Open Access

Open Access

REVIEW

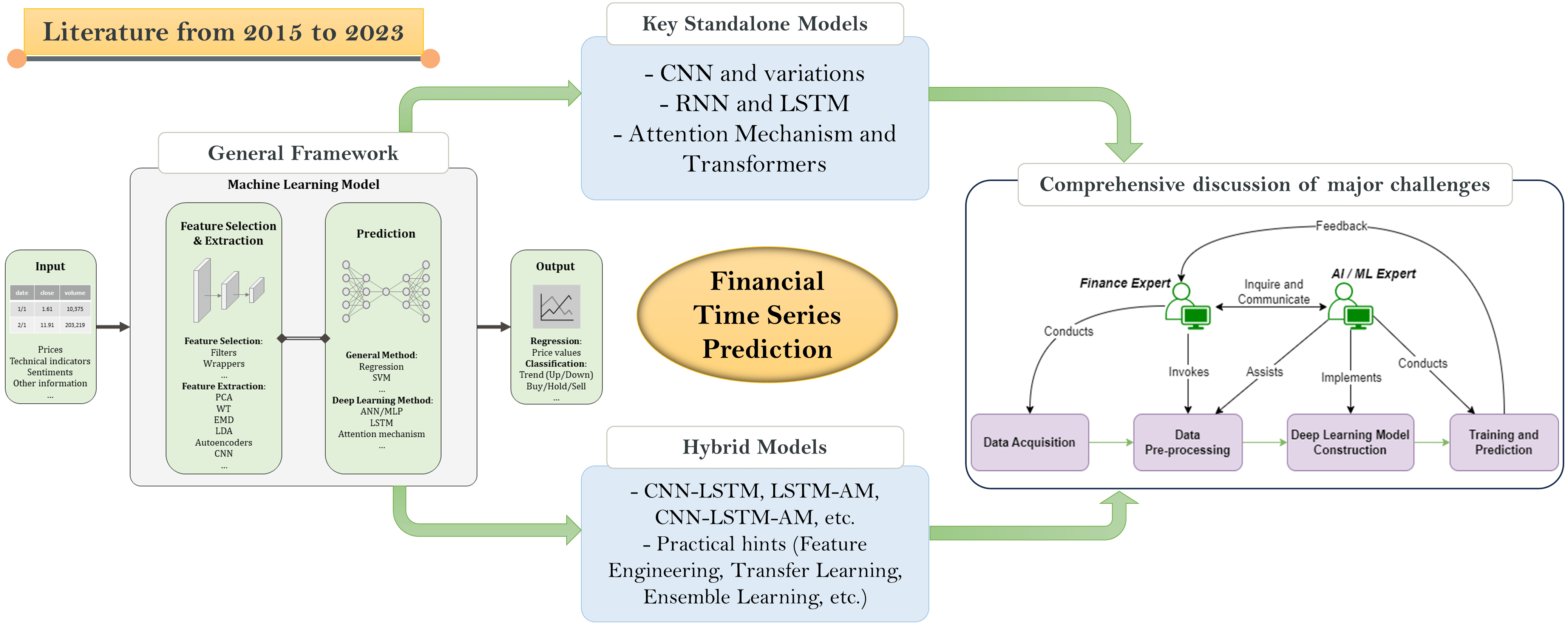

Deep Learning for Financial Time Series Prediction: A State-of-the-Art Review of Standalone and Hybrid Models

1 School of Software Engineering, Xiamen University of Technology, Xiamen, 361024, China

2 Peter Faber Business School, Australian Catholic University, North Sydney, 2060, Australia

3 Department of Information Engineering, Polytechnic University of Marche, Ancona, 60121, Italy

* Corresponding Authors: Weisi Chen. Email: ; Walayat Hussain. Email:

(This article belongs to the Special Issue: Machine Learning Empowered Distributed Computing: Advance in Architecture, Theory and Practice)

Computer Modeling in Engineering & Sciences 2024, 139(1), 187-224. https://doi.org/10.32604/cmes.2023.031388

Received 09 June 2023; Accepted 18 September 2023; Issue published 30 December 2023

Abstract

Financial time series prediction, whether for classification or regression, has been a heated research topic over the last decade. While traditional machine learning algorithms have experienced mediocre results, deep learning has largely contributed to the elevation of the prediction performance. Currently, the most up-to-date review of advanced machine learning techniques for financial time series prediction is still lacking, making it challenging for finance domain experts and relevant practitioners to determine which model potentially performs better, what techniques and components are involved, and how the model can be designed and implemented. This review article provides an overview of techniques, components and frameworks for financial time series prediction, with an emphasis on state-of-the-art deep learning models in the literature from 2015 to 2023, including standalone models like convolutional neural networks (CNN) that are capable of extracting spatial dependencies within data, and long short-term memory (LSTM) that is designed for handling temporal dependencies; and hybrid models integrating CNN, LSTM, attention mechanism (AM) and other techniques. For illustration and comparison purposes, models proposed in recent studies are mapped to relevant elements of a generalized framework comprised of input, output, feature extraction, prediction, and related processes. Among the state-of-the-art models, hybrid models like CNN-LSTM and CNN-LSTM-AM in general have been reported superior in performance to stand-alone models like the CNN-only model. Some remaining challenges have been discussed, including non-friendliness for finance domain experts, delayed prediction, domain knowledge negligence, lack of standards, and inability of real-time and high-frequency predictions. The principal contributions of this paper are to provide a one-stop guide for both academia and industry to review, compare and summarize technologies and recent advances in this area, to facilitate smooth and informed implementation, and to highlight future research directions.Graphic Abstract

Keywords

Cite This Article

Copyright © 2024 The Author(s). Published by Tech Science Press.

Copyright © 2024 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools