DOI:10.32604/csse.2021.014527

| Computer Systems Science & Engineering DOI:10.32604/csse.2021.014527 |  |

| Article |

Impact of Financial Technology on Regional Green Finance

1School of Management, Shanghai University of Engineering Science, Shanghai, 201620, China

2School of Financial Technology, Shanghai Lixin University of Accounting and Finance, Shanghai, 201209, China

3School of Business Administration, Shanghai Lixin University of Accounting and Finance, Shanghai, 201209, China

4School of Sciences, European University Cyprus, Nicosia, 22006, Cyprus

*Corresponding Author: Hui Wu. Email: wdhh429@163.com

Received: 26 September 2020; Accepted: 04 April 2021

Abstract: Finance is the core of modern economy, and a strong country cannot do without the support of financial system. With the rapid development of economy and society, the traditional financial services can not support the increasingly large and complex economic system. As a brand-new format, financial technology can help the financial industry to restructure and upgrade. At the same time, as an international consensus, green development is the only way for China to achieve sustainable development. Therefore, it is of great practical significance to study the impact of finance on the regional development of green finance. Based on the essence of green finance development, fuzzy principal component analysis is used to build the green finance evaluation index system in this paper. Taking the data of three provinces and cities in the Yangtze River Delta from 2015 to 2019 as an example, QAP analysis is used to study the impact of financial technology on the regional development of green finance. Research shows that explanatory variables are highly significant, that is, financial technology has a significant role in promoting green finance. Finally, based on the research conclusions, this paper puts forward suggestions on how green technology can better promote the development of green finance from three aspects of top-level design, technical research and supervision.

Keywords: Regional green finance; financial technology; fuzzy principal component analysis; QAP analysis

Destruction of the environment has been accompanied by the rapid development of the global economy. Many countries are paying more attention to achieving “green economic growth” while vigorously developing their economies [1]. Making traditional industries and strategic emerging industries environmentally friendly requires empowering the financial industry. The supply of captial to the green economy is an important manifestation of green finance. To promote economic development, it is necessary to develop high-quality finance to avoid economic uncertainty. Within China’s current development, green finance is a way to avoid economic uncertainty and it is an important driving force for advancing supply-side structural reforms. The level of green development reflected in the Green Finance Index and the evaluation of the degree of green development in a region have important practical effects for economic transformation, reducing investment risks, and helping traditional enterprises to improve their sustainable development capabilities.In recent years, China has implemented a policy of supporting the green economy. The People’s Bank of China Seven ministries including the Ministry of Finance, and the National Development and Reform Commission jointly issued the “Guiding Opinions on Building a Green Financial System.” As a result, China is becoming the first country in the world where the government explicitly supports the establishment of a green financial system in the form of a policy document. The design of the top-level system of China’s green finance is the first step of China’s green finance system.

Fintech refers to the financial innovation brought about by new technologies, which can create new business models, applications, processes, or products. These can have a significant impact on financial markets, financial institutions, or how financial services are provided. The business scenarios that combine technology and finance primarily include financial supervision, payment and settlement, financing products and services, insurance, Robo-advisors, and energy transactions. The underlying technologies mainly include artificial intelligence, blockchain, cloud computing, big data, and the internet of things, and some scholars use these technologies to study the construction of smart city such as smart transportation [2,3]. As a new business form, financial technology will promote the development of China’s financial industry. At the same time, the development of green economy is the only way to realize sustainable development. Therefore, it is of great practical significance to study the application of financial technology in green finance.

2 Literature Review and Comments

As a method and means to promote sustainable development, green financial services have become the mainstream trend of financial development. An international understanding of green finance can be roughly divided into two categories: The first category regards green finance as investment and financing activities that are meant to improve the environment, namely green investment. The starting point of this understanding comes from “filling the investment gap.” [4]. Another type of understanding directly incorporates environmental factors into the field of financial investment, including changes in environmental costs, changes in risk coefficients, and changes in the rate of a return. It is believed that the development of green finance is based on the mutual restriction between finance and the environment [5]. Most scholars define financial technology as a technological solution that can realize the transformation of the financial service industry. Scholars believe that financial technology is a new industry that uses technological innovation to improve the quality of financial services. Financial technology is a disruptive emerging financial industry that uses digital and information technology to achieve the innovation of the existing economic model [6,7]. Generally speaking, financial technology refers to financial innovation driven by technological innovation. Deep integration of finance and technology, with big data, blockchain, artificial intelligence, and cloud computing as the main technical support, has changed business. Fintech provides impetus to various industries by expanding service boundaries of financial institutions and improving service methods while improving financial efficiency and minimizing risks [8–11].

At present, scholars have not presented research on the application of financial technology in green finance. Jin et al. [12] studied the solutions to the problems existing in the development of green finance with the help of blockchain technology. Shen [13] pointed out effective integration of technology and finance provides favorable conditions for promoting integration of industrial finance and seeks more and better opportunities for development of green finance. Service system and service platforms for financial technology are achieving a high degree of integration and promoting the development of green finance in China. Liu [14] proposed that Chinese green finance still has shortcomings at the micro-foundation level, and financial technology can consolidate the micro-foundation of green finance by improving the ability to identify green projects, ensuring flows of funds to green project and promoting the accelerated development of green finance. Some scholars have noted the representativeness of blockchain technology in financial technology, and focused on blockchain technology to explore its application in green finance scenarios. He [15] explored the issue of financial technology promoting the innovation and development of green finance. Liu [16] noted that finance was the first field where blockchain was applied. Blockchain can weaken green financial risks through supply chain finance, improve green financial efficiency by reducing intermediate links, and strengthen supervision through information sharing. Zhang et al. [17] proposed that blockchain can promote development of green finance through four perspectives: promoting a valuable experience of the pilot zone, improving the green financial infrastructure, enriching green financial products, and reducing risk in green finance. From the green financial system perspective of construction, Yang [18] proposed that blockchain can improve the green financial credit information system, innovate and enrich the green financial product system, use smart contracts to improve efficiency and reduce risks, and optimize the green financial payment and settlement system. Yuan et al. [19] believed that blockchain was a disruptive technological innovation, and listed six application scenarios of financial technology in green finance, including digital currency and financial transaction. Arner et al. [20] believed that the application of financial technology was conducive to improving the efficiency of financial services and reducing the cost of financial services.

Few studies have focused on the relationship between green finance and financial technology, although separate research on green finance and financial technology can be found in the literature. However, under the environment of rapid development of financial technology, fintech will bring green finance the new development of the financial technology itself is based on “technology”. The purpose is to promote the transformation and upgrading of finance. Under this circumstance, how fintech can help the development of green finance is a place worth pondering.

From an innovation-driven perspective, this research explores and analyzes the important role on the impact of financial technology on green finance. Also committed to exploring the impact of financial technology on the evaluation system of green finance and clarifying financial technology, then provide countermeasures and suggestions on the mechanism of green finance.

3 Construction of Green Finance Evaluation System

As a financial system dominated by the banking industry in China, green credit accounts for a relatively high proportion of green finance, among which large state-owned commercial banks and policy banks are the main suppliers of green credit. At present, the evaluation system in green finance at home and abroad has formed a common logical foundation, and the literature mostly focuses on commercial banks and other financial institutions as the main research objects to construct a green finance evaluation index system. Therefore, this article summarizes the differences on the basis of existing research. From the perspective of the commonality of green finance evaluation research, combined with the characteristics of green finance reform and innovation under the background of financial technology, we try to incorporate diversified evaluation methods to evaluate green finance in a three-dimensional manner.

3.1 Selection of Green Finance Evaluation Index

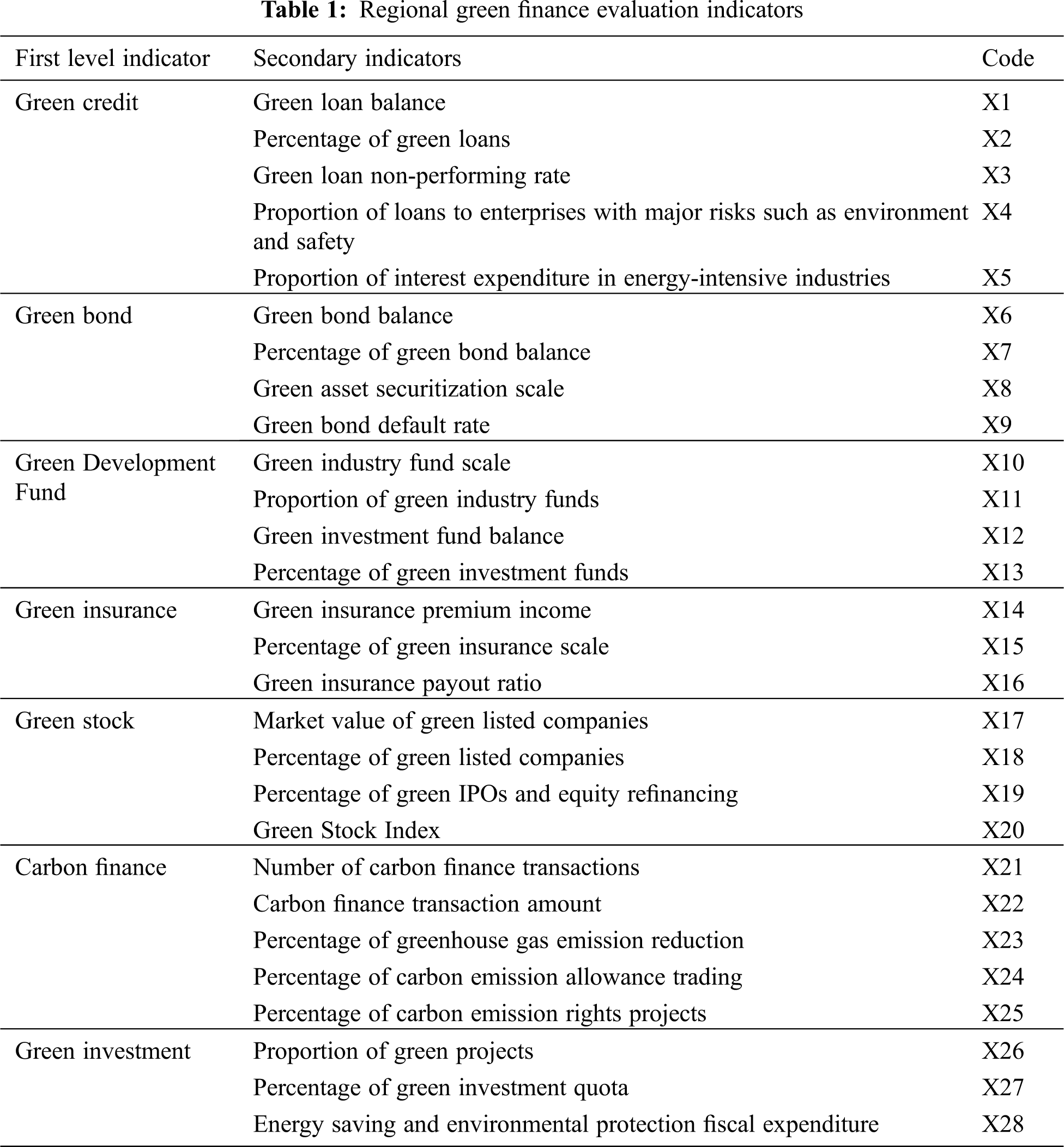

To ensure the credibility of the evaluation results, it is necessary to select indicators with a scientific attitude and strict and standardized methods based on the basic principles of the aforementioned indicator selection, and take their essence to eliminate the dross, and finally reflect the essence of green finance development in the evaluation research. Reflecting the true status of the development of green finance, in the large number of existing studies on the construction of the index system, it is not difficult to find that there are two obvious problems in the selection of an index. One is that the integrity of the index is too important, which leads to the bloated index system and the low feasibility of data collection; The second is impractical and unrealistic, as the data lacks authority. Indicators from the literature were screened in this study. First, relevant documents, including books, papers and conference reports were collected, and a series of high-frequency indicators were screened, such as the proportion of green credit, the expenditure of energy-intensive interest industries, and the proportion of carbon emissions. Then, referring to the existing official statistical caliber, comprehensively consider the above indicator selection principles, and according to the nature of each specific indicator, including green credit, green bonds, green development funds, green insurance, green stocks, carbon finance, green investment in seven dimensions.

Theoretically, research on green financial indicators falls into two areas: macro and micro. The micro perspective is often focused on operation and management of financial institutions themselves, and the performance of financial institutions in green financial services is evaluated. An evaluation of green finance from a macro perspective is focused on the relationship between financial and environmental development. Either target the status of green financial services provided by financial institutions or target the status of environmental investment in a specific region.Indicators are selected based on a macro perspective while accounting for the objective background of the integrated development of the Yangtze River Delta region. The relevant indicators are filtered and summarized in Tab. 1.

3.2 Green Finance Index Evaluation Method

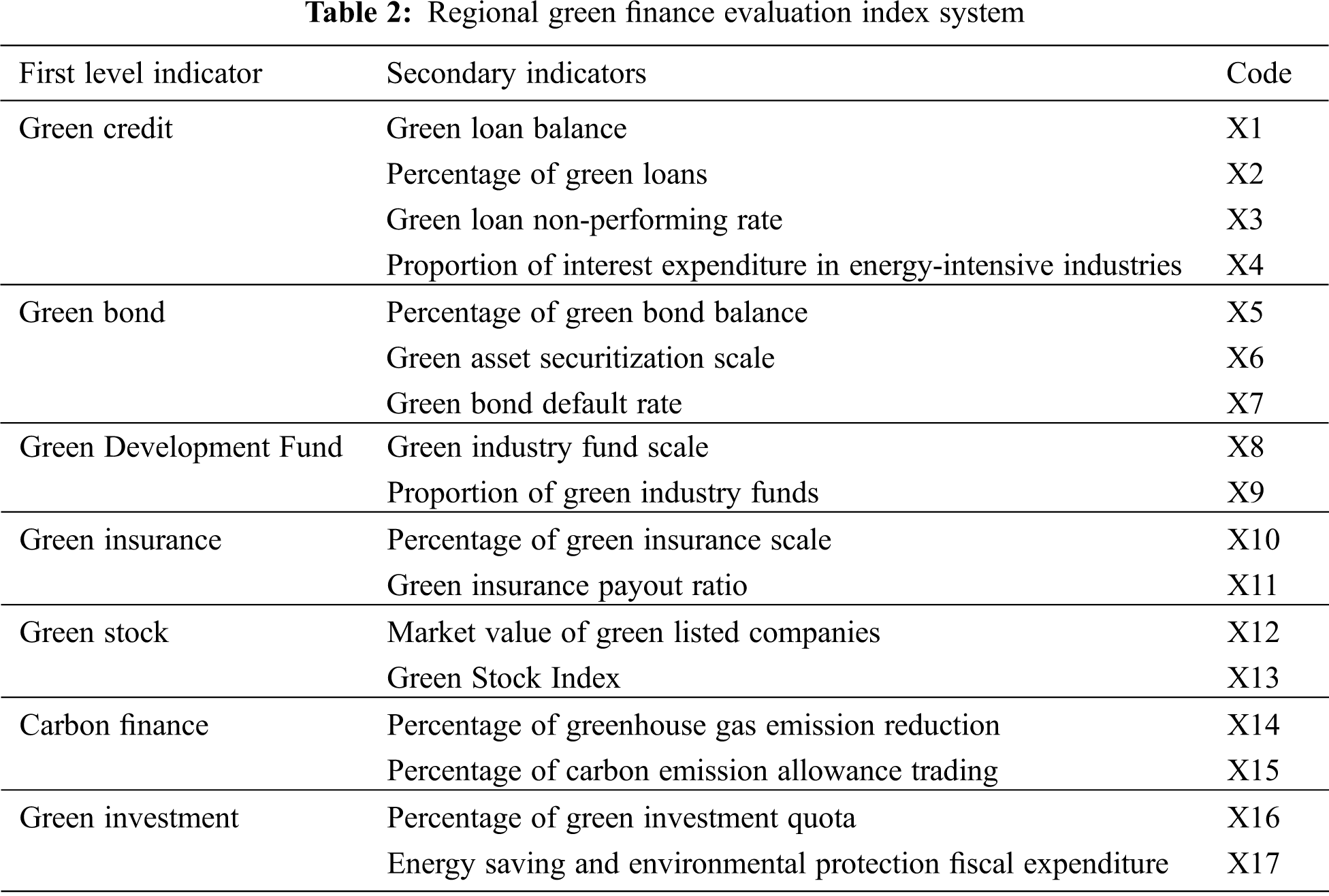

Principal component analysis is a statistical analysis method that converts multiple variables into a few principal components through dimensionality reduction. A simplified principal component index is used for more evaluation indicators. However, comprehensive indicators retain most of the information of the original variables and are unrelated to each other, which can simplify complex issues. But principal component analysis is very sensitive to incomplete value and extreme value, so it is easy to lead to incomplete data or extreme data to bring deviation of analysis results. Therefore, this paper applies the theory of fuzzy mathematics to principal component analysis, and applies fuzzy set to decision analysis, so as to minimize the possibility of human factors leading to the result deviation. Fuzzy principal component analysis is based on the contribution of principal components to variance combined with fuzzy theory to obtain reasonable correction weights.

After standardizing the secondary indicators of the original data, a weighted average is used to obtain an evaluation metric for the primary indicators.

where

The index is standardized using the

The correlation matrix

Using the unit feature vector corresponding to the previous eigenvalue of

The variance contribution rate of principal component

The variance contribution rate for each principal component is used as the initial weight, and the initial weight is modified to obtain the final weight. This is because each expert gives the number of weight intervals of each indicator and the optimism of the collaborative innovation ability of each candidate area according to the needs of the enterprise when evaluating the original indicators. For this purpose, it is necessary to calculate the weight

The weight fuzzy set

The preliminary is used to weight to obtain the final weight of the regional innovation capability evaluation index:

Fuzzy principal component analysis yields the indicators in Tab. 2.

After consulting a large amount of statistical data, three provinces and cities in the Yangtze River Delta were selected for analysis, with annual data ranging from 2015 to 2019 as the overall sample to empirically analyze the driving role of financial technology in green finance. Data sources include the Yangtze River Delta Statistical Yearbook, the website of China Banking and Insurance Regulatory Commission, annual reports and social responsibility reports of various banks, and wind databases. Interpolation was used to determine any missing data.

4.2 Explanatory Variable-financial Technology Index

Although financial technology is in a stage of rapid development, it has not yet been widely used in China, and there are relatively few indicators available for reference. As a result, there is no unified measurement indicator for financial technology in China. The more authoritative indices are mainly the Financial Technology Center Index (FHI) issued by the Internet Finance Research Institute of Zhejiang University; the Zhejiang Internet Finance Federation/Alliance issued by the Shenzhen Futian District Financial Development Agency, and the Xiangmihu Financial Technology Index (index code 399699.SZ), issued by Shenzhen Securities Information Co., Ltd. Year-end data from the Xiangmihu Financial Technology Index was used in this study. The index base date is May 26, 2017, and the point basis is 3000 points. The financial technology development status from January 6, 2012 is measured by selecting stocks from the financial technology industry such as distributed technology and interconnection technology in the A-share market.

4.3 Empirical Process and Result Analysis

The QAP analysis method includes three steps: First, the correlation between independent variables and dependent variables is determined followed by relationship list analysis. This involves a permutation test, which can be further refined into three steps: calculate and analyze the correlation coefficient between the long vectors formed by the known matrix; randomly replace rows and columns in the matrix, then calculate the correlation between the matrix after replacement to get a correlation matrix; and analyze the matrix of correlation coefficients to observe whether the result is within an acceptable range, and compare with the null hypothesis. The last step is regression analysis. The purpose is to study the relationship between the independent variable matrix and the dependent variable matrix. This is achieved with regular regression analysis on multiple independent variables and one dependent variable, followed by using multiple random permutations of ranks to determine a regression result.

4.3.1 QAP Correlation Analysis

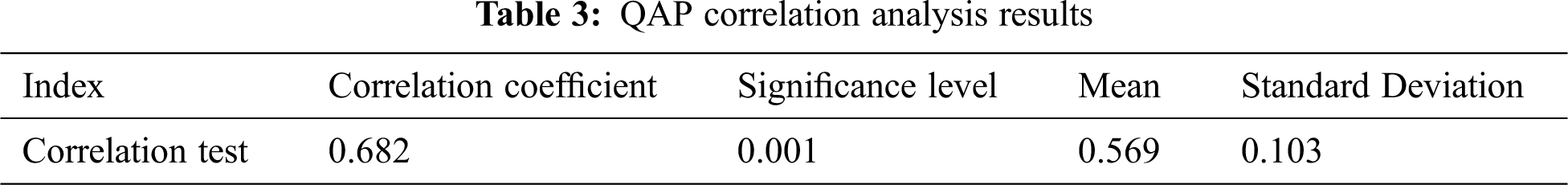

Tab. 3 shows that the correlation coefficient between regional evaluation and financial technology is 0.682, and the relationship is statistically significant.

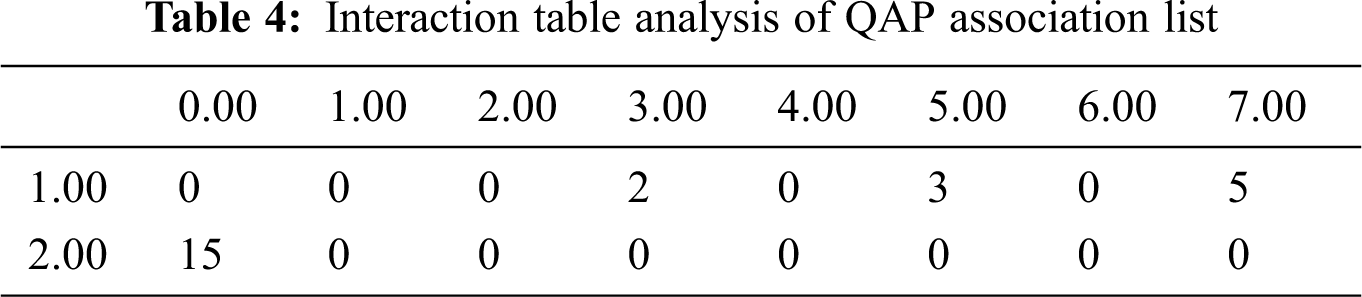

Tab. 4 shows the relationship between green finance and financial technology in the Yangtze River Delta.

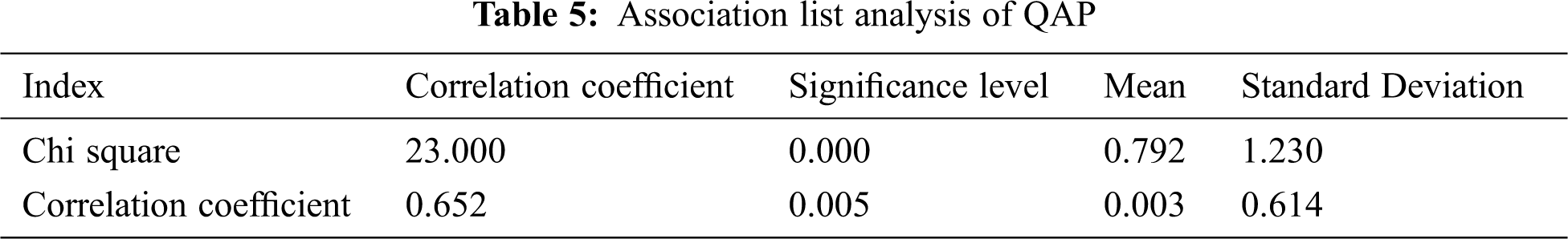

Tab. 5 shows that the results obtained after 2000 random permutations between the chi-square value and the correlation coefficient are all significant.

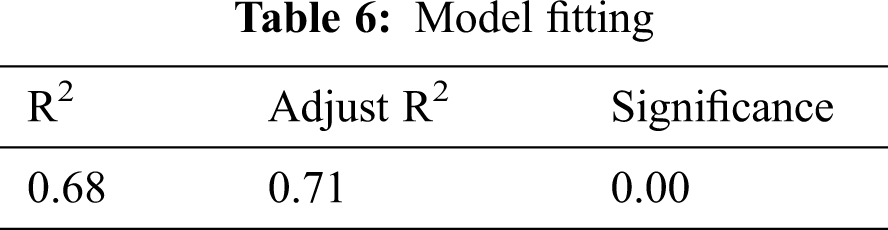

According to the model fitting results of QAP regression analysis, seen in Tab. 6, both the R-square and the adjusted R-square meet the requirements of regression analysis and meet the significance condition. Regression analysis was then performed.

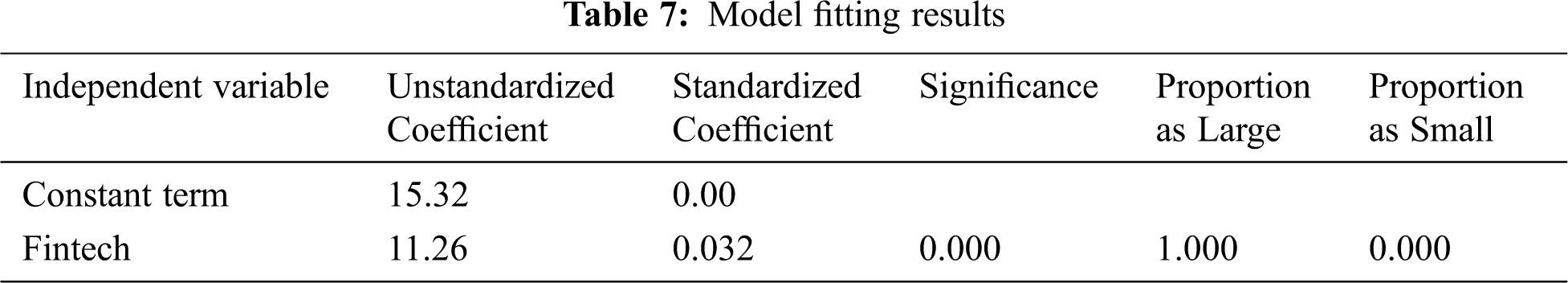

From the Tab. 7, regression results show that the standard coefficients and non-standard coefficients related to development of financial technology and regional green finance are positively correlated; this correlation also reached the requirement of significance, i.e., that financial technology will affect regional green finance. Development plays a catalytic role.

5 Research Conclusions and Countermeasures

Data from three provinces and cities in the Yangtze River Delta from 2015 to 2019 were analysis, and the driving role of financial technology on green finance was studied by using QAP analysis.

The empirical results show that the explanatory variables are highly significant, and financial technology has a significant role in promoting green finance. The results show that the Yangtze River Delta wants to promote the development of green finance and realize the optimization and upgrading of the industrial structure. Fintech will become an important starting point, use financial technology to improve the construction of a green finance series and green economy evaluation index systems to monitor the process and results to ensure the continuous development and improvement of green finance.

Through the demonstration of the logical basis of the combination of financial technology and green finance, we find that financial technology has a significant role in promoting the development of green finance. Based on the challenges of green finance in the financial technology model, this paper puts forward some suggestions for the better application of financial technology in green finance.

5.2.1 Improve Top-level Design and Strengthen International Cooperation

In the integration process of the Yangtze River Delta, the development of financial integration is inseparable from government support, and the continuous advancement of green finance also needs government encouragement. The government should actively promote financial technology, as well as formulate various financial technology technical standards and industry standards, so that the financial technology system can be applied to green finance under a unified framework. Clear policy signals should guide orderly development of financial technology such that it can gradually penetrate the field of green finance. The vast majority of China’s financial technology applications are still in the development stage, so we can learn from relevant foreign experience, track and summarize the latest developments in foreign financial technology applications, and refer to the case of foreign financial technology and green finance. In summary, it will comprehensively evaluate the impact of financial technology on green finance in China based on actual domestic conditions. Meanwhile development and application of China’s financial technology cannot be separated from the rest of the world. Therefore, international cooperation needs to be strengthened. For example, financial institutions can be encouraged to join the Global Financial Innovation Network Alliance (GFIN) and other international financial technology organizations to strengthen their voice in the international arena and participate in the formulation of international financial technology standards. In order for China’s financial technology development to be in line with international standards, it is necessary to comprehensively consider different legal systems and institutional differences at home and abroad, and design financial technology on this basis.

5.2.2 Develop Financial Technology Research, Seek Advantages and Avoid Disadvantages

At present, some Internet companies in China are exploring practical applications of financial technology, such as Ant Financial and Tencent. The government should actively guide and create good external conditions instead of engaging in excessive intervention. The government should step up efforts to create a financial technology infrastructure, and popularize the concept of financial technology in green finance in areas with irrational industrial structure, high energy consumption, and serious pollution, and create a good external environment for financial technology to promote the development of green finance. Appropriate preferential policies can be given to financial technology research, and state-owned banks can be encouraged to cooperate with financial technology companies to combine the financial advantages of commercial banks with financial technology companies; Foreign countries provide some examples where specialized financial technology research institutions have been established. The result is a deeper theoretical exploration of financial technology. Based on the continuous in-depth theoretical research, the government can encourage the development of financial technology and green finance experiments in areas where conditions permit, gradually accumulate experience, and extend the experience to the whole country under conditions of controllable risks.

5.2.3 Treat Rationally and Supervise Flexibly

Although financial technology has great prospects, it has become a popular topic of discussion in the financial industry, as if reform of the financial industry is imminent. However, one must realize that more than ten years, or even decades, might pass before a new technology experiences wide application. The underlying technologies of financial technology are still far from mature. Chinese green finance is also immature, and these two areas still need more theoretical research and extensive practical testing.

For regulators, it is necessary to look at the enthusiasm of fintech rationally. Regulators cannot interfere too much lest they hamper development of fintech, but lax regulation could allow fintech to create unacceptable risk in the financial system.

Funding Statement: The funding is sponsored by the National Social Science Fund of China (Grant No. 18CGL015).

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

1. Z. Liu, L. Lang, B. Hu, L. Shi, B. Huang et al., “Emission reduction decision of agricultural supply chain considering carbon tax and investment cooperation,” Journal of cleaner Production, vol. 294, no. 1, pp. 126305, 2021. [Google Scholar]

2. Z. Liu, B. Hu and B. T. Huang, “Decision optimization of low-carbon dual-channel supply chain of auto parts based on smart city architecture,” Complexity, vol. 5, pp. 1–14, 2020. [Google Scholar]

3. Z. Liu, Y. J. Zhao and B. Hu, “Research on staged pricing model and simulation of intelligent urban transportation,” IEEE Access, vol. 7, pp. 141404–141413, 2019. [Google Scholar]

4. S. C. Morrish and C. Lee, “Country of origin as a source of sustainable competitive advantage: The case for international higher education institutions in New Zealand,” Journal of Strategic Marketing, vol. 19, no. 6, pp. 517–529, 2011. [Google Scholar]

5. J. Boissinot, D. Huber and G. Lame, “Finance and climate: The transition to a low-carbon and climate-resilient economy from a financial sector perspective,” OECD Journal: Financial Market Trends, vol. 2015, no. 1, pp. 7–23, 2016. [Google Scholar]

6. C. Wright, “Global banks, the environment, and human rights: The impact of the equator principles on lending policies and practices,” Global Environmental Politics, vol. 12, no. 1, pp. 56–77, 2012. [Google Scholar]

7. C. Urban and J. M. Collins, “Understanding financial well-being over the lifecourse: An exploration of measures,” European Journal of Finance, vol. 26, no. 4–5, pp. 341–359, 2020. [Google Scholar]

8. B. M. S. van Praag, P. Frijters and A. Ferrer-i-Carbonell, “The anatomy of subjective well-being,” Journal of Economic Behavior & Organization, vol. 51, no. 1, pp. 29–49, 2003. [Google Scholar]

9. H. M. Mueller and C. Yannelis, “The rise in student loan defaults,” Journal of Financial Economics, vol. 131, no. 1, pp. 1–19, 2019. [Google Scholar]

10. P. Schulte and G. Liu, “FinTech is merging with IoT and AI to challenge banks: How entrenched interests can prepare,” Journal of Alternative Investments, vol. 20, no. 3, pp. 41–57, 2017. [Google Scholar]

11. L. Duan, Y. Lou, S. Wang, W. Gao and Y. Rui, “AI-oriented large-scale video management for smart city: Technologies, standards, and beyond,” IEEE MultiMedia, vol. 26, no. 2, pp. 8–20, 2017. [Google Scholar]

12. J. Y. Jin and R. Zhao, “Research trends of blockchain technology in green finance,” Finance and Accounting Monthly, vol. 13, pp. 172–176, 2019. [Google Scholar]

13. Y. B. Shen, “Research on the development of green finance in China under the background of financial technology,” China Business & Trade, vol. 8, pp. 46–47, 2017. [Google Scholar]

14. T. Liu, “Reshaping the micro foundation of green finance with financial technology,” Banker, vol. 210, no. 4, pp. 129–130, 2019. [Google Scholar]

15. Y. T. He, “Analysis of financial technology promoting green financial innovation and development,” China Circulation Economy, vol. 35, pp. 151–153, 2020. [Google Scholar]

16. H. B. Liu, “Analysis of the impact of blockchain technology on the development of green finance in China,” West China Finance, vol. 5, pp. 80–83, 2017. [Google Scholar]

17. W. Zhang and W. Lv, “Promoting the development of green finance with the help of blockchain technology,” Tsinghua Financial Review, vol. 12, pp. 95–98, 2017. [Google Scholar]

18. Y. H. Yang, “Research on the application of blockchain technology in the construction of green financial stock system in China,” Market Modernization Magazine, vol. 14, pp. 98–99, 2019. [Google Scholar]

19. Y. Yuan and F. Y. Wang, “Development status and prospect of blockchain technology,” Journal of Automation, vol. 42, no. 4, pp. 481–494, 2016. [Google Scholar]

20. D. W. Arner and J. Barberis, “FinTech in China: From the shadows?,” Journal of Financial Perspectives, vol. 3, no. 3, pp. 78–91, 2015. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |