Open Access

Open Access

ARTICLE

A Heavy Tailed Model Based on Power XLindley Distribution with Actuarial Data Applications

1 Department of Basic Sciences, Higher Institute of Administrative Sciences, Belbeis, 44621, Egypt

2 Faculty of Graduate Studies for Statistical Research, Cairo University, Giza, 12613, Egypt

3 Department of Quantitative Analysis, College of Business Administration, King Saud University, Riyadh, 11587, Saudi Arabia

4 Department of Computing, University of Eastern Finland, Joensuu, 80130, Finland

5 Central Agency for Public Mobilization & Statistics (CAPMAS), Cairo, 11819, Egypt

6 Department of Basic Sciences, Egyptian Institute of Alexandria Academy for Management and Accounting, EIA, Alexandria, 21919, Egypt

* Corresponding Author: Ibrahim E. Ragab. Email:

Computer Modeling in Engineering & Sciences 2025, 142(3), 2547-2583. https://doi.org/10.32604/cmes.2025.058362

Received 10 September 2024; Accepted 08 February 2025; Issue published 03 March 2025

Abstract

Accurately modeling heavy-tailed data is critical across applied sciences, particularly in finance, medicine, and actuarial analysis. This work presents the heavy-tailed power XLindley distribution (HTPXLD), a unique heavy-tailed distribution. Adding one more parameter to the power XLindley distribution improves this new distribution, especially when modeling leptokurtic lifetime data. The suggested density provides greater flexibility with asymmetric forms and different degrees of peakedness. Its statistical features, like the quantile function, moments, extropy measures, incomplete moments, stochastic ordering, and stress-strength parameters, are explored. We further investigate its use in actuarial science through the computation of pertinent metrics, such as value-at-risk, tail value-at-risk, tail variance, and tail variance premium. To obtain the point and interval parameter estimates, we use the maximum likelihood estimation approach. We do many simulation tests to evaluate the performance of our proposed estimator. Metrics like bias, relative bias, mean squared error, root mean squared error, average interval length, and coverage probability will be used in these tests to assess the estimator’s performance. To illustrate the practical value of our proposed model, we apply it to analyze three real-world datasets. We then compare its performance to established competing models, highlighting its advantages.Keywords

An essential area of statistics is lifetime data analysis, which models and examines the duration until a phenomenon fails or survives. It is useful in a wide range of disciplines, including biology, ecology, medicine, social sciences, and reliability engineering. The exponential distribution, with its constant failure rate function and memoryless quality, is one of the most popular distributions for lifespan data. Nevertheless, certain data types, such as those that show growing, declining, unimodal, or bathtub-shaped failure rate functions, might not be well-modeled by the exponential distribution. To get around the drawbacks of the exponential distribution and offer improved flexibility, many alternative distributions have been put forth in the literature. In this sense, one of the most flexible and straightforward lifespan models is the XLindley distribution (XLD), which was introduced by Chouia et al. [1] as a combination of the Lindley and the exponential distributions. The probability density function (PDF) and cumulative distribution function (CDF) of the XLD are defined as:

and

where

and

where

In numerous fields of study during the past decades, including economics, actuarial science, engineering, environmental research, lifespan, medical science, and many more, it has been determined that the classical distributions do not match the data well. To construct many unique models tailored for certain datasets, the authors have gone into great detail in their explanation. The classical distributions may be made more flexible by introducing additional parameters or by performing various transformations on the baseline distribution, which will improve its capacity to handle complex situations. To strengthen the flexibility of models in this context, many classes of distributions have been generated by using various processes, resulting in a more powerful and adaptable distribution for dataset modeling; for instance, Marshall-Olkin-G [11], beta-G [12], Kumaraswamy-G [13], transformed-transformer [14], Weibull-G [15], Dinesh-Umesh-Sanjay-G by [16], type I half-logistic-G [17], exponentiated half-logistic-G [18], Topp-Leone-G [19], Gompertz-G [20], beta odd Lindley-G [21], truncated power Lomax-G [22], Kavya-Manoharan-G [23], odd inverted Topp-Leone [24], Weibull Marshall-Olkin-G [25], sec-G [26], length-biased truncated Lomax-G [27], generalized logarithmic-X [28], alpha log power transformed-G [29], Marshall-Olkin-exponentiated half logistic-G [30] among others.

Probability distributions with a significant number of values in the tail of the distribution that is more than what would be predicted from a normal distribution are referred to as heavy-tailed (HT) distributions. This means that HT distributions assign a higher probability to extreme events or outliers. These distributions are valuable tools in various fields for understanding and managing the risk associated with rare but impactful events. The necessity of the HT distributions in actuarial practice has prompted actuaries to develop new flexible distributions (see [31–33]). Reference [34] covered the characteristics, estimates, and fundamental ideas of HT distributions, whereas reference [35] examined the estimation issue of HT distributions in extreme value theory. Moreover, several specific HT distributions have been introduced, including the HT Gleser distribution by [36], Type-I HT-G distributions by [37], Type I HT odd power generalized Weibull-G by [38], and HT generalized Topp-Leone-G by [39]. Many actual application studies in a variety of fields, including hydrology, biology, agriculture, production, survival, and finance, may be shown using the HT class of distributions. In recent times, Ahmed et al. [40] have introduced a new class of distributions dubbed the HT class of distributions. To better examine the underlying patterns of the data sets, this new addition is a useful tool for creating new models that are suitable for analyzing HT, symmetric, complicated, and skewed data sets. The HT-G family of distributions’ CDF and PDF may be written as follows, in that order:

and

where

The field of statistics has a large collection of probability distributions, each with its strengths and weaknesses. It is not possible to represent or express important aspects in every scenario using a single distribution. In response to this limitation, we introduce a novel extension of the PXLD with the assistance of the HT-G family, named the heavy-tailed PXLD (HTPXLD). This paper aims to achieve the following objectives:

• Create a flexible distribution that can display declining, right-skewed, and unimodal data. Its hazard rate function (HRF) can be growing, decreasing, unimodal, right-skewed, or reverse J-shaped.

• To construct and evaluate some of the key mathematical properties, including moments, linear representation of density function, incomplete moments (IMs), quantile function (QF), Bonferroni and Lorenz curves, stochastic ordering (SO), extropy measures, and stress-strength (SS) reliability parameter.

• To obtain the point and approximate confidence interval (CI) estimators of the unknown parameters of the HTPXLD using the maximum likelihood (ML) estimation method. Through the implementation of the Monte Carlo simulation approach, the accuracy of the proposed model estimates is evaluated.

• A comparative analysis of the proposed model against well-known alternatives is performed using three diverse real-world datasets to assess its practical applicability.

The paper proceeds as follows: Section 2 introduces the HTPXLD. Section 3 delves into its mathematical features. Few actuarial measures are examined in Section 4. In Section 5, we describe the process of estimating model parameters using the ML approach and create CIs for the unknown parameters of the model. A Monte Carlo simulation study is performed in Section 6 to demonstrate the consistency of the suggested estimate. Practical applications of the model are presented in Section 7. Section 8 concludes the paper with some final considerations and key findings.

2 Heavy-Tailed Power XLindley Distribution

This section introduces the core concepts behind the HTPXLD, including PDF, CDF, survival function (SF), HRF, and reversed HRF (RHRF). It also provides visualizations for the PDF and HRF. The CDF of the HTPXLD is created by inserting CDF (2) in CDF (3), resulting in the following expression:

where

For

A mathematical notion utilized in survival analysis, reliability engineering, and other domains is the HRF, represented by

The RHRF of the HTXLD is given by

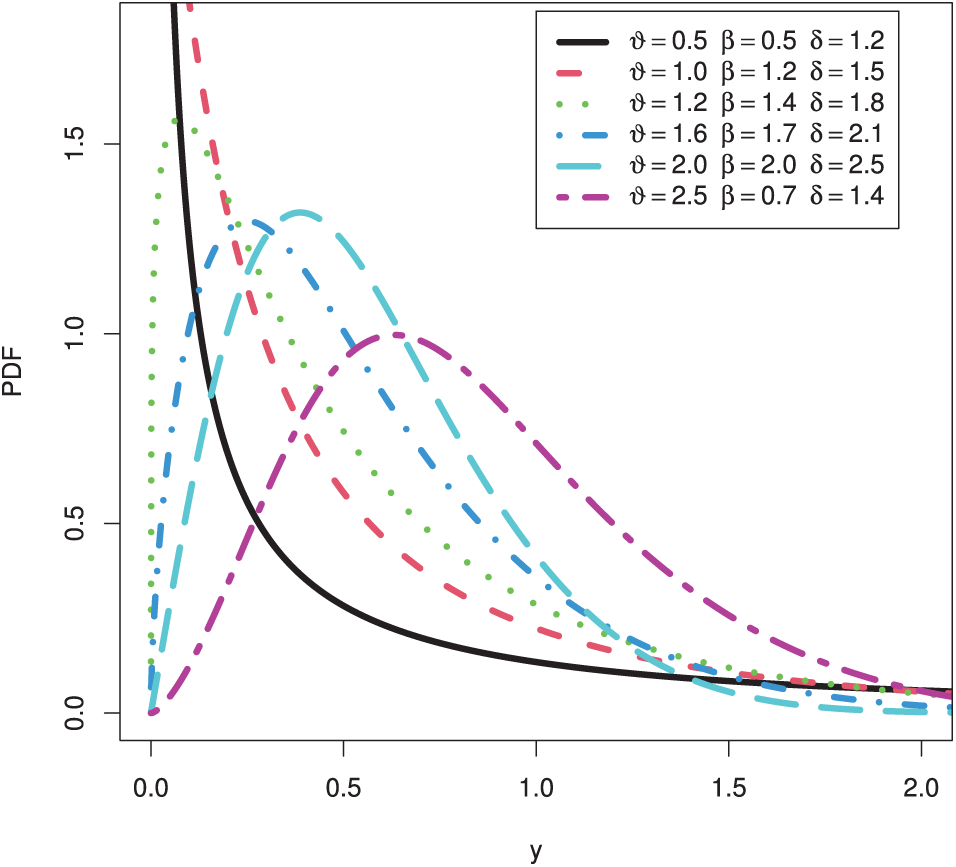

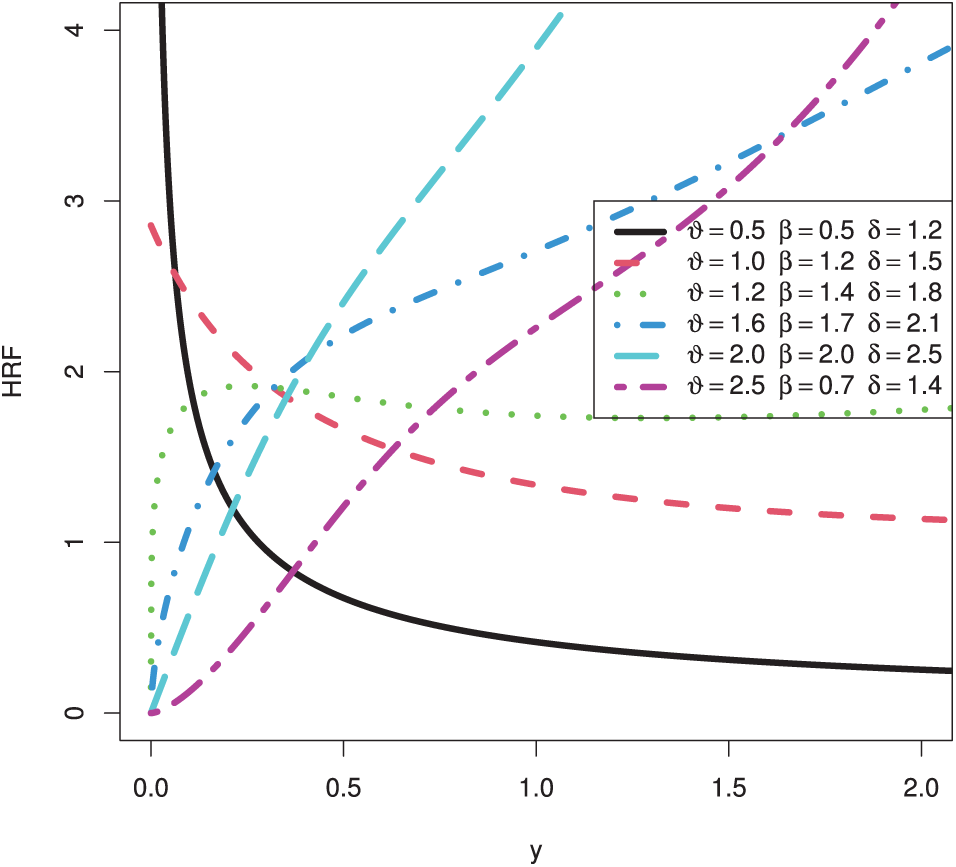

The PDF plots of the HTPXLD for particular parameter values are shown in Fig. 1. The HRF of the HTPXLD for the chosen parameter values is then shown in Fig. 2. From Figs. 1 and 2, we can note that the PDF can be right-skewed, unimodal, or decreasing, but the HRF can be increasing, decreasing, or upside-down.

Figure 1: Plots of the PDF for the HTPXLD

Figure 2: Plots of the HRF for the HTPXLD

A number of statistical properties, such as QF, moments, IMs, PDF linear expansion, Bonferroni and Lorenz curves, SO, SS parameters, and extropy measures that shed light on the structure of the distribution, will be covered here.

To analyze most of the statistical properties of HTPXLD, we can express the PDF as a linear combination of simpler functions. Using the following power series:

in PDF defined in Eq. (6) provides

Again, using a binomial expansion in PDF (8) yields

In statistical modeling, the QF is essential because it makes it possible to estimate certain percentiles, offers valuable insights into the data distribution, and supports a range of inferential and decision-making procedures. One may determine the QF of the HTPXLD, denoted as

which leads to

By multiplying the two sides of Eq. (10) by

Setting

and

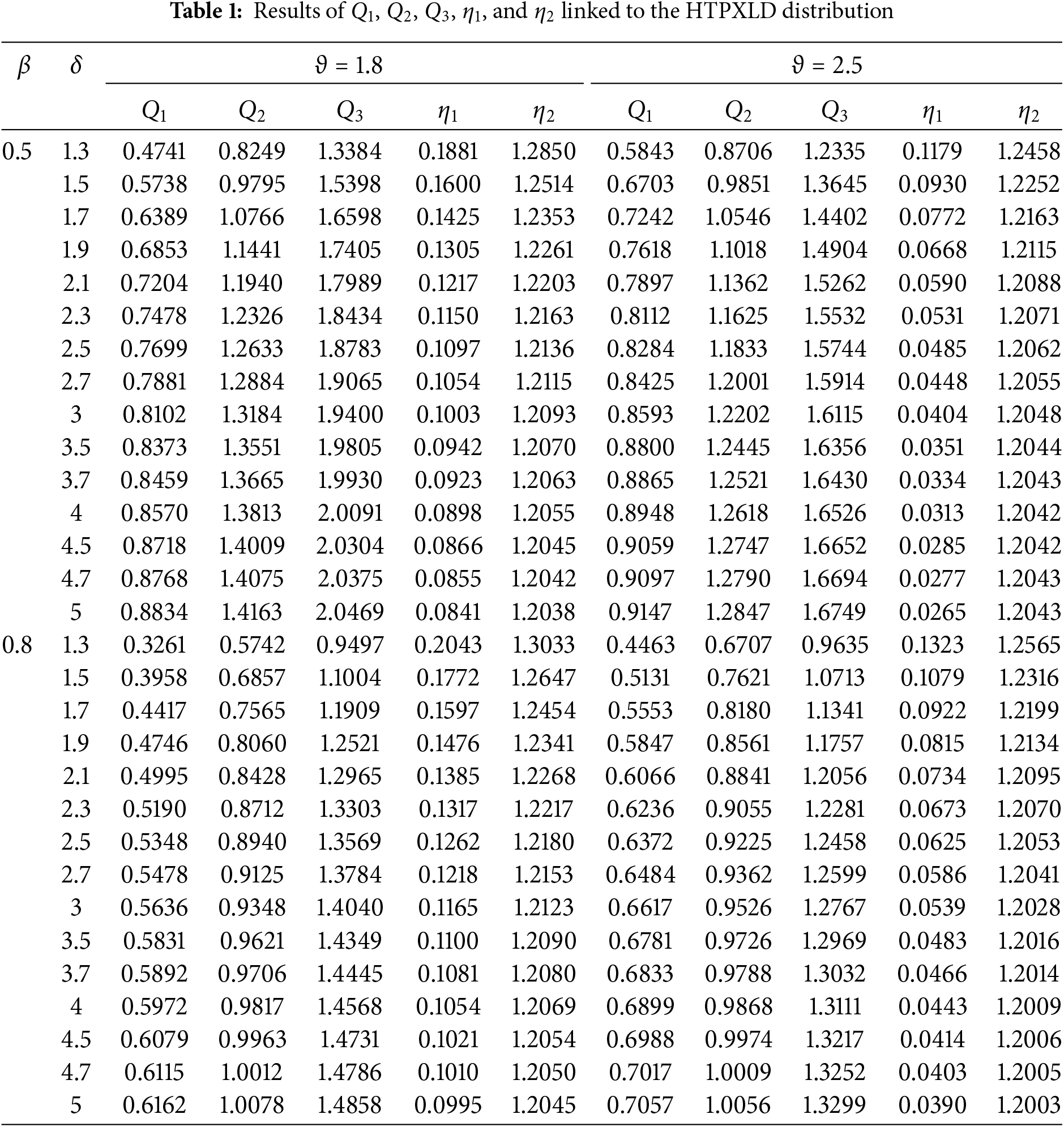

Table 1 presents quantile values (

Moments of distribution offer valuable insights into its shape. They reveal measures like central tendency (average), dispersion (spread), skewness (asymmetry), and kurtosis (peakedness). Therefore, deriving the moments is crucial for understanding any new distribution. The k-th moment about the origin of the HTPXLD is obtained by using PDF (9) as follows:

Using the transformation

where

Then, using the formulas,

Likewise, the k-th incomplete moment of the HTPXLD, based on PDF (9), is determined as follows:

Using the transformation

where

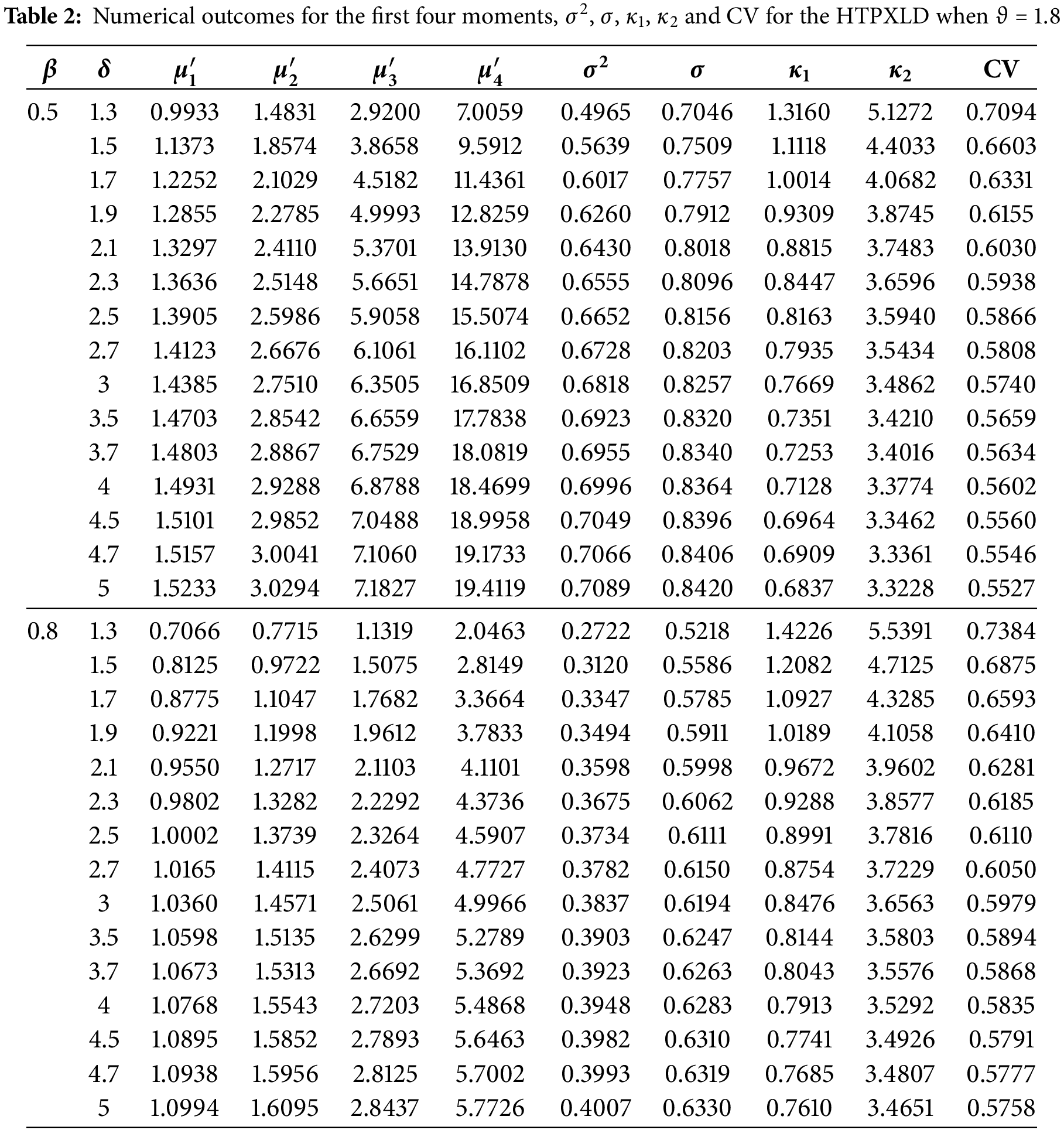

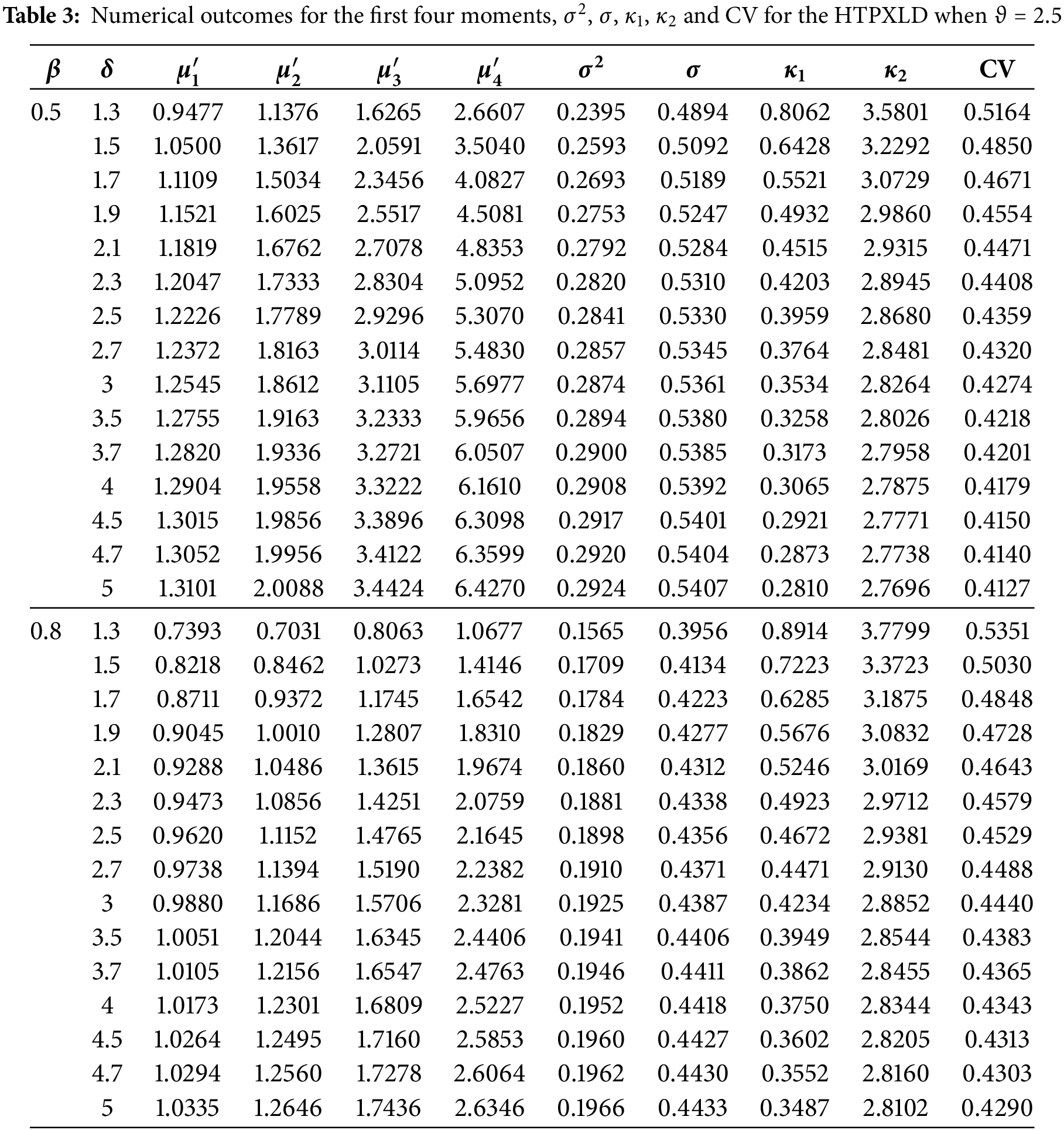

Tables 2 and 3 present numerical outcomes for the first four moments, variance (

Tables 2 and 3 reveal several trends: As

A concept in probability distributions that has been studied in great detail is stochastic ordering, which is crucial for analyzing comparative behavior among random variables in reliability theory and other fields. Stochastic ordering is a powerful tool used in probability and statistics to compare the behavior of random variables. It allows us to understand which random variable is “less risky” or has a “lower probability of taking on extreme values” compared to another. A random variable

• SO (represented by

• hazard rate order (represented by

• likelihood ratio order (represented by

According to Shaked et al. [45], the following impacts are widely recognized:

Let

then

For

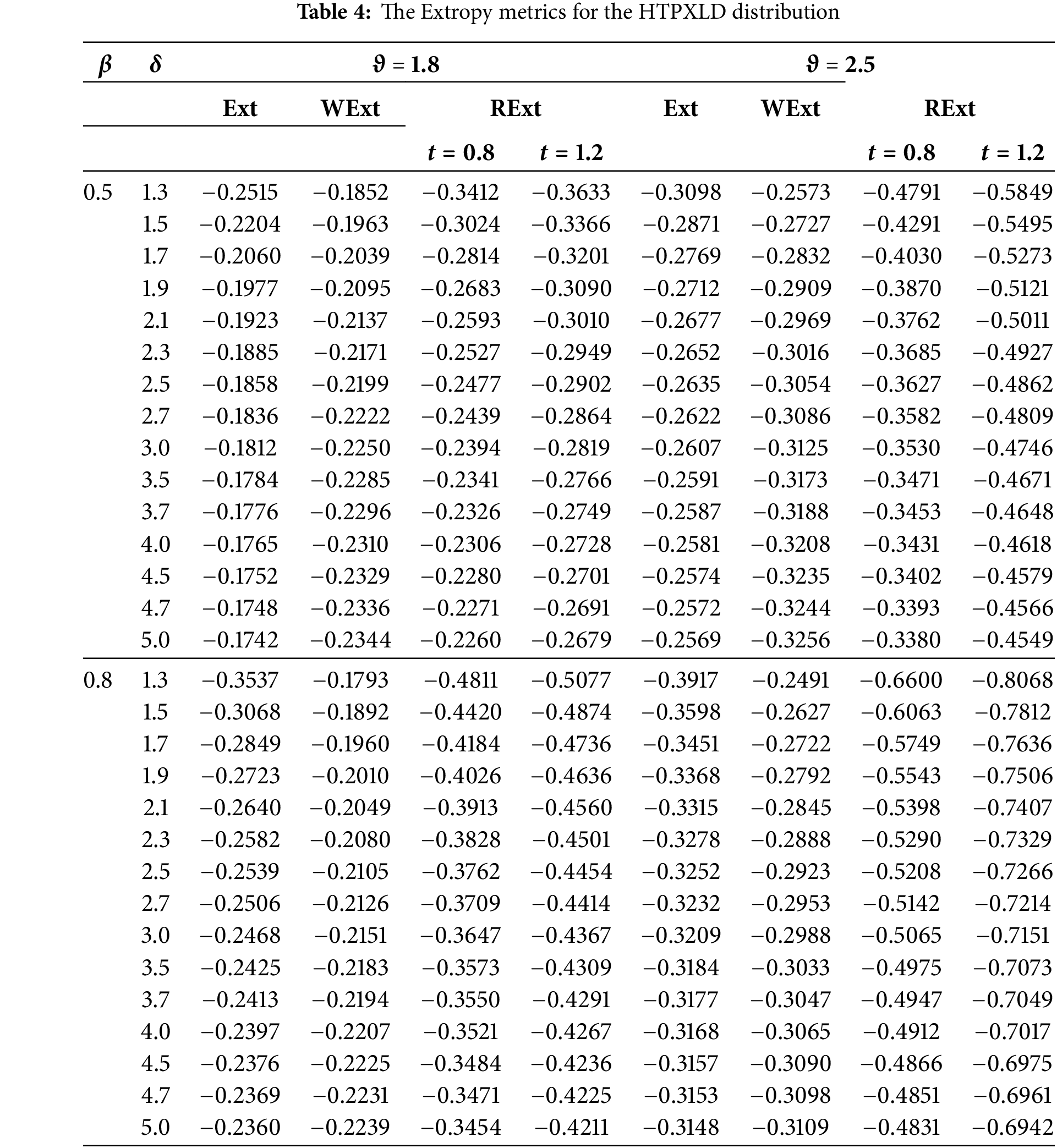

The extropy (Ext), which is the double complement of the entropy [46], was developed as an alternative uncertainty measure by Lad et al. [47]. The Ext can be statistically utilized to evaluate the accuracy of predicted distributions through the total log scoring method. For a non-negative random variableY, Ext is defined as follows:

Thus, using PDF (6) in (16), the extropy of the HTPXLD may be represented as follows:

Using the expansion (7) in (17) gives

Using binomial expansion in (18), we have

Then after some simplified form, the previous equation will be

Using the transformation

where

Weighted extropy (WExt), introduced by [48], offers an alternative perspective to traditional entropy. Unlike entropy, it assigns greater weight to larger values within a probability distribution. It can be expressed, mathematically, by

Then by inserting PDF (6) in (20), then the WExt is

Using the similar procedure discussed above, then

The residual extropy (RExt) at the time

Then, by inserting PDF (6) in (21) and using the similar procedure discussed above, the RExt will be

where

The SS model is a powerful tool in reliability engineering used to assess the probability of a component surviving under operational conditions. It considers two random variables: strength (X), which stands for the component’s intrinsic ability to withstand stress (Y). Therefore, the core concept of the SS model is captured by the following equation:

where

After simplifying Eq. (24), we get

where

Note that the integrals in Eq. (25) can be obtained as follows:

Then, by inserting

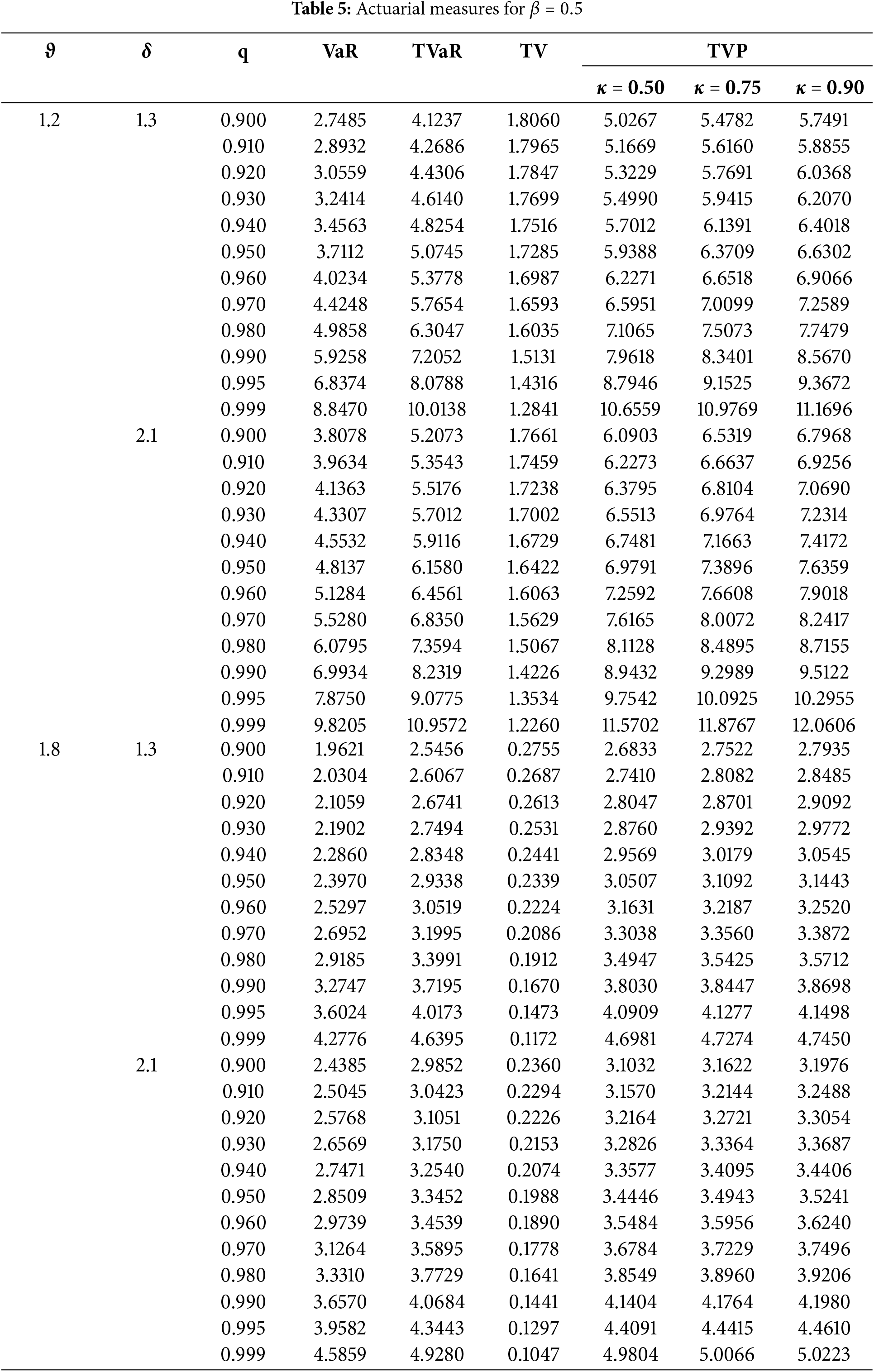

This section introduces several well-known risk measures for the developed model. These measures include Value-at-Risk (VaR), Tail Value-at-Risk (TVaR), Tail Variance (TV), and Tail Variance Premium (TVP).

As outlined in reference [49], the

TVaR is a crucial risk measure that evaluates the expected loss beyond a specified probability level, once an event has occurred. For the HTPXLD, the TVaR is defined as

4.3 Tail Variance and Tail Variance Premium

Landsman [50] first introduced the TV risk measure, which is defined by the variance of the loss distribution above a certain critical threshold. The TV for the HTPXLD can be expressed as

The TVP combines statistics related to both the central tendency and dispersion of the data, making it a significant risk measure. The TVP for the HTPXLD is given by

Table 5 demonstrates several key trends: Increasing

Our main goal in this section is to use the ML estimation method to obtain the point and interval estimates of the unknown parameters of the HTPXLD. Assume that

Regarding the model parameters

The non-linear Eqs. (27)–(29) are equated with zero to obtain the ML estimates (MLEs)

Instead of determining point estimates for the unknown parameters, it would be more helpful to identify a range of values that, with a specified probability, encompass them. These ranges are referred to as interval estimates. To build the parameters CIs, the asymptotic distribution of MLE of

where

Asymptotic normality of the MLEs allows for the construction of the

where is the upper

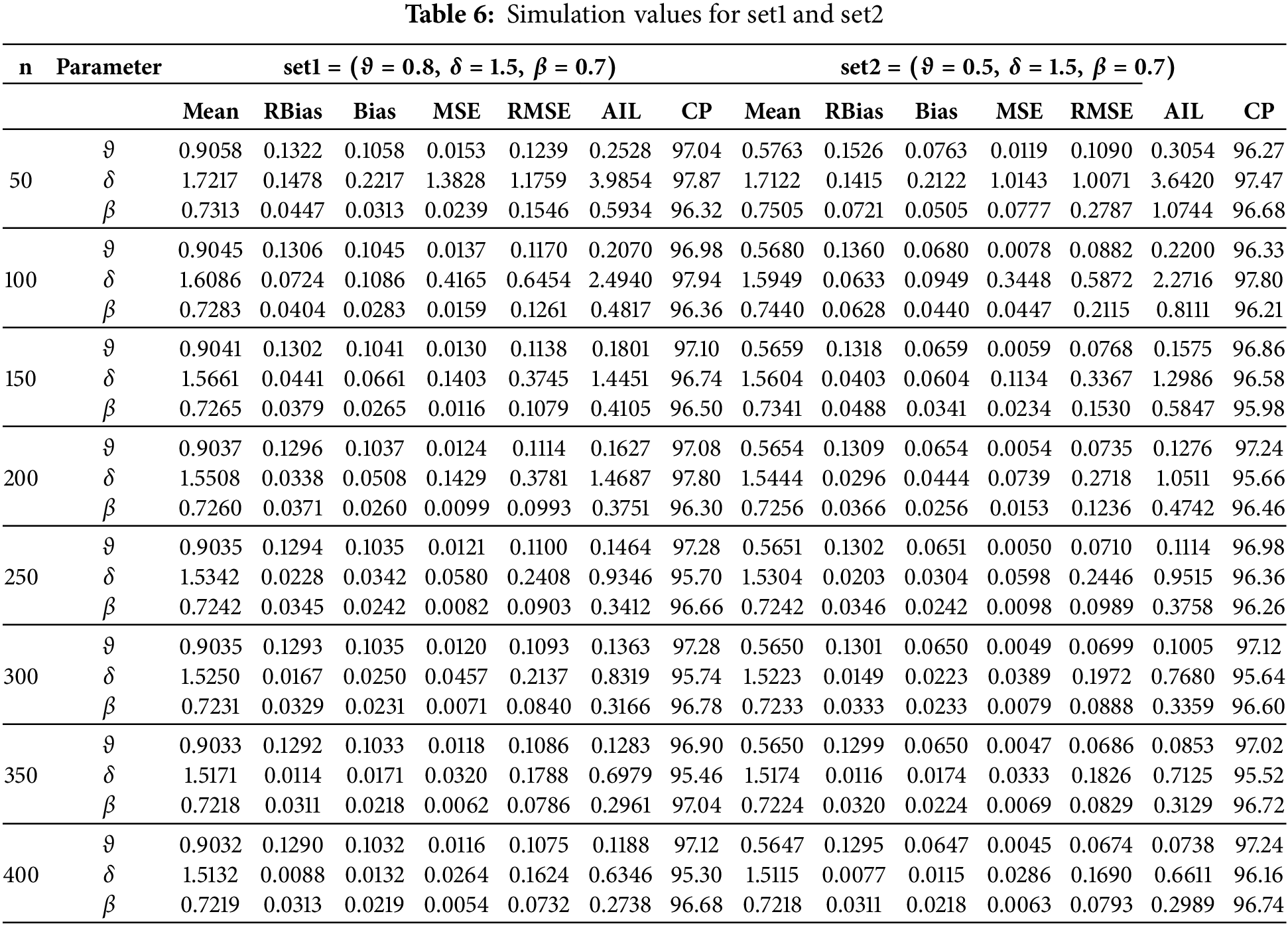

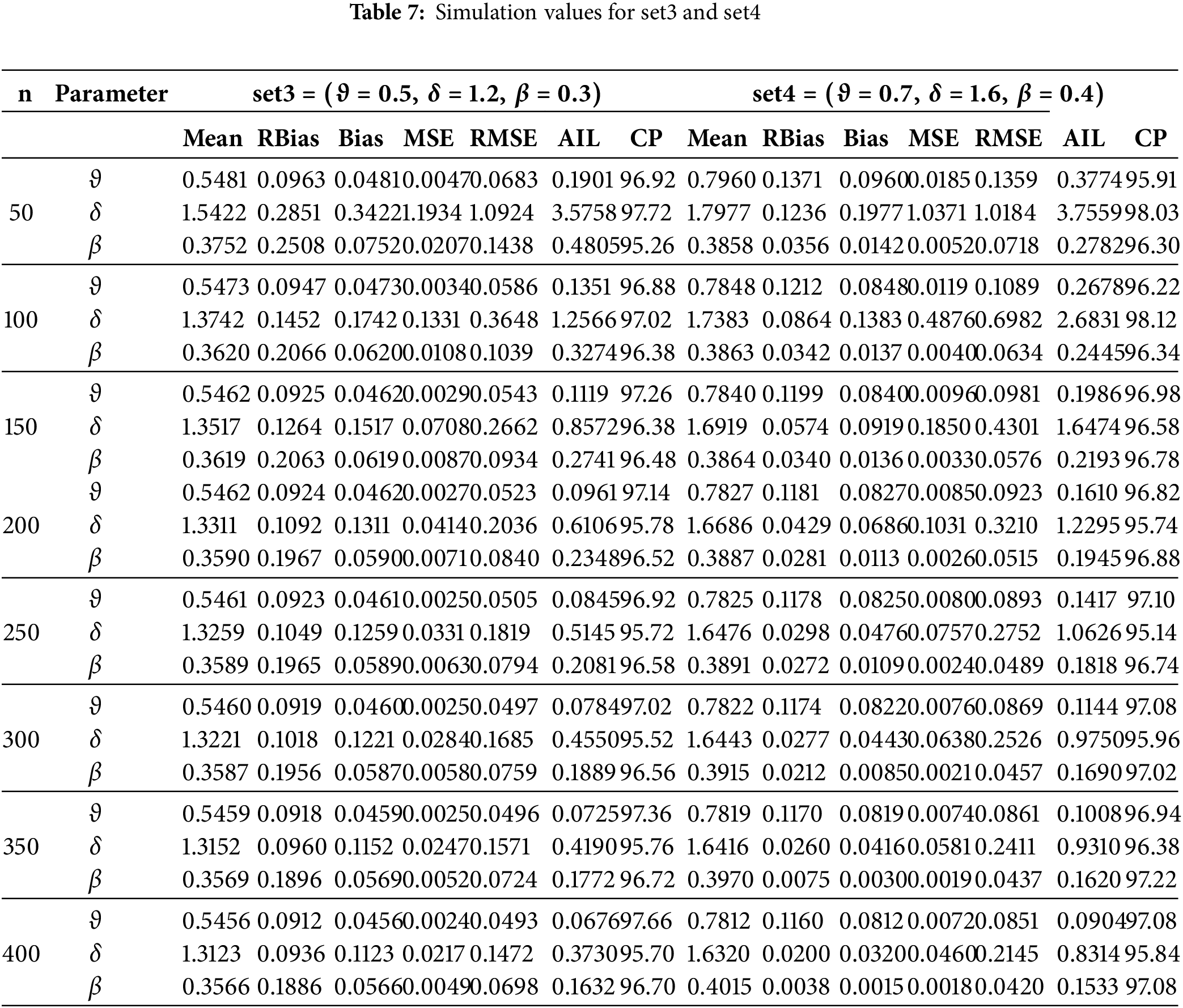

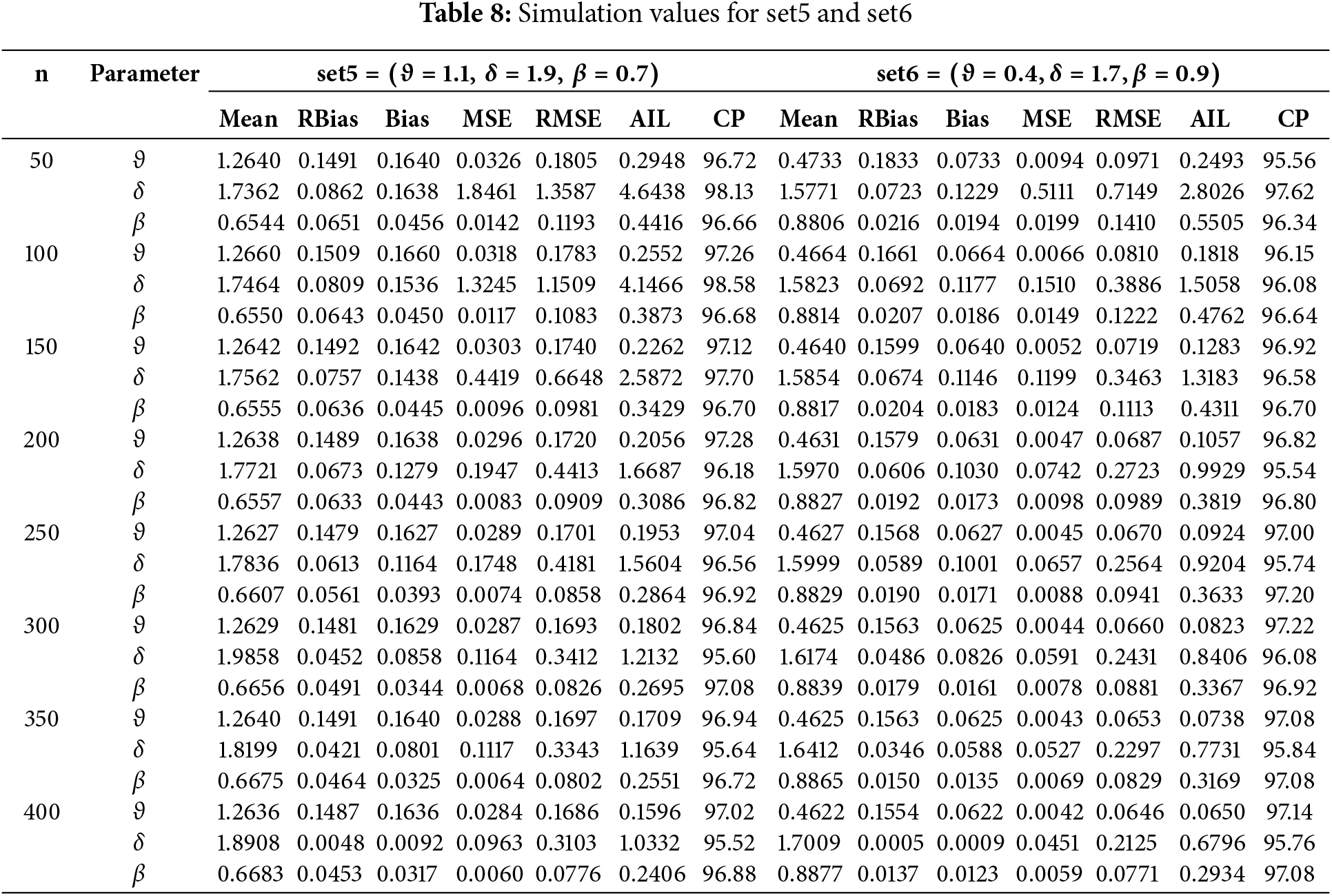

This section presents a simulation study to assess the performance of MLEs for the HTPXLD parameters

1) Generate 5000 random samples from the HTPXLD with sizes

2) Choose parameter values for the simulations as follows: set1 = (

3) Compute the MLEs, RBiases, Biases, RMSEs, and MSEs for each sample size and parameter set. Additionally, calculate the AIL and CP at a 95% confidence level for all sample sizes and parameter sets.

4) Present the numerical results in Tables 6–8. The performance of the estimated parameters is analyzed based on complete samples.

The results show in Tables 6–8 that bias, MSE, and RMSE all significantly decrease with increasing sample size (n). Furthermore, higher sample sizes increase CP and AIL, producing more accurate and trustworthy estimates and confidence ranges.

• Greater sample sizes lead to improvements in MSE. As the sample size increases, the parameter estimates converge closer to the real values, indicating that the MLEs are becoming more exact, as indicated by lower MSE values.

• As the sample size grows, the CP gets better, indicating that the CIs created for the parameter estimates get more trustworthy. The robustness of the estimates is improved by higher CP values, which indicate a higher probability that the intervals include the genuine parameter values.

• As the sample size grows, the values of AIL become lower.

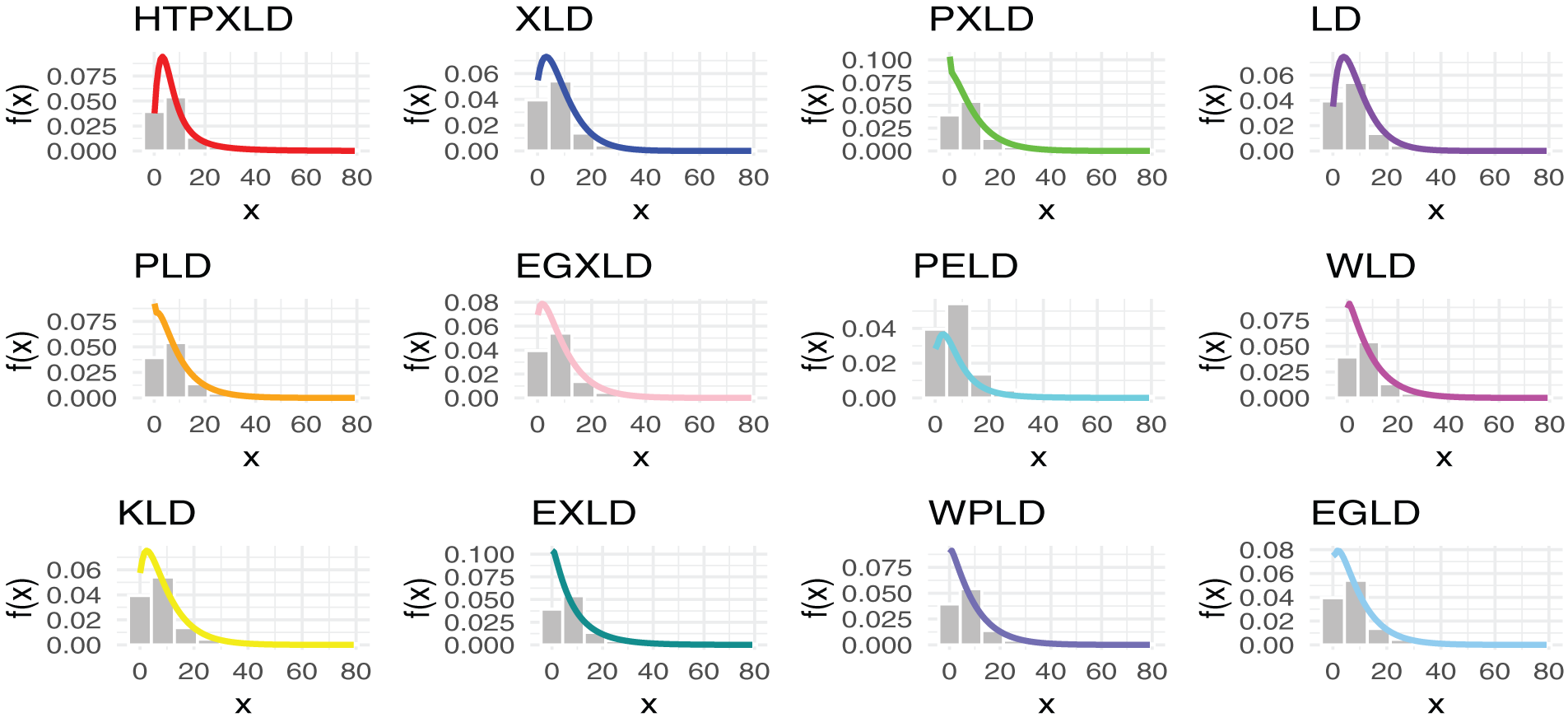

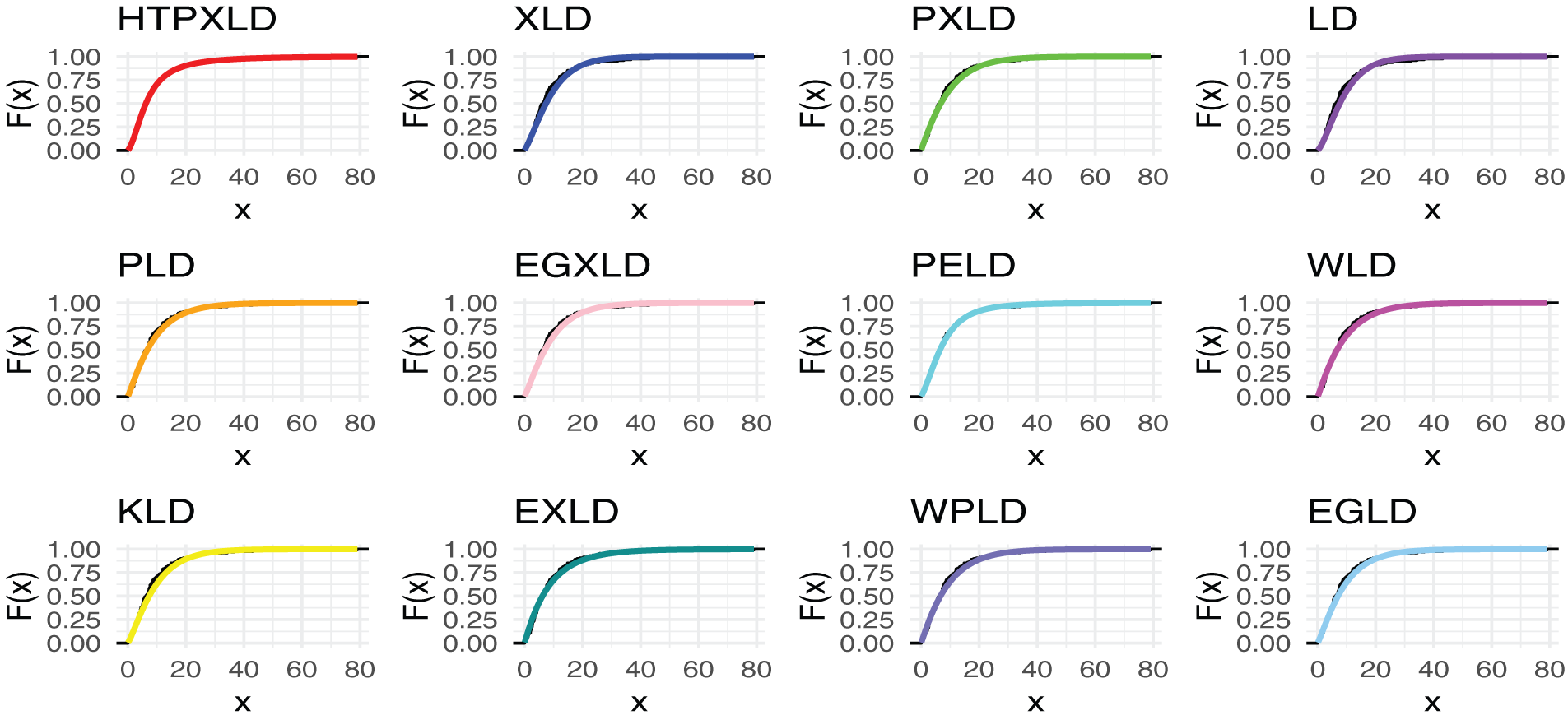

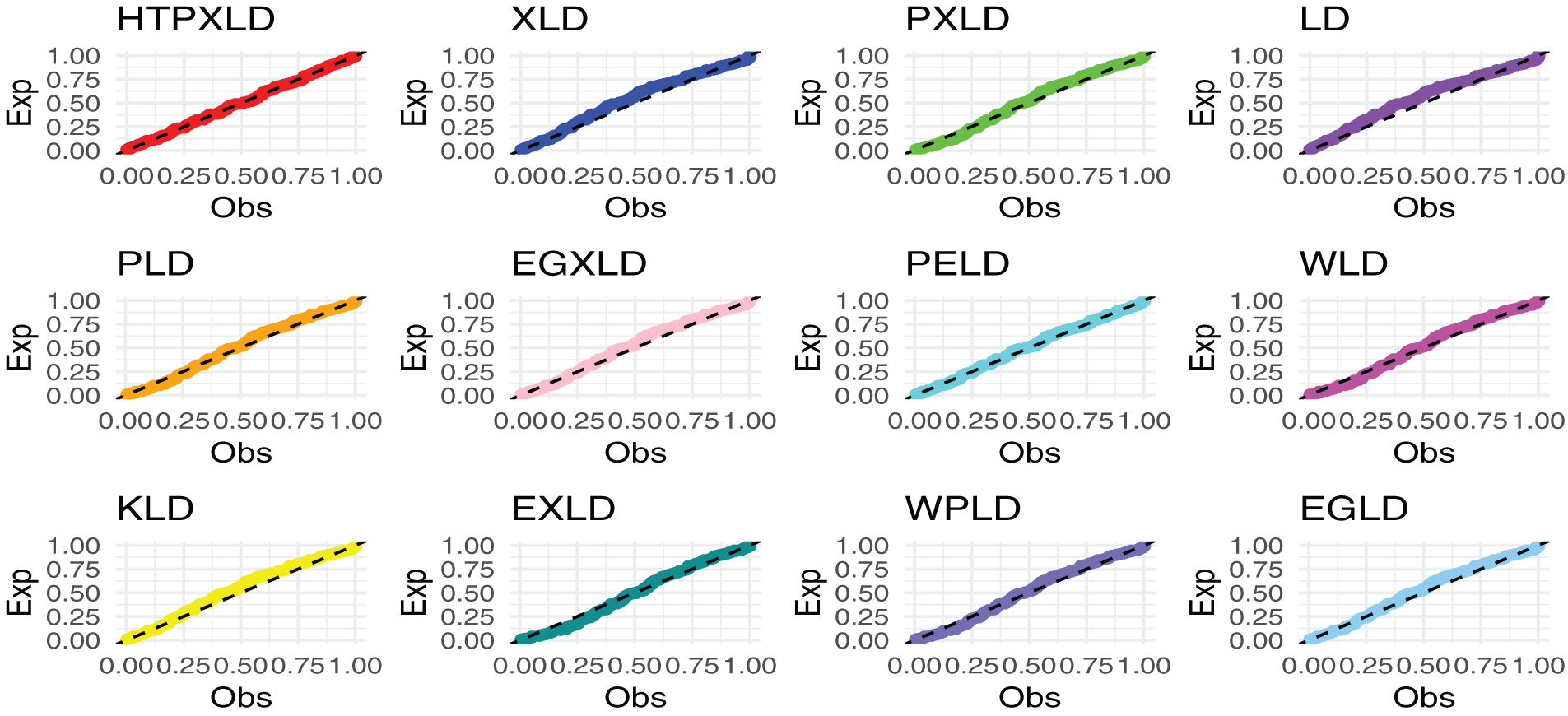

This section demonstrates the applicability of the HTPXLD in fitting real-world data by evaluating it against three actual datasets. The HTPXLD is compared with several alternative models, including XLD [1], Lindley (LD) [51], exponentiated generalized XLD (EGXLD) [52], power exponentiated LD (PELD) [53], Kumaraswamy LD (KLD) [54], Weibull power LD (WPLD) [15], exponentiated generalized power LD (EGLD) [55], power LD (PLD) [56], Weibull LD (WLD) [57], extended LD (EXLD) [58], and PXLD.

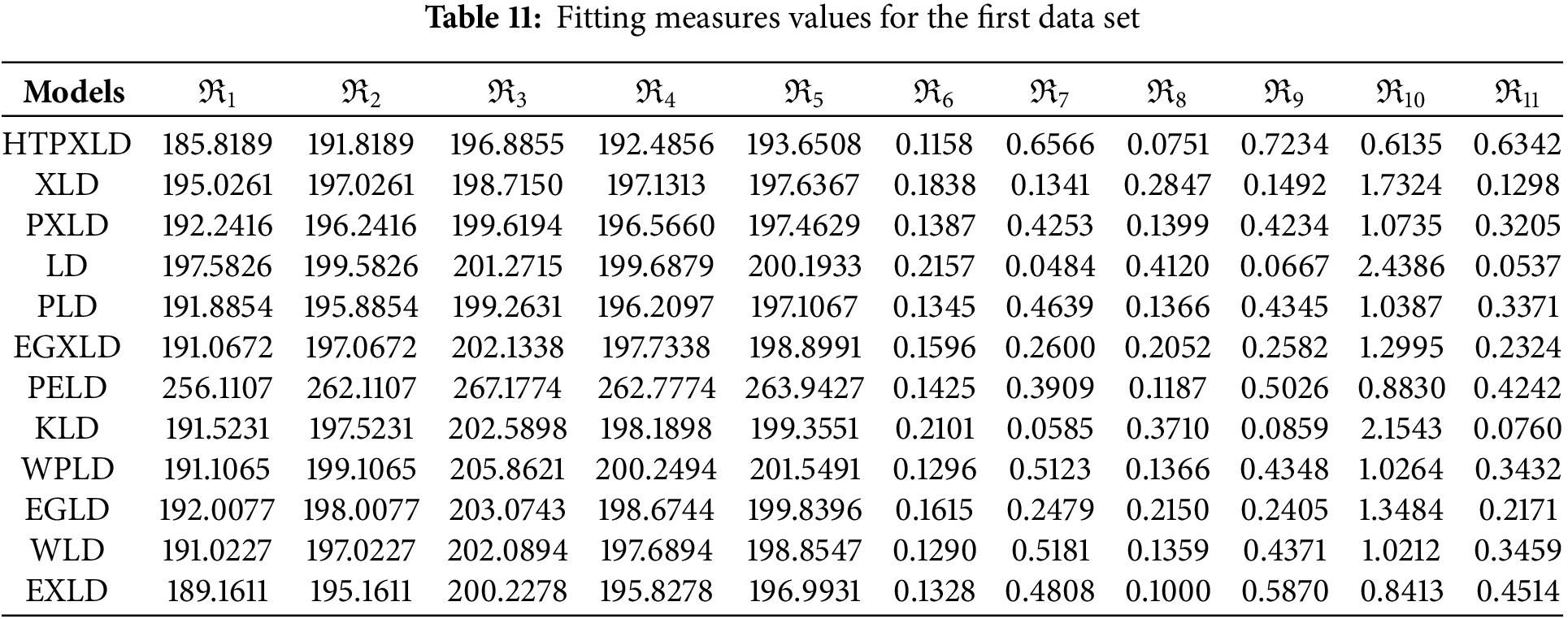

We use nine well-established goodness-of-fit measures to compare these models, including the Kolmogorov-Smirnov (

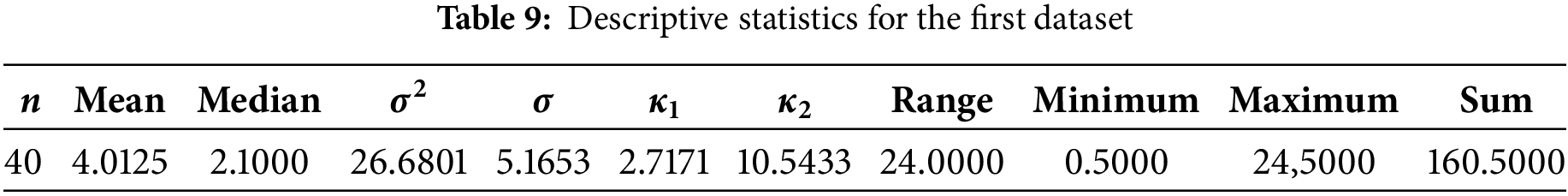

The first dataset consists of repair times for an airborne communication transceiver, provided by [59]. The recorded times are: 0.50, 0.60, 0.60, 0.70, 0.70, 0.70, 0.80, 0.80, 1.00, 1.00, 1.00, 1.00, 1.10, 1.30, 1.50, 1.50, 1.50, 1.50, 2.00, 2.00, 2.20, 2.50, 2.70, 3.00, 3.00, 3.30, 4.00, 4.00, 4.50, 4.70, 5.00, 5.40, 5.40, 7.00, 7.50, 8.80, 9.00, 10.20, 22.00, 24.50. Table 9 displays the results of the descriptive analysis for this dataset.

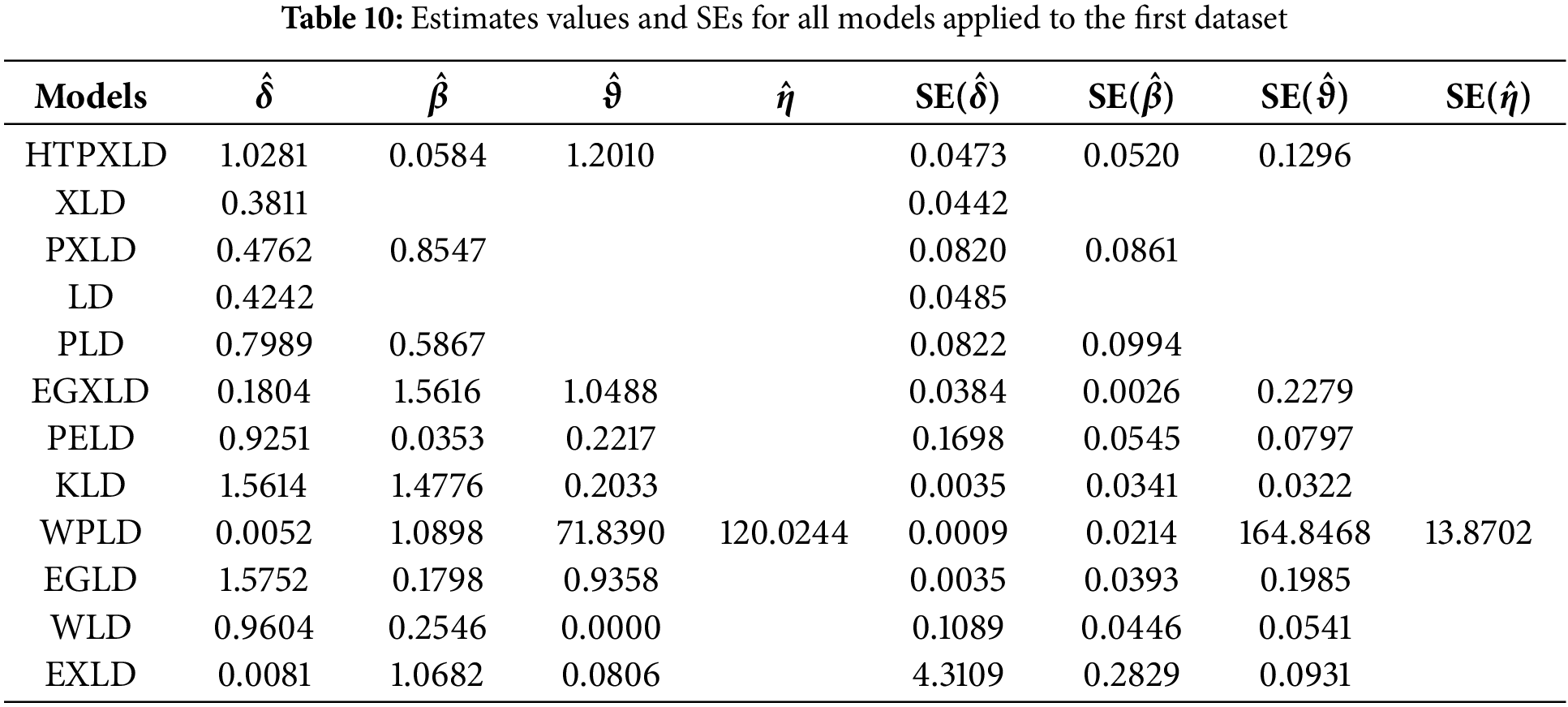

For the first dataset, Table 10 presents the MLEs along with their standard errors (SEs). Table 11 provides the numerical values for the

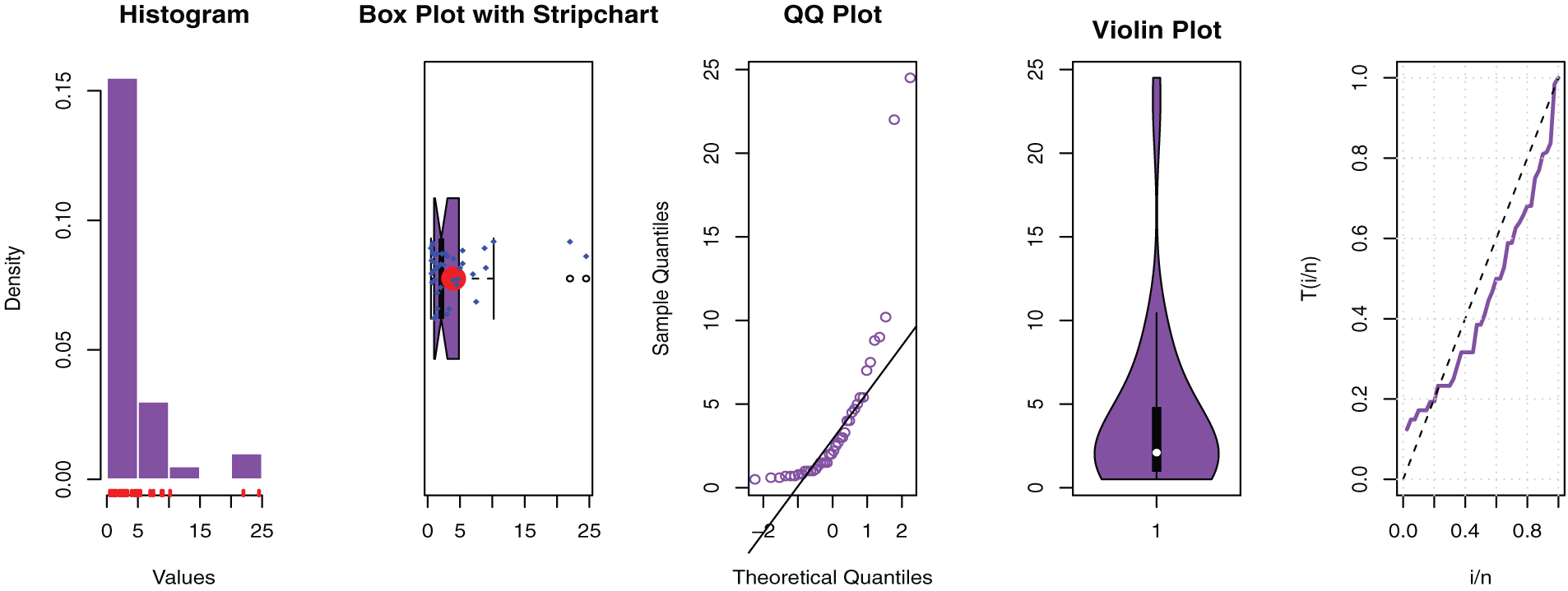

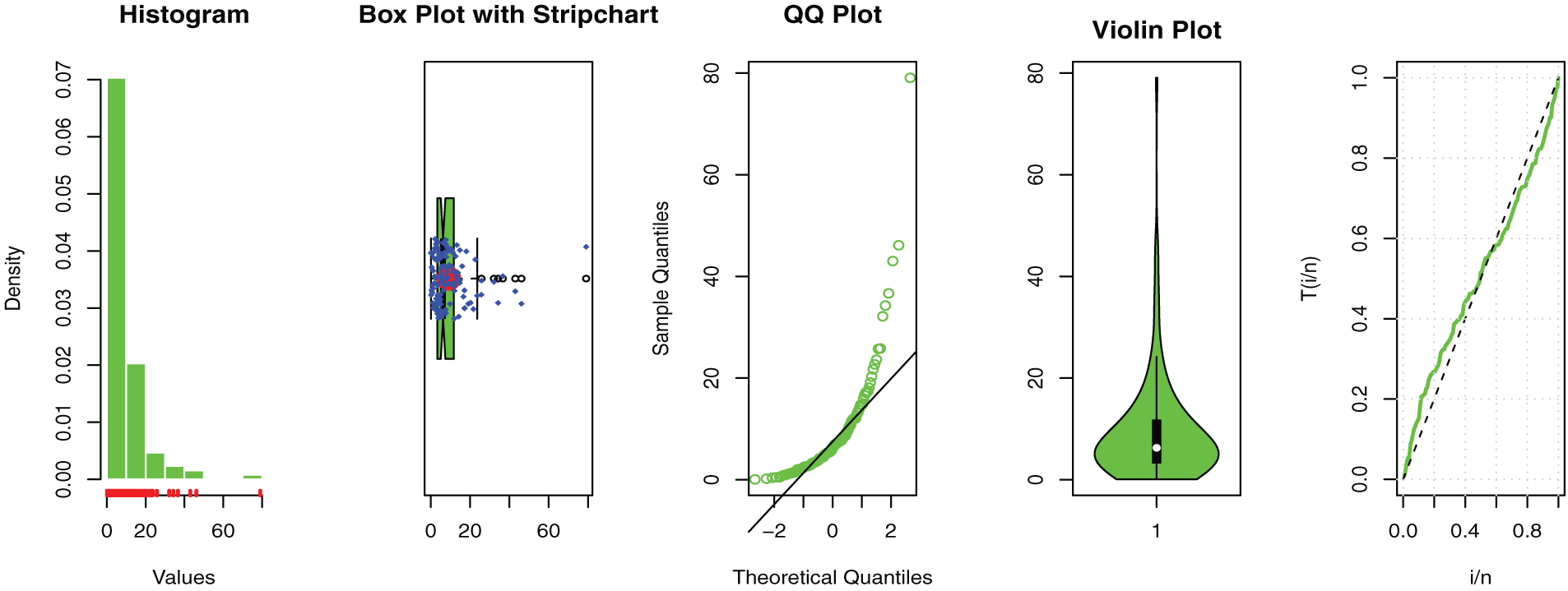

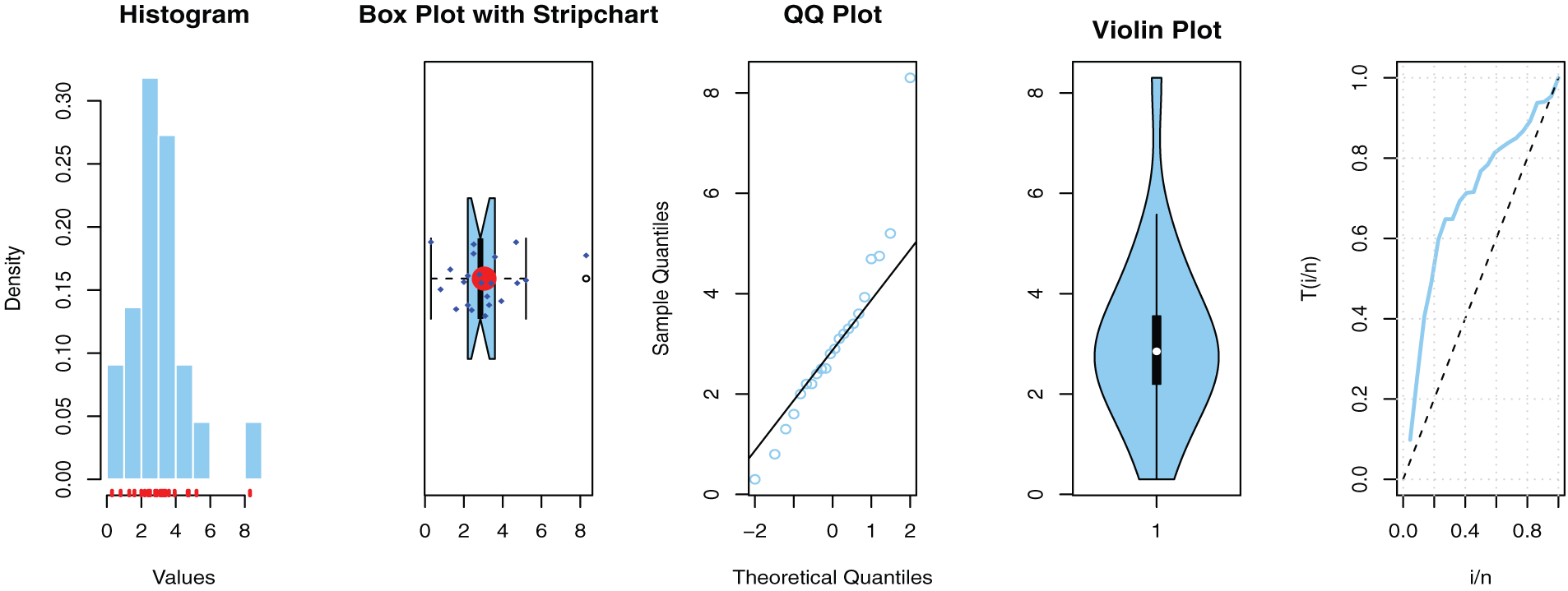

Figure 3: Some basic non-parametric plots for the first dataset

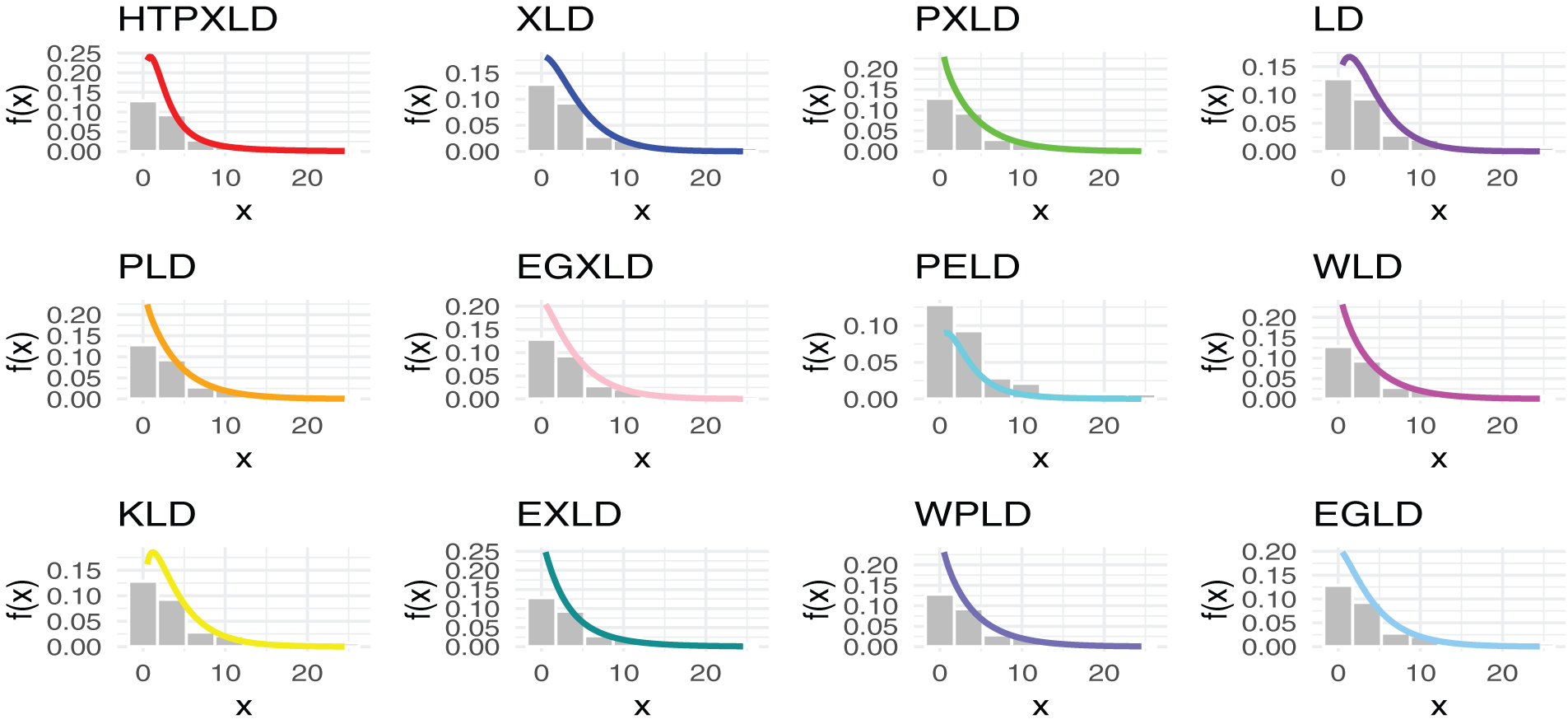

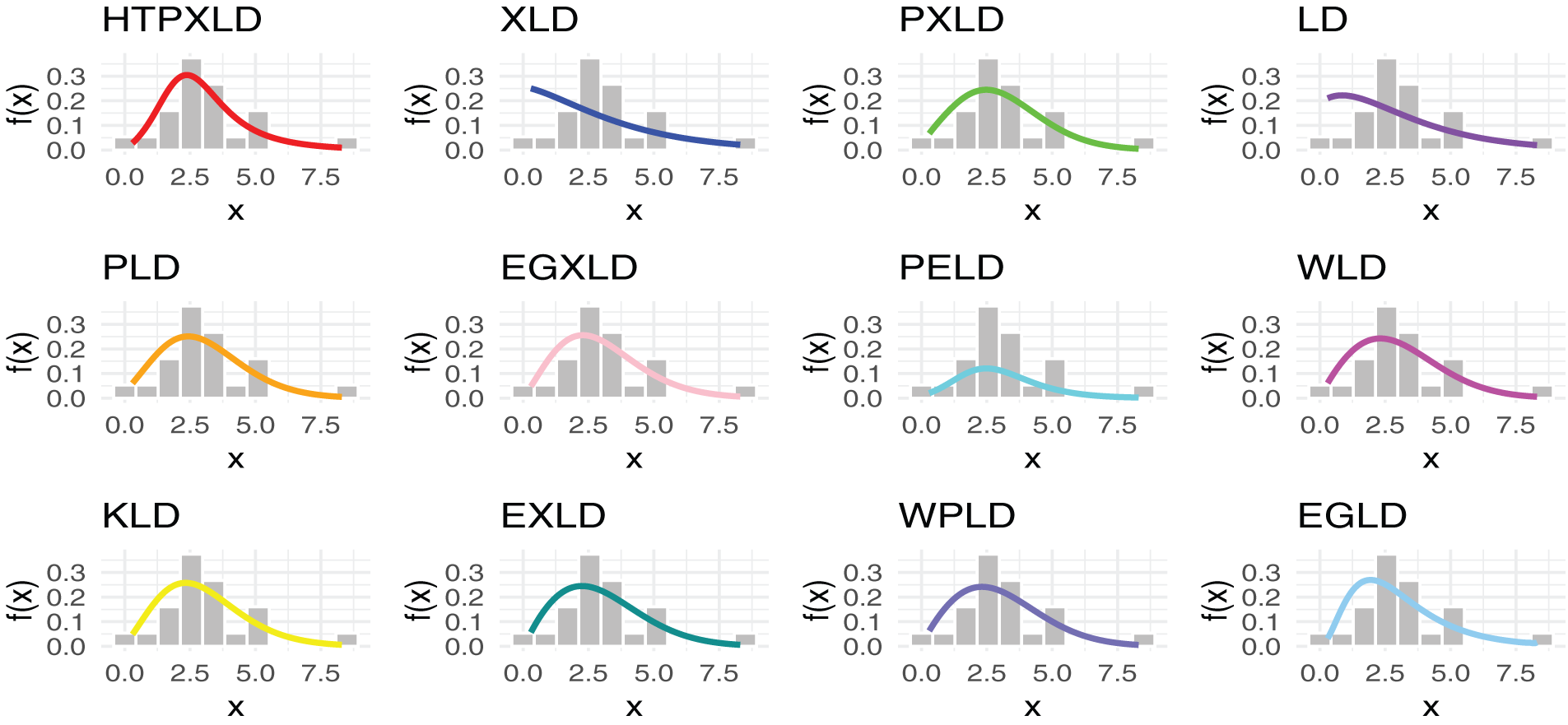

Figure 4: Estimated PDFs for the competing models for the first dataset

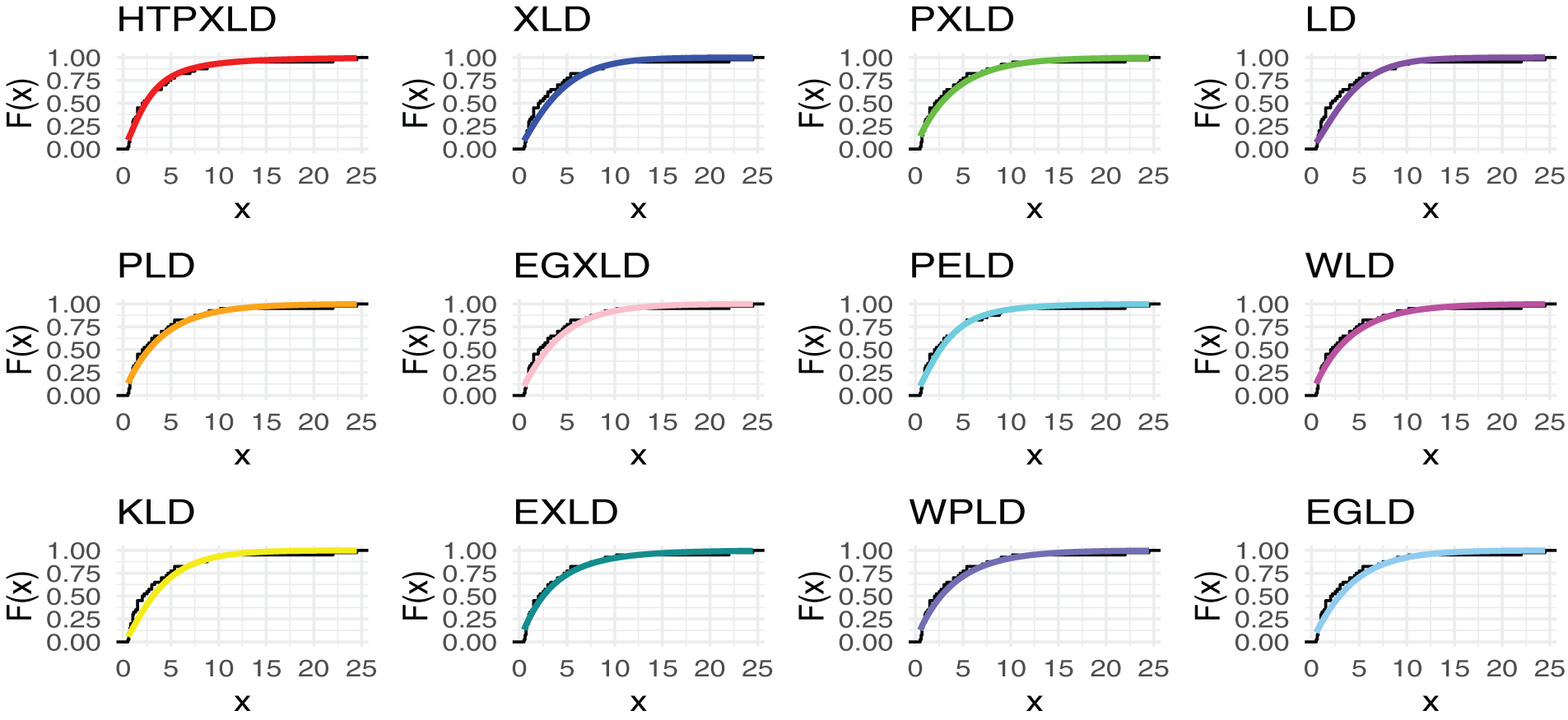

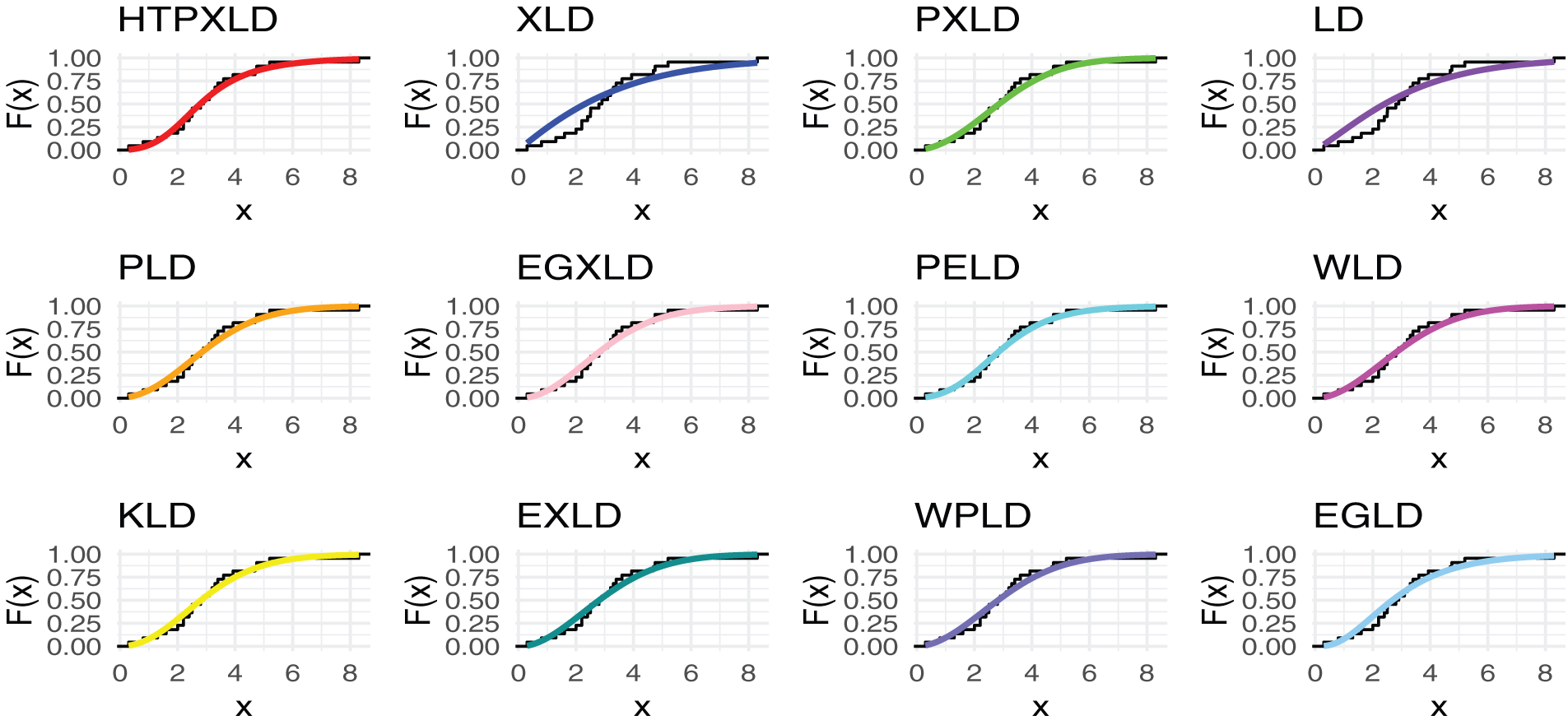

Figure 5: Estimated CDFs for the competing models for the first dataset

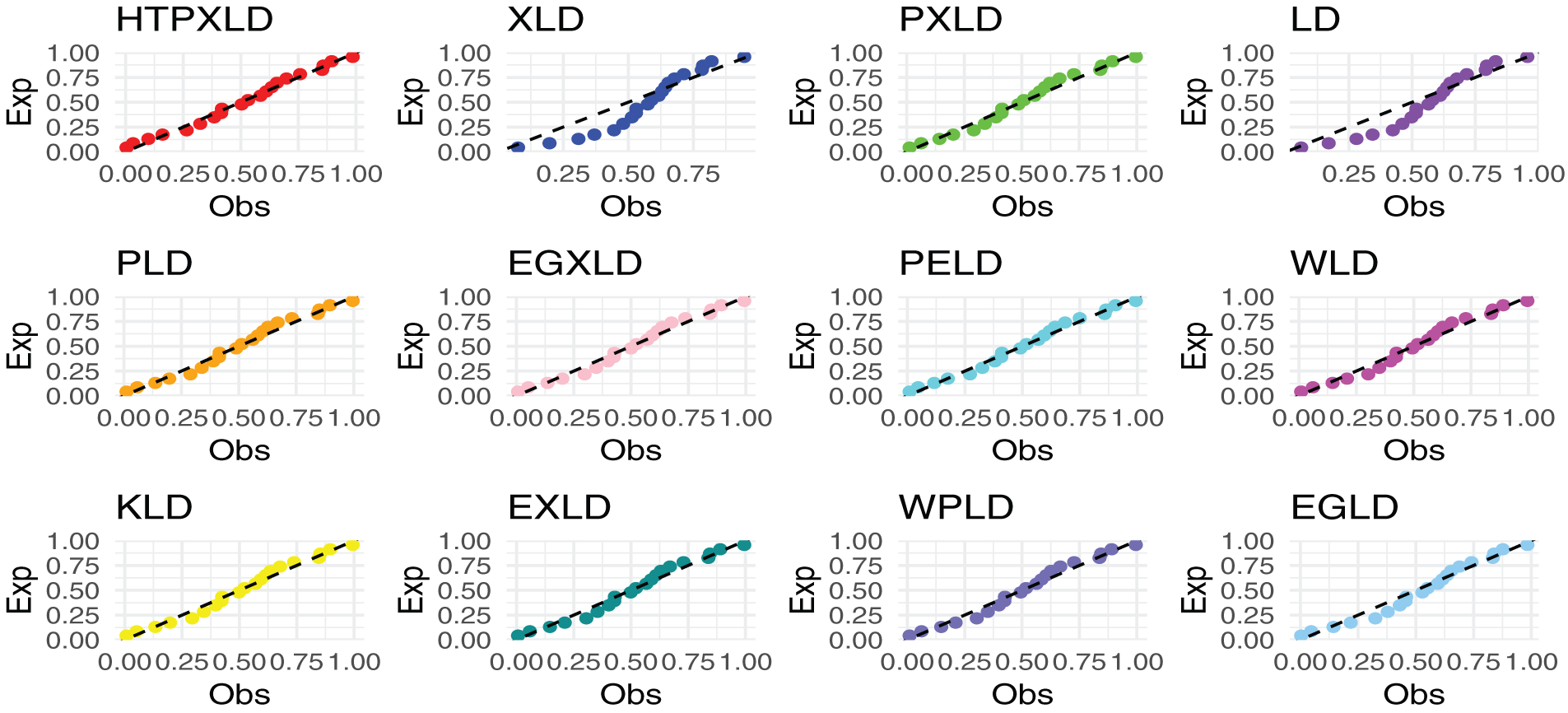

Figure 6: PP plots of competing models for the first dataset

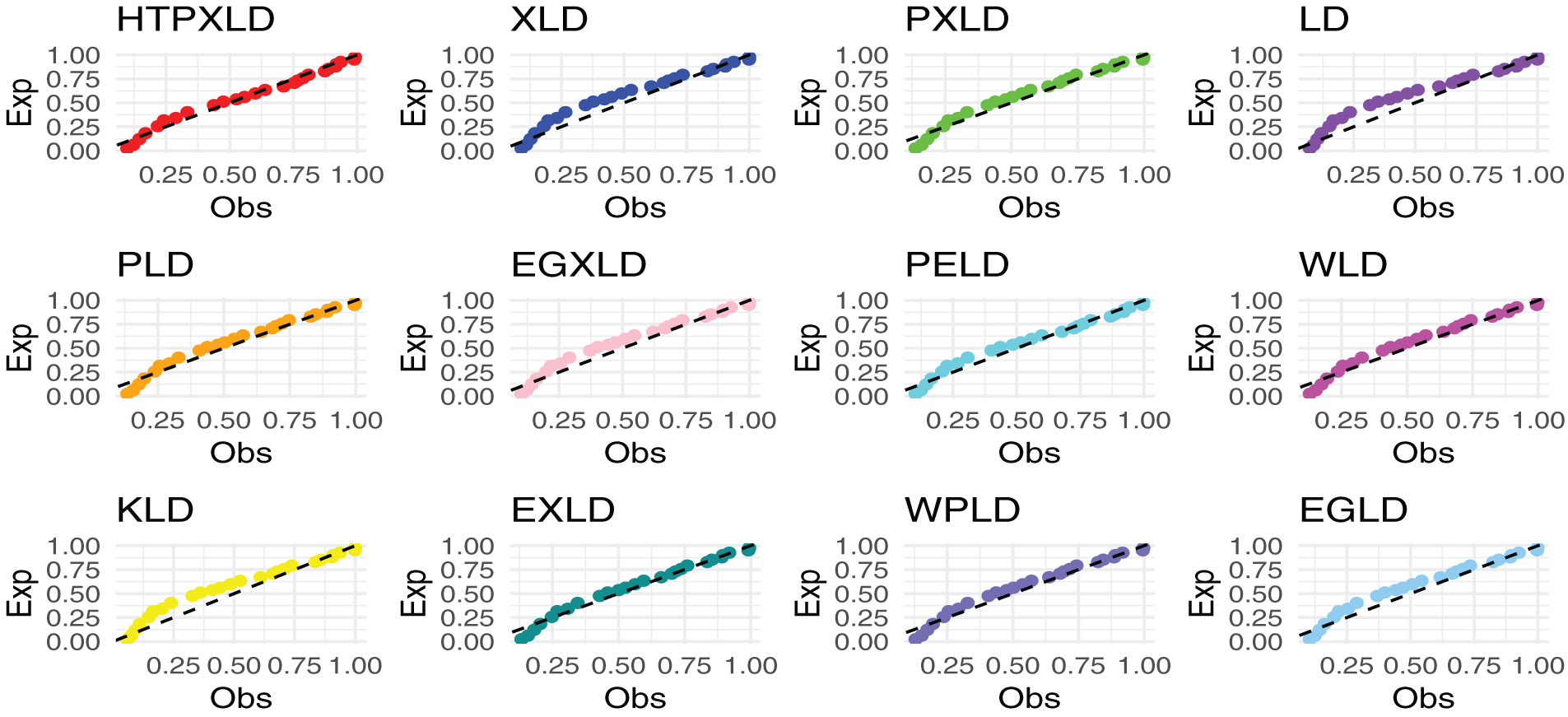

The data set provided by [60] shows the monthly remission periods of 128 individuals with bladder cancer who were selected at random. the data set that we work with is 0.08, 2.09, 3.48, 4.87, 6.94, 8.66, 13.11, 23.63, 0.2, 2.23, 3.52, 4.98, 6.97, 9.02, 13.29, 0.4, 2.26, 3.57, 5.06, 7.09, 9.22, 13.8, 25.74, 0.5, 2.46, 3.64, 5.09, 7.26, 9.47, 14.24, 25.82, 0.51, 2.54, 3.7, 5.17, 7.28, 9.74, 14.76, 6.31, 0.81, 2.62, 3.82, 5.32, 7.32, 10.06, 14.77, 32.15, 2.64, 3.88, 5.32, 7.39, 10.34, 14.83, 34.26, 0.9, 2.69, 4.18, 5.34, 7.59, 10.66, 15.96, 36.66, 1.05, 2.69, 4.23, 5.41, 7.62, 10.75, 16.62, 43.01, 1.19, 2.75, 4.26, 5.41, 7.63, 17.12, 46.12, 1.26, 2.83, 4.33, 5.49, 7.66, 11.25, 17.14, 79.05, 1.35, 2.87, 5.62, 7.87, 11.64, 17.36, 1.4, 3.02, 4.34, 5.71, 7.93, 11.79, 18.1, 1.46, 4.4, 5.85, 8.26, 11.98, 19.13, 1.76, 3.25, 4.5, 6.25, 8.37, 12.02, 2.02, 3.31, 4.51, 6.54, 8.53, 12.03, 20.28, 2.02, 3.36, 6.76, 12.07, 21.73, 2.07, 3.36, 6.93, 8.65, 12.63, 22.69.

Table 12 displays the results of the descriptive analysis for this dataset.

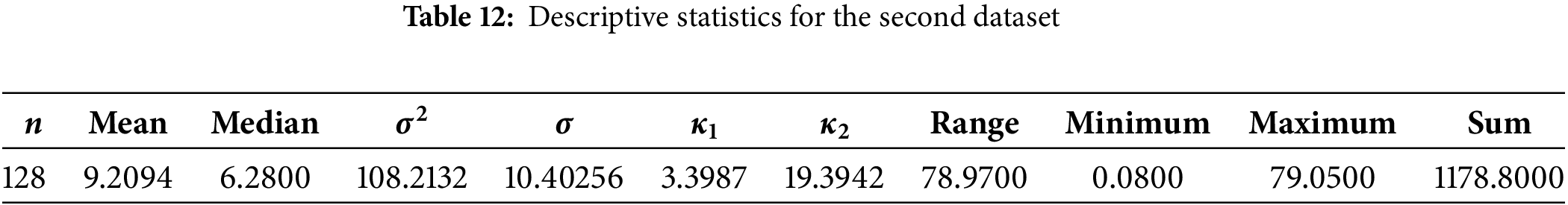

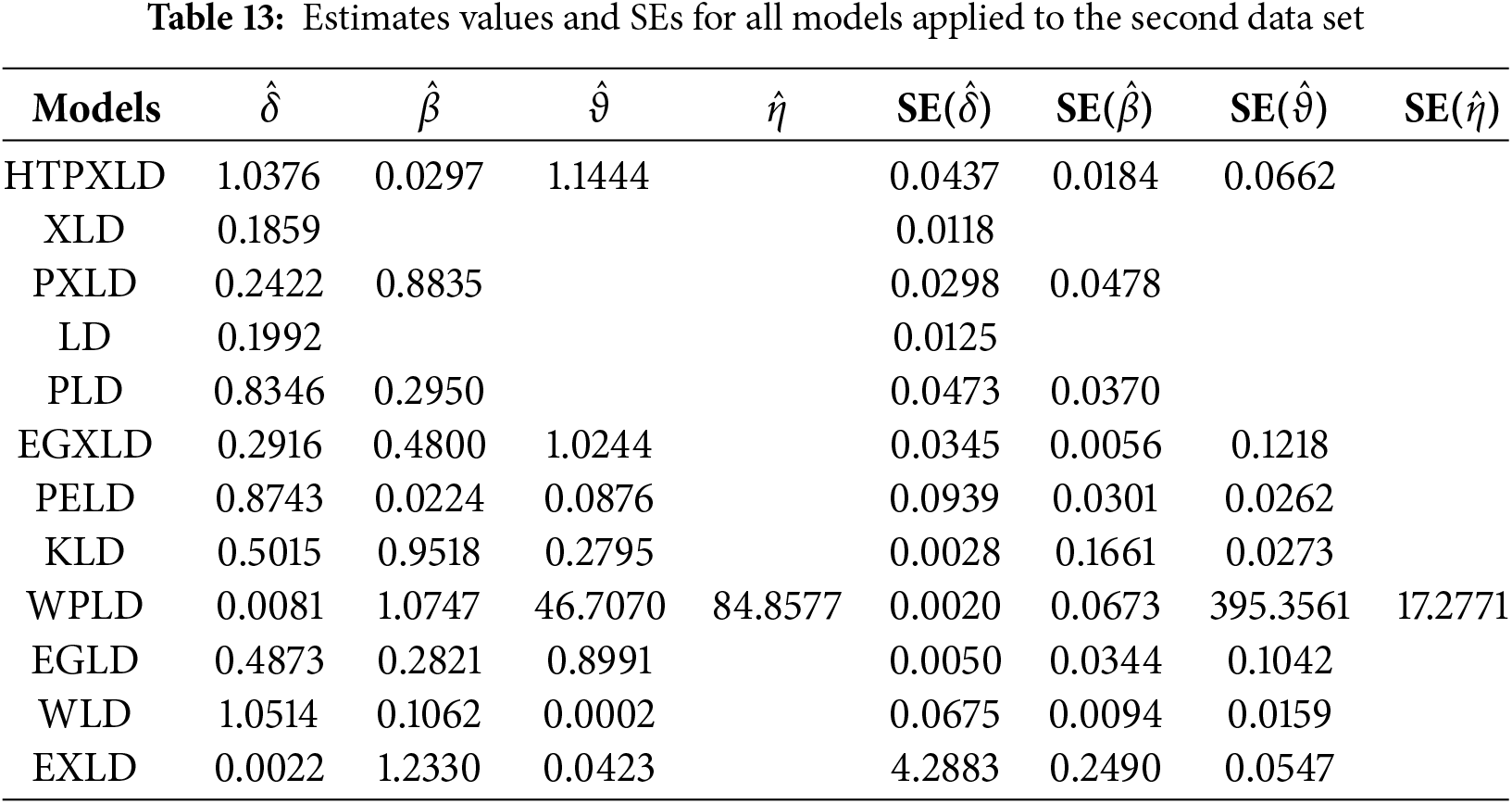

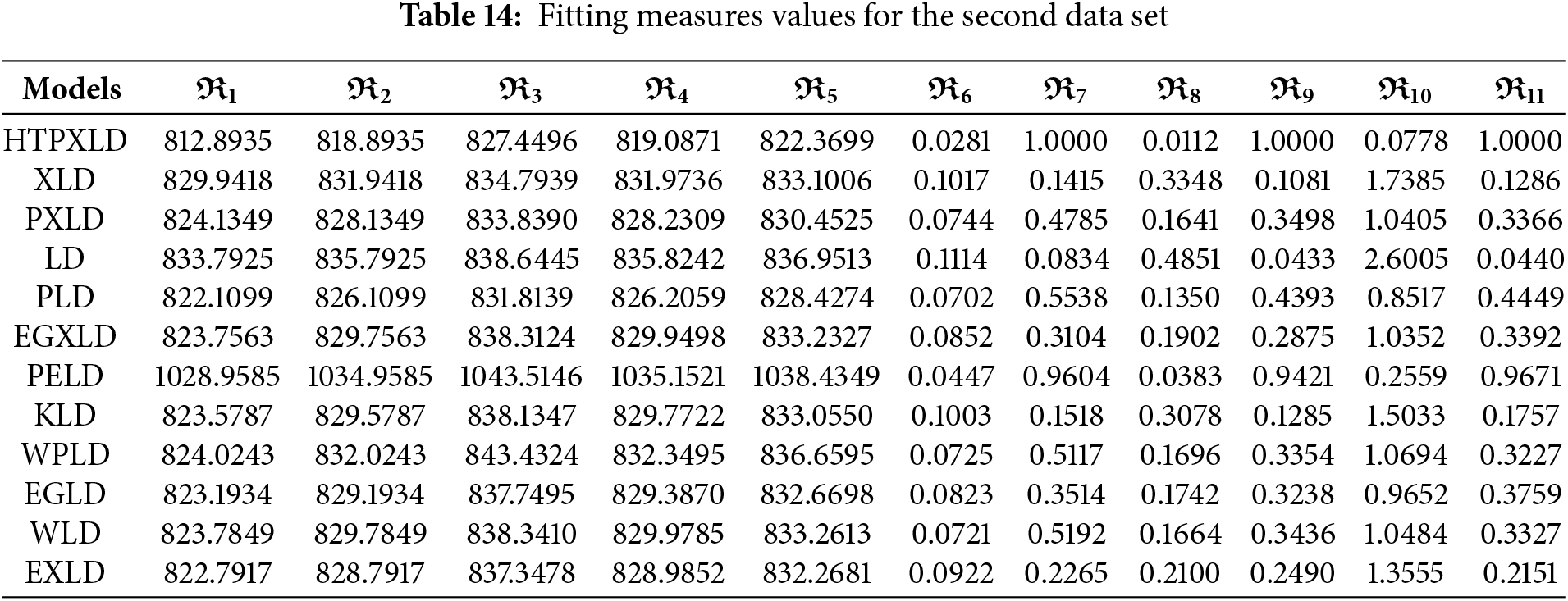

For the second dataset, Table 13 presents the MLEs along with their SEs. Table 14 provides the numerical values for the

Figure 7: Some basic non-parametric plots for the second dataset

Figure 8: Estimated PDFs for the competing models for the second dataset

Figure 9: Estimated CDFs for the competing models for the second dataset

Figure 10: Estimated CDFs for the competing models for the second dataset

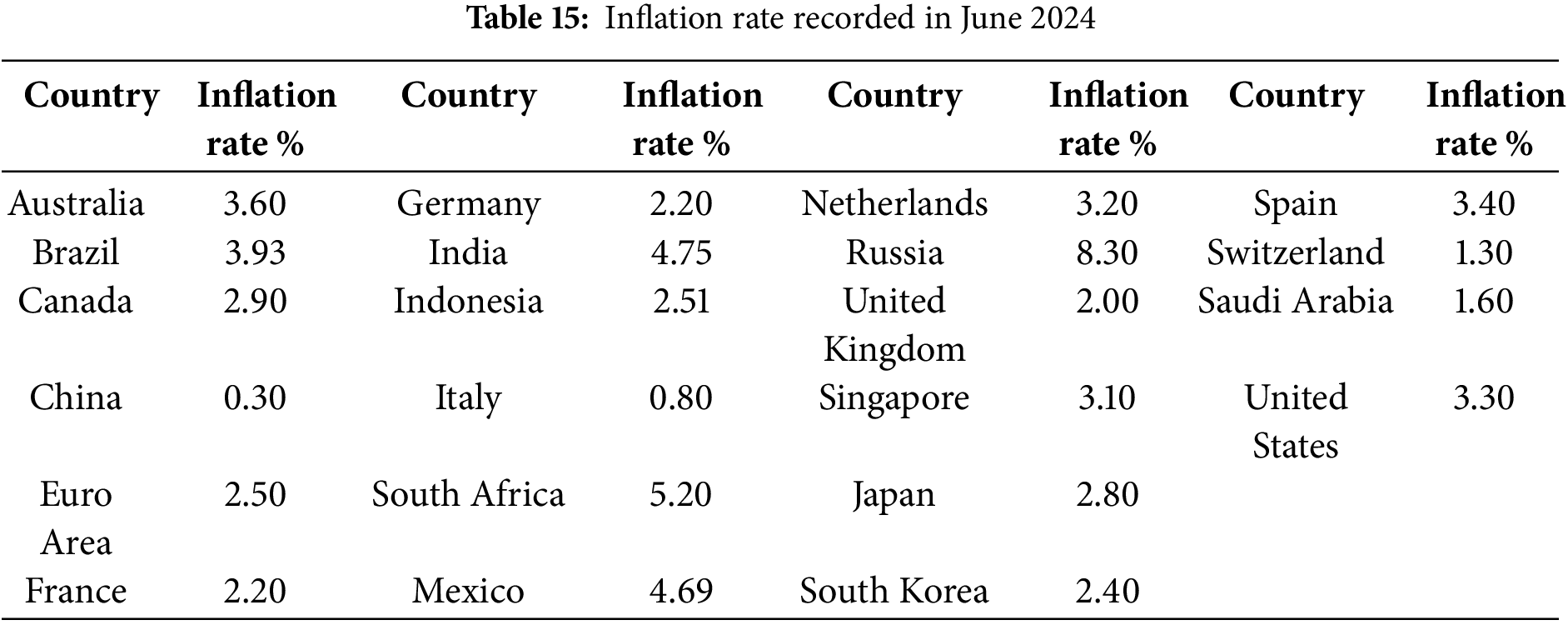

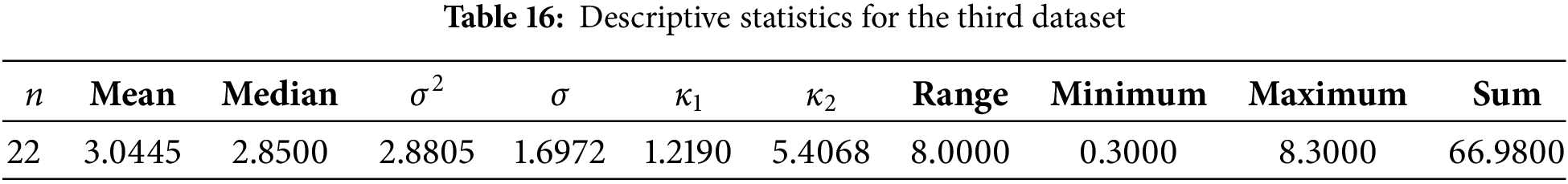

The third data set represents values for the inflation rate in several countries that were recorded in June 2024. The term “inflation rate” describes how prices for products and services vary over time. The electronic address from which it was taken is as follows: https://tradingeconomics.com/ (accessed on 07 February 2025). The data set is reported in Table 15. Table 16 displays the results of the descriptive analysis for this dataset.

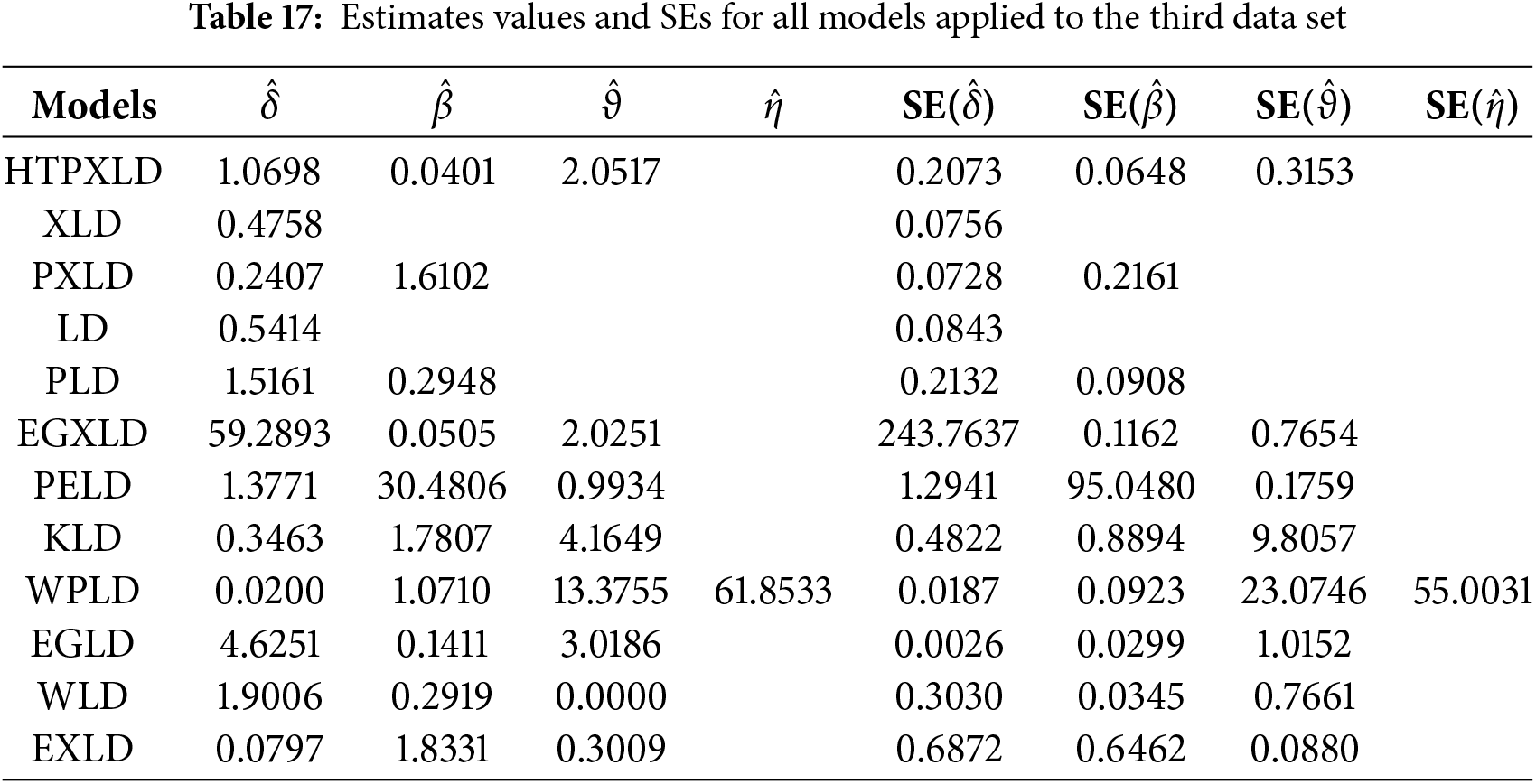

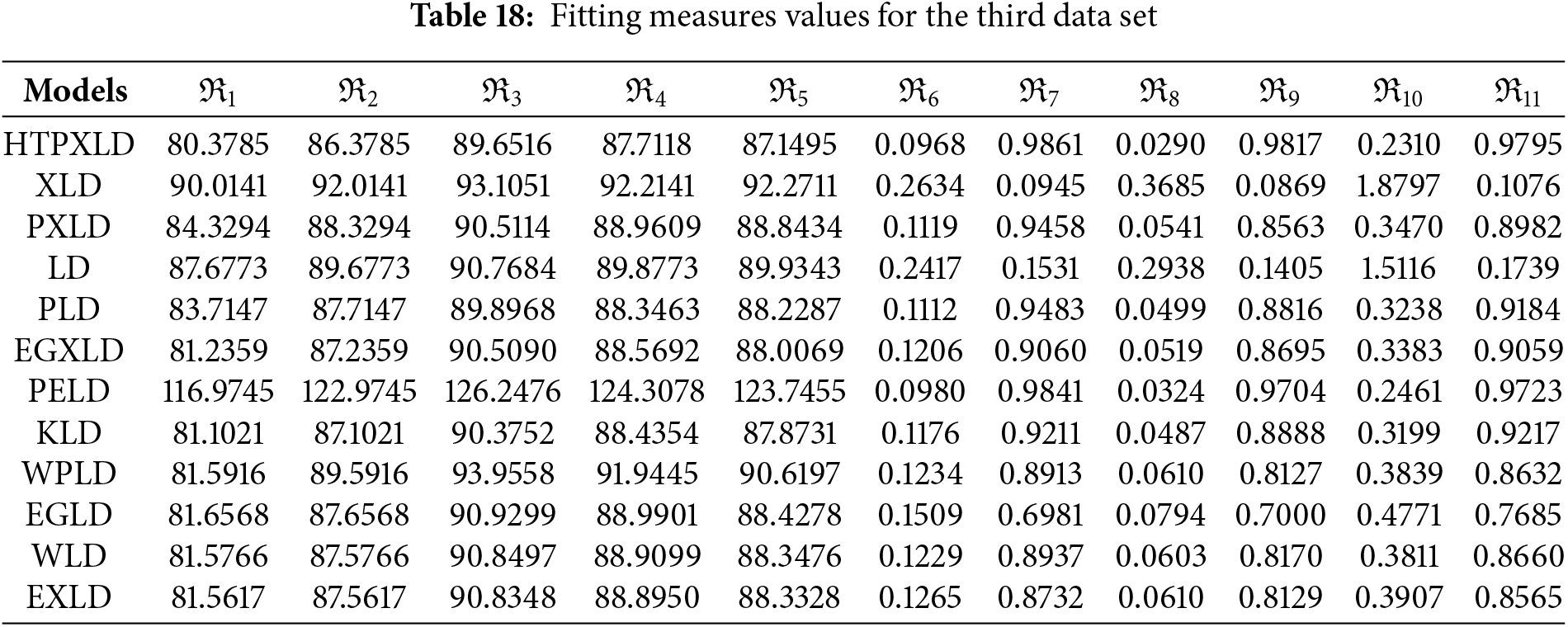

For the third dataset, Table 17 presents the MLEs along with their SEs. Table 18 provides the numerical values for the

Figure 11: Some basic non-parametric plots for the third dataset

Figure 12: Estimated PDFs for the competing models for the third dataset

Figure 13: Estimated CDFs for the competing models for the third dataset

Figure 14: PP plots of competing models for the third dataset

From the numerical values in Tables 11, 14, and 18 the HTPXLD is better than XLD, LD, EGXLD, PELD, KLD, WPLD, EGLD, PLD, WLD, EXLD, and PXLD for the three datasets.

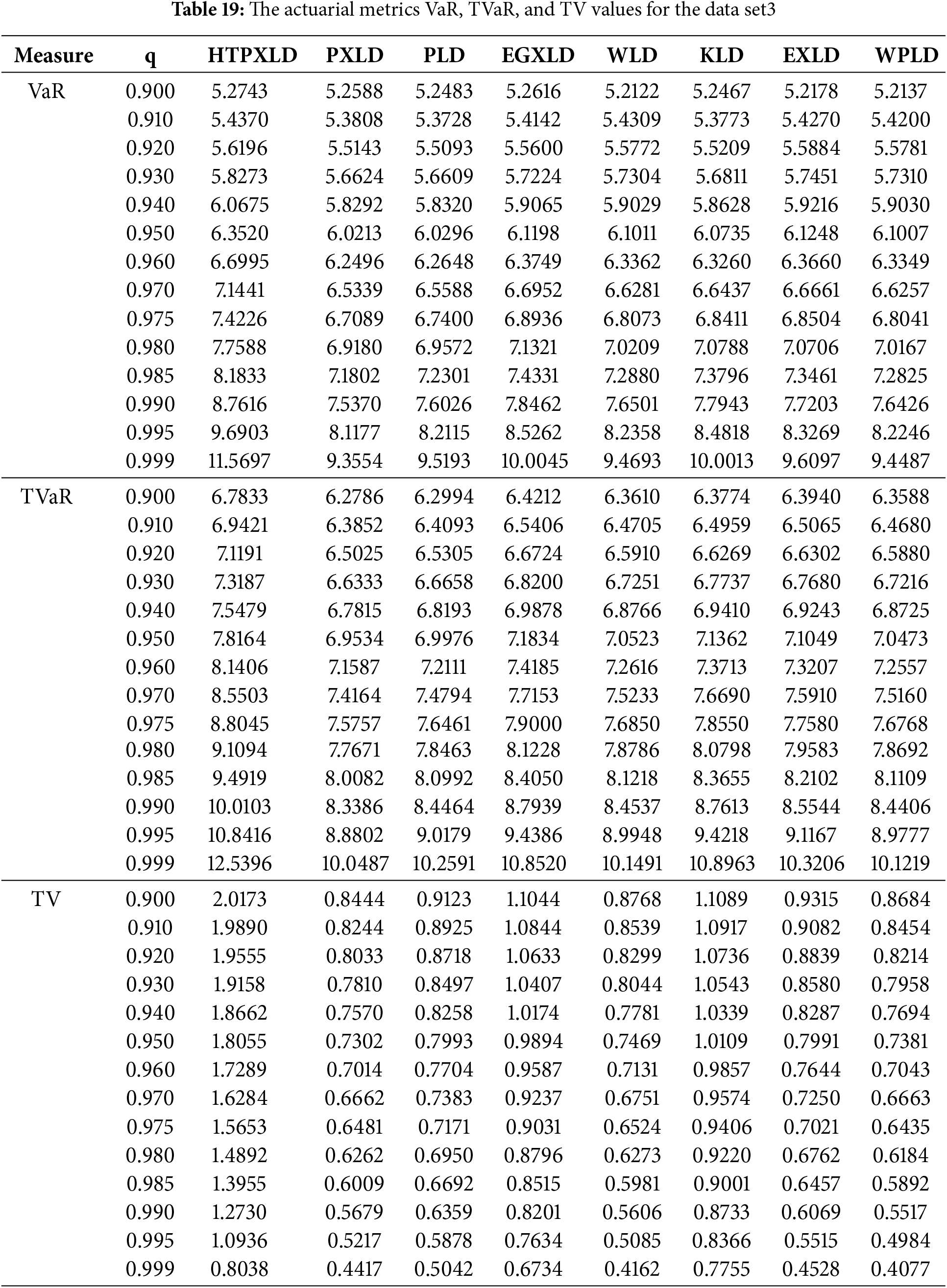

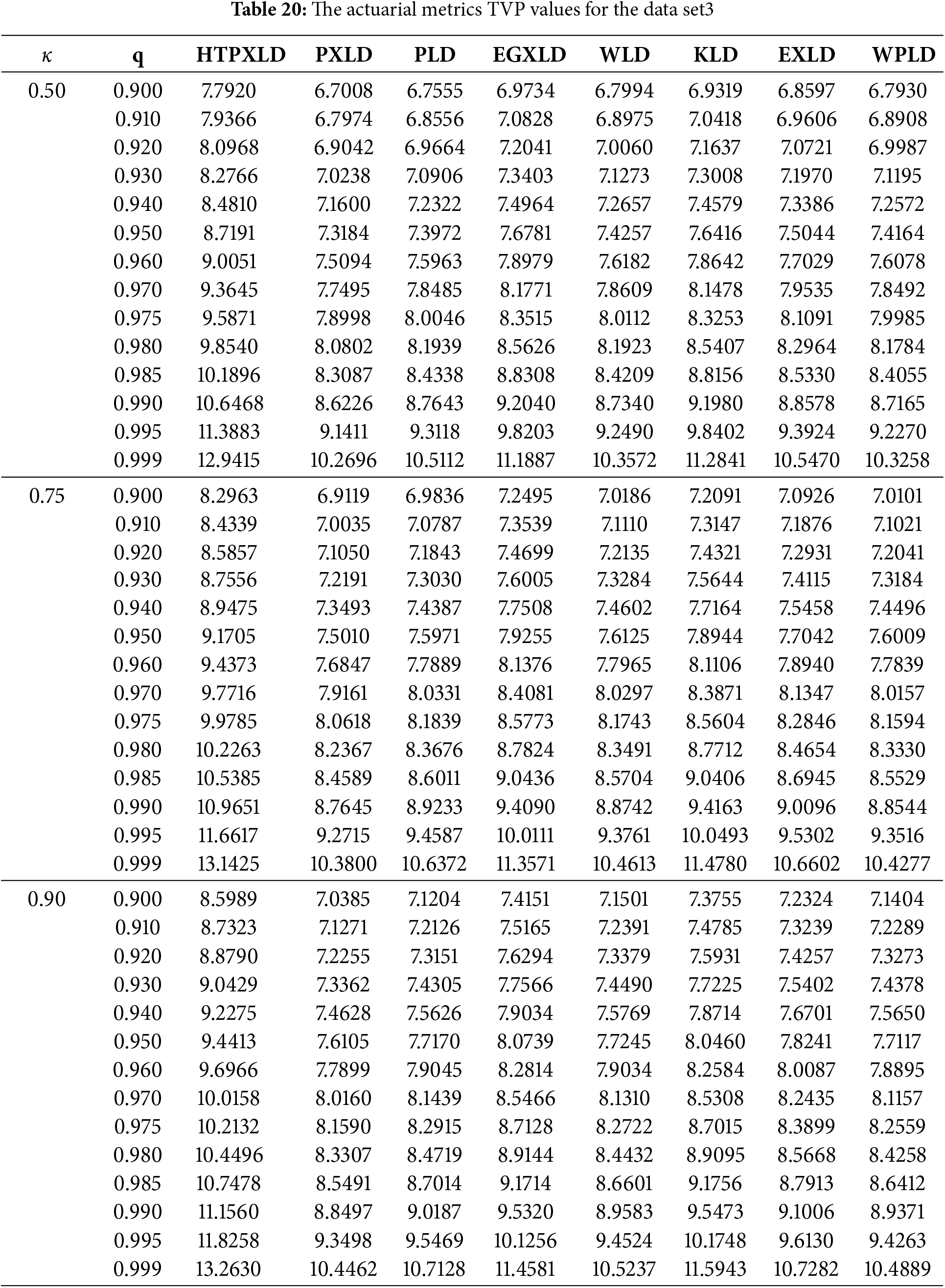

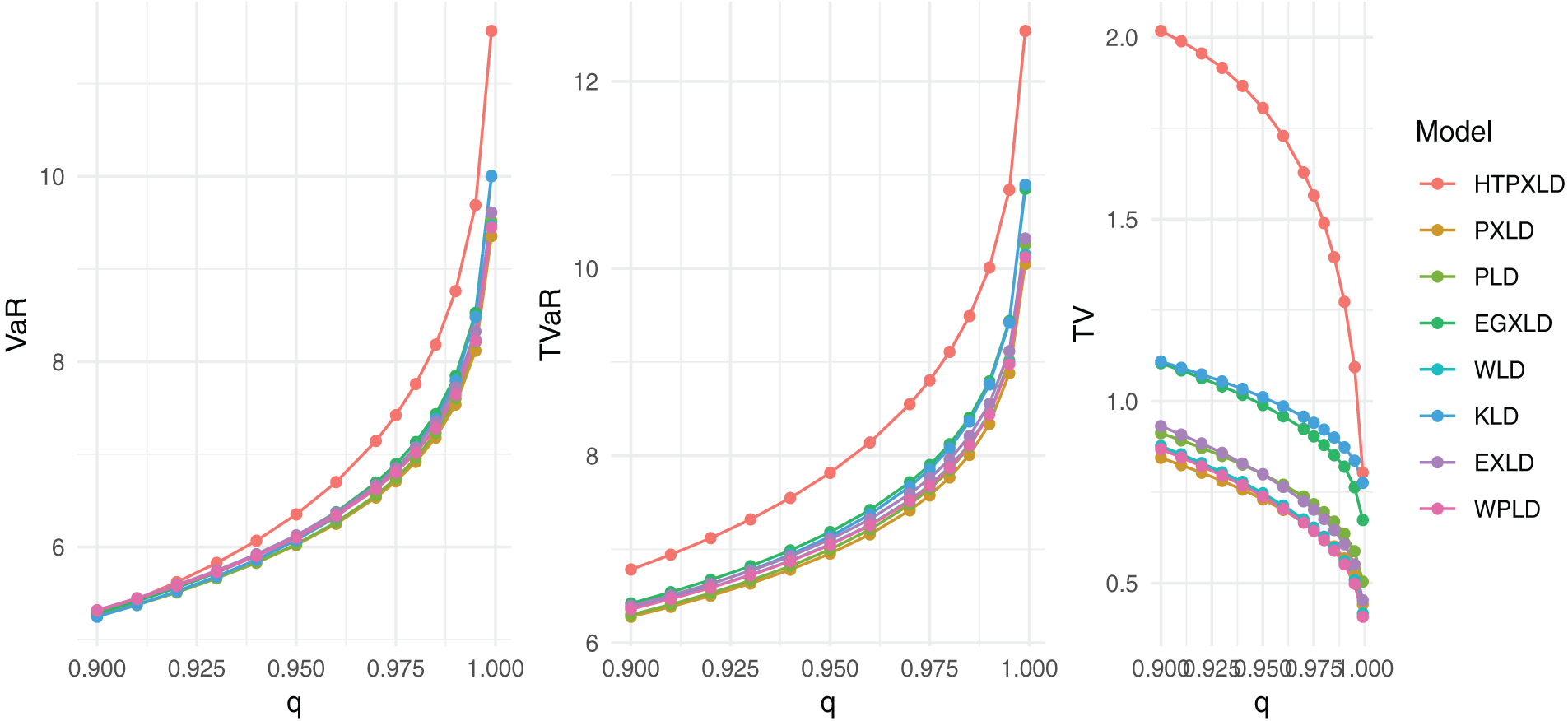

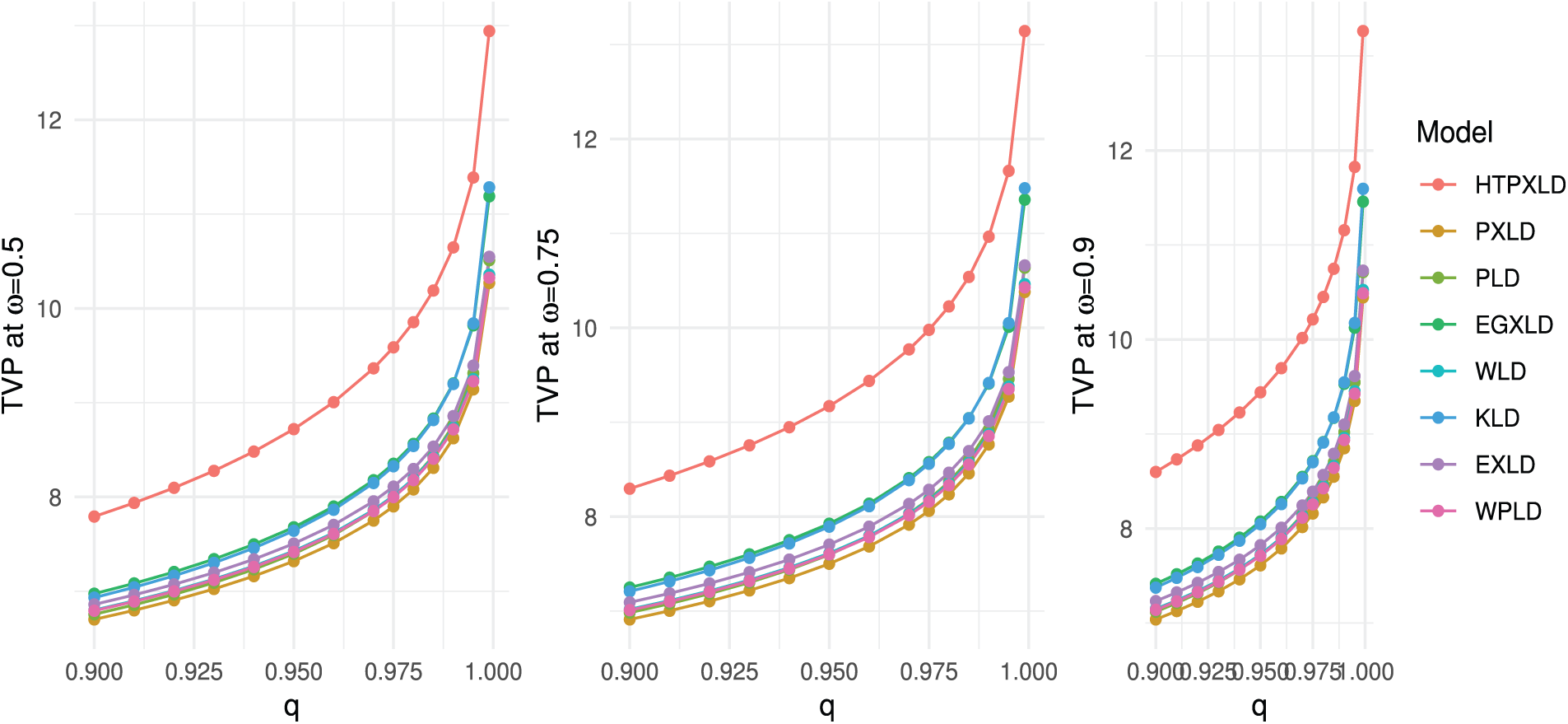

The actuarial measures VaR, TVaR, TV, and TVP of the HTPXLD, PXLD, PLD, EGXLD, WLD, KLD, EXLD, and WPLD are computed and compared using the third data set in the following. Tables 19 and 20 present the numerical findings.

We find that for different significance levels

Figure 15: Competing model VaR, TVaR, and TV plots for the third dataset

Figure 16: Competing model TVP plots for the third dataset

In the applied sciences, modeling heavy-tailed datasets is an important task, especially in domains like finance, medicine, and actuarial analysis. This paper constructs a novel heavy-tailed distribution by combining the PXLD with a heavy-tailed family. Especially when modeling leptokurtic lifespan data, that is, data with thicker tails this novel distribution presents a strongly modified version of the PXLD. With asymmetric forms and different degrees of peakedness, our suggested density gives more versatility, and its hazard rate function has various shapes. We delve into its statistical properties, deriving the quantile function, moments, incomplete moments, stochastic ordering, SS reliability parameter, and some extropy measures. We employ the ML procedure to estimate the model parameters. To assess the effectiveness of our proposed estimators, we conduct various simulation experiments. These experiments will evaluate the estimator’s performance using metrics like an average estimate, relative bias, bias, mean squared error, root mean squared error, average interval length, and coverage probability. We employ our suggested model to examine three real-world datasets to demonstrate its usefulness. The simulation analysis provided evidence that MLEs exhibit improved accuracy with increasing sample size. This is supported by the observed decrease in MSE, which is consistent with the theoretical expectation of parameter estimates converging toward their true values as the sample size grows. As sample numbers rise, the CP of the approximate CIs improves. As a result, we can be more certain that the actual parameter values fall inside the stated confidence intervals. Next, we evaluate its effectiveness in comparison to well-known rival models, emphasizing its benefits. A limitation of this study lies in its exclusive reliance on deriving point and interval estimates using the maximum likelihood method in the case of a complete sample. The simulation analysis presented in this work focuses specifically on scenarios with large sample sizes. Future studies should examine how well the HTPXLD performs in more realistic settings, such as those requiring ranked set sampling. Future studies should examine the HTPXLD’s performance on a larger variety of datasets with a range of attributes to fully evaluate its adaptability.

Acknowledgement: The authors thank King Saud University, Riyadh, Saudi Arabia for Supporting this research by Project Number (RSPD2025R548).

Funding Statement: This research is supported by researchers Supporting Project Number (RSPD2025R548), King Saud University, Riyadh, Saudi Arabia.

Author Contributions: Mohammed Elgarhy: Writing—original draft, Validation, Methodology, Formal analysis, Conceptualization, Writing—review, Investigation. Amal S. Hassan: Writing—original draft, Validation, Methodology, Formal analysis, Conceptualization, Writing—review, Investigation. Najwan Alsadat: Writing—original draft, Validation, Methodology, Formal analysis, Conceptualization, Writing—review, Investigation. Oluwafemi Samson Balogun: Writing—original draft, Validation, Methodology, Formal analysis, Conceptualization, Writing—review, Investigation. Ahmed W. Shawki: Writing—original draft, Validation, Methodology, Formal analysis, Conceptualization, Writing—review, Investigation. Ibrahim E. Ragab: Writing—original draft, Validation, Methodology, Formal analysis, Conceptualization, Writing—review, Investigation. All authors reviewed the results and approved the final version of the manuscript.

Availability of Data and Materials: All data generated or analyzed during this study are included in this published article.

Ethics Approval: Not applicable.

Conflicts of Interest: The authors declare no conflicts of interest to report regarding the present study.

References

1. Chouia S, Zeghdoudi H. The XLindley distribution: properties and application. J Stat Theory Appl. 2021;20(2):318–27. doi:10.2991/jsta.d.210607.001. [Google Scholar] [CrossRef]

2. Krishnarani S. On a power transformation of half-logistic distribution. J Probab Stat. 2016;2016(5):2084236. doi:10.1155/2016/2084236. [Google Scholar] [CrossRef]

3. Al-Omari A, Alhyasat K, Ibrahim K, Abu Bakar M. Power length-biased Suja distribution: properties and application. Electron J Appl Stat Anal. 2019;12(12):429–52. doi:10.1285/i20705948v12n2p429. [Google Scholar] [CrossRef]

4. Hassan AS, Nassar SG. Power lindley-G family. Ann Data Sci. 2019;6(2):189–210. doi:10.1007/s40745-018-0159-y. [Google Scholar] [CrossRef]

5. Shanker R, Shukla KK. Power weighted Sujayha distribution with properties and application to survival times of patients of head and neck cancer. Reliab Theory Appl. 2023;18(3):568–81. [Google Scholar]

6. Rady E, Hassanein W, Elhaddad T. The power Lomax distribution with an application to bladder cancer data. SpringerPlus. 2016;5:1–22. doi:10.1186/s40064-016-3464-y. [Google Scholar] [PubMed] [CrossRef]

7. Hassan AS, Nassr SG. Power lomax poisson distribution: properties and estimation. J Data Sci. 2018;16(1):105–28. doi:10.6339/JDS.201801_16(1).0007. [Google Scholar] [CrossRef]

8. Afify AZ, Gemeay AM, Alfaer NM, Cordeiro GM, Hafez EH. Power-modified kies-exponential distribution: properties, classical and bayesian inference with an application to engineering data. Entropy. 2022;24(7):883. doi:10.3390/e24070883. [Google Scholar] [PubMed] [CrossRef]

9. Hassan AS, Assar SM, Abd Elghaffar AM. Statistical properties and estimation of power-transmuted inverse Rayleigh distribution. Stat Trans New Series. 2020;21(3):1–20. doi:10.21307/stattrans-2020-046. [Google Scholar] [CrossRef]

10. Meriem B, Gemeay AM, Almetwally EM, Halim Z, Alshawarbeh E, Abdulrahman AT, et al. The power XLindley distribution: statistical inference, fuzzy reliability, and COVID-19 application. J Funct Spaces. 2022;2022(2):9094078. doi:10.1155/2022/9094078. [Google Scholar] [CrossRef]

11. Marshall AW, Olkin I. A new method for adding a parameter to a family of distributions with application to the exponential and Weibull families. Biometrika. 1997;84(3):641–52. doi:10.1093/biomet/84.3.641. [Google Scholar] [CrossRef]

12. Eugene N, Lee C, Famoye F. Beta-normal distribution and its applications. Commun Stat-Theor Meth. 2002;31(4):497–512. doi:10.1081/STA-120003130. [Google Scholar] [CrossRef]

13. Cordeiro GM, de Castro M. A new family of generalized distributions. J Stat Comput Simul. 2011;81(7):883–98. doi:10.1080/00949650903530745. [Google Scholar] [CrossRef]

14. Alzaatreh A, Lee C, Famoye F. A new method for generating families of continuous distributions. METRON. 2013;71(1):63–79. doi:10.1007/s40300-013-0007-y. [Google Scholar] [CrossRef]

15. Bourguignon M, Silva RB, Cordeiro GM. The Weibull-G family of probability distributions. J Data Sci. 2014;12(1):53–68. doi:10.6339/JDS.201401_12(1).0004. [Google Scholar] [CrossRef]

16. Kumar D, Singh U, Singh SK. A method of proposing new distribution and its application to bladder cancer patient data. J Stat Probab Lett. 2015;2:235–45. [Google Scholar]

17. Cordeiro GM, Alizadeh M, Diniz Marinho PR. The type I half-logistic family of distributions. J Stat Comput Simul. 2015;86(4):707–28. doi:10.1080/00949655.2015.1031233. [Google Scholar] [CrossRef]

18. Cordeiro GM, Alizadeh M, Ortega EMM. The exponentiated half-logistic family of distributions: properties and applications. J Probab Stat. 2014;2014(1):864396. doi:10.1155/2014/864396. [Google Scholar] [CrossRef]

19. Bodhisuwan W, Sangsanit Y. The Topp-Leone generator of distributions: properties and inferences. Songklanakarin J Sci Technol. 2016;38(5):537–48. [Google Scholar]

20. Alizadeh M, Cordeiro GM, Pinho LGB, Ghosh I. The Gompertz-G family of distributions. J Stat Theory Pract. 2016;11(1):179–207. doi:10.1080/15598608.2016.1267668. [Google Scholar] [CrossRef]

21. Chipepa F, Oluyede B, Makubate B, Fagbamigbe AF. The beta odd Lindley-G family of distributions with applications. J Probab Stat Sci. 2019;17(1):51–83. [Google Scholar]

22. Hassan AS, Sabry MAH, Elsehery AM. A new probability distribution family arising from truncated power lomax distribution with application to weibull model. Pak J Stat Oper Res. 2020;16(4):661–74. doi:10.18187/pjsor.v16i4.3442. [Google Scholar] [CrossRef]

23. Kavya P, Manoharan M. Some parsimonious models for lifetimes and applications. J Stat Comput Simul. 2021;91:3693–708. doi:10.1080/00949655.2021.1946064. [Google Scholar] [CrossRef]

24. Hassan AS, Al-Omari AI, Hassan RR, Alomani G. The odd inverted Topp Leone H family of distributions: estimation and applications. J Radiat Res Appl Sci. 2022;15(3):365–79. doi:10.1016/j.jrras.2022.08.006. [Google Scholar] [CrossRef]

25. Korkmaz MÇ., Cordeiro GM, Yousof HM, Pescim RR, Afify AZ, Nadarajah S. The Weibull Marshall-Olkin family: regression model and application to censored data. Commun Stat-Theor Meth. 2018;48(16):4171–94. doi:10.1080/03610926.2018.1490430. [Google Scholar] [CrossRef]

26. Souza L, de Oliveira WR, de Brito CCR, Chesneau C, Fernandes R, Ferreira TAE. Sec-G class of distributions: properties and applications. Symmetry. 2022;14(2):299. doi:10.3390/sym14020299. [Google Scholar] [CrossRef]

27. Hassan AS, Alsadat N, Chesneau C, Shawki AW. A novel weighted family of probability distributions with applications to world natural gas, oil, and gold reserves. Mathem Biosci Eng. 2023;20(11):19871–911. doi:10.3934/mbe.2023880. [Google Scholar] [PubMed] [CrossRef]

28. Shah Z, Khan DM, Khan Z, Faiz N, Hussain S, Anwar A, et al. A new generalized logarithmic-X family of distributions with biomedical data analysis. Appl Sci. 2023;13(6):3668. doi:10.3390/app13063668. [Google Scholar] [CrossRef]

29. Musekwa RR, Gabaitiri L, Makubate B. A new technique to generate families of continuous distributions. Revista Colombiana De Estadistica. 2024;47(2):329–54. doi:10.15446/rce.v47n2.112245. [Google Scholar] [CrossRef]

30. Makubate B, Chipepa F, Oluyede B, Moagi G. The Marshall-Olkin-exponentiated half logistic-G family of distributions: model, properties and applications. J Statist Manag Syst. 2024;27(7):1243–59. doi:10.47974/JSMS-854. [Google Scholar] [CrossRef]

31. Ahmad Z, Mahmoudi E, Hamedani CG, Kharazmi O. New methods to define heavy-tailed distributions with applications to insurance data. J Taibah Univ Sci. 2020;14(1):359–82. doi:10.1080/16583655.2020.1741942. [Google Scholar] [CrossRef]

32. Ahmad Z, Mahmoudi E, Hamedani GG. A class of claim distributions: properties, characterizations and applications to insurance claim data. Commun Stat-Theor Meth. 2020;51(7):2183–208. doi:10.1080/03610926.2020.1772306. [Google Scholar] [CrossRef]

33. Nadarajah S, Lyu J. New discrete heavy tailed distributions as models for insurance data. PLoS One. 2025;18(5):e0285183. doi:10.1371/journal.pone.0285183. [Google Scholar] [PubMed] [CrossRef]

34. Nair J, Wierman A, Zwart B. The fundamentals of heavy tails: properties, emergence, and estimation. Cambridge, UK: Cambridge University Press; 2022. doi:10.1017/9781009053730. [Google Scholar] [CrossRef]

35. McNeil AJ. Estimating the tails of loss severity distributions using extreme value theory. ASTIN Bull. 1997;27(1):117–37. doi:10.2143/AST.27.1.563210. [Google Scholar] [CrossRef]

36. Olmos NM, Gomez-Deniz E, Venegas O. The heavy-tailed gleser model: properties, estimation, and applications. Mathematics. 2022;10(23):4577. doi:10.3390/math10234577. [Google Scholar] [CrossRef]

37. Zhao W, Khosa SK, Ahmad Z, Aslam M, Affy AZ. Type-I heavy tailed family with applications in medicine, engineering and insurance. PLoS One. 2020;15(8):e0237462. doi:10.1371/journal.pone.0237462. [Google Scholar] [PubMed] [CrossRef]

38. Moakofi T, Oluyede B. The type I heavy-tailed odd power generalized Weibull-G family of distributions with applications. Commun Fac Sci Univ Ankara Series A1 Math Stat. 2023;72(4):921–58. doi:10.31801/cfsuasmas.1195058. [Google Scholar] [CrossRef]

39. Moakofi T, Oluyede B, Tlhaloganyang B, Puoetsile A. A new family of heavy-tailed generalized Topp-Leone-G distributions with applications. Pak J Stat Oper Res. 2024;20(2):233–60. doi:10.18187/pjsor.v20i2.4458. [Google Scholar] [CrossRef]

40. Ahmad Z, Mahmoudi E, Dey S. A new family of heavy tailed distributions with an application to the heavy tailed insurance loss data. Commun Statist-Simulat Computat. 2020;51(8):4372–95. doi:10.1080/03610918.2020.1741623. [Google Scholar] [CrossRef]

41. Corless RM, Gonnet GH, Hare DE, Jeffrey DJ, Knuth DE. On the Lambert W function. Adv Comput Math. 1995;5(1):329–59. doi:10.1007/BF02124750. [Google Scholar] [CrossRef]

42. Kenney JF, Keeping E. Mathematics of statistics (part one). Louisville, KY, USA: D. Van Nostrand Company, Inc.; 1962. [Google Scholar]

43. Moors JJA. A quantile alternative for kurtosis. J Royal Stat Soc: Series D (Stat). 1988;37(1):25–32. [Google Scholar]

44. Butler RJ, McDonald JB. Using incomplete moments to measure inequality. J Econom. 1989;42(1):109–19. doi:10.1016/0304-4076(89)90079-1. [Google Scholar] [CrossRef]

45. Shaked M, Shanthikumar JG. Stochastic orders and their applications. New York, NY, USA: Academic Press; 1994. [Google Scholar]

46. Shannon CE. A mathematical theory of communication. Bell Syst Tech J. 1948;27(3):379–423. doi:10.1002/j.1538-7305.1948.tb01338.x. [Google Scholar] [CrossRef]

47. Lad F, Sanfilippo G, Agr G. Extropy: complementary dual of entropy. Statist Sci. 2015;30(1):40–58. doi:10.1214/14-STS430. [Google Scholar] [CrossRef]

48. Balakrishnan N, Buono F, Longobardi M. On weighted extropies. Commun Stat-Theor Meth. 2022;51(18):6250–67. doi:10.1080/03610926.2020.1860222. [Google Scholar] [CrossRef]

49. Artzner P. Application of coherent risk measures to capital requirements in insurance. N Am Actuar J. 1999;3(2):11–25. doi:10.1080/10920277.1999.10595795. [Google Scholar] [CrossRef]

50. Landsman Z. On the tail mean-variance optimal portfolio selection. Insur Math Econ. 2010;46(3):547–53. doi:10.1016/j.insmatheco.2010.02.001. [Google Scholar] [CrossRef]

51. Lindley DV. Fiducial distributions and Bayes’ theorem. J Royal Stat Soc: Series B (Meth). 1958;20(1):102–10. doi:10.1111/j.2517-6161.1958.tb00278.x. [Google Scholar] [CrossRef]

52. Musekwa RR, Makubate B. A flexible generalized XLindley distribution with application to engineering. Sci Afr. 2024;24(2):e02192. doi:10.1016/j.sciaf.2024.e02192. [Google Scholar] [CrossRef]

53. Rajitha CS, Akhilnath A. Generalization of the Lindley distribution with application to COVID-19 data. Int J Data Sci Anal. 2022;23:1–21. doi:10.1007/s41060-022-00369-2. [Google Scholar] [PubMed] [CrossRef]

54. Abdelmoezz S, Mohamed SM. The kumaraswamy lindley regression model with application on the Egyptian stock exchange: numerical study, regression model. Jurnal Matematika, Statistika Dan Komputasi. 2021;18(1):1–11. doi:10.20956/j.v18i1.14784. [Google Scholar] [CrossRef]

55. MirMostafaee SMTK, Alizadeh M, Altun E, Nadarajah S. The exponentiated generalized power Lindley distribution: properties and applications. Appl Mathem-J Chin Univ. 2019;34(2):127–48. doi:10.1007/s11766-019-3515-6. [Google Scholar] [CrossRef]

56. Ghitany ME, Al-Mutairi DK, Balakrishnan N, Al-Enezi LJ. Power Lindley distribution and associated inference. Computat Statist Data Analy. 2013;64(9):20–33. doi:10.1016/j.csda.2013.02.026. [Google Scholar] [CrossRef]

57. Asgharzadeh AKBAR, Nadarajah S, Sharafi F. Weibull Lindley distribution. Revstat-Statist J. 2018;16(1):87–113. doi:10.57805/revstat.v16i1.234. [Google Scholar] [CrossRef]

58. Bakouch HS, Al-Zahrani BM, Al-Shomrani AA, Marchi VA, Louzada F. An extended Lindley distribution. J Korean Statist Soc. 2012;41(1):75–85. doi:10.1016/j.jkss.2011.06.002. [Google Scholar] [CrossRef]

59. Lemonte AJ, Barreto-Souza W, Cordeiro GM. The exponentiated Kumaraswamy distribution and its log-transform. Braz J Probab Stat. 2013;27(1):31–53. doi:10.1214/11-BJPS149. [Google Scholar] [CrossRef]

60. Lee ET, Wang J. Statistical methods for survival data analysis. New York, NY, USA: John Wiley & Sons; 2003. Vol. 476. [Google Scholar]

Cite This Article

Copyright © 2025 The Author(s). Published by Tech Science Press.

Copyright © 2025 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools