DOI:10.32604/cmc.2021.015316

| Computers, Materials & Continua DOI:10.32604/cmc.2021.015316 |  |

| Article |

Efficient MCDM Model for Evaluating the Performance of Commercial Banks: A Case Study

1Faculty of Computers and Informatics, Zagazig University, Zagazig, 44519, Egypt

2Department of Computational Mathematics, Science, and Engineering (CMSE), Michigan State University, East Lansing, MI, 48824, USA

3Department of Mathematics, Faculty of Science, Mansoura University, Mansoura, 35516, Egypt

4Department of Computer Science and Engineering, Soonchunhyang University, Asan, 31538, Korea

*Corresponding Author: Yunyoung Nam. Email: ynam@sch.ac.kr

Received: 07 November 2020; Accepted: 10 December 2020

Abstract: Evaluation of commercial banks (CBs) performance has been a significant issue in the financial world and deemed as a multi-criteria decision making (MCDM) model. Numerous research assesses CB performance according to different metrics and standers. As a result of uncertainty in decision-making problems and large economic variations in Egypt, this research proposes a plithogenic based model to evaluate Egyptian commercial banks’ performance based on a set of criteria. The proposed model evaluates the top ten Egyptian commercial banks based on three main metrics including financial, customer satisfaction, and qualitative evaluation, and 19 sub-criteria. The proportional importance of the selected criteria is evaluated by the Analytic Hierarchy Process (AHP). Furthermore, the Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS), Vlse Kriterijumska Optimizacija Kompro-misno Resenje (VIKOR), and COmplex PRoportional ASsessment (COPRAS) are adopted to rank the top ten Egyptian banks based on their performance, comparatively. The main role of this research is to apply the proposed integrated MCDM framework under the plithogenic environment to measure the performance of the CBs under uncertainty. All results show that CIB has the best performance while Faisal Islamic Bank and Bank Audi have the least performance among the top 10 CBs in Egypt.

Keywords: Commercial banks; uncertainty; MCDM; AHP; TOPSIS; VIKOR; COPRAS; hybrid systems

Commercial banks are one of the financial establishments that act in a particular part of the country’s financial system and economy [1]. It provides various financial services that help to make the overall financial system more efficient. Usually, the main processes of financial banks are making loans, taking deposits, and responding to interest rate variety to generate an efficient channel between saver and borrowers. That’s why the evaluation process of commercial banks is very critical that should be applied by modern and accurate techniques to rank them to improve their performance [2].

Certainly, to ensure an efficient economy and appropriate financial system, commercial banks’ performance must be measured and analyzed accurately using modern evaluation techniques. Evaluation of commercial banks process based on a set of economic metrics that measure if the bank has an advantage in some respects and disadvantages in others. It is notable that commercial banks’ evaluation is not confined just by a regulator and bank management bodies anymore, but also enhanced by clients to ensure the sustainability of the financial institutions. Thus, the evaluation process results may increase the capability to improve commercial banks’ performance [1,2].

Plithogenic is a generalization of a neutrosophic set that reinforces the proposed model by considering uncertainty and vague information. To perform the best evaluation of the top ten Egyptian commercial banks, Analytic Hierarchy Process (AHP) was adopted to weight three main financial metrics as well as 19 sub-criteria that have a direct influence on bank performance to both bank management bodies and client.

This research aims to rank the top ten commercial banks in Egypt. At this point, three MCDM techniques are adopted comparatively. Firstly, Vlse Kriterijumska Optimizacija Kompromisno Resenje (VIKOR) method efficiently solves detached resolution problems with inconsistent criteria. Secondly, the Technique for Order of Preference by Similarity to Ideal Solution (TOPSIS) method ranks alternatives based on the range of alternatives to the best and the worst solution. Thirdly, COmplex PRoportional ASsessment (COPRAS) method supposes proportional dependence of importance of alternatives according to a set of criteria. VIKOR, TOPSIS, and COPRAS are used to measure the banks by considering their performance from different perspectives. The contribution of this integrated framework is to rank the CBs using a more consistent and accurate framework that deals with uncertainty based on the plithogenic set.

The organization of this research is given as follows: an overview of previous researches that studied banks’ performance evaluation and MCDM techniques is presented in Section 2. Section 3 includes information and definitions about the techniques and principles used in this work. A performance evaluation framework based on plithogenic MCDM is explained in Section 4. Section 5 shows the evaluation process of the top ten Egyptian banks. Finally, Section 6 concludes this study.

2.1 Commercial Banks Performance Assessment

Performance evaluation is known as a process that monitors institution operations and measures whether it is attaining its goals. Banks’ performance evaluation is considered as a large research area in banking based on evaluation metrics. To utilize the evaluation process, it is significant to set group criteria that directly reflect banks’ performance [3]. These criteria may be measurable or unmeasurable. For instance, net profit is viewed as measurable criteria, whereas the degree of employee stability is unmeasurable criteria. The difficulty usually concentrated on selecting the proper criteria while measuring the institution’s performance. In the field of banking performance measurement, many metrics may conclude through the evaluation process such as profitability, productivity and effectiveness, human resource aspects, risk assessment, service evaluation, and financial management [4]. In this research, a group of financial, qualitative, and customer satisfaction measures are considered.

2.2 Multiple-Criteria Decision-Making (MCDM)

Bank performance evaluation has several efficient MCDM techniques that may be used to distinguish the financial institution according to their efficiency. In order to estimate the efficiency of banks, Wanke et al. [5] adopted fuzzy Data Envelopment Analysis (DEA). Foreign and Turkish banks’ performance was compared using TOPSIS and DEA by Bayyurt [6]. In addition, internet banking evaluation is obtained using VIKOR method to consider the psychological behavior of customers [7]. Moreover, Aghdaie et al. [8] proposed a hybrid approach for market segmentation and market segment evaluation and selection. The proposed model can be considered an integration model of Data mining and MADM. Aras et al. [9] proposed a sustainability performance evaluation model for Turkish banks based on TOPSIS. Recently, Roozbahani et al. [10] proposed an Inter-basin water transfer planning with grey COPRAS and fuzzy COPRAStechniques. Moreover, using an integrated two-stage fuzzy approach proposed by Wanke et al. [11], the efficiency of the banking industry in BRICS (Brazil, Russia, India, China, and South Africa) was analyzed in a reliable manner. The main deficiency of these studies is not considering the uncertainty of the evaluation process.

2.3 Performance Evaluation Criteria

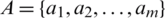

Based on the literature review, three main criteria related to commercial banks performance evaluation and 19 sub-criteria were summarized as follows:

A) Qualitative evaluation: measures human activities in a formal systematic way. Regarding bank performance evaluation, qualitative evaluation includes support from shareholders, ownership structure, market share, bank management, and employee constancy [12].

B) Financial metrics: financial performance metrics designate whether the institution’s operations are participating in bottom-line development. A selected group of financial metrics defined as, Operating Expense Ratio (OER), Loan-to-Deposit Ratio (LDR), Liquidity ratio, Cash and Cash Equivalents (CCE), Cash Flow from operating activity (CFO), Loan loss provisioning, Revenue per employee, Return on Total Assets (ROTA), Debt-to-Equity ratio (D/E), Deposits Time Capital, Capital adequacy ratio (CAR), and Non-performing Loan (NPL).

C) Customer satisfaction: nowadays, every institution has a challenge that focuses on customer preferences. This challenge is related to customer measurement of the institution’s performance. These preferences may include service level, quality of product/service, time, and cost. In bank performance evaluation, the customer perspective usually concludes customer’s accessibility level, customer interesting rate, customer retention rate, number of product and services, and internet banking evaluation [3].

In practice, data are usually uncertain and incomplete. To handle this issue, the neutrosophic theory was introduced as a generalization of the intuitionistic fuzzy set [11]. The neutrosophic was introduced by Smarandache [13]. The plithogeny was announced by Smarandache [14] as a generalization of neutrosophy that indicates genesis, establishment, improvement, and advancement of new objects from syntheses of conflicting or non-conflicting multiple old objects. The main advantage of the plithogenic set, is a high consideration of uncertainty and vague information [15]. The main two plithogenic set structures are contradiction degree and an appurtenance degree. The function that distinguishes each attribute value (v) and the most preferred (dominant (D)) is the contradiction degree function c(v, D). c(v1, v2) is c:  , and satisfying the following axioms:

, and satisfying the following axioms:

•  , no contradiction between the attribute values and itself.

, no contradiction between the attribute values and itself.

•  , contradiction degree between v1 and v2 is the same as between v2 and v1.

, contradiction degree between v1 and v2 is the same as between v2 and v1.

Definition 1. Let  and

and  be two plithogenic sets, their operations are:

be two plithogenic sets, their operations are:

• Plithogenic intersection:

where,  ,

,  .

.

TOPSIS method is a simple and useful MCDM method. The primary objective is to determine the exceptional alternative that has the shortest distance to the ideal positive solution (PIS) and the longest distance to the ideal negative solution (NIS). Its stages as follows:

✓ Build an evaluation matrix that measures the relationship between alternatives and corresponding criteria.

✓ Normalize the decision matrix using Eq. (2), and calculate weighted normalized decision matrix using Eq. (3):

where xij is the valuation of alternative i according to criterion j.

where wj is the weight of each criterion.

✓ Identify (PIS A+) and (NIS A−):

where Jb is a set of beneficial criteria, and Jnb is a set of non-beneficial criteria

✓ Compute the distances of each alternatives form v+ and v−, respectively as shown in Eqs. (8) and (9).

✓ Calculate the closeness coefficient (CC) of each alternative according to Eq. (10):

✓ Based on the results of CCi, rank the alternatives where the highest value is the superior alternative.

3.3 VIekriterijumsko KOmpromisno Rangiranje (VIKOR)

VIKOR is one of the MCDM useful and applicable methods to solve problems with inconsistent criteria proposed by Opricovic [16]. Its phases are labeled as follows:

Step 1: Build the evaluation matrix of m alternatives and n criteria and then normalize it according to Eq. (11):

Step 2: Determine the positive ideal solution  and negative ideal solution

and negative ideal solution  . If fj is beneficial criteria, then

. If fj is beneficial criteria, then  and

and  . Otherwise, if fj is non-beneficial criteria, then

. Otherwise, if fj is non-beneficial criteria, then  and

and  .

.

Step 3: Obtain the group utility Si and individual regret values Ri according to Eqs. (12) and (13):

where wj is the weight of criteria.

Step 4: Calculate the concordance index Qi according to Eq. (14) and rank the alternatives in descending order:

where, S− = maxiSi, S* = miniSi, R− = maxiRi, R* = miniRi, and  is the weight of the strategy of maximum group utility. It’s value is usually 0.5.

is the weight of the strategy of maximum group utility. It’s value is usually 0.5.

Step 5: With regard to this rank, there are two requirements which should be met:

—Requirement 1 (acceptable advantage):

where, in the Q ranking, A1 is the first alternative and A2 is the second, and the number of alternatives is m.

—Requirement 2 (acceptable stability): As the ranking of Q, in the ranking of S and R, A1must be superior. A selection of compromised alternatives is suggested in the case of one requirement not being satisfied:

1. If requirement 2 not convinced then, A1 and A2 are a compromise solution

2. If requirement 1 not convinced then,  , where Am is determined by Eq. (16).

, where Am is determined by Eq. (16).

3.4 Complex PRoportional Assessment (COPRAS)

This method is introduced by Zavadeskas et al. [17] in order to compare alternatives and define their priorities by considering the criteria weights. Its steps are described as follows:

Step 1: Arrange the evaluation of decision-makers of each alternative in the form of a decision matrix. Then, normalize the decision matrix and calculate the weighted normalized matrix according to Eqs. (17) and (18):

Step 2: Distinguish the criteria into beneficial and non-beneficial, and sum the weighted normalized values as Eqs. (19) and (20):

where, y+ij and y−ij are the weighted normalized values for the beneficial and non-beneficial criteria, respectively.

Step 3: Compute the importance (weight) of each alternative using Eq. (21):

where, S−min is the minimum value of S−i. Note that the higher value of Qi, the higher priority of alternative i.

Step 4: Calculate the quantitative utility for each alternative based on Qi using Eq. (22):

where,

Step 5: Rank the alternatives based on their utility. The higher value of Ui is the alternative with higher priority.

The purpose of this study is to assess the performance of commercial banks with a high consideration of uncertainty. To find the best approach to evaluate CBs performance, a plithogenic based MCDM model is proposed. A group of useful MCDM methods is used in this model to evaluate the performance efficiently. The main phases and steps of this model are discussed and illustrated in Fig. 1.

Stage 1: Obtain evaluation information by integrating a group of evaluators who have knowledge in banks management  . Define a decision-making problem aspect. These aspects consist of a set of criteria which measure the commercial banks’ performance

. Define a decision-making problem aspect. These aspects consist of a set of criteria which measure the commercial banks’ performance  , and the alternatives (commercial banks) that need to be evaluated

, and the alternatives (commercial banks) that need to be evaluated  .

.

Stage 2: Construct the evaluation of alternatives.

Step 1: Construct evaluation matrices to assess alternatives according to the corresponding criteria by decision-makers based on Tab. 1 that shows the triangular neutrosophic scale.

Step 2: Aggregate evaluation matrices provided by k decision-makers using plithogenic operator as shown in Eq. (1). In this step, the contradiction degree of each criterion should be considered in order to provide more accurate aggregation results.

Stage 3: Find the weights of criteria using the neutrosophic AHP method.

Step 1: Construct a problem hierarchy by defining the evaluation of commercial banks’ performance, main criteria, and the alternatives.

Step 2: Apply pairwise comparison.

Step 3: Aggregate pairwise comparison matrices as mentioned in Eq. (1).

Step 4: Calculate the consistency ratio (CR) using Eq. (23).

Figure 1: Performance evaluation of the proposed model

Table 1: Neutrosophic evaluation scale

If CR is a maximum 0.1, then the level of consistency is adequate. Otherwise, the comparison is inconsistent and the decision-maker is recommended to modify the comparison components to recognize superior consistency [11].

where,  ,

,  is the mean of the weighted sum vector divided by the corresponding criteria, and n is the number of criteria. RI is a random index assigned with the number of suggested criteria being considered as shown in Tab. 2.

is the mean of the weighted sum vector divided by the corresponding criteria, and n is the number of criteria. RI is a random index assigned with the number of suggested criteria being considered as shown in Tab. 2.

Step 5: Find the weight of the overall hierarchy.

Stage 4: Using TOPSIS, VIKOR, and COPRAS, rank the alternatives (commercial banks) according to their performance. Evaluation of CBs performance using these three MCDM methods include all diminutions of the problem and provides the decision-maker a wide range of possibility to take the decision efficiently. To make the computations easier, a de-neutrosophication is made for the aggregated evaluation matrix using Eq. (24).

Stage 4A: Evaluation using the TOPSIS method:

i) Calculate the weighted normalized matrix using Eqs. (2) and (3). Criteria weights are calculated using AHP in Stage 3, and the aggregated evaluation matrix in Stage 2.

ii) Identify the PIS and NIS using Eqs. (4)–(7).

iii) Find the distance to the PIS and NIS using Eqs. (8) and (9).

iv) Calculate the closeness coefficient using Eq. (10) in order to rank the commercial banks.

Stage 4B: Evaluation using the VIKOR method:

i) Normalize aggregated evaluation matrix in Stage 2 using Eq. (11).

ii) Determine PIS and NIS based on the nature of the criteria if it is beneficial or non-beneficial.

iii) Calculate group utility Si and individual regret values Ri using Eqs. (12) and (13).

iv) In order to rank commercial banks, calculate the concordance index Qi using Eq. (14).

v) Examine the VIKOR’s two conditions to find compromise solutions using Eqs. (15) and (16).

Stage 4C: Evaluation using the COPRAS method:

i) Calculate the weighted normalized evaluation matrix found in Stage 2 using Eqs. (17) and (18). The weight is calculated using AHP in Stage 3.

ii) Sum the weighted normalized values using Eqs. (19) and (20):

iii) Compute the significance of each alternative using Eq. (21):

iv) Calculate the quantitative utility for each alternative based on Qi using Eq. (22).

v) Rank the alternatives based on their utility.

5 Egyptian Commercial Banks Evaluation

5.1 Egyptian Top 10 Commercial Bank Evaluation

In the last five years, Egypt experienced major economic divergence at both local and global levels which brings challenges for the economy and banking systems. According to the Central Bank of Egypt (CBE), the Egyptian banking system includes 40 banks assorted as commercial, non-commercial, public, and private [12]. CBE supervises all Egyptian banks.

Improving bank performance produces high profitability, increases banking system capacity, and expands customer confidence. In this research, the performance of the Egyptian top 10 commercial banks in Egypt is evaluated. Evaluation of these 10 banks is applied according to three main evaluation metrics that consider qualitative, financial, and customer satisfaction aspects. The details of these criteria are already discussed in Section 2.3 in this research. This evaluation is assisted by a group of three experts, having great knowledge in finance and banking issues. The top commercial banks in Egypt are Alex bank, HSBC, QNB, CIB, Bank Audi, Banque de Cairo, Arab International Bank, Faisal Islamic Bank, Credit Agricole Bank, and Banque Misr. The proposed Plithogenic based MCDM model is applied to evaluate these 10 banks as follows.

Stage 1: Evaluation of commercial banks in Egypt is based on three main criteria, 19 sub-criteria, and 10 alternatives that are clearly illustrated in Fig. 2.

Stage 2: Three decision-makers evaluate the 10 CBs according to the defined criteria as shown in Tab. 3. These decision-makers have long experience in the banking field. Where they can judge objectively the performance of banks in Egypt. Where their opinions on these banks’ performance were gathered based on the criteria determined previously through a questionnaire. Measure the performance of the listed commercial banks according to the defined metrics. The measurement scale is Nothing (VWI), Very Weak (VW), Weak (W), Equally (E), Strong (S), Very strongly (VS), absolute (A). For example, what is the level of customer accessibility at Bank Audi? What is the level of consideration to the revenue per employee in CIB? And so on. Using plithogenic aggregation operator, aggregated matrix as shown in Tabs. 4 and 5 is calculated.

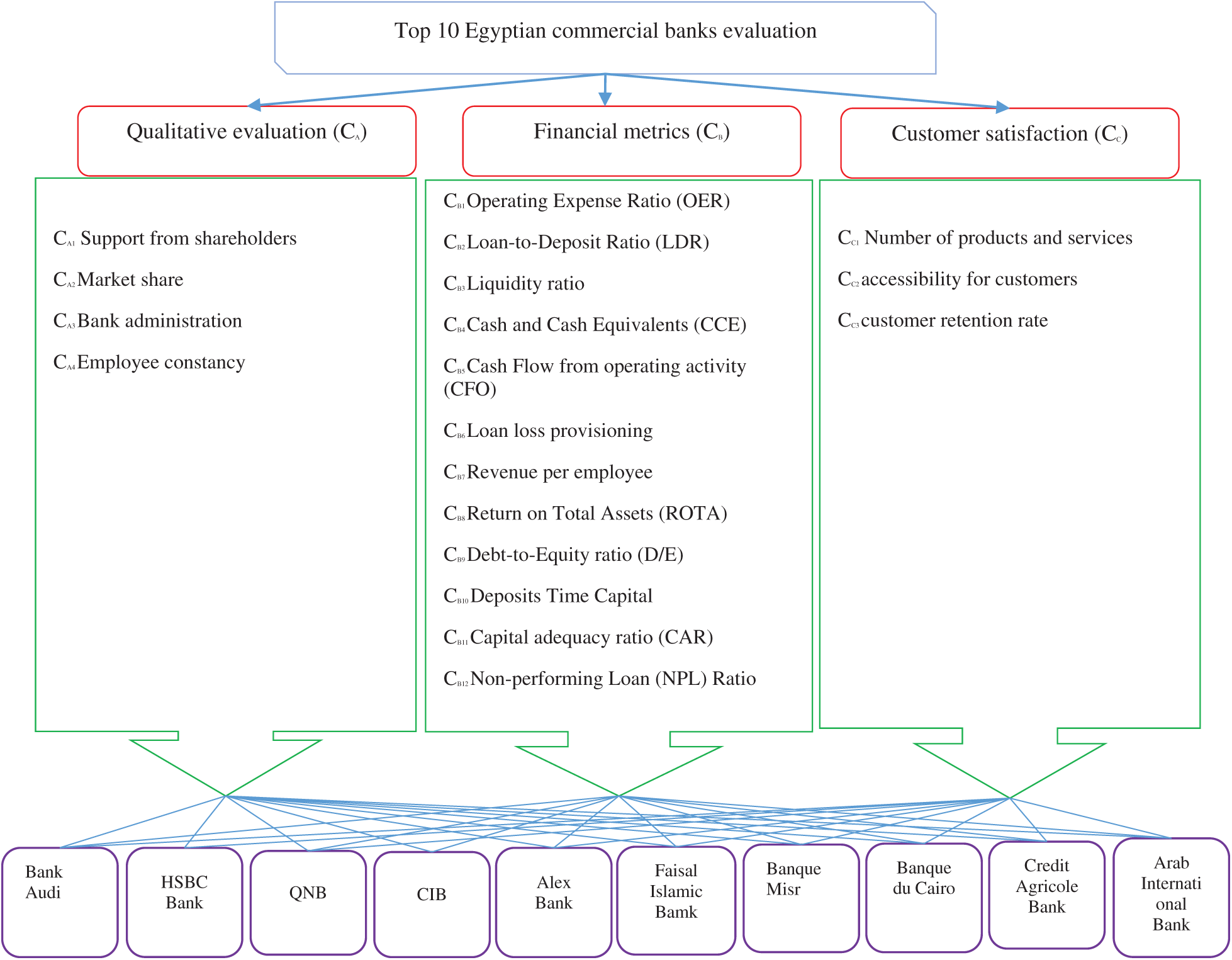

Stage 3: This stage aims to use AHP to find the weights of criteria. In this stage, the pairwise comparison is applied by the decision maker’s evaluation. The main criteria pairwise comparison is shown in Tab. 6. Aggregation of the three decision maker’s comparison is shown in Tab. 7 based on contradiction degree CD. Next, the aggregated pairwise comparison matrix is transformed into crisp values using Eq. (24). Pairwise comparison is then calculated according to consistency ratio CR. The overall weights are calculated using Tab. 8.

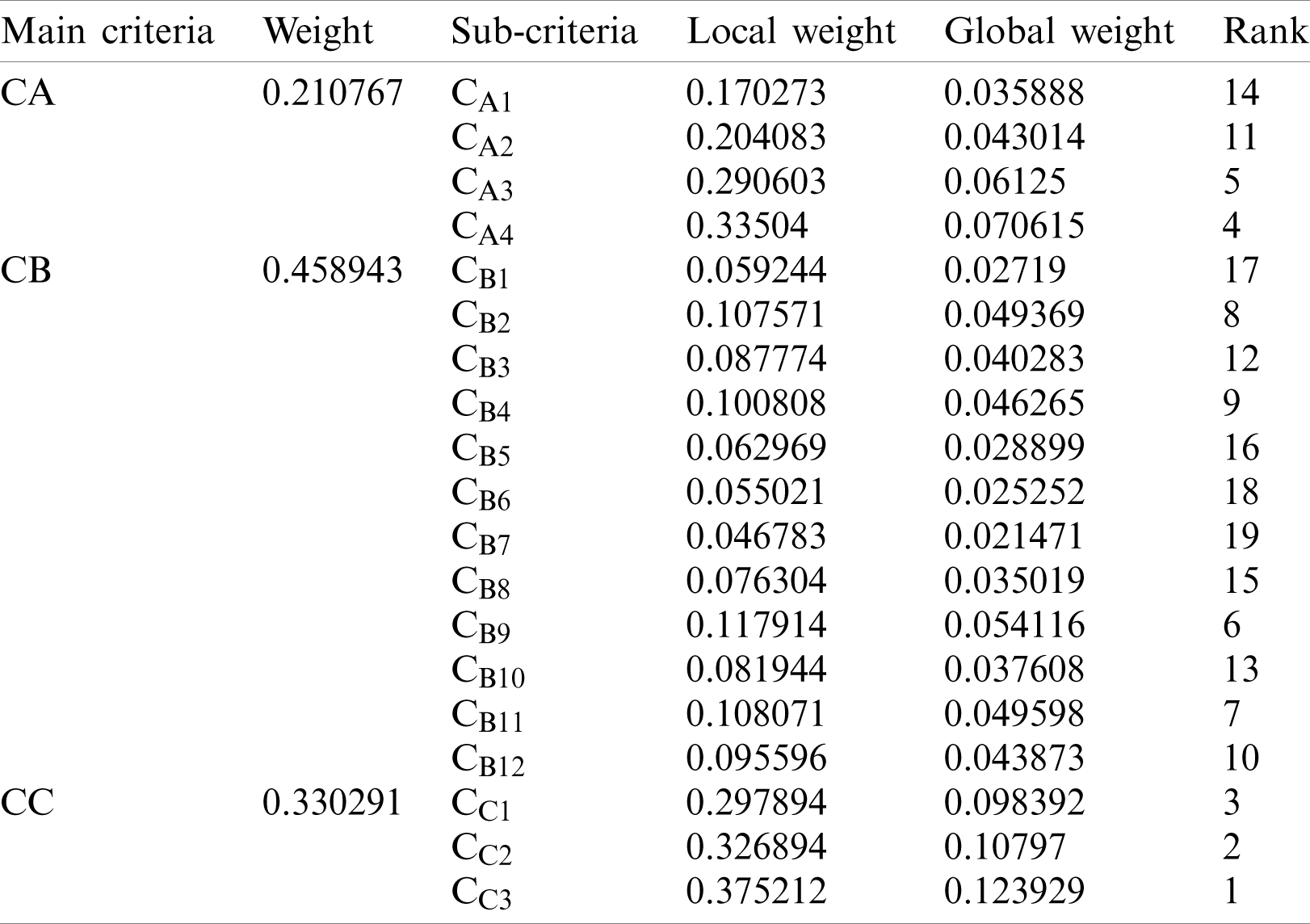

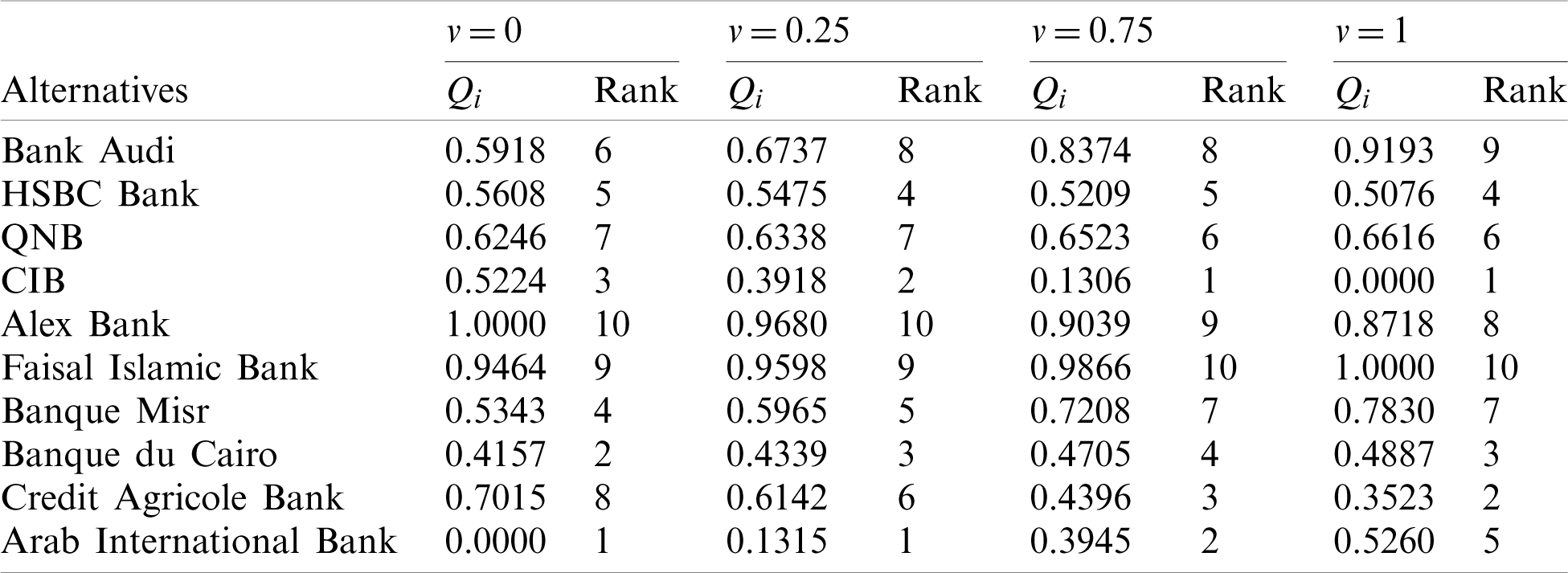

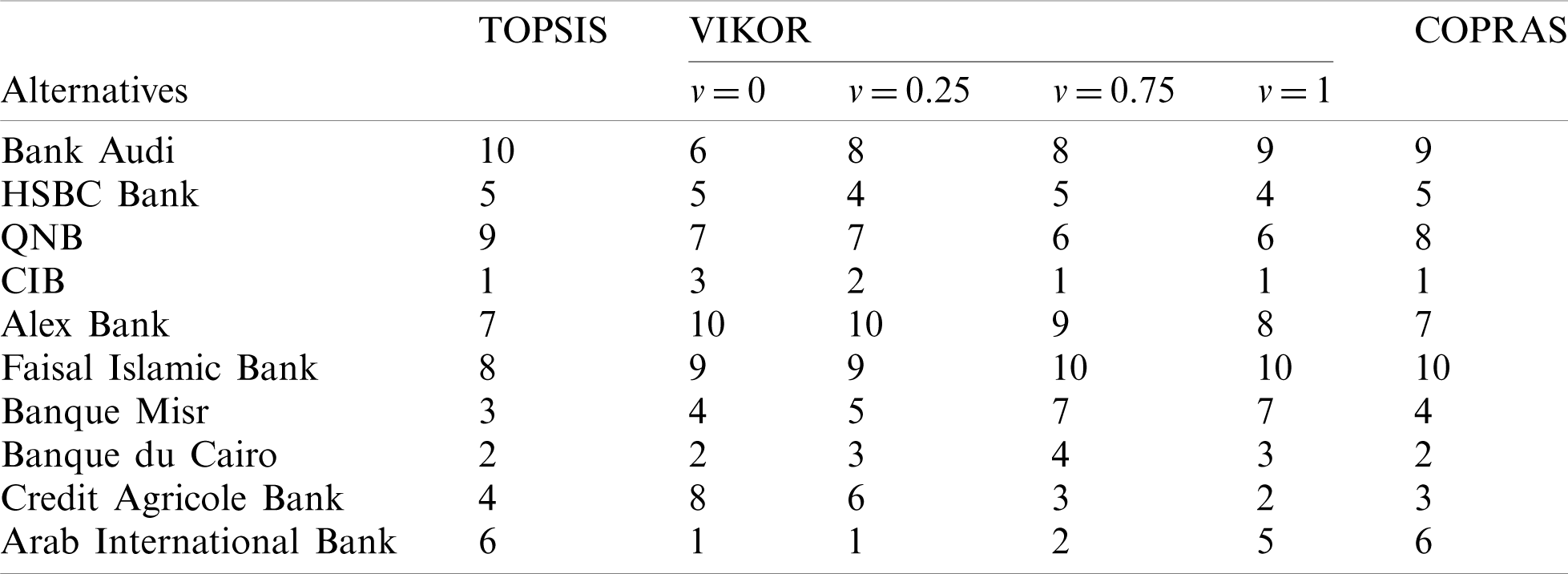

Stage 4A: Rank the top 10 CBs in Egypt using the TOPSIS method. According to the aggregated evaluation matrix in Tab. 5, rank the alternatives based on Eqs. (3–10). The ranking of 10 CBs is shown in Tab. 9. Stage 4B: Rank the top 10 CBs in Egypt using the VIKOR method. According to the aggregated evaluation matrix in Tab. 5, rank the alternatives were calculated based on the values ofSi, Ri and Qi. This calculation is done using Eqs. (12)–(14) using and shown in Tab. 10. Stage 4C: Rank the top 10 CBs in Egypt using the COPRAS method. According to the aggregated evaluation matrix in Tab. 5, rank the alternatives based on the quantitative utility for each alternative based on Qi using Eqs. (17–22), and the results are shown in Tab. 11.

Figure 2: Hierarchy of top 10 Egyptian commercial banks

Table 3: Evaluation matrix of CBs according to the criteria

Table 4: Aggregated evaluation matrix

Table 5: Crisp values of the aggregated evaluation matrix

Table 6: Main criteria pairwise comparison

Table 7: Aggregation of pairwise comparison of main criteria

Table 8: Local weight, global weight, and ranking of criteria

Table 9: Evaluation of top 10 CBs in Egypt using TOPSIS

Table 10: Evaluation of top 10 CBs in Egypt using VIKOR

Table 11: Evaluation of top 10 CBs in Egypt using COPRAS

After applying the proposed model in the evaluation process of the top ten commercial banks in Egypt we found that:

• Weights of criteria are evaluated using neutrosophic AHP based on neutrosophic evaluation scale and the results show that financial metrics are the most important with weight 0.4589 then, customer satisfaction with weight 0.3303, and lastly qualitative measures with weight 0.2108.

• According to the sub-criteria level, the customer retention rate is the highest weight 0.3752 and revenue per employee ratio is the lowest weight 0.0468.

• Evaluating the 10 CBs using TOPSIS, the result shows that CIB is the highest performance based on the given criteria followed by Banque du Cairo and Banque Misr. Audi Bank, QNB, and Fisal Islamic Bank are at the end of the ranking.

• The results of the VIKOR method recorded that CIB is also the highest performance followed by Arab International Bank and Banque du Cairo. On the other side, Fisal Islamic Bank and Bank Audi are also in the end of ranking with Alex Bank. This evaluation considered the weight of the strategy v = 0.5. It is significant to mention the changing of weight of the strategy v within the interval [0,1]. Accordingly, the sensitivity analysis on v is illustrated in Tab. 12 and Fig. 3 to make it easy for the readers to track its values.

Table 12: Ranking of the 10 CBs for different values of v

Figure 3: VIKOR results analysis

Finally, results of the COPRAS method show that CIB has also the highest performance followed by Arab International Bank and Credit Agricole Bank. But Fisal Islamic Bank and Bank Audi are at the end of ranking with QNB. As the result shows in Tab. 13, CIB is always at the top of ranking among 10 commercial banks, however, Faisal Islamic Bank and Bank Audi are always at the end of ranking according to performance measurements.

Table 13: Ranking of top 10 CBs in Egypt using TOPSIS, VIKOR, and COPRAS

Most researches condone uncertainty in the evaluation of banks because of unclearness of performance of some services in unexpected situations. Moreover, based on related literature, many researchers considered only financial metrics in evaluating banks’ performance. This research focused on these drawbacks to ensure more efficient, consistent, and accurate evaluation by measuring the performance of top commercial banks is important.

The plithogenic set is used to build the proposed MCDM model to increase the level of consideration of uncertainty. With the intention of calculating the weight of evaluation criteria, AHP was used, which showed that financial measurements are the most important criteria that must be considered in such evaluations. However, customer satisfaction and other qualitative measures are also important. Plithogenic aggregation operation provided accurate aggregation results according to the contradiction degree of given criteria. To evaluate the top commercial banks in Egypt, three different MCDM methods were applied. First, the TOPSIS method was used to rank the banks according to their distance to the ideal positive alternative and negative ideal alternative. Second, the VIKOR method ranked the banks based on different weights of the strategy. Third, the COPRAS method was used to evaluate the dependence of alternatives on given evaluation criteria. All the results showed that CIB is providing the best performance while Faisal Islamic Bank and Bank Audi have the least performance among top 10 commercial banks in Egypt.

Despite the strengths of our study, there are some limitations. First of all, this study does not consider non-financial measures in the evaluation process of the CBs. Also, the weights of the decision-makers are not taken into account during the evaluation. In future studies, we intend to include other non-financial measures such as political situation, government planning, and banking management for exploring more accurate evaluation. We also plan to apply our proposed model to different evaluation problem scales.

Ethical Approval: This article does not contain any studies with human participants or animals performed by any of the authors.

Funding Statement: This research was supported by Korea Institute for Advancement of Technology (KIAT) grant funded by the Korea Government (MOTIE) (P0012724, The Competency Development Program for Industry Specialist) and the Soonchunhyang University Research Fund.

Conflicts of Interests: The authors declare that there is no conflict of interest regarding the publication of the paper.

1. J. P. Hughes, J. Jagtiani, L. J. Mester and C. G. Moon. (2019). “Does scale matter in community bank performance? Evidence obtained by applying several new measures of performance,” Journal of Banking & Finance, vol. 106, pp. 471–499. [Google Scholar]

2. J. Fang, C. K. M. Lau, Z. Lu, Y. Tan and H. Zhang. (2019). “Bank performance in China: A perspective from bank efficiency, risk-taking and market competition,” Pacific-Basin Finance Journal, vol. 56, pp. 290–309. [Google Scholar]

3. H. Y. Wu, G. H. Tzeng and Y. H. Chen. (2009). “A fuzzy MCDM approach for evaluating banking performance based on Balanced Scorecard,” Expert Systems with Applications, vol. 36, no. 6, pp. 10135–10147. [Google Scholar]

4. H. Dinçer and S. Yüksel. (2019). “An integrated stochastic fuzzy MCDM approach to the balanced scorecard-based service evaluation,” Mathematics and Computers in Simulation, vol. 166, pp. 93–112. [Google Scholar]

5. P. Wanke, C. P. Barros and A. Emrouznejad. (2016). “Assessing productive efficiency of banks using integrated fuzzy-DEA and bootstrapping: A case of Mozambican banks,” European Journal of Operational Research, vol. 249, no. 1, pp. 378–389. [Google Scholar]

6. N. Bayyurt. (2013). “Ownership effect on bank’s performance: Multi criteria decision making approaches on foreign and domestic Turkish banks,” Procedia-Social and Behavioural Sciences, vol. 99, pp. 919–928. [Google Scholar]

7. D. Liang, Y. Zhang, Z. Xu and A. Jamaldeen. (2019). “Pythagorean fuzzy VIKOR approaches based on TODIM for evaluating internet banking website quality of Ghanaian banking industry,” Applied Soft Computing, vol. 78, pp. 583–594. [Google Scholar]

8. M. H. Aghdaie, S. Hashemkhani Zolfani and E. K. Zavadskas. (2013). “A hybrid approach for market segmentation and market segment evaluation and selection: An integration of data mining and MADM,” Transformations in Business and Economics, vol. 12, no. 2B, pp. 431–458. [Google Scholar]

9. G. Aras, N. Tezcan and O. K. Furtuna. (2018). “Multidimensional comprehensive corporate sustainability performance evaluation model: Evidence from an emerging market banking sector,” Journal of Cleaner Production, vol. 185, pp. 600–609. [Google Scholar]

10. A. Roozbahani, H. Ghased and M. H. Shahedany. (2020). “Inter-basin water transfer planning with grey COPRAS and fuzzy COPRAS techniques: A case study in Iranian Central Plateau,” Sci. Total Environ., vol. 726, pp. 138499. [Google Scholar]

11. P. Wanke, A. K. Azad and A. Emrouznejad. (2018). “Efficiency in BRICS banking under data vagueness: A two-stage fuzzy approach,” Global Finance Journal, vol. 35, pp. 58–71. [Google Scholar]

12. D. X. Cuong, H. T. Hien and T. Long. (2018). “Multi-criteria decision-making model evaluating the performance of vietnamese commercial banks,” International Journal of Financial Research, vol. 9, no. 1, pp. 132–141. [Google Scholar]

13. F. Smarandache. (1999). “A unifying field in logics: Neutrosophic logic,” In Philosophy, American Research Press, vol. 1, no. 1, pp. 1–141. [Google Scholar]

14. F. Smarandache. (2017). “Plithogenic set, an extension of crisp, fuzzy, intuitionistic fuzzy, and neutrosophic setsrevisited,” Neutrosophic Sets and Systems, vol. 21, no. 1, pp. 153–166. [Google Scholar]

15. M. Abdel-Basset, A. Gamal, R. K. Chakrabortty and M. Ryan. (2020). “A new hybrid multi-criteria decision-making approach for location selection of sustainable offshore wind energy stations: A case study,” Journal of Cleaner Production, vol. 280, pp. 124462. [Google Scholar]

16. S. Opricovic. (1998). “Multicriteria optimization of civil engineering systems,” Faculty of Civil Engineering, Belgrade, vol. 2, no. 1, pp. 5–21. [Google Scholar]

17. E. K. Zavadskas, A. Kaklauskas and V. Sarka. (1994). “The new method of multicriteria complex proportional assessment of projects,” Technological and Economic Development of Economy, vol. 1, no. 3, pp. 131–139. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |