| Computer Modeling in Engineering & Sciences |  |

DOI: 10.32604/cmes.2022.018437

ARTICLE

Research on the Impact of Market Concern for Real Estate Policy on Housing Prices: Evidence from Internet Search and Hedonic Price Theory

School of Economics and Management, Beijing University of Technology, Beijing, 100124, China

*Corresponding Author: Yang Gao. Email: gaoyang@bjut.edu.cn

Received: 24 July 2021; Accepted: 26 November 2021

Abstract: To avoid the effects of systemic financial risks caused by extreme fluctuations in housing price, the Chinese government has been exploring the most effective policies for regulating the housing market. Measuring the effect of real estate regulation policies has been a challenge for present studies. This study innovatively employs big data technology to obtain Internet search data (ISD) and construct market concern index (MCI) of policy, and hedonic price theory to construct hedonic price index (HPI) based on building area, age, ring number, and other hedonic variables. Then, the impact of market concerns for restrictive policy, monetary policy, fiscal policy, security policy, and administrative supervision policy on housing prices is evaluated. Moreover, compared with the common housing price index, the hedonic price index considers the heterogeneity of houses and could better reflect the changes in housing prices caused by market supply and demand. The results indicate that (1) a long-term interaction relationship exists between housing prices and market concerns for policy (MCP); (2) market concerns for restrictive policy and administrative supervision policy effectively restrain rising housing prices while those for monetary and fiscal policy have the opposite effect. The results could serve as a useful reference for governments aiming to stabilize their real estate markets.

Keywords: Real estate policy; market concerns for policy; hedonic price; Internet search data; housing prices

The real estate industry is an important link among many industries in China's national economic development. Owing to its high correlation and strong driving force, it has become one of the most important industries in China. To avoid excessive housing price fluctuations caused by systemic financial risks, the government has been exploring policies for regulating the housing market, including fiscal, monetary, and purchase restriction policies. For example, in 2010, the “purchase restriction order” was first introduced, which aimed to prevent the rapid rise of house prices by restricting purchase qualifications. In 2015, “destocking” was proposed to reduce real estate inventory. In 2017, the “317 New Deals” was proposed in Beijing, with stricter purchase restrictions. In 2021, Hangzhou issued restriction of “sales and purchase” to strengthen the real estate market regulation. Although the government employs an intensive regulation policy on housing prices, the effect of the policy does not reach expectations [1]. Simultaneously, the recent outbreak of the epidemic caused a long-term impact and greater pressure on the housing market in China. Therefore, implementing effective real-estate regulation policies is crucial.

Real estate regulation policies are crucial in the housing market [2]. Market participants can easily and instantly obtain relevant policy information through the internet. The impulse of policy information causes psychological changes in market participants, affecting their decision-making and affecting housing prices. Market participants’ concerns regarding policy information are important indicators reflecting the psychological changes of participants [3]. Thus, market concerns for policy (MCP) affect housing prices.

Internet search data (ISD) has a high prediction accuracy, is timely, and its samples exhibit obvious statistical significance. ISD can compensate for the hysteresis of traditional methods owing to its timeliness and can reflect the information of market concern [4,5]. Simultaneously, hedonic price theory (HPT) can remove the influence of characteristic changes from housing prices and obtain price changes caused by market supply and demand so it can better reflect housing price fluctuations. Therefore, ISD is selected as the measure of MCP, and hedonic price index (HPI) is selected as the housing price index, achieving the purpose of evaluating the impact of market concerns for policy on housing prices. Simultaneously, by analyzing their relationship, the impact of policies on housing prices could be reflected from a unique perspective, providing new perspective for estimating the impact of real estate policies.

Given the important role policies play in the real estate market, the regulatory effects of real estate policies have received extensive attention. Most scholars have conducted research on the effectiveness of both monetary and restrictive policies. As an essential macro-control policy, monetary policy works primarily through adjustment of interest rates and credit instruments. Iacoviello [6] studied the real estate markets of six European countries (France, Germany, Italy, Spain, Sweden, and Germany) and found that negative monetary policy had a significant negative impact on the market, and monetary policy shocks were crucial in driving housing price volatility in the short term. Research on the Norwegian [7] and on the South African [8] markets proved that loose monetary policy increased housing prices. Hasan et al. [9] considered the UK real estate market as the research object and believed that monetary policy tools, such as interest rate and credit scale, had a significant impact on housing prices. Yu et al. [10] found that a low mortgage interest rate was the most important factor in the soaring housing prices in Taipei; for every 1% increase in interest rate, housing prices fell by 5% to 17%. China has employed rigorous regulatory measures aimed at reducing speculative investment demand and curbing rising housing prices. Beijing was the first city to implement a purchase restriction policy. Scholars have argued on the effectiveness of the purchase restriction policy. Sun et al. [11] used Beijing as a sample to establish a breakpoint regression model, proving that purchase restriction policy in Beijing reduced resale prices by 17%–24%. Wu et al. [12] used data from 70 cities in China and proved that purchase restriction policy had a significant impact on housing prices and transaction volumes. However, some scholars have denied the effectiveness of restrictive policies. Cao et al. [13] performed a breakpoint regression based on the data of 70 Chinese cities. They concluded that although purchase restriction policy caused a sharp drop in housing prices and transaction volume, it had no significant effect on curbing the real estate bubble [13]. Jia et al. [14] found that purchase restriction policy in Guangzhou positively impacted housing prices based on housing resale transaction data, which was far from the expectations of policymakers. Some scholars have also studied the influence of other types of policies on the housing market. Magliocca et al. [15] studied the influence of land policy on real estate developers. Jiang et al. [16] simulated the effects of social welfare housing policy. The results showed that owing to rapid urbanization and improvement of living conditions, this type of policy could meet the growth of housing demand and therefore effectively alleviate price increase in the real estate market [16].

Most studies on real estate policies are based on historical data [17], and only a few studies have utilized ISD. Historical data have a certain lag, but ISD is timely and can reflect netizens’ concerns on policies and reflect their behavioral trends in reality [18]. Many scholars have employed ISD to build agents of market concerns for the stock market and crude oil market and achieved good results. To forecast the stock market, Vozlyublennaia et al. [19] built an agent of attention by searching the index and analyzing the relationship between attention and short-term index returns. They thought that the increase in investor attention improved market efficiency and led to short-term index returns, and when index returns were impacted, attention also changed [19]. The volume of Internet searches on the market included relevant information that investors prioritized [4,20]. For the crude oil market, Yao et al. [21] and Guo et al. [3] used the Google Trends Index to construct a timely and clear proxy for investor attention and studied the influence mechanism of consumer attention and crude oil prices. Ji et al. [22] constructed four types of oil-related event attention agents using the Google Trends Index to study the impact of four oil-related events on oil prices. Studies on the impact of policies using the ISD have been made. Wang et al. [2] believed that an Internet search was the best way for investors to obtain relevant policy information, which could reflect real estate control policies and investor concerns and expectations on the real estate market in time. They analyzed the relationship between ISD for policy-related keywords and the volume of housing transactions to study the effects of policies [2]. Zhang et al. [23] considered that a significant positive correlation was found between online search information and the effectiveness of science and technology innovation policies. Additionally, many researchers have studied the impact of real estate policies on housing prices, but most studies used official housing price data [24]. This type of data ignored the heterogeneity of houses and did not exclude housing price changes caused by heterogeneity. Therefore, adjusting housing price data is necessary. As HPT is the most widely used quality adjustment method [25], this study employs the method to compile housing price data.

In summary, the impact of real estate regulation policies on the real estate market is complex and involves various ways of action. Studies on real estate regulation are limited in three respects: first, in terms of the types of policies, many scholars have studied the impact of monetary policy and restrictive policies. However, there are few studies on security, fiscal, and administrative supervision policies. Second, on data used in the research, most studies use historical statistical data to study the effect of policy regulation, and few studies have used ISD to conduct research. Third, most of the literature in this field uses official housing price data and does not consider the impact of the heterogeneity of houses on prices. Therefore, this study innovatively uses big data technology to construct a market concern index (MCI) of policy and compile HPI, which considers the heterogeneous characteristics of houses and studies the MCI of monetary, restrictive, security, administrative supervision, and fiscal policies on hedonic prices. Additionally, as Beijing's market provides more evidence on the relationship between the real estate market and policies, this study uses the province's real estate market to explore the effects of regulation policies.

This study uses big data technology to obtain ISD and study the impact of MCP on housing price fluctuations. Using ISD can make real-time judgments on the role of the MCP and avoid the hysteresis of historical data. Additionally, considering the heterogeneity of houses on building age, traffic, number of floors, and other characteristics, this study compiles HPI to separate price changes caused by house quality from total price fluctuations, which helps us correctly judge the fluctuation of housing prices and provides a reasonable basis for policy regulation.

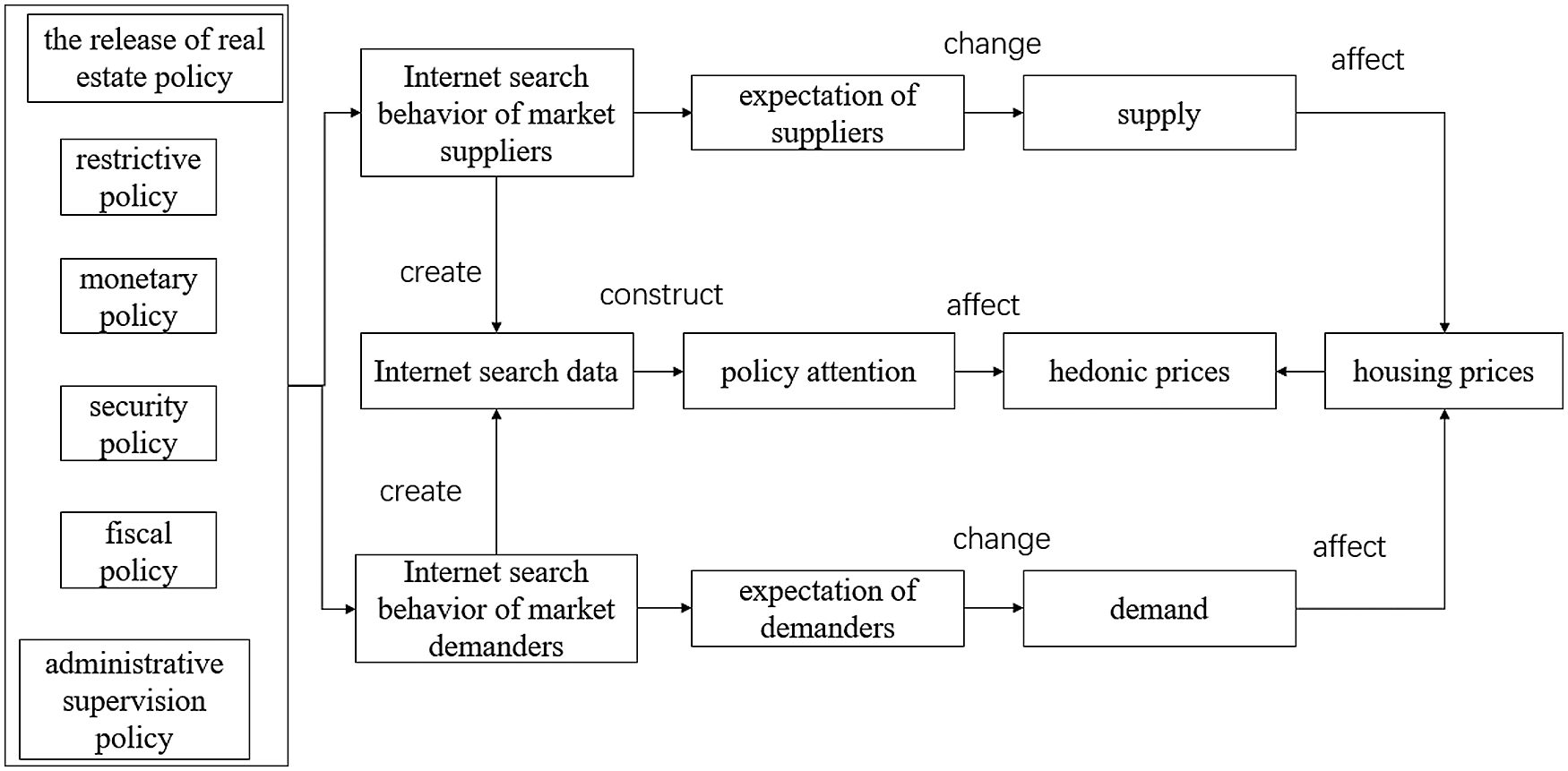

Internet search is the best way for both supply and demand sides to obtain policy information, and ISD can reflect the concerns and expectations of both sides in time [2]. Considering the above situation, this study establishes the MCI of policy based on Internet search. By studying the impact of MCP based on ISD on housing prices, policy effectiveness can be reflected from a unique perspective. This section theoretically analyzes the framework of the relationship between MCP and policy effectiveness. Framework composition is based on an analysis of the following three aspects:

(1) The response of housing buyers and real estate companies to real estate regulation policies determines the impact of the policy. The rational expectation theory holds that in economic activities, people expect prices before entering the market according to the information of past price changes. Buyers and enterprises are macroeconomic policy adjustment targets and actively influence the formulation of macroeconomic policies with their own rational expected economic behavior. Their response to macroeconomic policies determines the effects of these policies.

(2) Internet search behavior can be understood as a response to policy demand objects after the policy has produced effects. The policy effect is produced after the real estate regulation policy is promulgated. The real estate market changes and relevant personnel in the market need to gather information. Online search is the most effective way for both supply and demand parties in the real estate market to obtain policy information. More market-related personnel can obtain relevant policy information through online search.

(3) ISD can reflect the actual wishes of the actors and the information of MCP. Internet search behavior generates the ISD, and the data can reflect the attention of policy demand objects on the policy. By assessing the relationship between ISD and the real estate market, the impact of real estate policies on the real estate market can be emphasized from a unique perspective.

Based on this, this paper establishes a framework for the relationship between MCP and policy effectiveness. The specific theoretical framework is shown in Fig. 1.

Figure 1: Theoretical framework diagram

3.1 Constructing Market Concern Index of Policy

The keyword dimensionality of real estate policies is relatively high, so it is necessary to reduce the dimension or classify it. According to researches of scholars on actual estate-related policies and the attributes of keywords, this paper divides real estate policies into five categories and focuses on the impact of market concerns for restrictive policy, monetary policy, security policy, fiscal policy, and administrative supervision policy. This paper performs the following steps to filter keywords and collect the ISD of keywords to represent the interest and search behavior of the housing market for real estate policies.

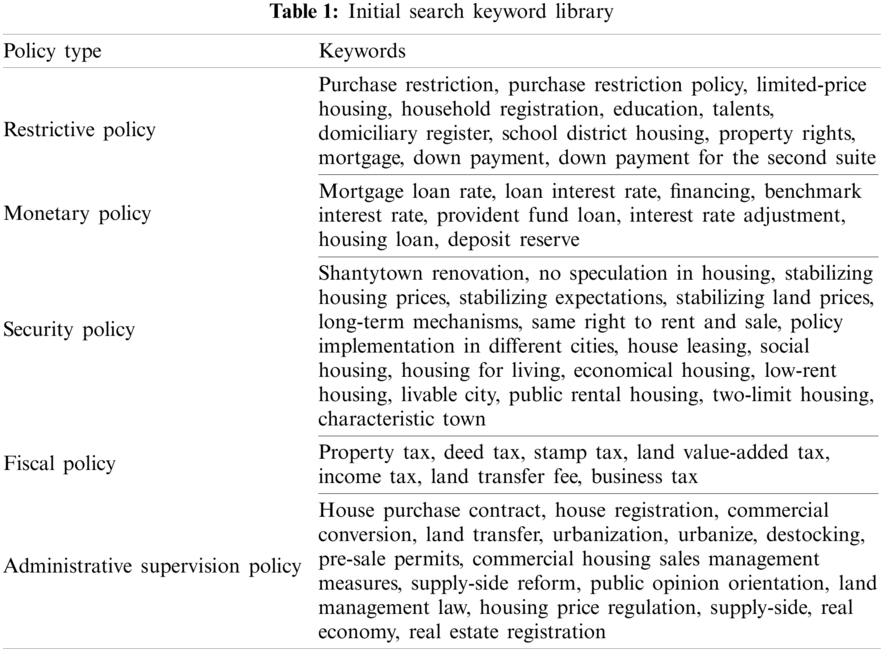

(1) Establish an initial keyword database. This paper first combines expert experience to mine keywords and use the keyword recommendation function of the Baidu Index to obtain a total of 60 non-repetitive keywords and form the initial keyword vocabulary, as shown in Table 1.

(2) Check the ISD of keywords. Manually check the data of selected keywords. Since Baidu Index does not provide search information for keywords with very few search volumes, it is necessary to check all keywords to ensure that the Baidu Index of the keyword is available for download, and remove keywords without Baidu Index.

(3) Estimate the correlation between ISD and HPI. Drawing on the practice of [26], this paper calculates the correlation coefficient between the HPI and the Baidu Index of keywords in the lag order 0–6 to select keywords. A correlation coefficient of 0.5 or higher indicates that the independent variable reflects the characteristics of the dependent variable [27]. Therefore, this paper uses 0.5 as the correlation coefficient threshold between the actual estate policy keyword and the hedonic price to filter the keywords.

After filtering the keywords, the MCI of policy is synthesized. The principal component analysis method (PCA) proved to be an effective tool for transforming various search engine data into comprehensive indicators [28,29]. Therefore, this paper synthesizes five types of policy attention indicators through PCA. The basic principle of PCA is to transform the original numerous related variables into a set of unrelated new variables through orthogonal transformation. These variables are linear combinations of the original variables. The mathematical model of PCA is:

Based on the research of [28] and [21], this paper selects the first

3.2 Constructing Hedonic Price Index

The correct judgment of housing price fluctuations is the foundation for formulating, implementing, and evaluating real estate policies. Therefore, the HPI is used to compile housing price indexes, improving the judgment of housing price fluctuations and providing a reasonable basis for policy regulation. The traditional method obtains housing price indexes by collecting housing price data in the housing market and calculating the average price ratio in different periods. The price change rate calculated by HPI includes the price difference caused by different characteristics of houses [25], ignoring the heterogeneity of houses. The compilation of HPI requires two steps as follows. First, this paper should establish a hedonic pricing model, carry out regression estimation, and screen out essential variables. Second, based on the regression results of the hedonic pricing model, this paper yields the price index by employing the conventional price index calculation method.

Hedonic variables can be divided into four categories: basic construction characteristics (such as building type, area, height, orientation, floor, etc.), neighborhood characteristics (such as plot ratio, afforestation, style, life, education, health care packages, etc.), location characteristics (such as administrative division, traffic condition, CBD distance, etc.) and transaction characteristics (for example, the method of payment, completed housing or pre-sale housing, transaction time, etc.). Based on the research on hedonic prices in domestic and foreign literature, this paper selects appropriate hedonic variables in combination with the specific situation in Beijing. The implied price of hedonic variables is mainly yielded through the linear regression of each variable. Moreover, the linear regression model assumes that the implied price is constant in a period of time, and the regression equation is:

According to the calculation method similar to the traditional Laplace index, the HPI of the fixed comparison period is calculated as follows:

Similarly, according to the calculation method similar to the Pap index, the fixed reporting period features remain unchanged, and the price index

Similarly, the Fisher index is:

The Fisher index takes the geometric mean of the fixed comparison period index and the fixed reporting period index, makes comprehensive use of the information of the comparison period, and has good economic and axiomatic characteristics.

3.3 The Impact of Market Concerns for Policy on Housing Prices

To examine the attention effect on housing prices, this paper constructed a panel regression model based on Internet search data and hedonic price index, as shown below:

The market concern index of restrictive policy, monetary policy, security policy, fiscal policy, and administrative supervision policy, respectively, indicates market concerns for corresponding real estate policies, respectively. Furthermore,

4.1 Market Concerns for Real Estate Policy

Baidu, China's largest search engine provider, leads the country's online search market and is becoming an important data source for scholars studying the Chinese market [36]. The Baidu Index database (http://index.baidu.com) contains search information from 01 January, 2011. Hence, the ISD used in this study was obtained from the index. User attention logged in the Baidu Index is based on search volume from tens of millions of Internet users in Baidu. Using our specific keywords as the object, we calculated the weighted sum of the search frequency of each keyword in the Baidu search and displayed the index in a graph. The Baidu Index of keywords is an absolute value, and it does not change over time. Our study first collects user attention data of each keyword on the Baidu Index from 01 February, 2016, to June 30, 2019.

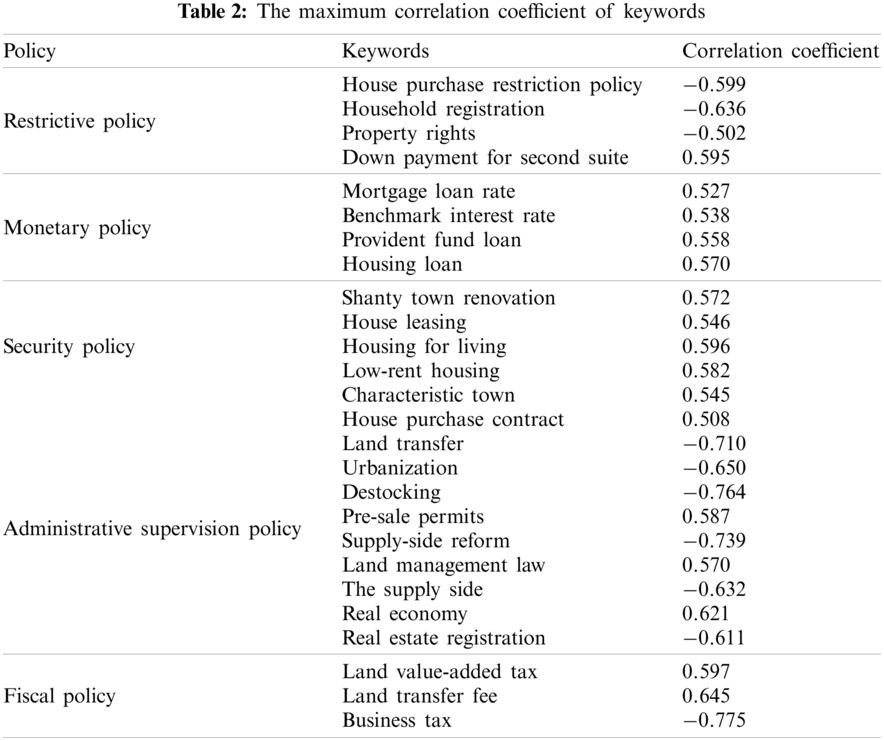

After downloading and checking the Baidu Index of keywords, this study uses a correlation coefficient to screen keywords (Table 2). Among search keywords in the restrictive policy category, “household registration” had the largest absolute value of correlation coefficients (−0.636), showing a significant negative correlation. Purchase restriction policy, being the most stringent regulation policy, limits purchase qualification of nonregistered residents. The correlation coefficient of the keyword “household registration” indicates that hedonic price will fall as the number of searches for “household registration” increases. In administrative supervision policy, the absolute value of the correlation coefficient of the keywords “supply-side reform” and “destocking” is 0.739 and 0.764, respectively, showing a significant negative correlation. Supply side reform is an important reform measure proposed by the national government in November 2015, and destocking of the real estate market is one of the most important tasks of supply side reform. The results show that with increases in the search volumes of “supply-side reform” and “destocking”, hedonic price decreases.

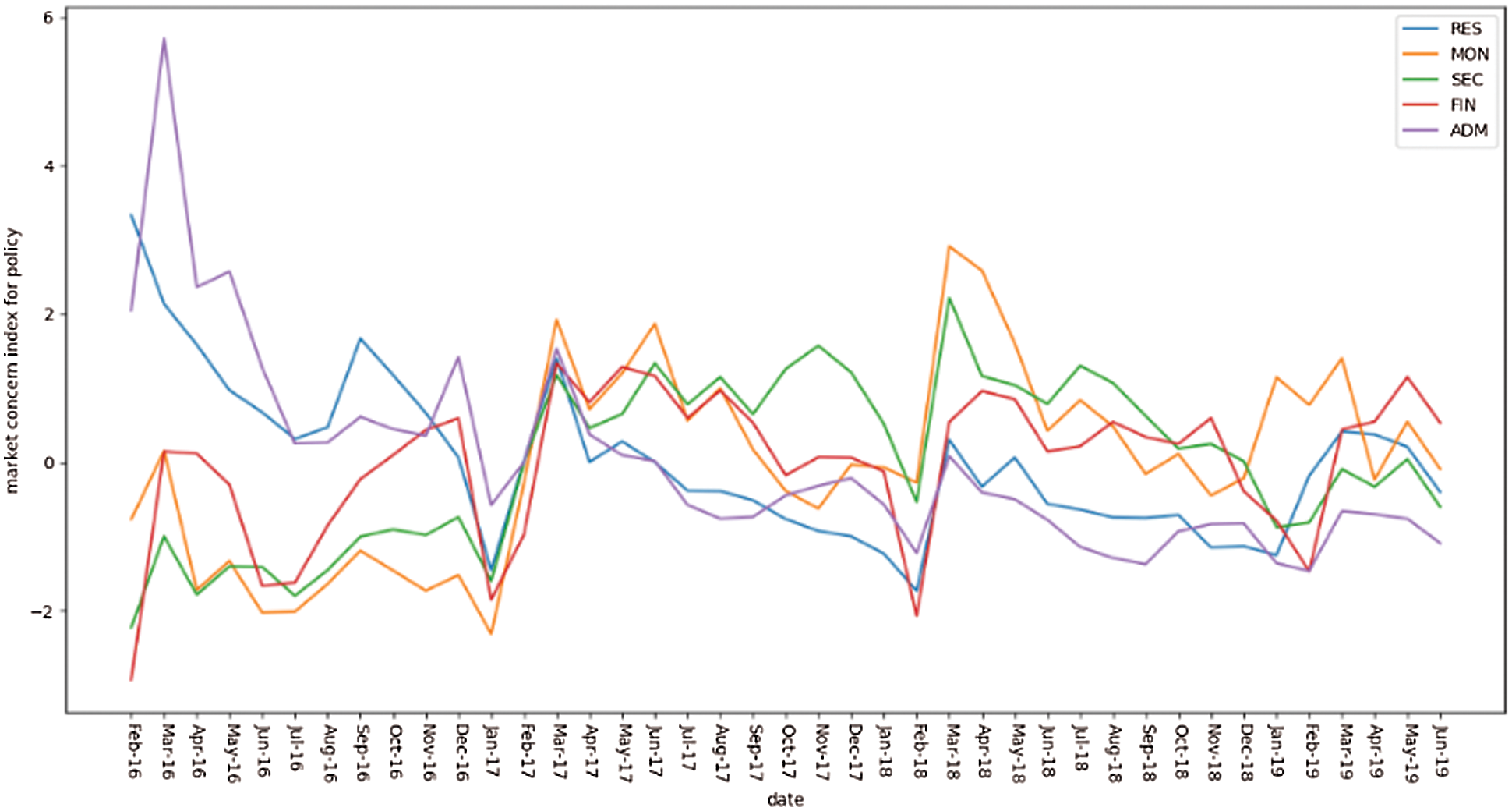

Finally, this study synthesizes the MCI of five types of policies through PCA, and the accumulated variance contribution rate was above 80%. Fig. 2 shows the synthetic indices. The five indexes present a cyclical trend, peaking in February 2016, March 2017, March 2018, and May 2019. The housing market was relatively flat during the Spring Festival and began recovering after the period, reaching a peak in the search volume.

Figure 2: Market concern index of policy

Lianjia occupies more than 50% of the secondhand housing market in Beijing and ranks first among intermediary agencies. Hence, the company's secondhand housing transaction records have strong representativeness [37]. Fangtianxia, a comprehensive information website having the largest amount of information and number of users, contains housing market information for 651 cities. Using transaction data from the two websites, combined with GIS geographic information, this paper obtained the hedonic variable data by compiling a Python web crawler. The sample of this paper covered a time span ranging from January 2016 to June 2019, with a total of 59,692 data points. January 2016 was used as the base period for compiling the HPI of secondhand houses in Beijing.

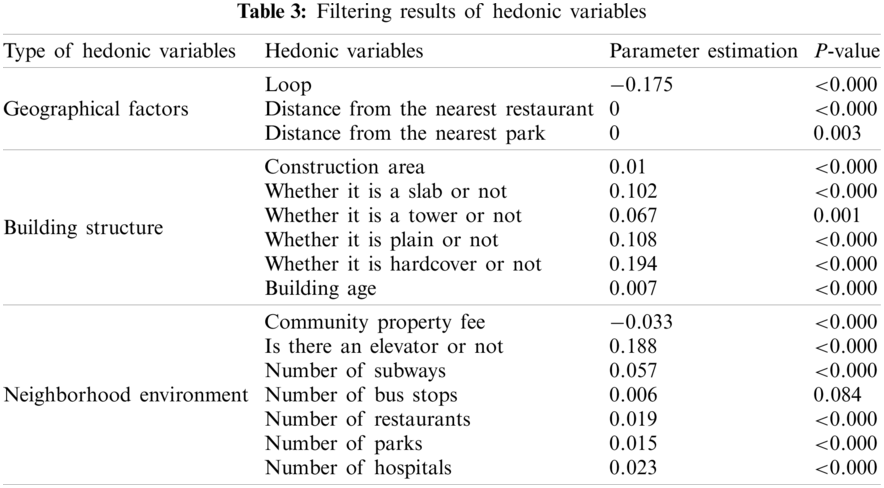

First, this paper screens out important hedonic variables through the stepwise regression method, as shown in Table 3.

According to formulas (2)–(4), this paper compiles the HPI of a fixed comparison period, fixed reporting period, and Fisher index. Compared with the HPI of the fixed comparison and fixed reporting periods, the Fisher index has good economic and axiomatic characteristics. Therefore, this study focused on analyzing the impact of MCP on the Fisher index.

4.3 The Impact of Market Concerns for Policy on Housing Prices

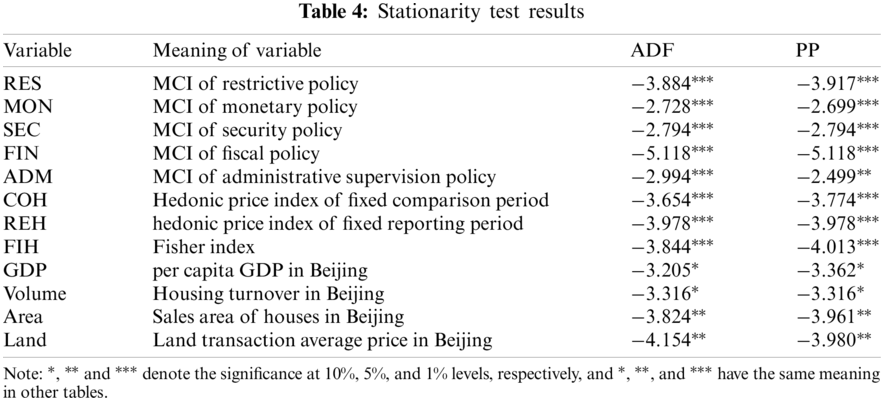

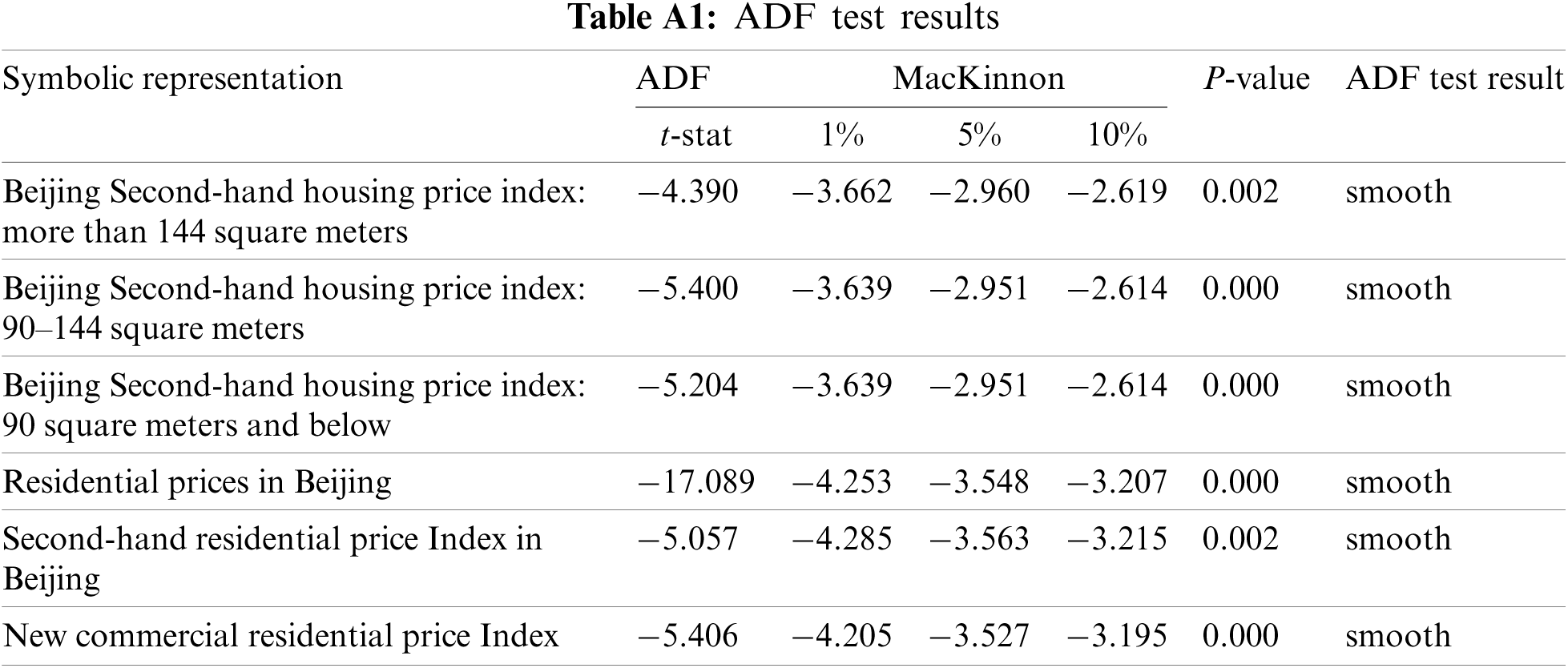

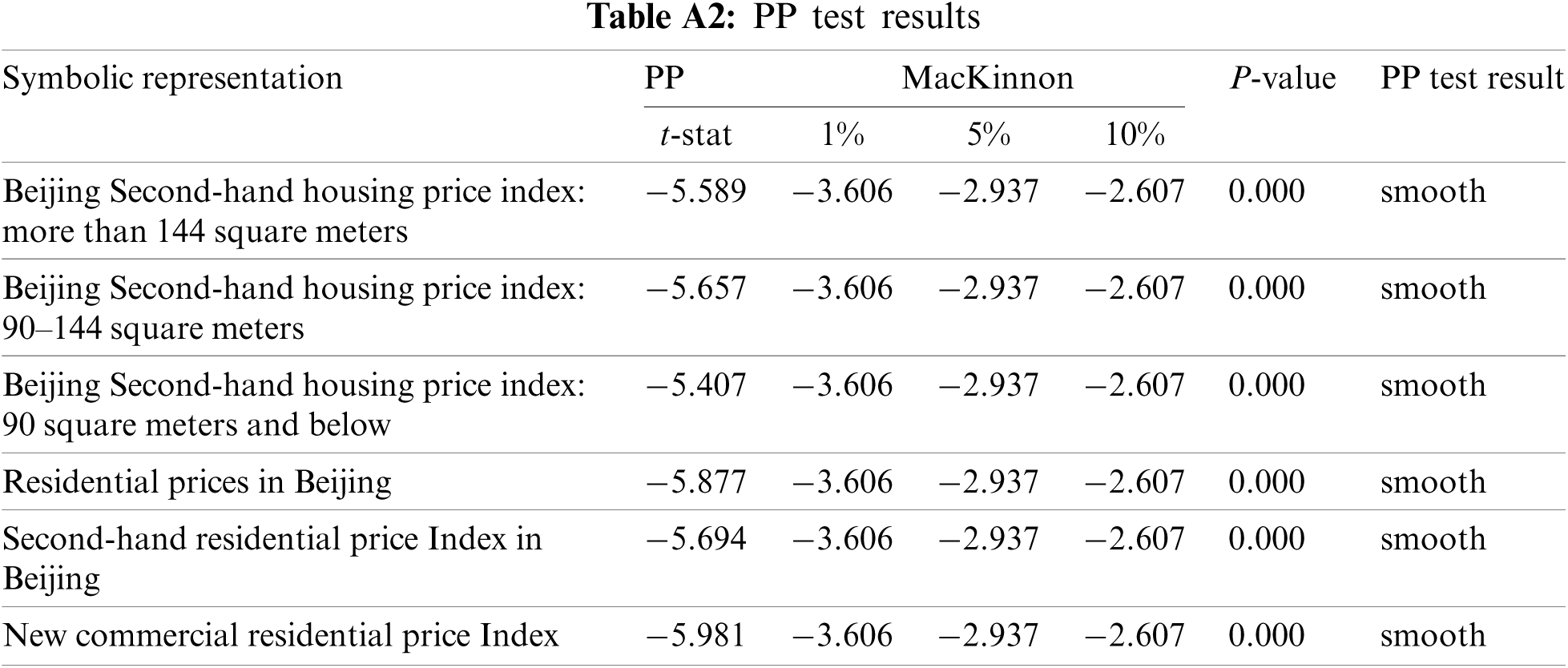

In this section, this paper analyzes the impact of MCP on housing prices. First, the long-term interaction between MCP and housing prices is estimated by using the Granger test. Then, economic models are built to study the specific impact of MCP on housing prices and verify the stability of the model. Excluding the policy concern index, all variables are logarithmic; Table 4 shows the results of the stationarity test. All variables passed ADF and PP tests.

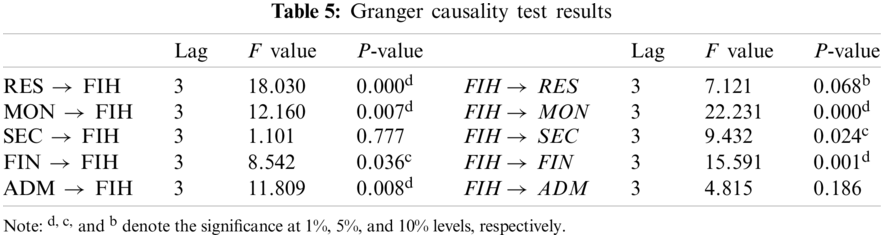

This study follows the work of [38] and employs the Granger test to test whether long-term interaction exists between MCP and housing prices (Table 5). First, the results show that the Granger bidirectional causality between market concerns for restrictive, monetary, and fiscal policies and hedonic prices is at the 10%, 1%, and 5% levels, respectively. Second, the Granger one-way causal relationship from market concerns for administrative supervision policy to hedonic price and from hedonic price to market concerns for security policy is verified at the 1% and 5% levels, respectively. Therefore, market concerns for restrictive, monetary, fiscal, and administrative supervision policies are reasons for the hedonic price. Our results provide innovative evidence of the effect of MCP on housing prices.

4.3.2 Analysis of the Impact of Market Concerns for Policy on Housing Prices

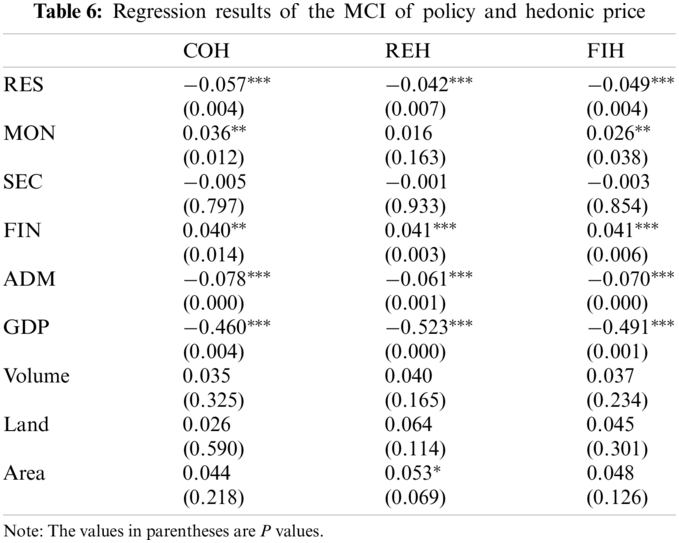

This study used COH, REH, and FIH as the dependent variables, and these variables reflect the market supply and demand situation. The MCI of policy is considered the independent variable, and control variables were added for the regression analysis. The least-squares method was used for estimating the parameter. Additionally, the AIC criterion is used to determine the optimal lag of the MCI of policy [39]; hence, this study chooses Lag 3. All variables passed the ADF and PP tests; Table 6 presents the results.

The Fisher index has several advantages compared to the other three hedonic price types. Therefore, this study focuses on analyzing the influence of MCP on the Fisher index. Table 6 draws the following three conclusions according to the coefficient. First, the coefficients of RES, SEC, and ADM are negative, indicating that with the increase in marker concerns for these three types of policies, hedonic price decreases. Restrictive policies, such as the purchase restriction policy, aim to curb the overheated housing market and prevent prices from rising too fast by limiting conditions for purchase. Administrative supervision policies could regulate the housing market through administrative examination, approval, and other measures. In recent years, the government introduced a “destocking” policy to match housing demand with housing supply and prevent excessive speculation. Security policy improves housing supply through public rental housing, affordable housing, and other measures to ensure that special groups can “have a place to live”. From the results, market concerns for restrictive and administrative supervision policies can effectively curb excessively rapid rise of housing prices. As the security policy is only for special groups, the market concerns for security policy do not have a significant impact on the overall housing market.

Second, the coefficients of MON and ADM are positive, indicating that with the increase in market concerns for these two types of policies, hedonic prices increase significantly. Fiscal policy mainly aims to regulate and control taxation. Fiscal policies, such as land value-added tax and other real estate taxes and fees, affect cost of real estate enterprises and thus affect hedonic prices. Monetary policy is the key driving force for change in real estate prices in China [39]. Interest rates and money supply are two important monetary policy tools; low interest rates and rapid money supply growth accelerate housing price growth [39]. The money supply in China increased by 28.155% from 2016 to 2019, and the People's Bank of China (PBOC) cut the benchmark loan rate in 2019. During the study period, PBOC adopted a loose monetary policy, and the market concerns for monetary policy significantly increase hedonic price at the 5% level (Table 6), which is consistent with the actual housing market.

Third, considering the absolute value of the coefficient, RES and ADM have a larger coefficient, and the market concerns for these two types of policies have greater influence on hedonic prices. Among the many real estate regulation policies issued, purchase restriction policy is the most stringent regulation policy. Housing prices showed a rapid rise from February 2016 to March 2017. The “317 New Deal” was released during the rise of the real estate market, and the level of housing prices was restored smoothly. This restrictive policy had immediate effect. Since the administrative supervision policy on “supply-side reform” and “destocking” was issued in 2015, inventory destocking of the real estate market in Beijing has been shortened and is an effectively satisfied part of the housing demand.

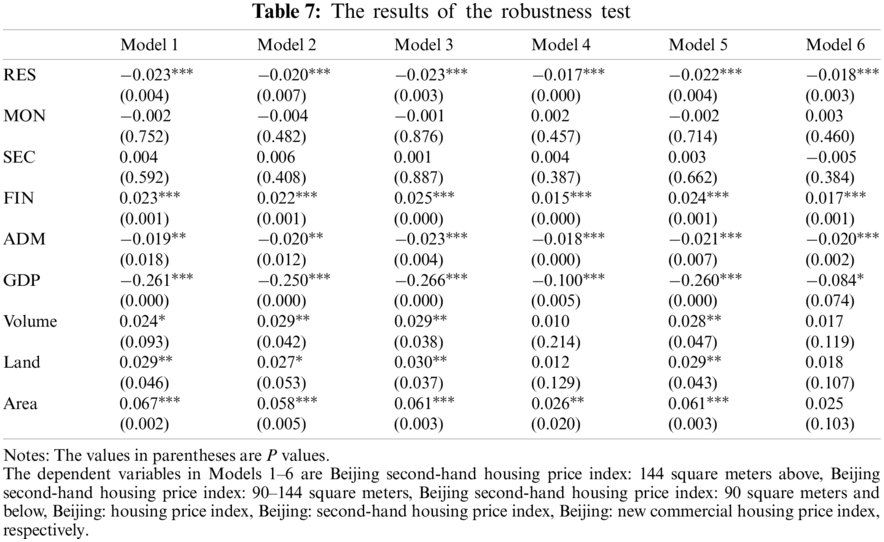

From the regression results of the COH and REH, the positive/negative and significance of coefficients are consistent with the regression results of the FIH. This content is based on an analysis of hedonic prices. To test model robustness, this study examines the influence of the MCI of policy on two types of classifications of new/secondhand houses and different areas of secondhand houses. All variables pass the ADF and PP tests (Tables A1 and A2). The different types of price indexes in Beijing are considered dependent variables, and the MCI of policy is considered an independent variable for regression. Table 7 lists the results.

The results of Table 7 imply that the negative effects of market concerns for restrictive and administrative supervision policies and the positive effects of market concerns for fiscal policy remain significant. The effect of market concerns for monetary policy on housing prices decreased significantly. The impact of market concerns for restrictive policy on the growth of both new and secondhand housing prices is significant at the 1% level and has significant impact on secondhand houses compared to the impact of market concerns for administrative supervision policy.

5 Conclusions and Recommendations

The healthy functioning of the real estate market has become an important economic and social issue. Governments are responsible for stabilizing the market and introducing real estate regulation policies to correctly guide residents’ housing consumption and promote the long-term and healthy development of the housing market. Policy effects are closely related to market participants’ expectations, and MCP reflects real estate market participants’ expectations of policy. This study analyzes the relationship between MCP and housing prices, reflecting the impact of policies on housing prices from a unique perspective. First, based on big data technology, this paper collected the ISD of related keywords of the real estate regulation policy from February 2016 to June 2019. The MCI of policy is constructed using the Baidu Index and PCA. Using crawler technology and geographic information system (GIS), this paper collected secondhand housing transaction data and constructed the hedonic price index. This type of price reflects pure price fluctuations under different qualities in different periods, which is helpful to judge housing price volatility correctly. The impact of the MCP on housing price fluctuations was then measured. Additionally, the stability of the model was tested using official house price data.

The results show that, first, a two-way Granger causality between MCP and housing prices exists. This indicates that changes in MCP lead to changes in housing prices and vice versa. The real estate market has become a “policy market”, which is deeply affected by government intervention. Second, market concerns for restrictive and administrative supervision policies effectively reduced housing prices, while market concerns for monetary and fiscal policies effectively increased housing prices. Restrictive policy curbs speculative demand by limiting the purchase eligibility of nonregistered residents. The administrative supervision policy aimed to match market supply and demand, while issuance of monetary policy and fiscal policy adheres to the national economic development plan. The results of these policies remain consistent with the expectations of policy effects. Additionally, the increase in market concerns for the purchase restriction policy can effectively restrain the price growth of new and secondhand houses. This research is of great significance in judging the effect of relevant policies on the housing market, predicting the actual change trend of the market, and providing a reference for the government to stabilize the market. Based on the results, this paper proposes the following policy recommendations:

(1) Formulate a reasonable policy based on the overall effect of multiple policies. Different types of real estate policies may play the opposite role. For example, restrictive policies restrict the conditions for buying houses, curb speculation and prevent the real estate market from overheating. However, the security policy increases the housing supply by providing welfare housing for special groups. Due to the increase in supply, security policies will increase the heat of the real estate market, contrary to restrictive policies. Therefore, balancing security policies and restrictive policies is necessary to give full play to the best policy effects. On the one hand, it is necessary to “no speculation in housing” to combat real estate speculation. On the other hand, it is necessary to “ensure houses” to ensure basic living needs, and to play the role of the restriction on sales while curbing speculation to the greatest extent.

(2) Based on the duration of policy effects, the real estate policy will be regularly adjusted. The effect of real estate policy regulation and control varies with the lag period. It can be seen from the research results that the three-phase lagging MCP has exerted better results. Therefore, real estate policies need to be adjusted regularly to maintain the regulatory effects of real estate policies.

(3) Focus on formulating restrictive policies and administrative supervision policies. From the research results, restrictive policies and administrative supervision policies have the greatest impact on housing prices. Therefore, they are the two types of policies that should be focused on. Restrictive policies are the first-class medicine in the real estate market, which can play a role in restraining the rise of house prices quickly by limiting the qualification of purchasing houses. Administrative supervision policies such as “destocking” can fundamentally adjust the supply and demand. Policymakers should focus on formulating two types of policies to keep the real estate market stable and healthy.

Funding Statement: The authors would like to thank the research grants from the National Natural Science Foundation of China (Nos. 61703014 and 62073008).

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

1. Jing, J., Li, Z., Zheng, J. (2015). The continuity and effectiveness of the real estate regulation policy: A perspective of credit redistribution. Economic Review, 194(4), 96–108. DOI 10.19361/j.er.2015.04.008. [Google Scholar] [CrossRef]

2. Wang, B., Yang, X. (2014). A study of real estate market macro-control policies’ effectiveness based on web search data. Business Review, 26(9), 78–88. DOI 10.14120/j.cnki.cn11-5057/f.2014.09.027. [Google Scholar] [CrossRef]

3. Guo, J., Ji, Q. (2013). How does market concern derived from the Internet affect oil prices? Applied Energy, 112, 1536–1543. DOI 10.1016/j.apenergy.2013.03.027. [Google Scholar] [CrossRef]

4. Da, Z., Engelberg, J., Gao, P. (2011). In search of attention. The Journal of Finance, 66(5), 1461–1499. DOI 10.1111/j.1540-6261.2011.01679.x. [Google Scholar] [CrossRef]

5. Drake, M. S., Roulstone, D. T., Thornock, J. R. (2012). Investor information demand: Evidence from Google searches around earnings announcements. Journal of Accounting Research, 50(4), 1001–1040. DOI 10.1111/j.1475-679X.2012.00443.x. [Google Scholar] [CrossRef]

6. Iacoviello, M. M. (2000). House prices and the macroeconomy in Europe: Results from a structural var analysis. ECB Working Paper No. 18, pp. 3–42. [Google Scholar]

7. Robstad, Ø. (2018). House prices, credit and the effect of monetary policy in Norway: Evidence from structural VAR models. Empirical Economics, 54(2), 461–483. DOI 10.1007/s00181-016-1222-1. [Google Scholar] [CrossRef]

8. Beracha, E., Wintoki, M. B. (2013). Forecasting residential real estate price changes from online search activity. Journal of Real Estate Research, 35(3), 283–312. DOI 10.1080/10835547.2013.12091364. [Google Scholar] [CrossRef]

9. Hasan, M. S., Taghavi, M. (2002). Residential investment, macroeconomic activity and financial deregulation in the UK: An empirical investigation. Journal of Economics and Business, 54(4), 447–462. DOI 10.1016/S0148-6195(02)00093-0. [Google Scholar] [CrossRef]

10. Yu, C., Chen, P. (2018). House prices, mortgage rate, and policy: Megadata analysis in Taipei. Sustainability, 10(4), 926. DOI 10.3390/su10040926. [Google Scholar] [CrossRef]

11. Sun, W., Zheng, S., Geltner, D. M., Wang, R. (2017). The housing market effects of local home purchase restrictions: Evidence from Beijing. The Journal of Real Estate Finance and Economics, 55(3), 288–312. DOI 10.1007/s11146-016-9586-8. [Google Scholar] [CrossRef]

12. Wu, Y., Li, Y. (2018). Impact of government intervention in the housing market: Evidence from the housing purchase restriction policy in China. Applied Economics, 50(6), 691–705. DOI 10.1080/00036846.2017.1340569. [Google Scholar] [CrossRef]

13. Cao, J., Huang, B., Lai, R. N. (2015). On the effectiveness of housing purchase restriction policy in China: A difference in difference approach. [Google Scholar]

14. Jia, S., Wang, Y., Fan, G. (2018). Home-purchase limits and housing prices: Evidence from China. The Journal of Real Estate Finance and Economics, 56(3), 386–409. DOI 10.1007/s11146-017-9615-2. [Google Scholar] [CrossRef]

15. Magliocca, N., McConnell, V., Walls, M., Safirova, E. (2012). Zoning on the urban fringe: Results from a new approach to modeling land and housing markets. Regional Science and Urban Economics, 42(1–2), 198–210. DOI 10.1016/j.regsciurbeco.2011.08.012. [Google Scholar] [CrossRef]

16. Jiang, X., Mai, Y. (2015). The social welfare housing project and its effects in China. Journal of Systems Science and Complexity, 28(2), 393–408. DOI 10.1007/s11424-014-3261-z. [Google Scholar] [CrossRef]

17. Vargas-Silva, C. (2008). Monetary policy and the US housing market: A VAR analysis imposing sign restrictions. Journal of Macroeconomics, 30(3), 977–990. DOI 10.1016/j.jmacro.2007.07.004. [Google Scholar] [CrossRef]

18. Choi, H., Varian, H. (2009). Predicting initial claims for unemployment benefits. https://ssrn.com/abstract=1659307. [Google Scholar]

19. Vozlyublennaia, N. (2014). Investor attention, index performance, and return predictability. Journal of Banking & Finance, 41(C), 17–35. DOI 10.1016/j.jbankfin.2013.12.010. [Google Scholar] [CrossRef]

20. Klemola, A., Nikkinen, J., Peltomäki, J. (2016). Changes in investors’ market attention and near-term stock market returns. Journal of Behavioral Finance, 17(1), 18–30. DOI 10.1080/15427560.2016.1133620. [Google Scholar] [CrossRef]

21. Yao, T., Zhang, Y., Ma, C. (2017). How does investor attention affect international crude oil prices? Applied Energy, 2(5), 336–344. DOI 10.1016/j.apenergy.2017.07.131. [Google Scholar] [CrossRef]

22. Ji, Q., Guo, J. F. (2015). Oil price volatility and oil-related events: An Internet concern study perspective. Applied Energy, 137, 256–264. DOI 10.1016/j.apenergy.2014.10.002. [Google Scholar] [CrossRef]

23. Zhang, Y., Song, C., Wang, Y., Qi, Y. (2018). Research on the effect of science and technology innovation policy based on Web search data. Soft Science, 32(9), 24–29. DOI 10.13956/j.ss.1001-8409.2018.09.06. [Google Scholar] [CrossRef]

24. Senhadji, A. S., Collyns, C. (2002). Lending booms, real estate bubbles and the Asian crisis. Social Ence Electronic Publishing, 2(20), 2–45. DOI 10.5089/9781451843859.001. [Google Scholar] [CrossRef]

25. Cheng, Y. (2010). Hedonic quality adjustment of housing price index: Methods and empirical comparison. Systems Engineering, 28(8), 24–30. DOI 10.1016/S1876-3804(11)60009-8. [Google Scholar] [CrossRef]

26. Li, S., Chen, T., Wang, L., Ming, C. (2018). Effective tourist volume forecasting supported by PCA and improved BPNN using baidu index. Tourism Management, 68, 116–126. DOI 10.1016/j.tourman.2018.03.006. [Google Scholar] [CrossRef]

27. Asuero, A. G., Sayago, A., González, A. G. (2006). The correlation coefficient: An overview. Critical Reviews in Analytical Chemistry, 36(1), 41–59. DOI 10.1080/10408340500526766. [Google Scholar] [CrossRef]

28. Li, J., Tang, L., Wang, S. (2020). Forecasting crude oil price with multilingual search engine data. Physica A: Statal Mechanics and its Applications, 551, 124178. DOI 10.1016/j.physa.2020.124178. [Google Scholar] [CrossRef]

29. Li, X., Pan, B., Law, R., Huang, X. (2017). Forecasting tourism demand with composite search index. Tourism Management, 59, 57–66. DOI 10.1016/j.tourman.2016.07.005. [Google Scholar] [CrossRef]

30. Gao, Y., Li, X., Dong, J. (2019). Why do housing prices differ? The role of public service in housing market. System Engineering Theory and Practice, 39(9), 2255–2262. DOI 10.12011/1000-6788-2018-1851-08. [Google Scholar] [CrossRef]

31. Sun, W., Zheng, S. (2016). How does the residents’ expected price affect housing price change? Statistical Research, 33(5), 51–59. DOI 10.19343/j.cnki.11-1302/c.2016.05.006. [Google Scholar] [CrossRef]

32. Tang, Y., Ma, C. (2017). Fiscal pressure, land finance and ratchet effects of house prices. China Finance and Economic Review, 38(11), 39–54. DOI 10.1515/cfer-2018-070105. [Google Scholar] [CrossRef]

33. Chalal, M., Medjdoub, B., Bezai, N., Shrahily, R. (2020). Big data to support sustainable urban energy planning: The evoenergy project. Frontiers of Engineering Management, 7(5), 287–300. DOI 10.1007/s42524-019-0081-9. [Google Scholar] [CrossRef]

34. Gao, Y., Feng, Z., Zhang, S. (2021). Managing supply chain resilience in the era of VUCA, vol. 8. China: Frontiers of Engineering Management. [Google Scholar]

35. Jin, J., Mc Ke Lvey, M., Dong, Y. (2020). Role of local governments in fostering the development of an emerging industry: A market-oriented policy perspective. Frontiers of Engineering Management, 7(1), 447–458. DOI 10.1007/s42524-020-0104-6. [Google Scholar] [CrossRef]

36. Zhao, R. (2019). Inferring private information from online news and searches: Correlation and prediction in Chinese stock market. Physica A: Statistical Mechanics and its Applications, 528, 121450. DOI 10.1016/j.physa.2019.121450. [Google Scholar] [CrossRef]

37. Shen, T., Yu, H., Zhou, L., Gu, H., He, H. (2020). On hedonic price of second-hand houses in Beijing based on multi-scale geographically weighted regression: Scale law of spatial heterogeneity. Economic Geograph, 40(3), 75–83. DOI 10.15957/j.cnki.jjdl.2020.03.009. [Google Scholar] [CrossRef]

38. Zhao, R. (2020). Quantifying the cross sectional relation of daily happiness sentiment and stock return: Evidence from US. Physica A: Statistical Mechanics and its Applications, 538, 122629. DOI 10.1016/j.physa.2019.122629. [Google Scholar] [CrossRef]

39. Xu, X. E., Chen, T. (2012). The effect of monetary policy on real estate price growth in China. Pacific-Basin Finance Journal, 20(1), 62–77. DOI 10.1016/j.pacfin.2011.08.001. [Google Scholar] [CrossRef]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |