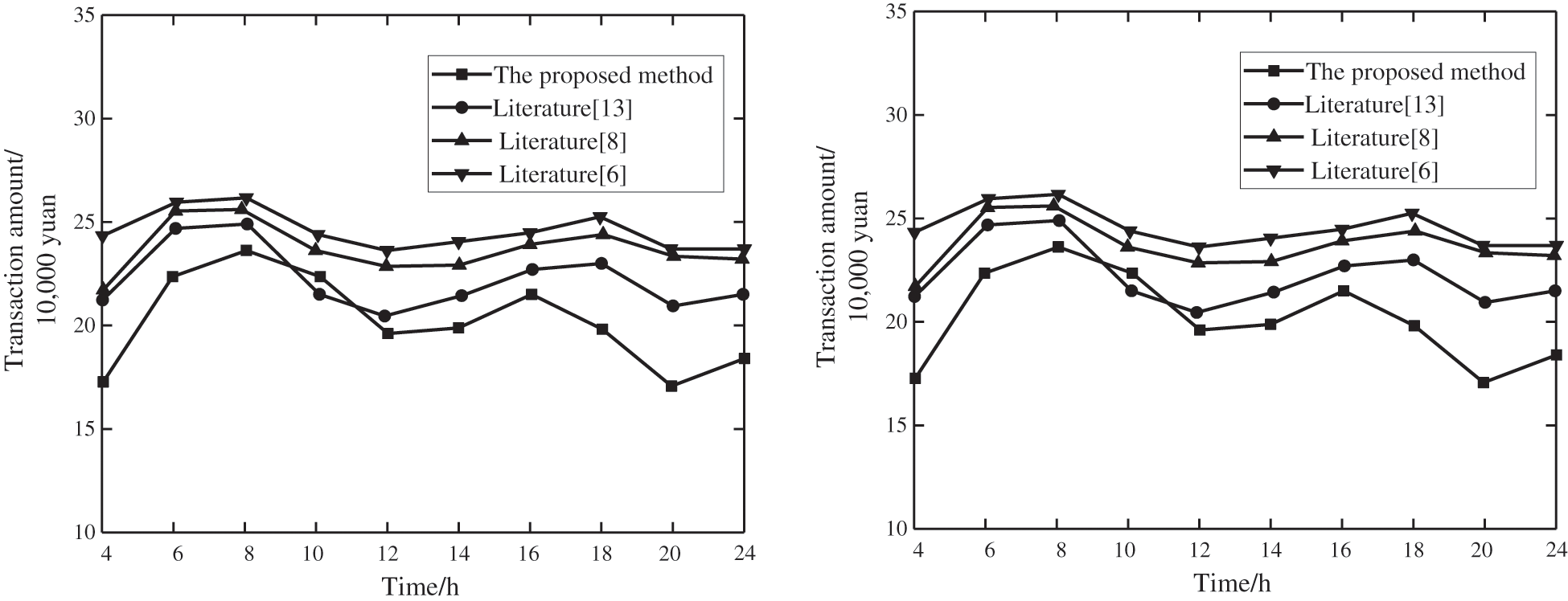

4.3.2 Economic Analysis of Power Transaction

The purpose of the power plant and user in power transaction is to achieve maximum economic benefit with one party buying the most electricity at the least cost and the other party selling the largest electricity. Taking into account the interests of both power transaction side, the obtained transaction volume in the ADN by using the proposed method and methods in [6,8,13] are shown in Fig. 9.

Figure 9: SDN turnover comparison

As can be seen from Fig. 9, compared with other methods, the turnover of the proposed method is the least, fluctuating around 200,000 yuan. According to the analysis of Fig. 6, the transaction price decreases with the increase of new energy supply, which urges users to use new energy to generate electricity more. Viewing the ADN as a whole, based on the transaction price fluctuation, the particle swarm algorithm is used to find the optimal transaction scheme, which further reduces the user’s power purchasing cost and increases the power sales of new energy power plants to realize the win-win situation. Literature [6] used the Nash bargaining method to optimize the operating cost, but does not considers the electricity price fluctuation, so the overall turnover is the largest. Although the double layer distributed power transaction mode of power-sharing used in [8] can reduce the power purchase cost to a certain extent, it lacks the corresponding algorithm optimization, so the economic performance needs to be improved. Li et al. [13] based on heterogeneous block-chain technology, achieves multi-energy system transactions, comprehensively considers multi-energy coordination optimization, and can make full use of new energy power supply. Around 10:00 a.m., the turnover is lower than the proposed method. But the optimization goal is single. Without a comprehensive analysis of the influencing factors, its economic performance still has room for improvement.

In recent years, blockchain technology has developed rapidly, and its application in the field of power trading has good prospects. Because there is little research on the application of block-chain to the specific implementation in power transactions, an ADN power transaction method based on block-chain is proposed. Based on the characteristics of block-chain decentralization, the block-chain structure of ADN power transactions is designed. Based on this, the power request mechanism is proposed, including storage perception request and cost perception request, and multi-objective optimal search is carried out by particle swarm optimization algorithm to research for the optimal power transaction scheme, and minimize users’ power purchase cost while maximizes the power sales volume of power suppliers. In addition, based on the experimental platform, the experimental demonstration of the proposed method shows that the increase of new energy output will lead to the decrease of electricity price, thus reducing users’ power purchase cost and reducing the amount of abandoned light and wind. Meanwhile, compared with other methods, the transaction delay of the proposed method is the smallest, about 0.2 s, the economic value is the best, and the overall transaction volume of the system is the smallest. It provides a reference for further exploring the application of block-chain technology in the power trading market.

Because the proposed method only uses the particle swarm algorithm for optimization and does not involve the bidding of transaction participants, the game mechanism of electricity price trading under block-chain architecture is lacking, which is also the focus of future research.

Acknowledgement: The authors would like to thank the editor and anonymous reviewers for their valuable comments.

Funding Statement: This work was supported by the Postdoctoral Research Funding Program of Jiangsu Province under Grant 2021K622C.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

References

1. Huang, H., Wen, K. Z., Liu, X. (2020). Power trading method based on consortium blockchain under ubiquitous power internet of things. Power System Protection and Control, 48(3), 22–28. [Google Scholar]

2. Lin, X. N., Ma, X., Wang, Z. X., Sui, Q., Li, Z. T. (2021). A novel current amplitude differential protection for active distribution network considering the source-effect of IM-type unmeasurable load branches. International Journal of Electrical Power & Energy Systems, 129, 1–13. DOI 10.1016/j.ijepes.2021.106780. [Google Scholar] [CrossRef]

3. Capitanescu, F. (2018). TSO-DSO interaction: Active distribution network power chart for TSO ancillary services provision. Electric Power Systems Research, 163(5), 226–230. DOI 10.1016/j.epsr.2018.06.009. [Google Scholar] [CrossRef]

4. Wang, J., Zhou, N. C., Wang, Q. G. (2018). Electricity direct transaction mode and strategy in microgrid based on blockchain and continuous double auction. Proceedings of the CSEE, 38(17), 5072–5084. [Google Scholar]

5. Xie, K., Zhang, X., Zhang, S. N., Liu, Y. H., Cai, Y. J. et al. (2020). Application and prospect of blockchain technology in electricity trading. Automation of Electric Power Systems, 44(19), 19–28. [Google Scholar]

6. Rui, T., Li, G. L., Wang, Q. J., Hu, C. G., Zhang, J. et al. (2018). Nash bargaining method for multi-microgrid energy trading in distribution network. Power System Technology, 43(7), 2576–2583. [Google Scholar]

7. Hayes, B. P., Thakur, S., Breslin, J. G. (2020). Co-simulation of electricity distribution networks and peer to peer energy trading platforms. International Journal of Electrical Power & Energy Systems, 115(2), 1–10. DOI 10.1016/j.ijepes.2019.105419. [Google Scholar] [CrossRef]

8. Luo, F. J., Dong, Z. Y., Liang, G., Murata, J., Xu, Z. (2017). A distributed electricity trading system in active distribution networks based on multi-agent coalition and blockchain. IEEE Transactions on Power Systems, 34(3), 4097–4108. DOI 10.1109/TPWRS.2018.2876612. [Google Scholar] [CrossRef]

9. Zhong, W., Xie, K., Liu, Y., Yang, C., Xie, S. L. (2019). Topology-aware vehicle-to-grid energy trading for active distribution systems. IEEE Transactions on Smart Grid, 10(2), 2137–2147. DOI 10.1109/TSG.2018.2789940. [Google Scholar] [CrossRef]

10. Che, Z., Wang, Y., Zhao, J. J., Qiang, Y., Ma, Y. et al. (2019). A distributed energy trading authentication mechanism based on a consortium blockchain. Energies, 12(15), 2878. [Google Scholar]

11. He, H., Luo, Z., Wang, Q., Chen, M. X., He, H. Q. et al. (2020). Joint operation mechanism of distributed photovoltaic power generation market and carbon market based on cross-chain trading technology. IEEE Access, 8(2), 66116–66130. DOI 10.1109/ACCESS.2020.2985577. [Google Scholar] [CrossRef]

12. Chaudhary, R., Jindal, A., Aujla, G. S., Aggarwal, S., Kumar, N. et al. (2019). BEST: Blockchain-based secure energy trading in SDN-enabled intelligent transportation system. Computers & Security, 85(8), 288–299. DOI 10.1016/j.cose.2019.05.006. [Google Scholar] [CrossRef]

13. Li, B., Cao, W. Z., Zhang, J., Chen, S. (2018). Transaction system and key technologies of multi-energy system based on heterogeneous blockchain. Automation of Electric Power Systems, 42(4), 183–193. [Google Scholar]

14. Yan, M., Huang, H. B., Yang, S. F. (2021). Distributed authentication scheme for industry internet platform application based on consortium blockchain. Journal of Physics, 1856(1), 1–7. DOI 10.1088/1742-6596/1856/1/012032. [Google Scholar] [CrossRef]

15. Makhloufi, S., Mekhilef, S. (2021). Logarithmic PSO based global/local maximum power point tracker for partially shaded photovoltaic systems. IEEE Journal of Emerging and Selected Topics in Power Electronics, 10(1), 375–386. [Google Scholar]

16. Gong, G. J., Wang, H. J., Zhang, T., Chen, Z. M., Wei, P. F. et al. (2019). Research on intelligent trading and cooperative scheduling system of energy internet based on blockchain. Proceedings of the CSEE, 39(5), 1278–1290. [Google Scholar]

17. Qaeini, S., Nazar, M. S., Yousefian, M., Heidari, A., Shafie-khahet, M. et al. (2019). Optimal expansion planning of active distribution system considering coordinated bidding of downward active microgrids and demand response providers. IET Renewable Power Generation, 13(8), 1291–1303. DOI 10.1049/iet-rpg.2018.6006. [Google Scholar] [CrossRef]

18. Mao, T. A., Zhou, Y. Q., Wang, L., Su, Y. X., Duan, B. et al. (2021). Fair-efficient energy trading for microgrid cluster in an active distribution network. Sustainable Energy, Grids and Networks, 26, 1–9. [Google Scholar]

19. Xiao, Q., Chen, Z., Zhu, Z. Y., Wang, X. L., Kuang, Y. et al. (2020). Discussion on decentralized electricity market for distributed generation transactions. Automation of Electric Power Systems, 44(1), 208–218. [Google Scholar]

20. Li, Y., Fan, X. W., Cai, Z. Y., Yu, B. (2018). Optimal active power dispatching of microgrid and distribution network based on model predictive control. Tsinghua Science and Technology, 23(3), 266–276. DOI 10.26599/TST.2018.9010083. [Google Scholar] [CrossRef]

21. Ping, J., Yan, Z., Chen, S. J., Shen, Z. Y., Yang, S. (2019). Credit risk management in distributed energy resource transactions based on blockchain. Proceedings of the CSEE, 39(24), 7137–7145+7487. [Google Scholar]

22. Gong, G. J., Wang, H. J., Zhang, T., Chen, Z. (2018). Research on electricity market about spot trading based on blockchain. Proceedings of the CSEE, 38(23), 6955–6966. [Google Scholar]

23. Quijano, D. A., Padilha-Feltrin, A. (2019). Optimal integration of distributed generation and conservation voltage reduction in active distribution networks. International Journal of Electrical Power & Energy Systems, 113(12), 197–207. DOI 10.1016/j.ijepes.2019.05.039. [Google Scholar] [CrossRef]

24. She, W., Gu, Z. H., Yang, X. Y., Tian, Z., Chen, J. S. et al. (2019). A model of multi-energy complementation and safety transaction on heterogeneous energy blockchain. Power System Technology, 43(9), 3193–3201. [Google Scholar]

25. Usman, M., Coppo, M., Bignucolo, F., Turri, R. (2018). Losses management strategies in active distribution networks: A review. Electric Power Systems Research, 163(10), 116–132. DOI 10.1016/j.epsr.2018.06.005. [Google Scholar] [CrossRef]

26. Huang, W., Ge, L., Hua, L., Yang, S. (2018). Day-ahead and real-time optimal scheduling for active distribution network based on probabilistic power flow. Automation of Electric Power Systems, 42(12), 51–57+105. [Google Scholar]

Cite This Article

Copyright © 2023 The Author(s). Published by Tech Science Press.

Copyright © 2023 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools