Open Access

Open Access

ARTICLE

Research on the Effects of the Most Used Market Power Mitigation Mechanisms Considering Different Market Environments

1 State Grid Shanghai Municipal Electric Power Company, Shanghai, 200122, China

2 China Electric Power Research Institute Co., Ltd., Nanjing, 210003, China

3 Southeast University, Nanjing, 210096, China

* Corresponding Author: Beibei Wang. Email:

Energy Engineering 2022, 119(6), 2193-2210. https://doi.org/10.32604/ee.2022.020943

Received 21 December 2021; Accepted 24 March 2022; Issue published 14 September 2022

Abstract

The market power mitigation method of the supply-side has become one of the key points affecting the stability of the electricity spot market. Different mitigation mechanisms are used in the current mature electricity markets of the world. However, the same market power mitigation mechanism shows different effects in different market environments. Every market operator in the world needs the most efficient way to mitigate market power. Considering that there is no relevant literature discussing the market power effects of different mitigation methods in detail, the mitigation effects need to be discussed and further researched. So, we analyze the effects of the most utilized market power mitigation mechanisms while considering different market environments. Firstly, we establish a Nash-Stackelberg interactive game model to simulate the competitive strategies of power suppliers. Secondly, the different market power mitigation approaches are modeled. Then, a multi-agent system (MAS) genetic interior-point algorithm is proposed to solve the problem of suppliers. Finally, through the simulation analysis, the market power mitigation effects of different mechanisms while considering three operation states of the system in two market structures are all analyzed.Keywords

According to the experience of the reformed electricity markets around the world, due to the lack of a standard international regulatory system, participants always use the advantages to exercise market power to obtain more benefits [1,2]. With the successfully carried out pilot electricity spot market in some provinces in China, market power abuse problems also follow. For example, in the market participants in the region with line transmission constraints, few of them can alleviate transmission congestion. These market participants may therefore increase the quoted prices, which then causes social efficiency loss and wasted resources [3]. Therefore, the market power mitigation method of the supply-side is of concern to the market operators and remains important to the operation stability of the spot market.

Different mechanisms are formed to mitigate the market power in mature electricity markets around the world. The market power mitigation mechanisms can improve social efficiency and ensure market fairness as well. The approaches to mitigate market power can be divided into ex-ante contract signing [4], ex-post punishment [5], and ex-ante price substitution [6,7] introduced the Albert and New Zealand auctioned the operation rights of major suppliers to other participants to reduce the market share. For the participants who have greater market power and cannot be physically split, they can be forced to sign a power generation contract with a demand-side or reliability operation contract with the market operator [8]. Ex-post punishment is to investigate and punish the abuse of market power through legislation or formulating market rules. Ex-ante price substitution substitutes the quoted price through the ceiling price of participants to mitigate the market power [9].

However, the same market power mitigation mechanism shows different effects in different market environments. Every market operator in the world needs the most efficient way to mitigate market power [3]. The literature above only described a certain market power mitigation method, which is compared with the unregulated market [4–9]. Considering that there is no relevant literature discussing the market power effects of different mitigation methods in detail, the mitigation effect needs to be discussed. So, we analyze the effects of the most used market power mitigation mechanisms considering different market environments. Also, there are two important parts of the research that need to be considered as follows.

The research on the effect of market power mitigation mechanisms needs to model the competition process of the suppliers at first. The game theory of Cournot, Bertrand, and Supply Function Equilibrium (SFE) is used to model and analyze the strategies of suppliers, respectively [10,11], but the market-clearing is not considered in the process of the model. In this case, the strategic behavior analysis of suppliers does not consider the market trading rules and divorces the reality. In [12], Pozo et al. proposed the Stackelberg game model and considers the behavior of suppliers and market-clearing, but this model ignores the unit and power flow constraints in a grid. It deviates from the actual operation greatly. In [13], Ernst et al. considered the constraints and puts forward a target design of the market power mitigation mechanism. However, the mechanism only has a single adaptive operation state; this problem is also a common one in many other pieces of research. Therefore, to avoid this problem, we establish a Nash-Stackelberg interactive game model. Then, the effect of the current market power mitigation mechanisms in different operation states under typical electricity market structures is discussed.

The effect of market power mitigation mechanism research needs to first consider the market-clearing power and precisely calculate the Nash-Stackelberg interactive game model of suppliers second. To solve the unconstrained electricity market model, the corresponding centralized convex optimization problem is always found to get the equilibrium [14–16] adopts the traditional game theory method, which is the Karush-Kuhn-Tucker (KKT) condition, to solve the equilibrium problem subject to equilibrium constraints (EPEC). However, due to the computation burden and nonconvexity of the KKT condition, this method is difficult when considering the topology constraints. The genetic algorithm can solve the optimal bidding strategy problem of suppliers through an iterative process [17]. As a widely used market clearing algorithm, the interior-point method can be combined with the genetic algorithm to solve the bilevel interactive optimization problem [18]. Due to the need for optimal strategy storage and continual updating, the Multiagent System (MAS) can provide information storage and interaction between each supplier. In summary, we proposed the method of MAS-genetic-interior-point method to solve the established Nash-equilibrium interactive game model.

In this paper, firstly, the Nash-Stackelberg interactive game model of the supply-side is established to describe the optimal strategy of suppliers. Secondly, the market power mitigation mechanism models in different countries are settled. Thirdly, the MAS-genetic-interior-point method is proposed to solve the models above. Finally, through the simulation analysis, the market power mitigation effects of different mechanisms considering three operation states of the system in two market structures are all analyzed.

The main contributions of the study are as follows:

i.Market Power Mitigation Effects Analyze: In this paper, the most used market power mitigation mechanisms are applied in various scenarios. The market power mitigation effects of the mechanisms considering different operating states of the system in typical market structures are analyzed. The result of the analysis can provide ideas for mitigating market power for market operators.

ii.Nash-Stackelberg interactive bidding model: In this study, the Nash- Stackelberg interactive bidding model is constructed to include both follower and leader models. This realizes the process of a supplier bidding strategy based on benefit maximization and market clearing based on operation cost minimization which considers general system constraints. Through the proposed MAS-genetic-interior-point method, the established Nash-equilibrium interactive game model can be solved. Therefore, this facilitates the modeling, calculation, and analysis of the market power mitigation mechanism.

2 Nash-Stackelberg Interactive Bidding Model

The market-clearing model should consider the minimum and maximum technical output constraints of generators and network topology to model the unilateral bidding strategies of the supply-side in the electricity market. System power balance constraints, network constraints, and minimum and maximum technical output constraints should be considered regarding market-clearing. The day-ahead electricity market clearing is carried out with the goal of minimizing operation costs. The specific modeling is as follows:

(1) Objective function

where fISO is the ISO operation cost, PGi is the decision variables of supplier’s output value, kei is the bidding strategy of the i-th supplier.

(2) Power balance constraint

where M is the collection of nodes in the system, l and m are the nodes, which indicates that when calculating the node power balance, m is all the branches connected to node l, and the branch connected by lm must be in the branch sets B. PDK is the load consumption of the k-th user. Xlm is the reactance value of branch lm.

(3) Line power flow upper limit constraint

where Plm max is the maximum transmission power flow of branch lm.

(4) Minimum and maximum technical output constraints

where Pimin and Pimax are the technical minimize and maximize output value of the i-th generator. G is the generator set.

2.2 Supplier Bidding Strategy Model

The bidding strategy models of suppliers aim at maximizing their own benefits. kei is the bidding strategy. It represents the suppliers will quoted kei times than the cost. The Lagrange multiplier

The constraints of the supplier’s quotation coefficient are as follows:

There is a game relationship between various suppliers. All suppliers play a game based on the market-clearing model and finally form a stable relationship between the suppliers. The stable relationship of the suppliers constitutes the Nash equilibrium.

2.3 Nash-Stackelberg Interactive Bidding Model

In the Nash-Stackelberg interactive bidding model, the follower is the market-clearing model, and the leader is the bidding model of the supplier. The market equilibrium framework is as follows (Fig. 1).

Figure 1: The market equilibrium framework for generators

The objective function of the model is the aim of the generator bidding strategy model, and the constraint is the transformed market-clearing model. The interactive model can be changed into the single layer economic scheduling problem. The problem can be described as Eqs. (7)–(14).

s.t.

where

3 Market Mitigation Mechanism Models

References [4–6] showed the different market mitigation mechanism models in the mutual electricity markets of America, Nord Pool, and England, respectively. The market power mitigation methods can be divided into three categories: ex-ante contract signing, ex-ante price substitution, and ex-post punishment. Different market power mitigation mechanisms are modeled and analyzed as follows.

In general, when the contracted electricity price is fixed, i.e., the bilateral contract takes the physical contract of electricity, the more electricity is contracted, and the lower the electricity price at the equilibrium of the spot market. For ex-ante contract signing, Alberta, Canada, and New Zealand auctioned off the asset management rights of major players to other companies before the market started. Several domestic markets in China that have been run on a trial basis, the Guangdong power market and the Zhejiang power market particularly, use this form of financial contract as well. So, we adopted the form of these financial contracts in the later simulations.

We assume that the contract volume of generator i is Xi and the contract price is

s.t.

Eqs. (8)–(10) where the first term in Eqs. (15) represents the revenue of generators settled in the spot market excluding the contracted volume portion of the contract market, the second term is the revenue in the contract market, and the last term is the cost of generation.

3.2 Ex-Ante Price Substitution

Some market operators tend to treat generators that do not pass market power identification with market power prior to market trading, by declaring prices directly by setting price caps. Market power regulators in America, such as PJM, NEISO, NYISO, Midwest, CAISO, and ERCOT, use the ex-ante price substitution method to mitigate market power. The price cap of PJM, NEISO, NYISO and Midwest is 1000$, CAISO is 500$–1000$ and ERCOT is 3000$. Setting a price cap mainly limits the maximum value of generator prices and can effectively limit the ability of generators to manipulate prices from the government or system operator’s perspective. We assume that the set ceiling is

s.t.

Eq. (16) is needed to select the lowest value of the marginal price and price cap after strategic offers. The common problems with this mechanism, in general, can be concluded as:

It creates new market barriers while suppressing market power, causing some generators not to participate in the market, and it cuts the incentive for new investors to enter the market when pricing is too low. When pricing is too high, the market power mitigation effect is not strong enough either.

The US independent market monitoring (IMM), the UK electricity market (Ofgem), and the Nord Pool make disclosures about quotes, market manipulation, and the release of information about connected transactions in the middle of the market, and issue findings of violations and dispositions. Ex-post punishment is set as a threat, and the specific settings are set directly by the government/system operator. We assume that the penalty for generators who abuse market power is

s.t.

Eqs. (8)–(10) where the last term of Eq. (17) indicates the penalty caused by the generator judged to be abusing market power, and Eq. (18) indicates the penalty with or without the 0 1 variable Yi becomes true when the market power indicator MPi of generator i exceeds or falls below a set level, and otherwise false level. In this paper, we choose to use the Lerner indicator to make the judgment of the penalty.

4.1 Nash Equilibrium Algorithm-MAS Framework

The solution idea of MAS is similar to Gauss Seidel’s algorithm [19]. The classical Gaussian Seidel algorithm first represents the optimal strategy of each competing player in the form of an optimal response function, defines the initial solution randomly, iterates step by step according to the optimal response function, and finally approximates the solution of the system of equations gradually. The difference of MAS is that the optimal response function does not need to be expressed explicitly, but can be expressed implicitly through the two-layer optimization model of market participants.

As shown in Fig. 2, the archive set A of the information center keeps the latest strategy combinations of each smart offer body of the system in the last round, i.e.,

Figure 2: The Nash equilibrium process based on MAS framework

The specific steps of the MAS-based process are as follows:

Step 1: Inputting the original parameters to generate the initial bidding strategies of the market participants.

Step 2: The information center randomly initializes the portfolio of investment strategies in the archive set A, ensuring that the strategies of each market participant take values within the allowed range.

Step 3: setting the maximum number of iterations, Imax.

Step 4: At the beginning of the k-th iteration, market participant i obtains the opponent’s bidding strategy x−i from the information center and solves the optimal bid for the bidding strategy of the original problem. Given the opponent’s bidding strategy x−i, each market participant finds the optimal response strategy under the maximum of its own return.

Step 5: Send the current solution xik to the information center and update the corresponding variables in the archive set A.

Step 6: Determine the convergence condition. If there is an update of the optimal strategy of the market participant, then the number of iterations is +1 and return to Step 4. If the optimal strategy is not updated, then the system reaches convergence and goes to Step 7.

Step 7: The information center archive set A is the pure strategy Nash equilibrium point among market participants.

4.2 The Leader of Stackelberg Model-Genetic Algorithm

The market participants constitute the leader, the constraints considered by market participants are mainly upper and lower value constraints for equations within a certain range, so this paper uses the particle swarm algorithm in the genetic algorithm to search for the combination of market participants’ strategies in this layer and evaluates the quality of the solution with the fitness function (market participants’ returns) [20]. The solution process is shown in Fig. 3. Each particle i consists of the offer strategy fetching values of each market participant:

Figure 3: The leadership solution flow chart in the stackelberg model based on PSO

4.3 The Follower of Stackelberg Model-Interior Point Method

The main body of the Stackelberg follower is the market-clearing model. The best response of each market participant considering the market-clearing price association under capacity constraint and line tide constraint can no longer be expressed explicitly. The application of the particle swarm algorithm for the leader layer solution in the previous section makes it necessary for the lower layer to give only the fitness values (market participant returns) under different strategy set choices, so this paper solves the following layer clearing model by the interior-point method [21]. The application of the interior point method to the solution of general convex optimization problems is relatively mature, and the application of the interior point method can directly obtain the Lagrange multiplier of the market power balance equation, and the interior point method solution process is not repeated.

Based on the above discussion, the general flow chart of the genetic-internal point method based on MAS is shown in Fig. 4.

Figure 4: The PSO-IPM solution flow chart based on MAS

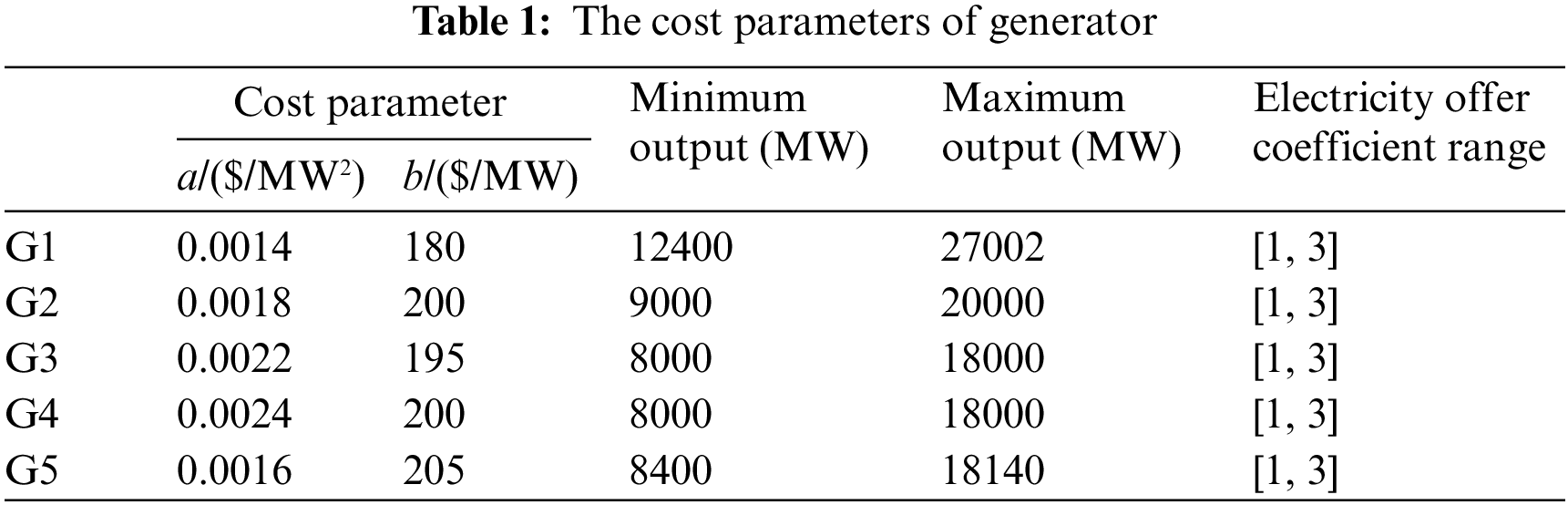

In order to verify the correctness of the previous theory, this section selects the power market data of Zhejiang Province in China. 101142 MW of total installed power capacity in 2020. 70000 MW of load data on December 11, 2020 at 17:00 are also used for the load level in the simulation. When considering the minimum and maximum output value, the basic information of each power producer is calculated. The basic information of the five oligopoly generators simulated in this paper is shown in Table 1.

Considering the actual topology privacy, the base case applies a simplified simulation of the topology of the Zhejiang province power grid in the 3-node test system to achieve a simulation analysis of the behavior of generators within the regional power market, so the simulated calculated contact line power is slightly higher than the actual value.

5.2 Base Line in the Different Operation States

In order to be closer to the actual market operation and make the analysis more convincing, the minimum and maximum technical output constraints and network constraints are considered, respectively. The strategic offer behavior of generators under the presence of each constraint is compared and analyzed separately, and the network parameters are set as follows:

a. The minimum technical output constraint is triggered, and the minimum technical output of G4 is 10000 MW.

b. The maximum technical output constraint is triggered, and the maximum technical output of G2 is 10000 MW.

c. Line transmission constraint is triggered, line 2-3 transmission constraint is 40000 MW.

5.2.1 Trigger of Minimum Technical Output Constraint

Fig. 5 shows the comparison graph of the offer results when the minimum technical output constraint is triggered. In Fig. 5a, it can be seen that after the minimum technical output constraint is triggered, other generators basically maintain the pre-trigger offer level, but the G4 offer factor of the generator increases significantly as well. After considering the minimum technical output, the G4 winning bid under the G4 strategic bidding equilibrium is higher than the result without the technical output constraint. At this point, the market has to call for more expensive G4 resources because of the minimum G4 technical output constraint, and the market-clearing price increases at this point. Generator G4, under the full information game, knows that the market-clearing price is elevated, so it continues to raise the false offer, as shown in Fig. 5a. However, only the G4s with minimum technical output limit are more obvious concerning raising prices, because G4s are forced to take up more supply, which reduces the supply-demand ratio of the remaining units, so even if the market-clearing price increases, the remaining generators are still conservative in raising prices.

Figure 5: Bid comparison based on minimum technical output constraint model

5.2.2 Trigger of Maximum Technical Output Constraint

Fig. 6 shows the results of the offer under the maximum technical output constraint being triggered. From Fig. 6a, it can be seen that all generators show bid-raising behavior when the maximum technical output of generator G2 is triggered. After the maximum technical output of generator G2 is considered, the winning bid of G2 under the strategic bidding equilibrium of generator G2 is lower than the model result without the technical output constraint, and is furthermore at the maximum technical output. The G4 generators, knowing that the market price has increased, continue to raise their bids, and the remaining generators raise their bids due to the increase in the supply/demand ratio.

Figure 6: Bid comparison based on maximum technical output constraint model

5.2.3 Trigger of Line Transmission Constraint

The difference between the strategic offer of the generators shown in Fig. 7 and the market-clearing price and LMP shown in Fig. 8 before and after considering the line transmission constraint is significant. The strategic suppliers will further exercise market power to create congestion. The following is an analysis of the specific market-clearing prices after considering transmission constraints.

(1) The increase in the clearing price of node 1 is due to the blockage of line 2-3 caused by the strategic bidding of generators. G1 without considering the effect of blockage mitigation is fully competitive through cost, and the position of each generator does not differ much and offers slightly above the true cost; when considering the blockage constraint, the generators find that their profits can increase after deliberately causing a blockage, and that all generators raise their strategic offers at this time. The G1 connected at node 1 becomes the only marginal unit due to its ability to mitigate line 2-3 blockage, so its strategic offer factor is equal to the upper limit of the offering factor, and the clearing price is as high as $624/MWh.

(2) Node 2 has a slightly higher clearing price and a slightly higher strategic offer factor. Node 2 is affected by the line 2-3 transmission limit, and the generation ceiling is 40000 MW, supplying more generation than load demand, and the generator offer is still around the marginal offer. The nodal price is slightly raised due to slightly elevated demand (44351.62 MW of generation at this node without blocking constraint), and the generator will slightly raise its offer, so the market-clearing price for node 2 is slightly raised when it has line tide constraints.

(3) Node 3 is the node where the load is located, and the market-clearing price increases the most when the blocking constraint is considered. This is because an increase of 1 MW load at node 3 reduces the output of node 2 generators by 1 MW, while node 1 generators need to increase their output by 2 MW.

Figure 7: Bid comparison based on line transmission constraints model

Figure 8: Nash Equilibrium power flow comparison based on line transmission constraint

5.3 Effect Analysis of the Market Power Mitigation Mechanisms in Typical Market Structures

The supply-side market power mitigation mechanisms, ex-ante contract signing, ex-ante price substitution, and ex-post punishment, are applied in three operation states under two typical market structures to analyze the mitigation effect and compare the advantages and disadvantages of different methods. Each mitigation mechanism is set up as follows.

M1-Market power mitigation mechanism with contract signing. The contract volume is set at 50% of the total generation capacity of the generators, i.e., 50% participate in the market and 50% sell electricity at the contract price. the contract prices of the generators G1--G5 are set at [210 220 230 240 250] ($/MWh), respectively.

M2-A market power mitigation mechanism with a price cap. The price cap is set at $500/MWh.

M3-A market power punishment mechanism. When the Lerner index of a supplier is judged to be higher than 0.5, the supplier will be punished. The penalty amount is set to $100000. The equation of the Lerner index can be described as follows:

By analyzing the current electricity market structure in the world, it is found that there are two typical electricity market structures, and the effects of market power mitigation mechanisms are not the same for different electricity market structures. Therefore, we analyze the effectiveness of the market power mitigation mechanism in three operation states under two typical market structures, respectively. The analysis can provide inspiration for innovative and imaginative engineering applications in the future.

5.3.1 A Typical Electricity Market with Oligopolistic Characteristics

A typical electricity market with oligopoly characteristics mainly means that a generator in the current electricity market has a high market share and a low energy cost. So, the supplier has a natural advantage in market-clearing. The market power mitigation effects of the three market power mitigation mechanisms-M1 M2 and M3 can be obtained in three different market operation states-a b and c, respectively.

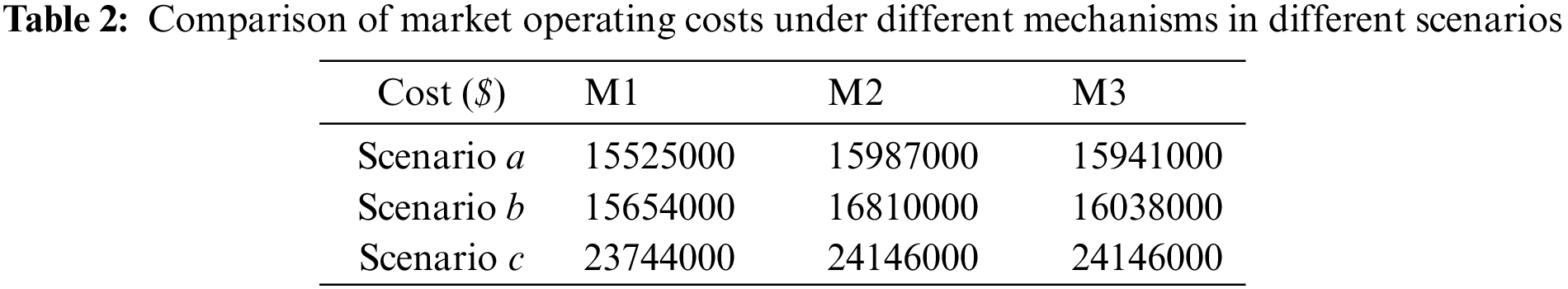

The offer variation of the different market power mitigation mechanisms used in the system, which has a minimum technical output constraint, is shown in Fig. 9. In Table 2, It can be seen that M2, which has the best mitigation effect on G4 generators with the maximum market power after the minimum technical output appears, but the overall operating cost of M2 is the highest. M1 with the best suppression of G1 market power has the lowest operation cost. We also reach similar conclusions after analyzing scenarios b and c.

Figure 9: The mitigation effect of market power mitigation mechanism in scenario a

At the same time, the results are analyzed. Firstly, in the case of minimum technical output, generator G4 has the largest market power, M2 effectively limits G4’s offer through price coercion, G4’s willingness to participate in the market decreases, and the generation capacity decreases. Other units that do not touch the price cap will have a greater opportunity to exercise market power, and G1, which already has a price advantage and a larger market share, will have a higher offer, so M2’s market operating costs will be higher instead. With the introduction of the M1 mechanism for futures market contracts, generators execute financial contracts, and individual generators are able to rationally compare the returns obtained in the futures market and the spot market; they too can make strategic offers with the goal of maximizing profits.

Since M1 is a contract price for half of the generation capacity, it provides a good disincentive for G1 market power, which has a large market share, and since G1 has the lowest price, the market operating cost is at the lowest level. At this point, suppliers’ strategic behavior is limited and spot market prices are mitigated. However, since the purpose of this mechanism is only to stabilize the spot price, transactions in the futures market are not formed through optimal dispatch, and therefore lead to a situation where the total operating cost increases when higher-cost units clear power. The operation cost of the punishment mechanism M3 is in the medium range for the penalty is not strong enough to offset the net profit of the suppliers. The supplier is more willing to take the risk and exercise market power even under the risk of punishment.

The contract mechanism M1 provided the best market power mitigation method in the typical electricity market with oligopolistic characteristics. The effect of the mechanism can be described as M1 > M3 > M2. Without this prior condition in the typical electricity market, M1 may lead to a larger market share for higher-cost units, when the market-clearing price will be higher, and also lead to an increase in total market operation costs. Therefore, we proceed to discuss the effectiveness of the market power mitigation mechanism in a typical electricity market with balanced characteristics.

5.3.2 A Typical Electricity Market with Balanced Characteristics

A typical electricity market with balanced characteristics means that the market shares of individual suppliers in the electricity market are more balanced, but the costs of the suppliers are different. Through simulation analysis, the market power mitigation effects of the three market power mitigation mechanisms, M1, M2, and M3, can be obtained in different market operation states, a, b and c, respectively. Since the mitigation effects on different market operation states are basically the same, the examples of clearing power and quotation factor are still performed first for scenario a.

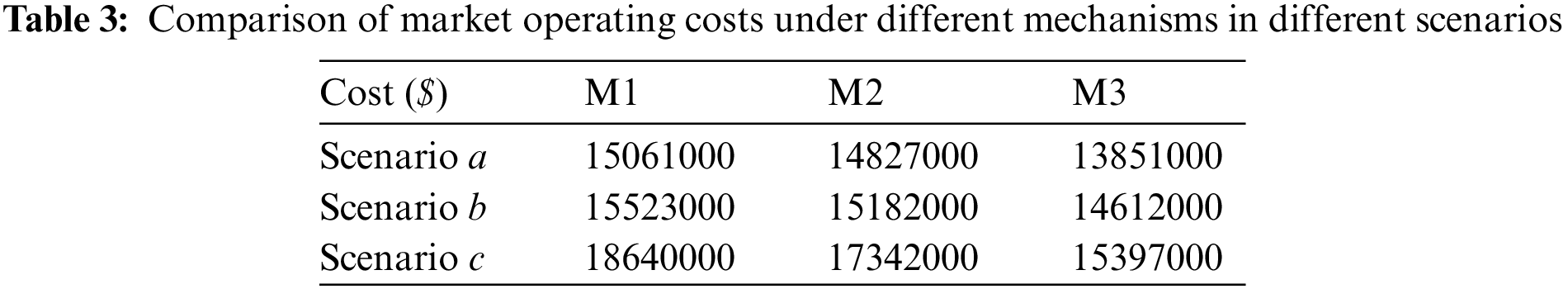

The three market power mitigation mechanisms when the system has a minimum technical output constraint. The respective clearing power and quotation factor changes also change, as is shown in Fig. 10. It can be seen that the total cost of M3 is the lowest under the minimum technology output triggers. We also reach similar conclusions in Fig. 10 after analyzing scenarios b and c.

Figure 10: The mitigation effect of market power mitigation mechanism in scenario a

The reasons are analyzed from Table 3. The market shares of the suppliers are basically the same, and M2 has a limited mitigating effect on market power because the higher-cost generators do not have an absolute advantage in market share and therefore do not exercise market power significantly. According to the analysis in 5.3.1, M1 makes the higher-cost generators increase their market share and, therefore, the total costs increase due to its penalty mechanism, M3 makes the suppliers reduce their generation if they continue to increase their quotation factor, which also becomes unprofitable. Therefore, the market power exercise of the generators is mitigated and the market operating costs are effectively reduced. The conclusions above apply to the typical electricity market with balanced characteristics. The mechanism effectiveness is M3 > M2 > M1.

In this paper, the MAS-genetic-interior-point algorithm is proposed to solve the interactive equilibrium model of the Nash-Stackelberg leader layer, and Stackelberg follower layer in the strategy bidding model considering minimum and maximum technical output constraints and line transmission constraints to simulate and derive the mitigation effects of different market power mitigation mechanisms.

(1) The market-clearing model considering multiple physical constraints will increase the market power of each supplier and reduce the market efficiency. When minimum technical output constraint is triggered, the supplier’s quotation factor is significantly increased and other suppliers basically maintain their quotation factor levels. All generators with maximum technical output triggered show significant price-raising behavior. Generators considering the network blockage constraint create network blockage in order to further strategize their offers.

(2) Supply-side market power mitigation mechanisms can reduce the market power of generators in different constrained markets. The market power mitigation mechanism based on financial contracts performs best. However, it is based on certain market conditions.

(3) The current market power mitigation mechanism can only partially mitigate the market power to a certain extent, but cannot lead to a competitive equilibrium level. It is necessary to continue the research on market power mitigation methods in order to find the optimal market power mitigation mechanism applicable to different markets.

(4) A comparative analysis of the existing market power mitigation mechanisms has analyzed the effectiveness of market power mitigation for suppliers in the two typical market structures. The ex-ante contract signing mechanism can better mitigate market power in the typical market structure with oligopolistic characteristics, while the ex-post punishment mechanism is better in the typical market structure with balanced characteristics.

Acknowledgement: This work is supported by the Science and Technology Project of State Grid Corporation of China (Provincial power spot market and power grid dispatching and operation joint deduction technology research and system development).

Funding Statement: The authors received no specific funding for this study.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

References

1. Borenstein, S., Bushnell, J., Knittel, C. R. (1999). Market power in electricity markets: Beyond concentration measures. The Energy Journal, 20(4), 1–10. DOI 10.5547/ISSN0195-6574-EJ. [Google Scholar] [CrossRef]

2. Bask, M., Lundgren, J., Rudholm, N. (2011). Market power in the expanding nordic power market. Applied Economics, 43(9), 1035–1043. DOI 10.1080/00036840802600269. [Google Scholar] [CrossRef]

3. Cherukuri, A., Cortés, J. (2019). Iterative bidding in electricity markets: Rationality and robustness. IEEE Transactions on Network Science and Engineering, 7(3), 1265–1281. DOI 10.1109/TNSE.6488902. [Google Scholar] [CrossRef]

4. Zhang, S., Fu, X., Wang, X. (2012). Effects of option contracts on electricity markets: A Cournot equilibrium analysis. 2012 Asia-Pacific Power and Energy Engineering Conference, Shanghai, China. DOI 10.1109/APPEEC.2012.6307417. [Google Scholar] [CrossRef]

5. Rose, J., Gerhardt, D., Karp, J. (2014). Of polar vortexes and PJM price spikes. https://www.pserc.edu/empire/Of%20Polar%20Vortexes%20and%20PJM%20Price%20Spikes%20White%20Paper%20012414.pdf. [Google Scholar]

6. Brown, D. P., Olmstead, D. E. H. (2017). Measuring market power and the efficiency of alberta’s restructured electricity market: An energy-only market design. Canadian Journal of Economics/Revue Canadienne d’é Conomique, 50(3), 838–870. DOI 10.1111/caje.12280. [Google Scholar] [CrossRef]

7. Möst, D., Genoese, M. (2009). Market power in the German wholesale electricity market. The Journal of Energy Markets, 2(2), 1–47. DOI 10.21314/JEM.2009.031. [Google Scholar] [CrossRef]

8. Amountzias, C., Dagdeviren, H., Patokos, T. (2017). Pricing decisions and market power in the UK electricity market: A VECM approach. Energy Policy, 108(1), 467–473. DOI 10.1016/j.enpol.2017.06.016. [Google Scholar] [CrossRef]

9. MISO (2018). The office of enforcements’ division of energy market oversight. 2017 State of the Market Report of the New York ISO Markets. Washington. [Google Scholar]

10. Lundin, E., Tangerås, T. P. (2020). Cournot competition in wholesale electricity markets: The nordic power exchange. International Journal of Industrial Organization. Nord Pool, 68(1), 1–10. [Google Scholar]

11. Mokhtari, S., Yen, K. K. (2021). Impact of large-scale wind power penetration on incentive of individual investors, a supply function equilibrium approach. Electric Power Systems Research, 194(1), 1–10. DOI 10.1016/j.epsr.2020.107014. [Google Scholar] [CrossRef]

12. Pozo, D., Contreras, J. (2011). Finding multiple nash equilibria in pool-based markets: A stochastic EPEC approach. IEEE Transactions on Power Systems, 26(3), 1744–1752. DOI 10.1109/TPWRS.2010.2098425. [Google Scholar] [CrossRef]

13. Ernst, D., Minoia, A., Marija, I. (2004). Market dynamics driven by the decision-making power producers. Proceedings of 2004 IREP Symposium-Bulk Power System Dynamics and Control-VI, Denver, CO,USA. [Google Scholar]

14. Huang, L., Zhang, S., Wang, X. (2020). A distributed algorithm for solving cournot equilibrium model of electricity markets. 2020 5th International Conference on Power and Renewable Energy (ICPRE), vol. 10, no. 2, pp. 138–142. Shanghai, China. [Google Scholar]

15. Green, R. J., Newbery, D. M. (1992). Competition in the British electricity spot market. Journal of Political Economy, 100(5), 929–953. DOI 10.1086/261846. [Google Scholar] [CrossRef]

16. Vahidinasab, V., Jadid, S. (2010). Normal boundary intersection method for suppliers’ strategic bidding in electricity markets: An environmental-economic approach. Energy Conversion and Management, 51(6), 1–10. [Google Scholar]

17. Sweeting, A. (2007). Market power in the england and wales wholesale electricity market 1995–2000. The Economic Journal, 117(520), 654–685. DOI 10.1111/j.1468-0297.2007.02045.x. [Google Scholar] [CrossRef]

18. Ernst, D., Minoia, A., Ilic, M. (2004). Market dynamics driven by the decision-making of both power producers and transmission owners. IEEE Power Engineering Society General Meeting, 1(2), 255–260. DOI 10.1109/PES.2004.1372795. [Google Scholar] [CrossRef]

19. Peng, X., Tao, X. (2018). Cooperative game of electricity retailers in China’s spot electricity market. Energy, 145(1), 152–170. DOI 10.1016/j.energy.2017.12.122. [Google Scholar] [CrossRef]

20. Kristiansen, M., Korpås, M., Svendsen, H. G. (2018). A generic framework for power system flexibility analysis using cooperative game theory. Applied Energy, 212(1), 223–232. DOI 10.1016/j.apenergy.2017.12.062. [Google Scholar] [CrossRef]

21. Amin, W., Huang, Q., Afzal, M. (2020). A converging non-cooperative & cooperative game theory approach for stabilizing peer-to-peer electricity trading. Electric Power Systems Research, 183(1), 106278. DOI 10.1016/j.epsr.2020.106278. [Google Scholar] [CrossRef]

Cite This Article

Copyright © 2022 The Author(s). Published by Tech Science Press.

Copyright © 2022 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools