DOI:10.32604/csse.2021.015314

| Computer Systems Science & Engineering DOI:10.32604/csse.2021.015314 |  |

| Article |

Investigain: A Productive Asset Management Web Application

1Department of Electrical and Computer Engineering, North South University, Bashundhara, Dhaka 1229, Bangladesh

2Department of Computer Science, College of Computers and Information Technology, Taif University, P. O. Box 11099, Taif 21944, Saudi Arabia

3Department of Information Technology, College of Computers and Information Technology, Taif University, P. O. Box 11099, Taif 21944, Saudi Arabia

*Corresponding Author: Mohammad Monirujjaman Khan. Email: monirujjaman.khan@northsouth.edu; monirkhan.qmul@gmail.com

Received: 15 November 2020; Accepted: 19 January 2021

Abstract: The Investigain is a progressive web application to make mutual funds investments through a Systematic Investment Plan. The application utilizes the web’s modern capabilities, such as Asynchronous JavaScript and XML (AJAX), JavaScript, and Hypertext Marker Language (HTML5). The application also uses a powerful relational database management system, such as MySQL, to display asset management information. The application has two portals, one for investors and one for a particular asset manager or asset management company. Each investor has an account in the investor portal. The investor can view his/her profile, current balance, balance history, dividends, the units of mutual funds bought, unit price, the value of each mutual fund, and can pay installments using an embedded online payment gateway. Asset managers can monitor all investments, manage user accounts, and reimburse dividends using the admin portal. This paper also presents the experimental results of using the Investigain application, compares them with existing systems, and details the application’s prospect to improve its socio-economic conditions. The system’s frontend is designed with Bootstrap and jQuery frameworks. The backend is designed using Hypertext Preprocessor (PHP) server-side scripting language. The system demonstrated increased satisfaction from its clients.

Keywords: Asset management; mutual fund; web application; systematic investment plan; investment; web; internet; net asset value; capital market

A mutual fund is a reserve that pools the investments of several investors who share common financial goals. The money thus collected is then invested in sectors like the money market and the capital market, such as bank deposits, shares, debentures, and other securities. Share unit holders share the income earned through these investments, and capital appreciation is realized in proportion to the number of units owned (Ghosh [1]). There are two types of mutual funds: open-end and closed-end. Closed-end funds have a fixed number of shares traded in the stock market, which begins through Initial Public Offering, just like regular stocks. Open-ended funds have no limit on the number of shares that are offered through a fund company (e.g., an asset management company) to the investors, and they are not traded in the stock market (Majaski [2]). An investor can buy from/sell closed-ended mutual funds to another investor via matching orders. It is the core of the stock market (Order matching system [3]). The open-ended ones can only be bought from/sold to the fund company directly. The open-end mutual funds are the medium through which asset management companies take money from investors and make investments. Direct investment in the stock market yields a limited portfolio that needs to be self-managed. Meanwhile, investing through mutual funds in the stock market yields a vast portfolio of diverse securities professionally managed (Hayes [4]).

Each unit of a closed-ended mutual fund has a price called Net Asset Value (NAV), which is the current market value of a fund’s holdings, usually expressed as a per-share amount (Telukunta [5]). NAV of a mutual fund is calculated by subtracting the fund’s liabilities from its total asset value, which is also equal to ‘shareholders’ equity (Weert [6]). It depends on the performance of the investments made after collecting the money (Hayes [4]). Mutual fund units can be purchased one time, which gives a fixed number of units, or can be purchased by making recurring payments, which adds more units in each interval, like month or year. The former is called a lump sum investment, and the latter is called the Systematic Investment Plan (SIP). For many investors, SIP is the best way to invest in mutual funds. It offers the following benefits, even when the periodic payment is small:

• An investment is completed at the predetermined intervals. It spreads overtime during rising and falling markets. SIP lowers the average cost of units and reduces the risk of investment. This process is called cost averaging (Naqvi [7]).

• A return is earned on the investment’s returns by regularly increasing the investment by a fixed amount. This process is called the power of compounding (Naqvi [7]).

• SIP nurtures investors’ savings habits that regularly keep aside affordable sums of money, and investors can possess unbelievable wealth without realizing it (Pai [8]).

• In SIP, investment is less stressful and helps people stay invested because small amounts, paid at regular intervals, and the money is spread out over time (Naqvi [7]).

• It can be a weapon to counter economic inflation (Pai [8]).

Despite these advantages, the SIP is still not well-known in some countries, like Bangladesh. Therefore, most people tend to deposit money in banks’ savings accounts, which gives lower return rates. Interest rates on all types of deposit schemes in state banks are between 3% and 6% (Alo [9]), while SIP return rates vary between 10% and 23% (Top 10 Mutual Funds - India [10]).

In Bangladesh, buying/selling closed-end mutual funds online are possible due to the stock market’s official trading applications. Still, the online process of buying/selling open-end mutual funds has not been implemented. Investors still need to fill up a form to register and go to the bank to write a check and hand it to the company or its agents at regular intervals. To mitigate the complexity of the trading process, we develop the Investigain system. It is a cloud-based mobile, friendly, and responsive web application. Asset management companies can use this application to simplify the trading process. Using the application, the investors can register themselves, add schemes for customization, see balance, units, NAV, and other data, and make electronic payments online.

The following works are related to Systematic Investment Plan, mutual funds, and software applications related to mutual funds:

1.1.1 The Scenario of Investment in SIP among the Retail Customers

Authors in [1] analyze the growth of the mutual fund industry. The research also discusses investment plan in a mutual fund and the benefits of SIP, find out the investor preference for Asset Management Companies, identify the reasons for investing in a mutual fund, and suggests the process to boost the mutual fund industry.

1.1.2 Mutual Funds and SIP with their Best Performing Funds

In [5], the authors discuss the SIP terms, such as mutual funds and their different types, and net asset value (NAV).

1.1.3 A study on awareness of investment opportunities in mutual funds—special Significance on SIP

In [11], the authors describe the SIP’s awareness level, source of information, and decision-making factors. It recommends early and systematic investment.

1.1.4 Mutual Fund Mobile Applications

Some Android and iPhone Operating System (iOS) applications exist, likey Cams, GoMF, KTrack, InvesTap, etc. (Suresh [12]). The applications can be used for investment into Mutual Funds, SIP, buy/sell units, switch among various mutual fund schemes with various mutual fund asset management companies, and view all the investments. However, none of these applications are available in Bangladesh.

1.2 Organization of This Paper

This paper is structured as follows: Section 1 explains Mutual Fund, Systematic Investment Plan, Asset Management, the motivation for the development of Investigain application, Section 2 discusses related works; design and functions of Investigain, Section 3 discusses the development process of the Investigain application, including its interface, comparative analysis results with the existing systems, use case and the impact of Investigain on the society; Section 4 concludes the paper and highlights the future works to improve Investigain.

2 Product Description, Technology and Implementation

Investigain is a multi-user platform Progressive Web Application (PWA), consists of two portals. The first one is for an investor (investor portal), and the second one is for an asset manager (admin portal). PWAs leverage the latest web capabilities to deliver an experience that combines traditional native mobile apps’ features with the web’s advantages. PWA has distinctive advantages over native app:

• Connection-independent availability: The interface is always available regardless of internet connectivity (Ater [13]).

• Fast load times: PWA can be launched and perform faster than even a native app regardless of the speed of the connection (Ater [13]).

• Push Notifications: Notifications shown on the notification panel are just like a native app (Ater [13]).

• More secure: It does not control all the hardware of the device, unlike the native app (Ater [13]).

• Easier development: Native apps are designed, especially for one platform, like iOS or Android. Sometimes these apps even cannot maintain compatibility with all the target devices. On the other hand, PWAs can be developed quickly for all platforms at once (Raczynski [14]).

Investigain is an account-based application. The interested people can register and login to add a SI scheme by clicking the ‘+’ button on the interface. Information of corresponding mutual funds, like the number of units, NAV, total value, etc., of every scheme, added, and other important information, like aggregate units and value of all schemes, is shown on the home page. The profile page shows all the personal information of the user.

The homepage of the investor portal of Investigain displays the current balance as wallet amount, which is the total amount paid by the investor. The homepage also displays the number of mutual fund units, NAV of every mutual fund, and every scheme’s total value for the investor. Each scheme can host one mutual fund with the flexibility to choose the installment amount and the interval. The wallet amount decreases when an equivalent amount of mutual fund units is issued for the investor during purchase. The wallet amount increases when an investor sells units to asset managers during re-purchase, and the equivalent total price of the units are credited to the wallet amount. The number of units varies each period depending on its current unit price (i.e., the NAV) as the amount paid by the investor each period is constant. During purchase and re-purchase, the new wallet amount is calculated as follows:

Here,

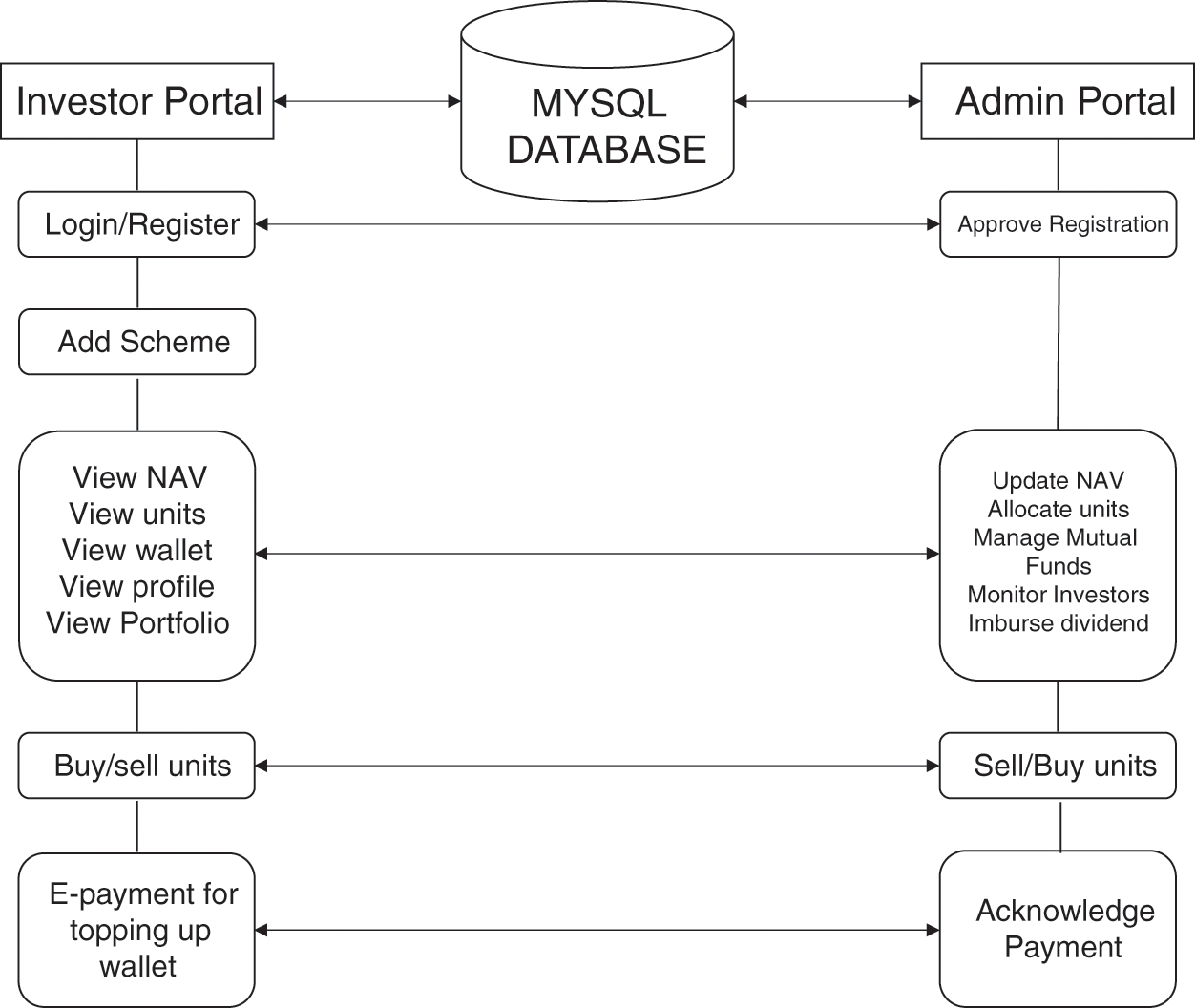

Figure 1: Block diagram of the functions of Investigain

Like any other investments in the world, investors expect a better Return on Investment (ROI). Systematic Investment Plan return is reimbursed to investors annually in a dividend between 10 and 23 percent. The dividend amount depends on the asset manager’s capital gain from managing the portfolio (Sialm & Starks [16]). Besides, investors can also receive profit by selling units to the asset manager when the re-purchase price becomes higher than the purchase price spent to obtain the units. These returns are added to the wallet. For example, when an investor gets a 5000 Taka dividend in a particular year and her previous wallet amount is 1706.5 Taka, the new wallet amount would be 5000 + 1706.5 = 6706.5 Taka. If, instead, the investor purchased 1700 units at 9 Taka and then opts to sell these units when the re-purchase price is 12 Taka, the profit she gains is (12 − 9) × 1700 = 5100 Taka and new wallet balance is 5100 + 1706.5 = 6806.5 Taka.

The above description is for investors. At the other end, the asset manager (or the person who operates under the asset manager’s instructions) monitors each investor’s units and wallet amount through the portal. The asset manager can also update NAV, investor information, purchase and re-purchase units for investors, update mutual fund information. He also specifies the dividend percentage and dispatches it, so the dividend credits to investors’ investors’ wallet the number of units of each investor. Investors can choose to set aside dividends, so the total dividend of the tenure can be redeemed when the scheme completes or credit the dividends towards the wallet amount for reinvestment, which produces compounding returns. A summary of these functions is illustrated in Fig. 1 as above.

2.1 Technologies Used to Develop the Application

The following languages and tools have been used to develop the Investigain application, including both its portals:

2.1.1 Hypertext Markup Language (HTML)

HTML can be viewed as a markup tool or language for composing web pages or presenting the same data. Tags are used to carry out the markup. It also interacts with the Internet browser about how the data should be represented on the web page (Olanrewaju, Habaebi, & Khan, [17]).

2.1.2 Cascading Style Sheets (CSS)

Cascading Style Sheets (CSS) is a language to specify the appearance of documents written in a markup language such as HTML. With CSS, for example, the color of text, font style, paragraph spacing, background images, etc., can be controlled (Pouncey & York, [18]).

2.1.3 Hypertext Preprocessor (PHP)

PHP is an open-source general-purpose scripting language suitable for web development, embedded into HTML. The PHP code is executed on the server and then received by the client as HTML pages (What is PHP? [19]).

JavaScript is a dynamic computer programming language. It is lightweight and widely used as a part of web pages, whose implementations allow client-side script to interact with the user and make dynamic pages. It is an interpreted programming language with object-oriented capabilities that allows building interactivity into otherwise static HTML pages (JavaScript - Overview [20]).

MySQL is a Relational Database Management System (RDBMS) based on Structured Query Language (SQL). The core of MySQL is the MySQL server, which handles all of the database instructions (Rouse, [21]).

jQuery is a concise and fast JavaScript library used to simplify event handling, HTML document traversing, and animation for faster website development. jQuery simplifies the HTML’s client-side scripting resulting in seamless development of web applications (Definition - What does jQuery mean? [22]).

2.1.7 Asynchronous JavaScript and XML (AJAX)

AJAX is a technique for creating better, faster, and more interactive web applications with XML, HTML, CSS, and JavaScript (What is AJAX? [23]).

A service worker is a script that the browser runs in the background (Gaunt [24]).

Notepad++ is a free source code editor that supports several languages (Ho, [25]).

Google Chrome is a freeware web browser that also contains useful web development tools.

2.2 Data Structure and Algorithm of the Application

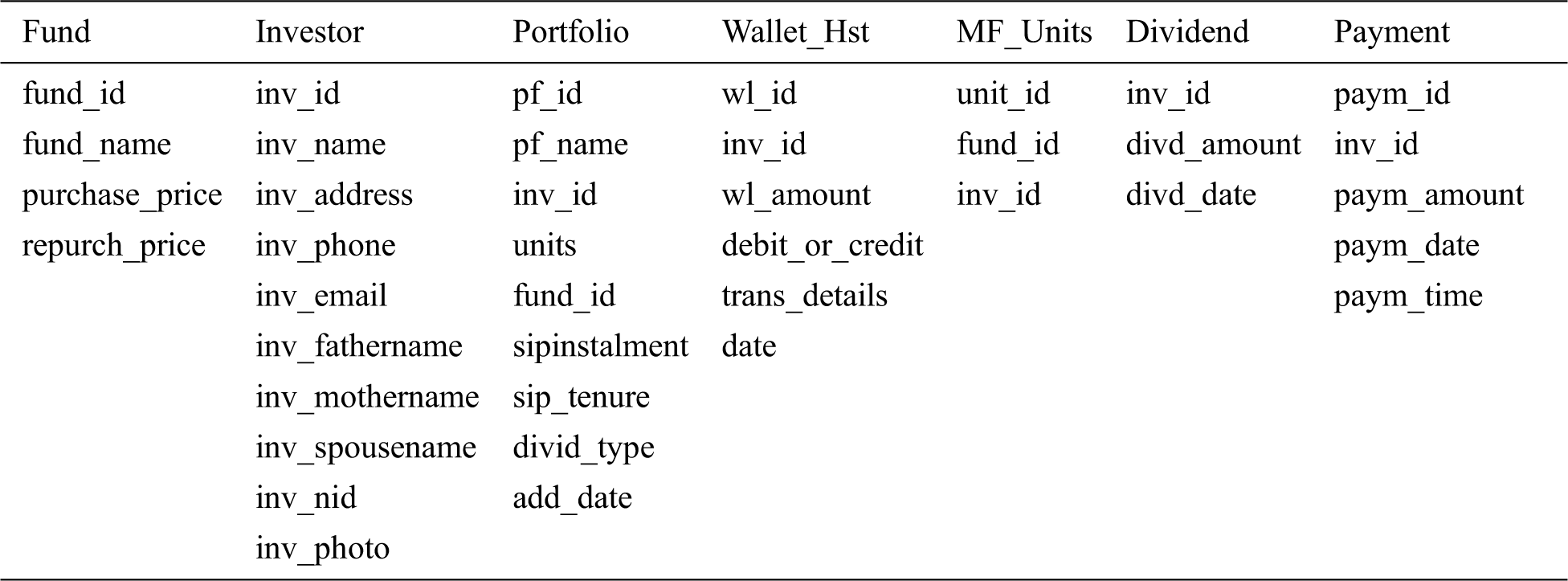

Tab. 1 shows the tables of the database (MySQL) of Investigain. The top row represents the name of the database tables, and the next rows are the headers of the corresponding table of the database. Multiple tables are left-joined or right-joined where applicable and primary keys like inv_id, fund_id which are foreign keys in other tables, are linked together for referential integrity (Markowitz [26]), so that data remains synchronized between the tables.

Table 1: Schema of the database

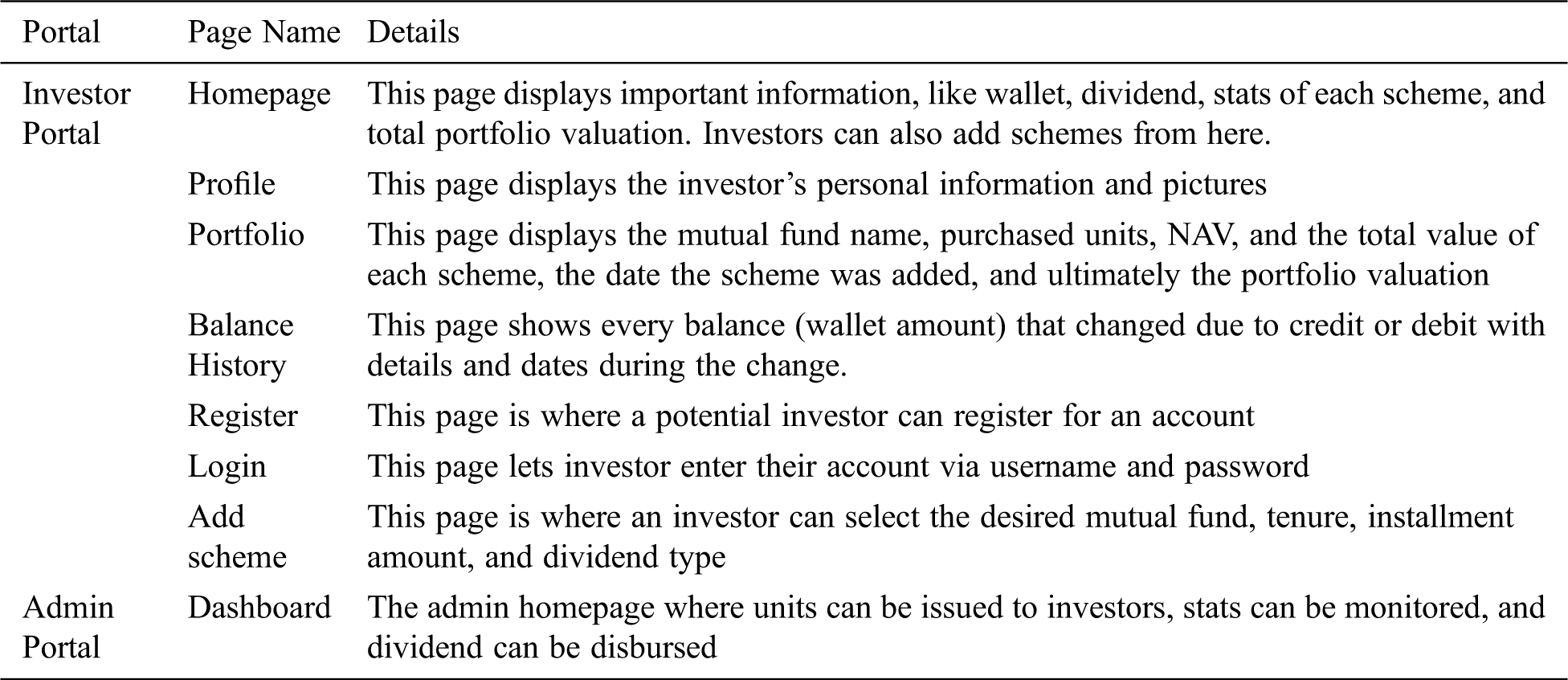

The two portals are described in Tab. 2.

Table 2: Description of pages of the application

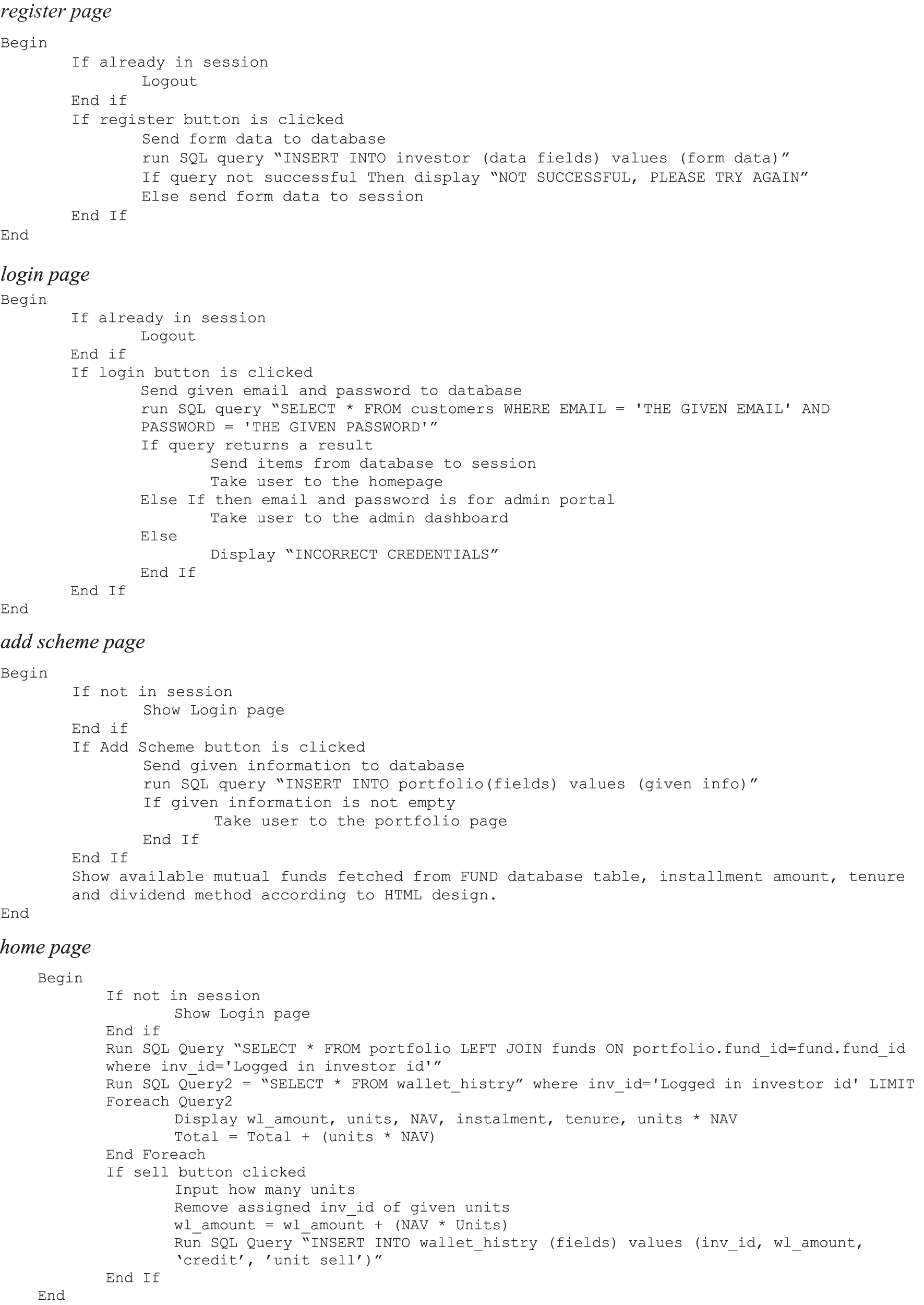

The following pseudo-code shows the algorithm of each page of the application.

2.3 Data Sampling and Methodology

One of the country’s asset management companies, HF Asset Management Limited, agreed to offer research assistance for this work. Data was collected from their system using the following methods:

• Interact with various people, like officials and investors, and study/observe various processes, like registration, logging, computer input, balance sheets, portfolios, etc.

• Text analysis, like extracting necessary data from the system and note the mechanism of dataflow and trends of these datasets.

• Interview for familiarizing with the processes.

• The recording time of processes, like registering to schemes, purchasing units through existing systems, and handing out questionnaires for comparative analysis.

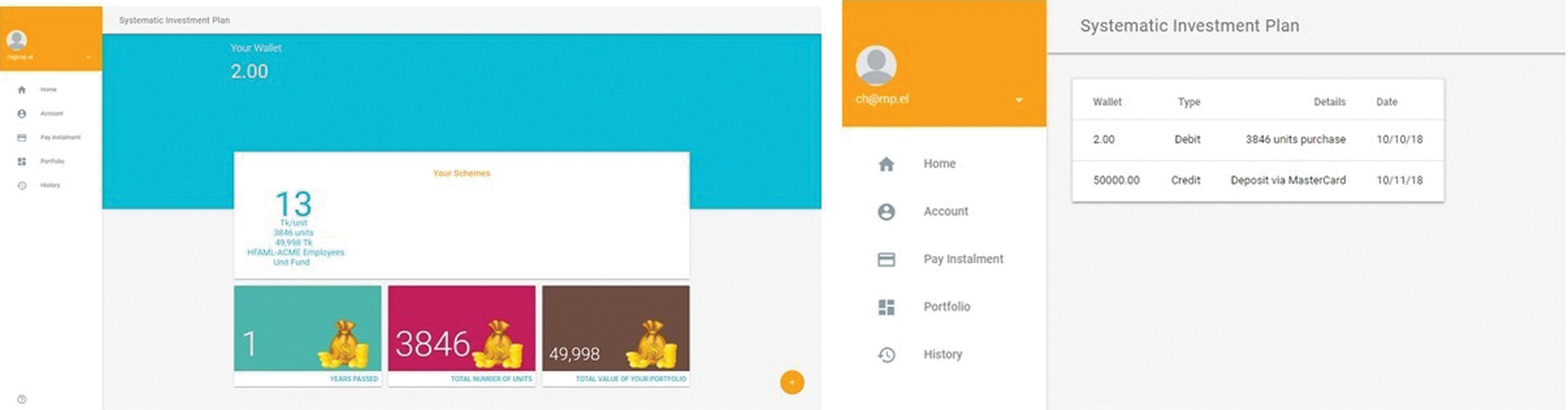

We performed white-box, alpha, and beta testing (Nidhra & Dondeti, [27]) of the application fora few months. The testing was found to significantly reduce wait times and duration of most processes like investor registration, payment, inquiry, and units’ transaction from the existing system. This prolonged testing period resulted in the application producing desired outputs after fixing any code errors and bugs. Fig. 2 shows some of the application’s interfaces after testing.

Figure 2: The homepage and wallet history of the investor portal of Investigain

3.1 Use Case and Comparative Analysis

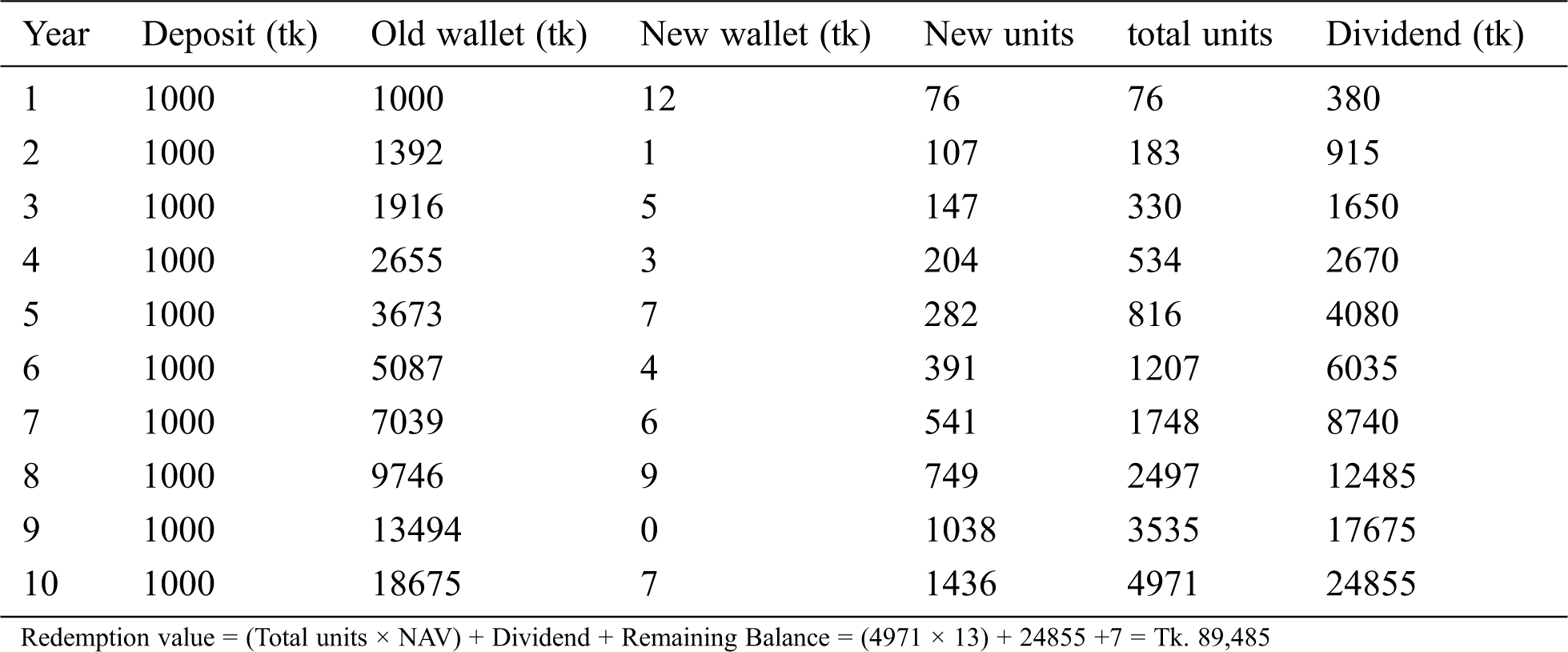

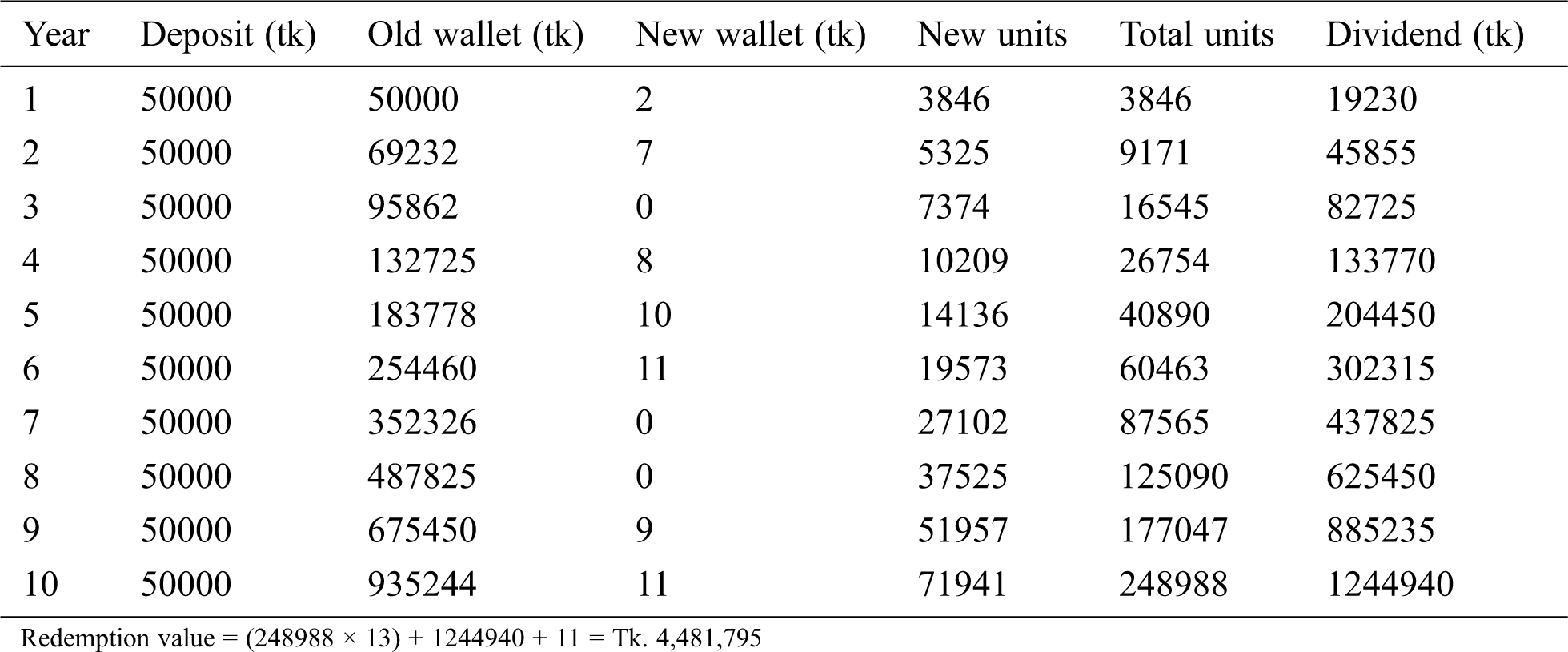

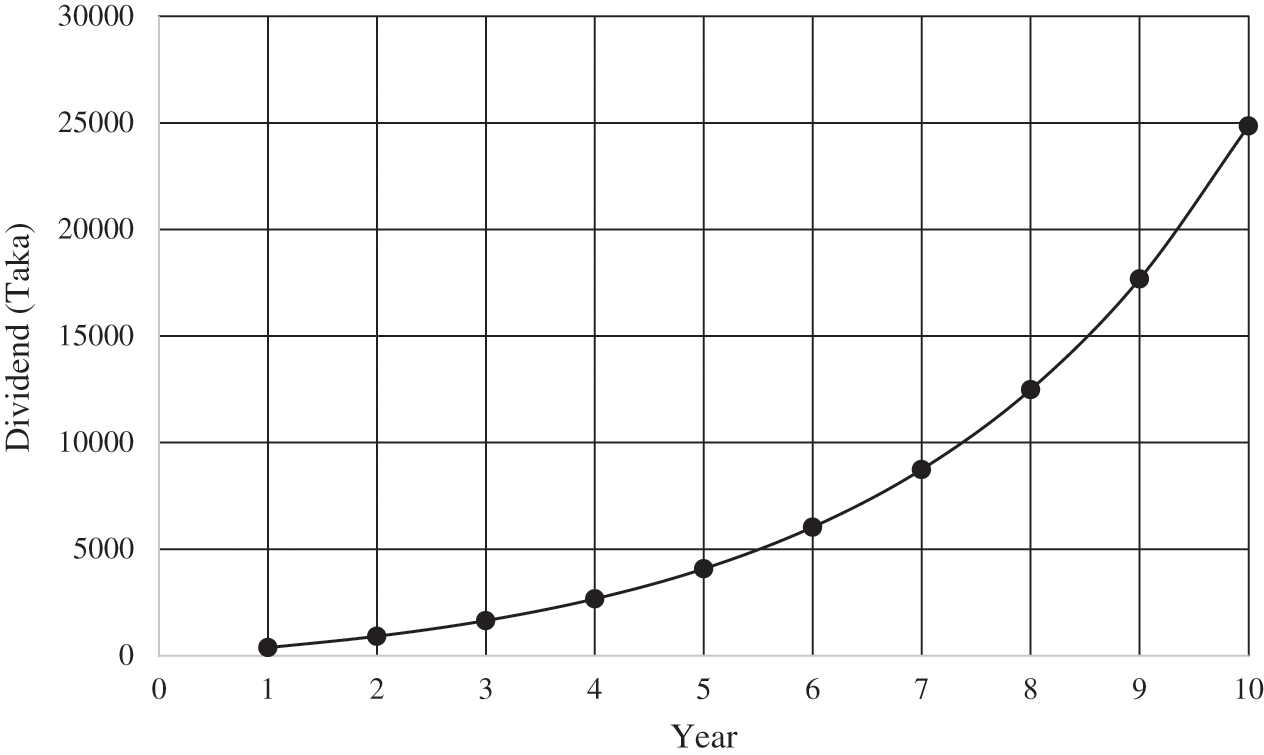

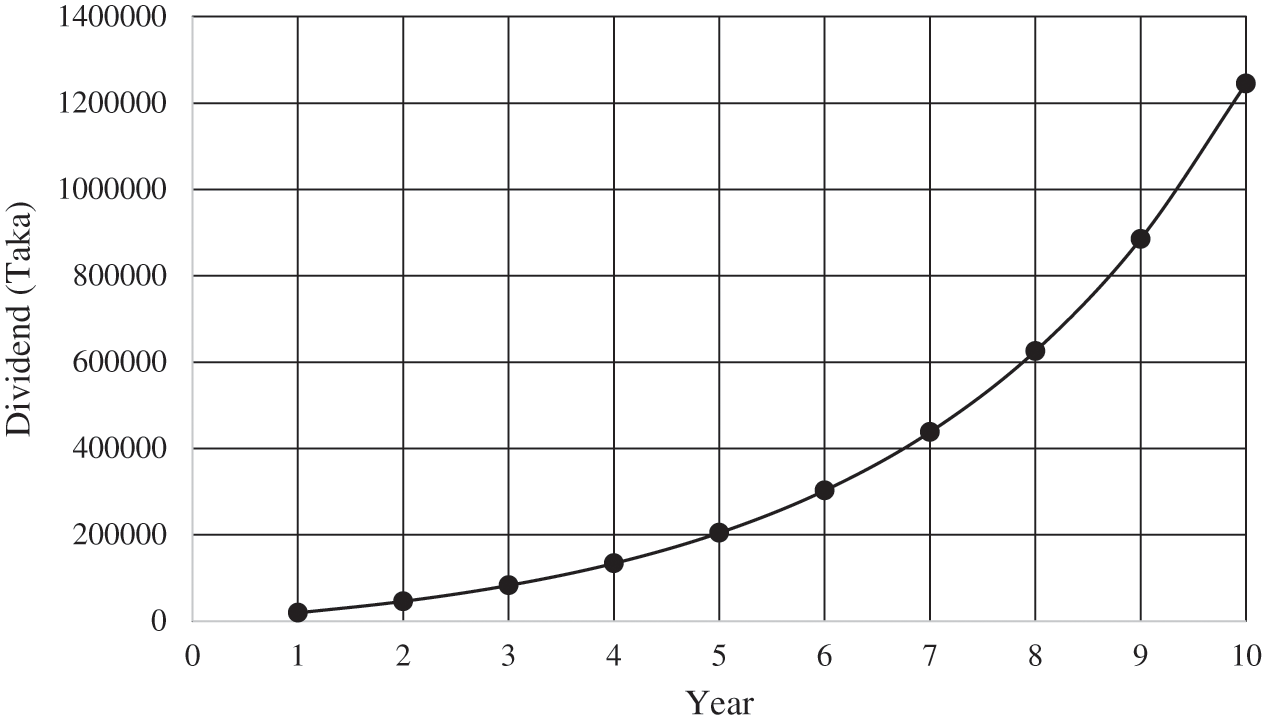

The following is the use case of a projected ten-year-long scheme based on a SIP of two persons using Investigain, one with Tk. 1000 yearly installment deposit (periodic payment), and another one with Tk. 50,000 yearly deposit, both having a cumulative investment, their dividends are reinvested together with their deposits. The data from their application portals are recorded over this period, as shown in Tabs. 3 and 4. It is assumed that these persons sold no units over this period, and both registered the same mutual fund whose NAV (purchase price) was Tk. 13 per unit on average. It is also assumed that, on average, both persons receive yearly Tk. 5 dividends per unit of the mutual fund.

Table 3: Use case of the first person using the application

Here, the first person deposited Tk. 1000 in the first year used to buy 76 units of the mutual fund worth 988 Taka. Twelve 12 Taka remained was added with the dividend returned by these units at the end of the year together with Tk. 1000 deposit in the next year to buy 107 more units, and so on.

Table 4: Use case of the second person using the application

Here, the second person deposited Tk. 50,000 in the first year, used to buy 3846 units of the mutual fund worth 49,998 Taka. Twi taka that remained was added with the dividend returned by these units at the end of the year together with Tk. 50,000 deposit in the next year to buy 5325 more units and so on.

For both persons, the ROI is almost the same. The first person invested 1000 × 10 = 10,000 Takas to obtain a return of 89, 485 Takas, which is (89485 ÷ 10000) × 100 = 894.85% of the investment. The second person invested 50000 × 10 = 500,000 Takas to obtain a return of 4,481,795 Takas, which is (4481795 ÷ 500000) × 100 = 896.36% of investment.

However, if the scheme’s duration (tenure) is taken into account, the return is significant. If it is assumed that both these persons redeemed their units after five years instead of ten years, the redemption value for the first person would be 4080 + 7 + (816 × 13) = 14,695 Takas which is (14695 ÷ 5000) × 100 = 293.9% of investment, and the redemption value for the second person would be 204450 + 10 + (40890 × 13) = 736,030 Takas which is (736030 ÷ 250000) × 100 = 294.4% of investment. Therefore, if the scheme continues for twenty years, the return would be enormous due to compounding power. Also, the amount of dividend, which can also be understood by observing the exponential trend of graphs in Fig. 3 and Fig. 4, plotted from Dividend and Year data of Tabs. 3 and 4, respectively.

Figure 3: Graph of dividend versus year for the first person

Figure 4: Graph of dividend versus year for the second person

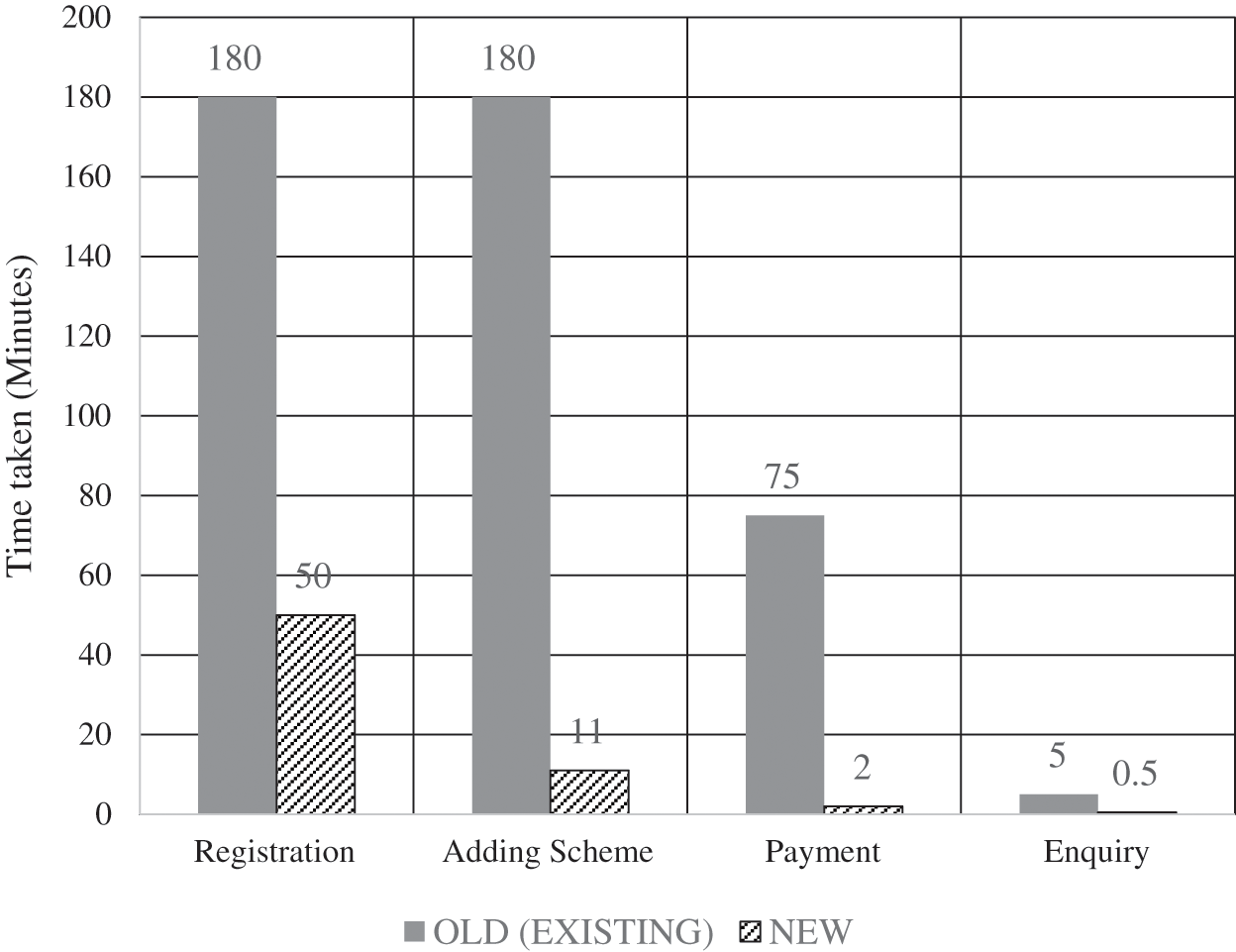

To discuss how the new system is better than the existing system (paper-based), the following graph in Fig. 5 resulting from data acquisition illustrates the comparison between these systems.

Figure 5: Graph of time taken for tasks related to SIP

In the existing system, time taken for registration of an investor and adding scheme includes: the completion time of writing on form paper (10 minutes), travel time to arrive at the form collection point (60 minutes average), and wait for time for approval (110 mins), as registration and adding scheme is the same process. Payment is made via bank cheques, which includes travel time (60 minutes average), check writing time (5 minutes), and wait time for an acknowledgment (10 minutes). Inquiry for units held currently and their values can take five minutes if inquired over the phone to convey the information through brokerage and depository software (Easley, Kiefer, & O’Hara [28]).

In the new system, the time is taken to register an investor-only includes the completion time of entering data to the online form (5 minutes) and wait for time for approval (45 minutes). Adding a scheme takes 11 minutes (1 minute for online form completion and 10 minutes for approval) as re-registration is not necessary—multiple schemes can be created in a single account. Payment is made through the application by using a payment gateway, which takes 2 minutes. An inquiry is instantaneous (0.5 minutes) as the investor login, and the information appears on the homepage right after.

3.2 Social Impact of this Work

Investigain can significantly impact society as the target audience increases due to its utilization of the Internet. It is already apparent how the SIP yields an unbelievable return on a longer duration. Therefore, if people start a SIP right from their early days in life, such as student life, they may enjoy great wealth when they start to grow old, even if the installment is small. A limited number of investors knew about the SIP. Because of increased exposure and recognition by Investigain, people from all walks of life, regardless of financial condition, may reap the Systematic Investment Plan’s rewards, which may combat poverty.

The web-based method showed decreased time than the traditional paper-based method in carrying out different processes for registering to Systematic Investment Plan. It enforces the suitability of their use as an efficient, cost-effective, and productive asset management tool for a SIP. The web application makes it incredibly convenient for investors and fund managers to view and manage their mutual funds. They feel more connected, bringing increased convenience and satisfaction in the way customers avail service from asset management companies. Investigain has been designed to tackle most shortcomings of the previously existing system, but Investigain has some disadvantages that may raise adoption and usage difficulty. It requires devices with modern browsers supporting HTML5 and JavaScript. Therefore, low-income people who cannot afford compatible mobile devices or computers cannot use the application directly. It can be overcome by assigning agents who can indirectly allow them to enjoy the application’s services. Internet connection is required to display up-to-date information to its users. If the browsing device is disconnected from the Internet, the application may still run due to its Progressive Web Application nature, but the data will not be updated. Online payment requires digital transaction methods, so if investors cannot pay digitally, assistance may be needed from third parties to pay via cash or checks. The interface language is English, so people who do not know the language might face difficulties.

In the future, the application can be improved by added the following features:

• Develop iOS and Android versions of the application.

• Use a machine learning model at the asset manager end to automatically manage the portfolio to maximize capital gain, which in turn increases the net asset value of mutual funds.

• Expand the application to be a full-fledged asset management solution for asset managers and stock brokerage firms, covering all types of investment methods.

• Add reminder system features for installment payment on time through push notifications, e-mail, and SMS.

• Support local language, such as Bengali.

Acknowledgement: This proposed solution would not have been possible without the support from Taif University Researchers Supporting Project number (TURSP-2020/98), Taif University, Taif, Saudi Arabia, and the survey respondents’ help, respectable persons of the collaborating asset management company. The authors also would like to thank the Department of Electrical and Computer Engineering of North South University.

Funding Statement: Taif University Researchers Supporting Project number (TURSP-2020/98), Taif University, Taif, Saudi Arabia.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

1. D. R. A. K. Ghosh, “The scenario of investment in systematic investment plan (SIP) among the retail customers,” Global Journal of Finance and Economic Management, vol. 1, no. 1, pp. 49–62, 2005. [Google Scholar]

2. C. Majaski, “Closed-End vs. Open-End Investments: What’s the Difference?,” Open-End Investments, 2019, May 11, pp. 1–2. https://www.investopedia.com/ask/answers/042315/what-are-primary-differences-between-closed-end-investment-and-open-end-investment.asp. [Google Scholar]

3. Wikipedia, “Order Matching System,” 2019, Dec 25. [Online]. Available: https://en.wikipedia.org/wiki/Order_matching_system. [Google Scholar]

4. A. Hayes, “Mutual Fund,” 2020, Feb 24. [Online]. Available: https://www.investopedia.com/terms/m/mutualfund.asp. [Google Scholar]

5. R. Telukunta, “Mutual funds and systematic investment plans with their best performing funds,” Imperial Journal of Interdisciplinary Research, vol. 3, no. 6, pp. 2454–1362, 2017. [Google Scholar]

6. F. D. Weert, “3.3 Goodwill,” in Bank and Insurance Capital Management, 1st edition, Chichester, UK: West Sussex, pp.20, 2011. [Google Scholar]

7. A. Naqvi, “Lump Sum vs SIP: Which Is the Better Mode of Investment?,” 2020. [Online]. Available: https://www.paisabazaar.com/mutual-funds/lump-sum-vs-sip-better-mode-mutual-fund-investment/. [Google Scholar]

8. A. Pai, “Have A Golden SIP,” 2013, Jul 5. [Online]. Available: https://www.business-standard.com/article/pf/have-a-golden-sip-111070300030_1.html. [Google Scholar]

9. B. R. and J. Alo, “Banks to Lower Interest Rates,” 2018, Jun 21. [Online]. Available: https://www.thedailystar.net/frontpage/banks-lower-interest-rates-1593052. [Google Scholar]

10. SIP Calculator, “Top 10 Mutual Funds – India,” 2020. [Online]. Available: https://sipcalculator.in/top-10-mutual-funds. [Google Scholar]

11. K. Byju, “A study on awareness of investment opportunities in mutual funds - special significance on SIP,” International Journal of Advance Research and Innovative Ideas in Education, vol. 1, no. 3, pp. 255–264, 2016. [Google Scholar]

12. K. Suresh, “10 Best Mutual Fund Mobile Apps for Investing Online in India,” 2017, Dec 12. [Online]. Available: https://myinvestmentideas.com/2017/12/best-mutual-fund-mobile-apps-for-investing-online-in-india. [Google Scholar]

13. T. Ater, Introducing progressive web apps. In: Building Progressive Web Apps: Bringing the Power of Native to the Browser. Chapter 1. 1st ed. Sebastopol, CA, USA: O’Reilly Media, Inc, pp. 5, 2017. [Google Scholar]

14. M. Raczynski, “Native App or A Progressive Web App (PWA) – Which to Choose and When?,” 2018, Apr 6. [Online]. Available: https://insanelab.com/blog/web-development/native-app-vs-progressive-web-app-pwa. [Google Scholar]

15. A. Akhigbe, D. Kim and J. Madura, “Price performance following share-repurchase announcements by closed-end funds,” The Financial Review, vol. 42, no. 4, pp. 537–555, 2007. [Google Scholar]

16. C. Sialm and L. Starks, “Mutual fund tax clienteles,” Journal of Finance, vol. 67, no. 4, pp. 1397–1422, 2012. [Google Scholar]

17. R. F. Olanrewaju, M. H. Habaebi and B. U. I. Khan, HTML basicsin conquest XHTML: a programers guide to: extensible hypertext markup language. 1st ed. Munich, Germany: GRIN Publishing, pp. 7, 2013. [Google Scholar]

18. I. Pouncey and R. York, “Introducing cascading style sheets,” in Beginning CSS: Cascading Style Sheets for Web Design, 3rd ed. Hoboken, NJ: John Wiley & Sons, 2011. Available: https://www.wiley.com/en-us/Beginning+CSS%3A+Cascading+Style+Sheets+for+Web+Design%2C+3rd+Edition-p-9780470891520, [Google Scholar]

19. PHP Mannual, “What is PHP?” 2020. [Online]. Available: http://php.net/manual/en/intro-whatis.php. [Google Scholar]

20. Tutorialspoint, “JavaScript - Overview,” 2020. [Online]. Available: https://www.tutorialspoint.com/javascript/javascript_overview.htm. [Google Scholar]

21. R. Margaret, “Definition MySQL,” 2018, July. [Online]. Available: https://searchoracle.techtarget.com/definition/MySQL. [Google Scholar]

22. Techopedia, “Definition - What Does jQuery Mean?,” 2017, January. [Online]. Available: https://www.techopedia.com/definition/3977/jquery. [Google Scholar]

23. Tutorialspoint, “What is AJAX?” 2020. [Online]. Available: https://www.tutorialspoint.com/ajax/what_is_ajax.htm. [Google Scholar]

24. M. Gaunt, “Service Workers: An Introduction,” 2020. [Online]. Available: https://developers.google.com/web/fundamentals/primers/service-workers. [Google Scholar]

25. D. Ho, “What is Notepad++,” 2020. Available: https://www.notepad-plus-plus.org. [Google Scholar]

26. V. M. Markowitz, “Safe referential integrity and null constraint structures in relational databases,” Information Systems, vol. 19, no. 4, pp. 359–378, 1994. [Google Scholar]

27. S. Nidhra and J. Dondeti, “Black box and white box testing techniques—a literature review,” International Journal of Embedded Systems and Applications, vol. 2, no. 2, pp. 29–50, 2012. [Google Scholar]

28. D. Easley, N. M. Kiefer and M. O’Hara, “One day in the life of a very common stock,” Review of Financial Studies, vol. 10, no. 3, pp. 805–835, 1997. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |