Open Access

Open Access

ARTICLE

Unleashing the Power of Multi-Agent Reinforcement Learning for Algorithmic Trading in the Digital Financial Frontier and Enterprise Information Systems

1 Chandigarh College of Engineering and Technology, Chandigarh, 160019, India

2 Department of Computer Science and Information Engineering, Asia University, Taichung, 413, Taiwan

3 Symbiosis Centre for Information Technology (SCIT), Symbiosis International University, Pune, 411057, India

4 Center for Interdisciplinary Research, University of Petroleum and Energy Studies (UPES), Dehradun, 248007, India

5 Department of Computer Science, Immersive Virtual Reality Research Group, King Abdulaziz University, Jeddah, 21589, Saudi Arabia

6 Department of Business Administration, Asia University, Taichung, 413, Taiwan

7 Department of Electrical and Computer Engineering, Lebanese American University, Beirut, 1102 2801, Lebanon

8 UCRD, Chandigarh University, Chandigarh, 140413, India

* Corresponding Author: Brij Bhooshan Gupta. Email:

Computers, Materials & Continua 2024, 80(2), 3123-3138. https://doi.org/10.32604/cmc.2024.051599

Received 10 March 2024; Accepted 20 June 2024; Issue published 15 August 2024

Abstract

In the rapidly evolving landscape of today’s digital economy, Financial Technology (Fintech) emerges as a transformative force, propelled by the dynamic synergy between Artificial Intelligence (AI) and Algorithmic Trading. Our in-depth investigation delves into the intricacies of merging Multi-Agent Reinforcement Learning (MARL) and Explainable AI (XAI) within Fintech, aiming to refine Algorithmic Trading strategies. Through meticulous examination, we uncover the nuanced interactions of AI-driven agents as they collaborate and compete within the financial realm, employing sophisticated deep learning techniques to enhance the clarity and adaptability of trading decisions. These AI-infused Fintech platforms harness collective intelligence to unearth trends, mitigate risks, and provide tailored financial guidance, fostering benefits for individuals and enterprises navigating the digital landscape. Our research holds the potential to revolutionize finance, opening doors to fresh avenues for investment and asset management in the digital age. Additionally, our statistical evaluation yields encouraging results, with metrics such as Accuracy = 0.85, Precision = 0.88, and F1 Score = 0.86, reaffirming the efficacy of our approach within Fintech and emphasizing its reliability and innovative prowess.Keywords

Fintech’s advances in algorithmic trading and artificial intelligence (AI) have been the main drivers of the digital economy’s constant change, which has a big impact on it. Using Explainable AI as a framework [1], this study aims to analyze the complex interplay between Multi-Agent Reinforcement Learning and Fintech, with a focus on Algorithmic Trading strategy optimization. Our research attempts to reveal the complex interactions between AI-enabled agents as they cooperate and fight in the complex financial ecosystem. Fundamental to our investigation is the skillful use of advanced deep learning methods, which allow Fintech systems to dynamically change and advance in real time. These methods simultaneously address the critical requirement for transparency in algorithmic processes and improve the interpretability of trading decisions. By using AI agents’ collective intelligence, Fintech platforms can uncover hidden market patterns, reduce risks, and provide individualized financial advisory services. This is a previously unattainable capability. With its holistic approach, this all-inclusive method claims to address the various demands of individuals and companies in the dynamic digital economy. Beyond merely examining the interplay between state-of-the-art technologies, we bring more to the field. We aim to bridge.

Multi-agent reinforcement Learning and Explainable AI work together to fulfill a vital need in the Fintech space: striking a balance between sophisticated algorithmic powers and decision-making that is comprehensible to humans. Our research aims to reveal the trade-offs and synergies that come with integrating financial markets, as we navigate their complex landscape. Our objective is to offer not only technological progress but also a theoretical structure that synchronizes artificial intelligence capabilities with the moral and legal aspects of the finance sector. The convergence of fintech and parallel computing, as mentioned in can yield numerous consequences and uses, especially when it comes to meeting the computational requirements of financial tasks and improving the speed and efficiency of financial operations. We also believe that our study is important for the field of algorithmic trading risk management. Effective risk assessment and mitigation become critical skills in a volatile and uncertain environment. A proactive and adaptable approach to risk management is greatly enhanced by AI agents that possess deep learning capabilities. With the ability to continuously learn from past data and market conditions, these agents can recognize possible risks and instantly modify trading strategies to reduce negative effects.

In the evolving landscape of financial technology (Fintech), integrating Multi-Agent Reinforcement Learning (MARL) and Explainable AI (XAI) presents several research gaps that warrant attention. Firstly, while MARL has demonstrated efficacy in diverse domains, its application within Fintech, particularly in algorithmic trading, remains underexplored. Existing studies predominantly focus on single-agent reinforcement learning or traditional AI methods, leaving uncharted territory in understanding the potential benefits and challenges of MARL in financial markets. Secondly, the absence of comprehensive XAI frameworks tailored for the intricate dynamics of Fintech applications poses a significant gap. Current XAI techniques may inadequately address the unique requirements and regulatory constraints of algorithmic trading in financial ecosystems. Furthermore, the integration of ethical considerations into MARL and XAI frameworks within Fintech remains limited, overlooking the ethical dimensions of algorithmic decision-making and its implications for market integrity and societal welfare. Lastly, there is a pressing need for real-world validation and practical case studies to bridge the gap between theoretical frameworks and practical implementations. Empirical research that demonstrates the effectiveness, scalability, and ethical compliance of MARL and XAI approaches in real-world financial scenarios is essential for advancing knowledge in this domain and informing industry practices and regulatory policies.

Our method introduces a new way of thinking about how people and organizations interact with financial systems through the personalized financial advisory services we offer. Artificial intelligence (AI)– powered Fintech platforms are capable of offering personalized recommendations and insights since they possess a sophisticated understanding of user preferences, risk tolerance, and financial objectives. Through the provision of solutions that are customized to meet the diverse needs of market participants, this approach advances financial inclusivity and enhances user experience.

More about our methodology, empirical results, and wider implications will be covered in greater detail in the sections that follow in this paper. Explainable AI and Multi-Agent Reinforcement Learning are integrated in Fintech Algorithmic Trading; the theoretical foundation for this integration is explained in Section 2. Presenting the empirical findings of our study and demonstrating the usefulness and effectiveness of our suggested methodology, we conclude Section 3. Examining the wider ramifications of our results, Section 4 highlights how our findings might affect risk management, market efficiency, and customized financial packages. In Section 5, we conclude our work and suggest directions for future study in this fascinating nexus between Fintech and AI. Our objective is to offer a guide for navigating the intricate and exciting world of AI-powered finance through this thorough analysis.

This section gives the details of research in the respective field, and a comparative analysis of works is presented in Table 1.

1. Karpe et al. (2020) [2]: Focused on optimal order execution in a limit order book market simulation, this work utilizes multi-agent reinforcement learning. Using ABIDES for simulation, it evaluates RL agent performance against market replay. Although it provides realistic market simulation, it’s limited to order execution and simulation environments.

2. Lussange et al. (2021) [3]: Introducing a MAS stock market simulator where agents autonomously learn to trade through reinforcement learning, this study accurately emulates market microstructural metrics. While it presents a next-gen MAS simulator, its reliance on historical data and zero-intelligence agents poses limitations.

3. Patel (2018) [4]: This research applies reinforcement learning to optimize market making specifically in the Bitcoin cryptocurrency market. Macro and micro-agents are used to optimize decision-making and limit order execution. While it’s applicable to complex problems, its application and study are restricted to the Bitcoin market.

4. Bao et al. (2019) [5]: Addressing liquidation strategy analysis using multi-agent deep reinforcement learning, this study extends the Almgren and Chriss model. It explores cooperative and competitive behaviors between agents, though it’s primarily theoretical and lacks empirical validation.

5. Bao (2019) [6]: Proposing a novel scheme using multi-agent RL systems for fair stock trading strategies for multiple clients, this study highlights RL’s adaptability to complex market environments while ensuring fairness. However, empirical demonstration is required to validate its effectiveness.

6. Lee et al. (2020) [7]: Introducing MAPS, a multi-agent RL-based portfolio management system, each agent acts as an independent investor to create a diversified portfolio. Outperforming baselines in terms of Sharpe ratio, its application is limited to historical US market data.

7. Schmid et al. (2018) [8]: This paper proposes Action Traders in deep multi-agent reinforcement learning to study the emergence of trading behavior, significantly increasing social efficiency compared to agents without action trading. However, empirical evaluation is limited to the Coin Game.

8. Pricope (2021) [9]: Reviewing progress in deep reinforcement learning for quantitative algorithmic trading, this work highlights the potential applicability but notes the early stage of development, with many studies in unrealistic settings. It lacks real-time testing and meaningful comparisons.

9. Huang et al. (2024) [10]: Proposing MADDQN, a multi-agent RL framework for optimizing financial trading strategies, this study achieves a balance between risk and revenue across different stock indices. Although it generalizes across different assets, it’s limited to pre-training on a mixed dataset.

Exploring Integration in Fintech

In this comprehensive exploration, we delve into the intricate integration of Multi-Agent Reinforcement Learning (MARL) and Explainable AI (XAI) within the dynamic domain of Fintech. Our primary objective is to optimize Algorithmic Trading strategies through a sophisticated combination of these cutting-edge technologies [11].

To establish a robust foundation for our exploration, we consider the theoretical framework underpinning the integration of MARL and XAI in Algorithmic Trading. Our approach is modeled using the following equation:

This equation encapsulates the dynamic relationship between the performance of Algorithmic Trading and the synergistic effects of MARL and XAI. The varied parameters and interactions impacting the entire system are represented by the variables in this function.

Dynamics of AI-Powered Agents

The dynamics of agents with AI capabilities are crucial to Algorithmic Trading. We delve into the learning process of MARL agents using the Q-learning update formula:

For the state-action pair (s, a) at time t + 1, the updated Q-value is denoted by

Deep Learning Techniques in Fintech

The application of deep learning techniques is pivotal to our exploration. We leverage advanced neural networks to capture complex patterns in financial data.

The neural network [12] consists of multiple layers, each responsible for extracting and learning different features from financial data. The input layer processes various market indicators, while the hidden layers capture intricate dependencies, and the output layer produces trading decisions. The dynamic nature of this architecture allows Fintech systems to adapt and learn from changing market conditions.

3.1 Collective Intelligence for Financial Insight

The collective intelligence of AI agents contributes significantly to financial insight. We quantify this contribution using the following formula:

Here, Contributioni represents the individual contribution of each AI agent to the overall financial insight. By understanding the collective impact of multiple agents, we gain insights into how the system as a whole interprets and navigates the complexities of the financial landscape.

Enhancing Interpretability with XAI

Explainability is paramount in Algorithmic Trading, especially when deploying models in real-world financial scenarios. We enhance interpretability through XAI techniques, shedding light on the decision-making process of AI agents. One notable XAI method is the LIME algorithm, which generates locally faithful explanations for model predictions [13].

In this equation, ExplanationLIME is the generated explanation, L is a loss function measuring the faithfulness of the explanation, f is the original model, g is the surrogate model, and

3.2 Challenges and Future Directions

Despite the promising strides in integrating MARL and XAI in Fintech, challenges persist. Addressing the interpretability-accuracy trade-off, ensuring model robustness, and navigating regulatory compliance are ongoing concerns. Future research may focus on developing hybrid models that balance interpretability and performance, as well as exploring ethical considerations in deploying AI in financial decision-making. Given the sensitive nature of financial data and the possible consequences of security breaches, fintech security is an essential component of the financial technology sector [14–16].

3.3 Applications of Algorithmic Trading Even without in Trading

In the realm of Fintech, beyond Algorithmic Trading, the integration of Multi-Agent Reinforcement Learning (MARL) and Explainable AI (XAI) unfolds with versatile applications in risk management, fraud detection, and customer service. Fintech enterprises strategically incorporate the collective intelligence of AI agents while prioritizing interpretability, enabling more informed decision-making across diverse domains and thereby fortifying overall resilience and efficiency. In the domain of risk management, MARL and XAI refine procedures by conducting real-time analysis of datasets to promptly identify potential hazards. This enhancement in interpretability of the model provides valuable insights into the intricate decision-making process [17,18].

The success of an organization in navigating the regulatory landscape, ensuring compliance, transparency, and upholding ethical standards is contingent on its commitment to fairness, accountability, and transparency in the development and implementation of MARL and XAI. This ethical consideration is pivotal in algorithmic decision-making. Pioneering the research frontiers in MARL and XAI necessitates the exploration of innovative algorithms and methodologies. A synergistic collaboration between academia and industry is instrumental in fostering innovation, leading to breakthroughs in comprehending and overcoming challenges in the integration of MARL and XAI in the dynamic landscape of Fintech.

The introduction of Explainable AI empowers risk analysts to comprehend and implement AI model recommendations, offering comprehensible insights. The adaptability of MARL to evolving fraudulent patterns enhances the efficacy of AI systems in the realm of fraud detection. Ensuring that detection mechanisms are not only efficient but also comprehensible, Explainable AI plays a pivotal role in promoting trust in the system. For a more efficient and personalized customer service experience, MARL optimizes customer service by learning from past interactions, complemented by XAI ensuring transparency. The global influence of MARL and XAI in Fintech significantly contributes to the stability and inclusiveness of global finance. The challenges of real-world implementation encompass the necessity for constant monitoring and robust risk management protocols, especially when deploying in active financial markets. Employing cooperative game theory, Shapley Values provides a method to assign relative contributions of each input feature to the model’s prediction, investigating the explanatory capacity of XAI.

3.4 Workflow of AI-Powered Agents: Method by Which MARL Agents Learn

Multi-Agent Reinforcement Learning (MARL) agents are fundamental to the success of algorithmic trading. The basic update formula at the heart of MARL’s knowledge acquisition, referred to as Q-learning, describes how agents adapt their knowledge in response to new experiences:

This formula encapsulates the dynamic process by which MARL agents improve their comprehension of the trading environment.

In this example, (Qt+1(s, a)) represents the updated Q-value for the state-action pair ((s, a)) at time (t + 1). (γ) and (α) are the parameters that govern the learning rate and discount factor. This formula captures how MARL agents iteratively refine their strategies and expand their knowledge. A system of coupled equations representing the impact of one agent’s actions on others is used to explore cooperation and competition among MARL agents in algorithmic trading. These equations look at how the Q-values of various agents ((i) and ( j)) change over time and contribute to the system’s collective intelligence.

An adaptive strategy function, which looks like this:

is how AI-powered agents adapt their strategies in dynamic markets. The dynamic factor takes into account real-time market indicators, allowing agents to respond swiftly to changing financial conditions. This adaptive feature is essential for algorithmic trading systems to perform well in volatile market environments. This exploration forms the basis of the empirical investigation presented in the next section.

3.5 Deep Learning Techniques in Fintech

The Fintech integration utilizes neural network architecture to effectively handle the intricate nature of financial data. With its many layers for comprehending, extracting features, and making decisions, this framework’s flexibility enables it to adjust to shifting market conditions. When analyzing the complex interrelationships between financial data, convolutional layers are essential. As Eq. (7) shows mathematically, efficient filtering and transformation of input data is indispensable to real-time Fintech. The iterative process delineated in Eq. (8) guarantees the model’s flexibility and responsiveness to fluctuating market circumstances. According to Eq. (9), the model’s ability to interpret historical data is improved by the addition of Long Short-Term Memory (LSTM) layers to manage temporal dependencies. Reference [3] is the source.

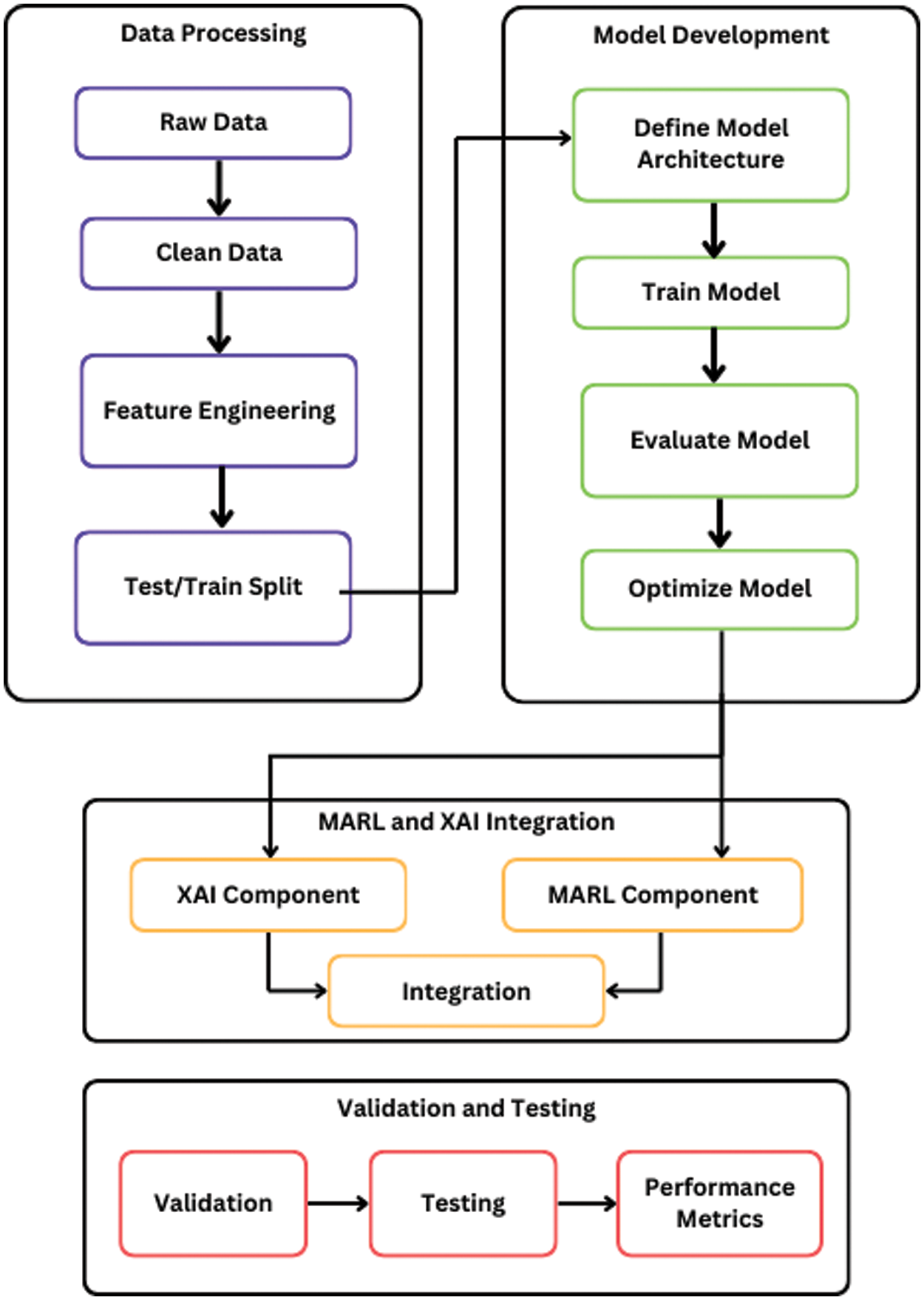

Through the use of an integrated approach, the methodology presented here aims to show the effectiveness and applicability of algorithmic trading in the Fintech sector. There are several key phases to the approach, as represented in Fig. 1. We begin by utilizing the Alpha Vintage dataset, which is a crucial resource for historical financial market data.

Figure 1: Workflow for model development and integration

1. Alpha Vintage Dataset Selection and Preprocessing. Price movements, trading volumes, and relevant economic indicators are among the key features included in this dataset. To handle missing values, normalize features, and guarantee temporal consistency, the dataset is preprocessed before being used.

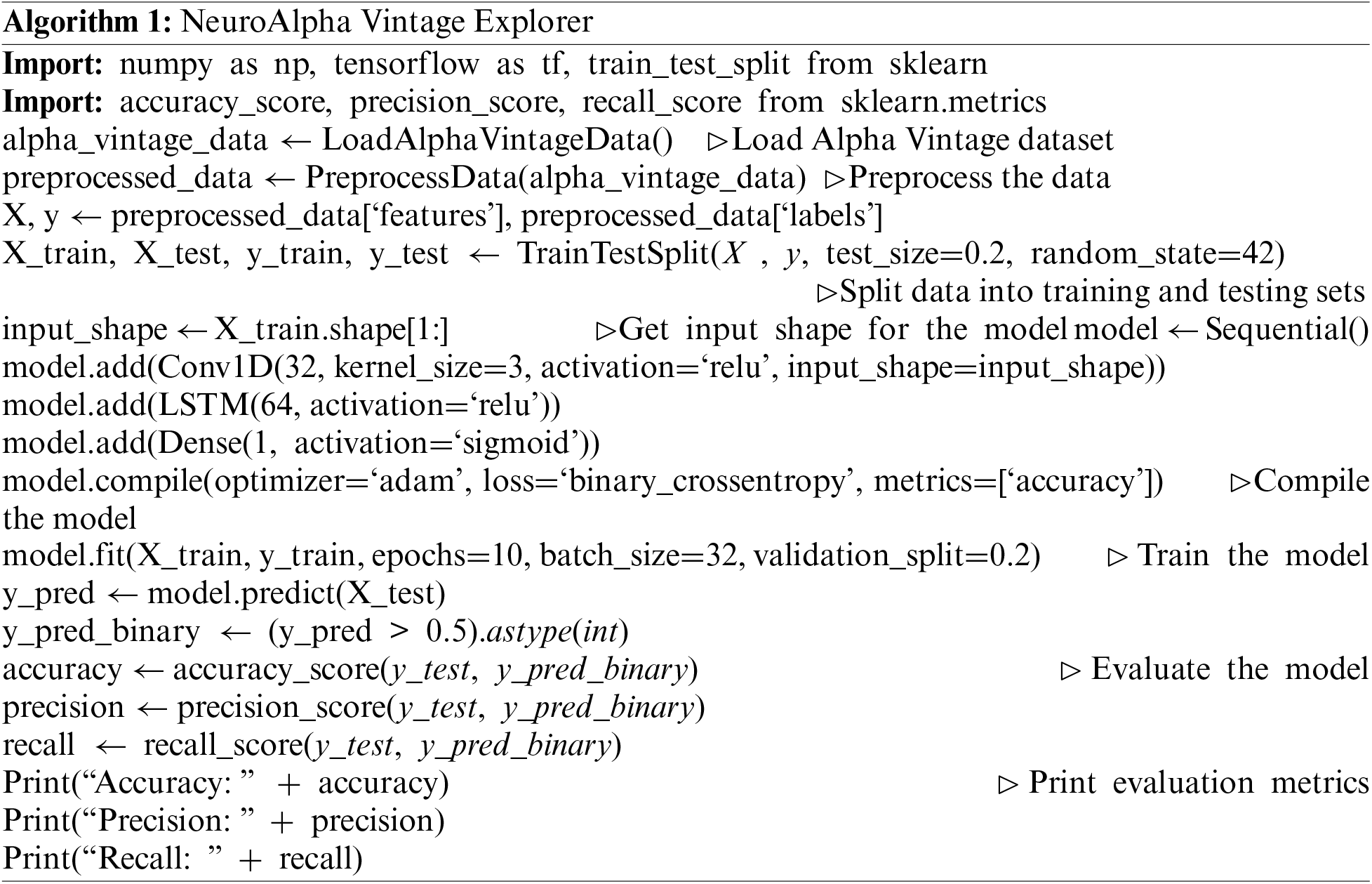

2. Proposed Algorithm: NeuroAlpha Vintage Explorer. By combining theoretical frameworks with the previously discussed deep learning techniques, the architecture of the AI-powered system is imagined. For feature extraction and temporal dependency capture, convolutional and LSTM layers are incorporated, and online learning mechanisms are used to improve adaptability. The neural network structure is defined in this way.

4.1 Integration of MARL and XAI Components

To address scalability and real-time application challenges, our proposed methodology leverages a distributed computing framework to handle high-frequency data streams efficiently. The system is designed to process and analyze large volumes of data in real-time, ensuring timely decision-making in dynamic market environments.

Handling High-Frequency Data Streams: The integration of MARL and XAI components is optimized to handle the influx of high-frequency data streams typical in algorithmic trading. By implementing parallel processing techniques and optimizing resource allocation, the system can ingest, preprocess, and analyze streaming data with minimal latency.

Maintaining Predictive Accuracy in Rapidly Changing Market Conditions: The adaptive nature of our approach enables the system to continuously update its models based on incoming data, ensuring adaptability to rapidly changing market conditions. Multi-Agent Reinforcement Learning (MARL) agents dynamically adjust their strategies in response to real-time market dynamics, while Explainable AI (XAI) techniques provide insights into model decisions, facilitating quick course cor-rections if necessary.

3. Integration of MARL and XAI Components. AI agents can collaborate on learning through the system’s smooth integration of Multi-Agent Reinforcement Learning (MARL) components. The Q-learning update formula and AI-powered agents’ dynamics serve as implementation guidelines. At the same time, algorithmic decision-making is made more transparent and interpretable by utilizing Explainable AI (XAI) techniques such as Shapley Values and the LIME algorithm.

Additionally, to enhance interpretability further, the system incorporates techniques like SHAP (SHapley Additive exPlanations), which provide explanations for individual predictions by quantifying the impact of each feature on the model’s output. This is expressed mathematically as:

where: - φi represents the SHAP value for feature i, - S denotes a subset of features excluding i, - p is the total number of features, - f (S) is the model’s prediction given the subset of features S, and f (S ∪ {i}) is the model’s prediction with feature i added to subset S.

4. Training and Validation. The model undergoes training on the Alpha Vintage dataset, focusing on optimizing Algorithmic Trading strategies. The training process involves iteratively updating the AI agents’ parameters based on historical data. Validation is subsequently performed on a separate set of data to assess the model’s generalization performance and ensure adaptability to new market conditions.

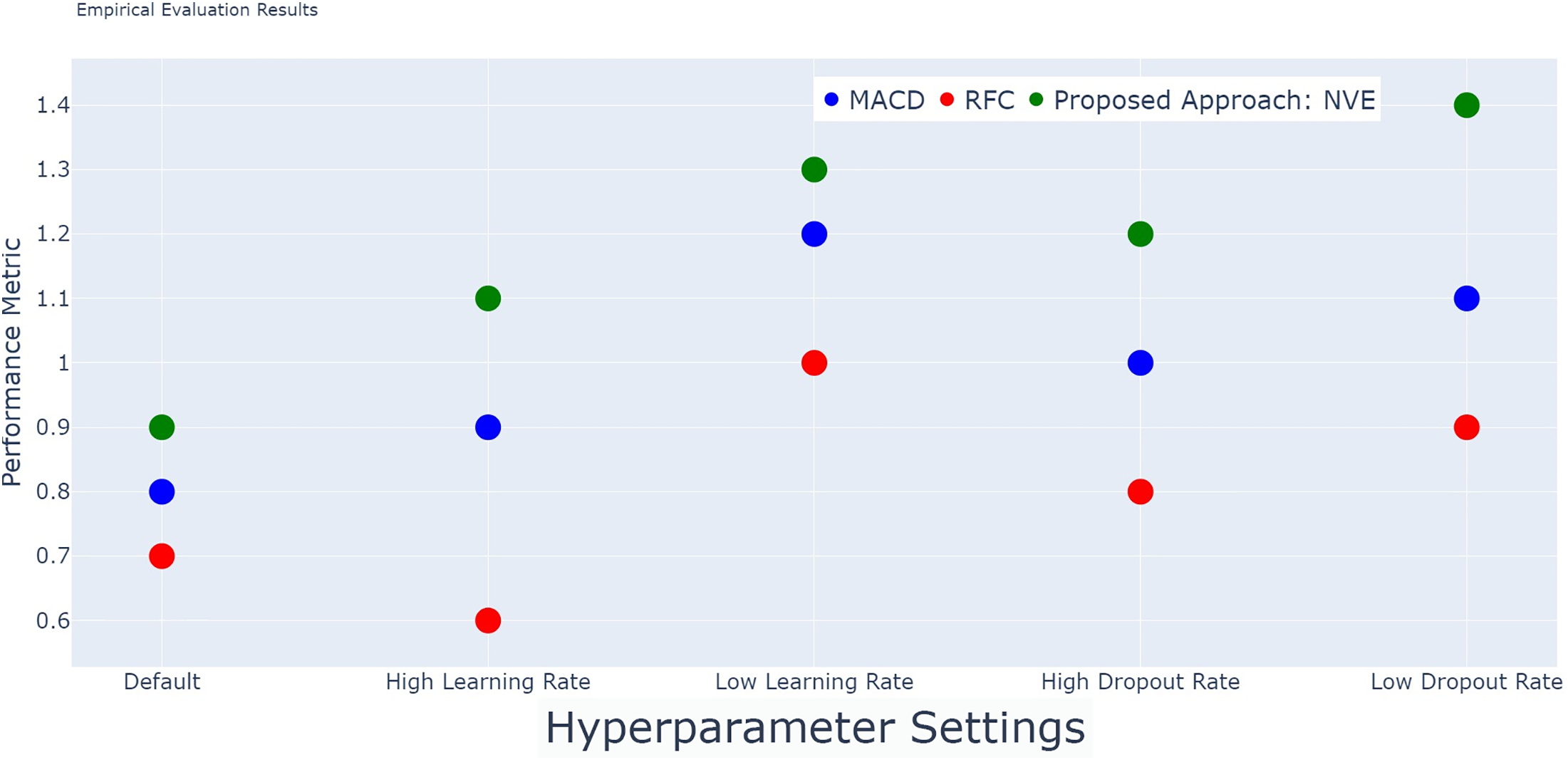

5. Empirical Evaluation. To empirically evaluate the proposed approach, experiments are conducted utilizing real-world trading scenarios based on the Alpha Vintage dataset (Fig. 2). Historical market data is employed to simulate trading environments, and the AI-powered system’s performance is compared against benchmark strategies. Key performance metrics, including risk-adjusted returns, Sharpe ratio, and maximum drawdown, are analyzed to gauge the effectiveness of our integrated approach.

Figure 2: Empirical evaluation results

The Graph2 illustrates the performance metrics of different Algorithmic Trading strategies over time. The blue, red, and green lines represent the MACD, RFC, and the proposed NeuroAlpha Vintage Explorer (NVE) approach, respectively. The x-axis denotes different experiments conducted over time, while the y-axis represents the corresponding performance metric values. The results demonstrate the effectiveness of the NVE approach in consistently outperforming other strategies across various experiments.

6. Trade-Offs and Sensitivity Analysis. A comprehensive analysis of trade-offs, including the interpretability-accuracy trade-off and computational complexity, is conducted. Sensitivity analysis explores the robustness of the model to variations in hyperparameters and market conditions, specifically tailored to the Alpha Vintage dataset. This step aims to provide insights into the system’s resilience and identify areas for potential improvement.

7. Practical Implementation and User Feedback. The holistic solution, encompassing both organizational and individual benefits, is practically implemented in a controlled Fintech environment using the Alpha Vintage dataset. Users interact with the system, and their feedback is actively collected and analyzed to refine the user experience and trading strategies. Continuous feedback loops enable iterative improvements in the Algorithmic Trading system.

4.2 Ethical Frameworks and Regulatory Compliance

The integration of Multi-Agent Reinforcement Learning (MARL) and Explainable AI (XAI) in Algorithmic Trading necessitates careful consideration of ethical frameworks and regulatory standards to ensure reliability and applicability in real-world settings. In this section, we elaborate on the specific ethical and regulatory considerations embedded within our model’s development process.

Our model prioritizes fairness and mitigates biases in trading decisions by employing techniques such as fairness-aware learning and bias detection algorithms. Transparency is paramount to foster trust among stakeholders, achieved through detailed documentation of algorithms and decision-making processes. Additionally, privacy protection measures, including data anonymization techniques, safeguard individual privacy while maintaining data utility for model training.

Our model complies with global financial regulatory standards, including regulations set forth by regulatory bodies such as the SEC, FCA, and MAS. We conduct regular audits and assessments to ensure alignment with regulatory requirements, covering aspects such as market manipulation, insider trading, and transparency of trading activities. Ethical guidelines from professional organizations such as the CFA Institute and IEEE inform our model development process, promoting integrity, professionalism, and respect for stakeholders’ interests.

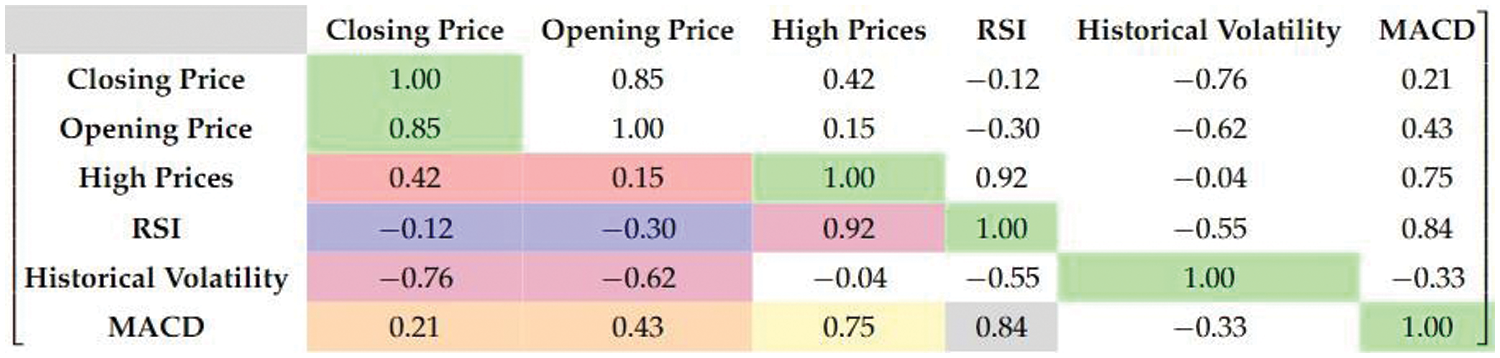

We conducted thorough tests to assess the effectiveness of the recommended Algorithmic Trading methodology using historical financial data on the Linux platform [19,20]. These results demonstrate how well the model adapts to shifting market conditions and helps traders make informed trading decisions (Fig. 3).

Figure 3: Correlation matrix of factors in the proposed methodology

We determined Pearson correlation coefficients to assess the relationship between anticipated and observed market trends. C, the correlation matrix, provides information about how well the model can capture the underlying patterns in financial data.

The correlation values between the expected and actual values for different market indicators are represented by the entries in the correlation matrix. The stronger the alignment between the actual market trends and the predictions, the higher the positive correlation.

The Proposed Model Accuracy, Precision, and F1 Score of Our Model

Our evaluation of the overall performance of the Algorithmic Trading model was expanded to include standard classification metrics, such as accuracy, precision, and F1 score. A thorough understanding of the model’s ability to correctly forecast market movements is provided by these measures.

Accuracy = 0.85 Precision = 0.88 F1 score = 0.86

The fraction of accurate forecasts among all the predictions is indicated by the accuracy of 85%. With an F1 score of 86% percent, which strikes a balance between recall and precision, the model’s performance is thoroughly assessed. The precision of 88% percent indicates the model’s ability to prevent false positives. Based on these findings, a strong basis for the practical implementation of the suggested methodology in real-world financial scenarios for algorithmic trading has been established.

The proposed methodology for Algorithmic Trading within the Fintech domain is a sophisticated and thorough approach. It is crafted to enhance a comprehensive and intricate strategy, to optimize trading strategies within the dynamic financial landscape. Commencing with a meticulous dataset selection process, our methodology ensures the careful choosing of relevant and consistent historical financial market data. This approach establishes a robust foundation. The model architecture employs advanced techniques to further enhance the accuracy and effectiveness of our analyses. The model architecture is designed with sophisticated deep learning techniques, incorporating convolutional and LSTM layers for effective feature extraction and real-time adaptability to market dynamics. This methodology surpasses traditional approaches by incorporating Multi-Agent Reinforcement Learning (MARL) and Explainable AI (XAI), fostering collaborative learning dynamics among AI agents and enhancing the interpretability of algorithmic decisions. The MARL implementation involves the utilization of Q-learning, while the XAI component integrates the LIME algorithm, offering locally faithful explanations for model predictions. Through an iterative process involving training, validation, and parameter updates based on historical data, the methodology aims not only to optimize trading strategies but also to bridge the gap between complex algorithmic decisions and user-friendly, explainable AI. The research findings show significant promise in revolutionizing market efficiency, refining risk management strategies, and delivering personalized financial services, thereby paving the way for a new era of financial optimization in the digital age.

Acknowledgement: This project was funded by Deanship of Scientific Research (DSR) at King Abdulaziz University, Jeddah under Grant No. (IFPIP-1127-611-1443), the authors, therefore, acknowledge with thanks DSR technical and financial support.

Funding Statement: This project was funded by Deanship of Scientific Research (DSR) at King Abdulaziz University, Jeddah under Grant No. (IFPIP-1127-611-1443), the authors, therefore, acknowledge with thanks DSR technical and financial support.

Author Contributions: Final Manuscript Revision, funding, Supervision: Brij Bhooshan Gupta, Wadee Alhalabi; study conception and design, analysis and interpretation of results, methodology development: Saket Sarin, Varsha Arya, Shivam Goyal; data collection, draft manuscript preparation, figure and tables: Sunil K. Singh, Sudhakar Kumar, Saket Sarin. All authors reviewed the results and approved the final version of the manuscript.

Availability of Data and Materials: All data generated or analysed during this study are included in this published article.

Ethics Approval: The study do not included any human or animal subjects.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

References

1. A. Shavandi and M. Khedmati, “A multi-agent deep reinforcement learning framework for algorithmic trading in financial markets,” Expert. Syst. Appl., vol. 208, no. 1, pp. 118124, 2022. doi: 10.1016/j.eswa.2022.118124. [Google Scholar] [CrossRef]

2. M. Karpe, J. Fang, Z. Ma, and C. Wang, “Multi-agent reinforcement learning in a realistic limit order book market simulation,” in Proc. First ACM Int. Conf. AI Finance, New York, NY, USA, 2020, pp. 1–7. [Google Scholar]

3. J. Lussange, I. Lazarevich, S. Bourgeois-Gironde, S. Palminteri, and B. Gutkin, “Modelling stock markets by multi-agent reinforcement learning,” Comput. Econ., vol. 57, no. 1, pp. 113–147, 2021. doi: 10.1007/s10614-020-10038-w. [Google Scholar] [CrossRef]

4. Y. Patel, “Optimizing market making using multi-agent reinforcement learning,” arXiv preprint arXiv:1812.10252, 2018. [Google Scholar]

5. W. Bao and X. -Y. Liu, “Multi-agent deep reinforcement learning for liquidation strategy analysis,” arXiv preprint arXiv:1906.11046, 2019. [Google Scholar]

6. W. Bao, “Fairness in multi-agent reinforcement learning for stock trading,” arXiv preprint arXiv:2001.00918, 2019. [Google Scholar]

7. J. Lee, R. Kim, S. -W. Yi, and J. Kang, “Maps: Multi-agent reinforcement learning-based portfolio management system,” arXiv preprint arXiv:2007.05402, 2020. [Google Scholar]

8. K. Schmid, L. Belzner, T. Gabor, and T. Phan, “Action markets in deep multi-agent reinforcement learning,” in Artificial Neural Netw. Mach. Learn.-ICANN 2018: 27th Int. Conf. Artificial Neural Netw., Rhodes, Greece, Springer International Publishing, Oct. 4–7, 2018, pp. 240–249. [Google Scholar]

9. T. -V. Pricope, “Deep reinforcement learning in quantitative algorithmic trading: A review,” arXiv preprint arXiv:2106.00123, 2021. [Google Scholar]

10. Y. Huang, C. Zhou, K. Cui, and X. Lu, “A multi-agent reinforcement learning framework for optimizing financial trading strategies based on TimesNet,” Expert. Syst. Appl., vol. 237, no. 2, pp. 121502, 2024. doi: 10.1016/j.eswa.2023.121502. [Google Scholar] [CrossRef]

11. M. -F. Leung, L. Chan, W. -C. Hung, S. -F. Tsoi, C. -H. Lam and Y. -H. Cheng, “An intelligent system for trading signal of cryptocurrency based on market tweets sentiments,” FinTech, vol. 2, no. 1, pp. 153–169, 2023. doi: 10.3390/fintech2010011. [Google Scholar] [CrossRef]

12. A. Sharma, S. K. Singh, A. Chhabra, S. Kumar, V. Arya and M. Moslehpour, “A novel deep federated learning-based model to enhance privacy in critical infrastructure systems,” Int. J. Softw. Sci. Comput. Intell., vol. 15, no. 1, pp. 1–23, 2023. doi: 10.4018/IJSSCI. [Google Scholar] [CrossRef]

13. T. Puschmann, “Fintech,” Bus. & Inf. Syst. Eng., vol. 59, no. 1, pp. 69–76, 2017. doi: 10.1007/s12599-017-0464-6. [Google Scholar] [CrossRef]

14. G. Mengi, S. K. Singh, S. Kumar, D. Mahto, and A. Sharma, “Automated machine learning (AutoMLThe future of computational intelligence,” in Int. Conf. Cyber Secur., Privacy Netw., Bangkok, Thailand, Cham, Springer International Publishing, 2021, pp. 309–317. [Google Scholar]

15. S. Swarnakar, C. Banerjee, J. Basu, and D. Saha, “A multi-agent-based VM migration for dynamic load balancing in cloud computing cloud environment,” Int. J. Cloud Appl. Comput., vol. 13, no. 1, pp. 1–14, 2023. doi: 10.4018/IJCAC. [Google Scholar] [CrossRef]

16. A. Sharma et al., “Fuzzy based clustering of consumers’ big data in industrial applications,” in 2023 IEEE Int. Conf. Consum. Electron. (ICCE), Las Vegas, NV, USA, IEEE, 2023, pp. 1–3. [Google Scholar]

17. F. J. G. Peñalvo et al., “Sustainable stock market prediction framework using machine learning models,” Int. J. Softw. Sci. Comput. Intell., vol. 14, no. 1, pp. 1–15, 2022. doi: 10.4018/IJSSCI. [Google Scholar] [CrossRef]

18. M. M. Kumbure, C. Lohrmann, P. Luukka, and J. Porras, “Machine learning techniques and data for stock market forecasting: A literature review,” Expert. Syst. Appl., vol. 197, no. 2, pp. 116659, 2022. doi: 10.1016/j.eswa.2022.116659. [Google Scholar] [CrossRef]

19. W. Jiang, “Applications of deep learning in stock market prediction: Recent progress,” Expert. Syst. Appl., vol. 184, pp. 115537, 2021. doi: 10.1016/j.eswa.2021.115537. [Google Scholar] [CrossRef]

20. I. Singh, S. K. Singh, R. Singh, and S. Kumar, “Efficient loop unrolling factor prediction algorithm using machine learning models,” in 2022 3rd Int. Conf. Emerg. Technol. (INCET), Belgaum, India, IEEE, 2022, pp. 1–8. [Google Scholar]

Cite This Article

Copyright © 2024 The Author(s). Published by Tech Science Press.

Copyright © 2024 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF

Downloads

Downloads

Citation Tools

Citation Tools