Open Access

Open Access

ARTICLE

Novel Early-Warning Model for Customer Churn of Credit Card Based on GSAIBAS-CatBoost

School of Science, Wuhan University of Technology, Wuhan, 430070, China

* Corresponding Authors: Congjun Rao. Email: ; Fuyan Hu. Email:

(This article belongs to the Special Issue: Data-Driven Robust Group Decision-Making Optimization and Application)

Computer Modeling in Engineering & Sciences 2023, 137(3), 2715-2742. https://doi.org/10.32604/cmes.2023.029023

Received 25 January 2023; Accepted 16 March 2023; Issue published 03 August 2023

Abstract

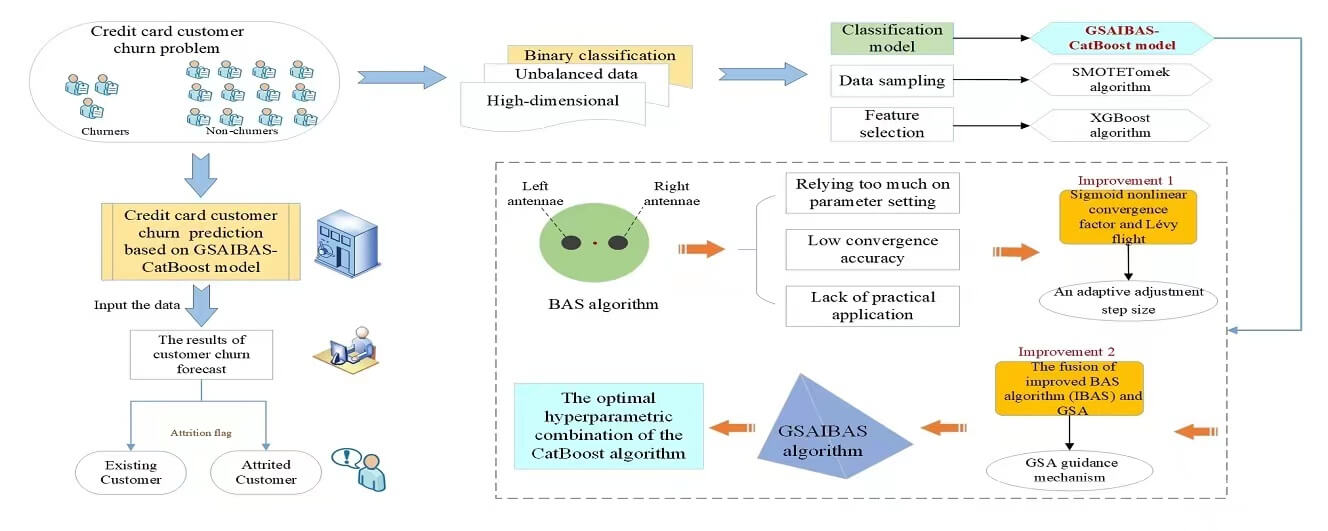

As the banking industry gradually steps into the digital era of Bank 4.0, business competition is becoming increasingly fierce, and banks are also facing the problem of massive customer churn. To better maintain their customer resources, it is crucial for banks to accurately predict customers with a tendency to churn. Aiming at the typical binary classification problem like customer churn, this paper establishes an early-warning model for credit card customer churn. That is a dual search algorithm named GSAIBAS by incorporating Golden Sine Algorithm (GSA) and an Improved Beetle Antennae Search (IBAS) is proposed to optimize the parameters of the CatBoost algorithm, which forms the GSAIBAS-CatBoost model. Especially, considering that the BAS algorithm has simple parameters and is easy to fall into local optimum, the Sigmoid nonlinear convergence factor and the lane ight equation are introduced to adjust the fixed step size of beetle. Then this improved BAS algorithm with variable step size is fused with the GSA to form a GSAIBAS algorithm which can achieve dual optimization. Moreover, an empirical analysis is made according to the data set of credit card customers from Analyttica ocial platform. The empirical results show that the values of Area Under Curve (AUC) and recall of the proposed model in this paper reach 96.15% and 95.56%, respectively, which are significantly better than the other 9 common machine learning models. Compared with several existing optimization algorithms, GSAIBAS algorithm has higher precision in the parameter optimization for CatBoost. Combined with two other customer churn data sets on Kaggle data platform, it is further verified that the model proposed in this paper is also valid and feasible.Graphic Abstract

Keywords

Cite This Article

Copyright © 2023 The Author(s). Published by Tech Science Press.

Copyright © 2023 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools